Summary:

- Returning CEO Bob Iger announced a cost reduction program and an organizational restructure that has the potential to deliver a much sharper focus on DTC profitability.

- The obsession with growing streaming subscriber numbers at almost any cost is over.

- The Parks, Experiences and Products segment continues to perform strongly.

- Investors should be prepared for a major restructure and impairment charge in the months ahead.

- With signs that DIS will have a much greater focus on profitability going forward, I upgrade to a Buy rating.

cjmacer/iStock Editorial via Getty Images

Introduction

The Walt Disney Company (NYSE:DIS) reported 1Q23 results on 08 February 2023. Back in November 2022, the market reacted positively to news that Bob Iger would return for another stint in the CEO seat; whether the bounce in the share price was due to excitement about what Iger could achieve or relief that the rather unpopular Bob Chapek was ousted remains unclear. With the 1Q23 result, Iger put forward a game plan for the near-term which triggered another bounce in the share price, however this initial enthusiasm has since quickly faded.

In my previous DIS note, I expressed concerns that bullish comments regarding what Iger could deliver for shareholders during his anticipated two-year tenure were probably too optimistic. In this note, I’ll review interesting aspects of the 1Q23 result and discuss some of the initial moves that Iger has made.

Disney Media and Entertainment Distribution – Costly Transition

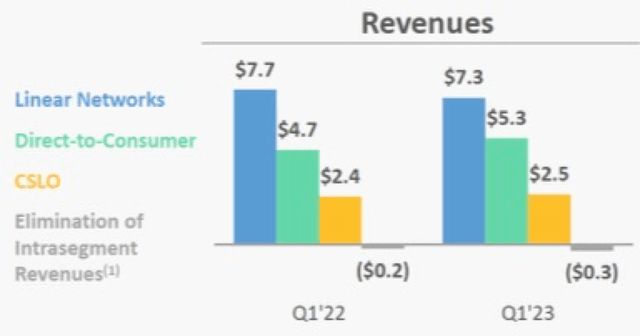

The 1Q23 presentation includes a chart (Exhibit 1) which, if looked at in isolation, can be interpreted to tell a comforting story: DIS, ever looking to the future, predicted the decline of Linear Networks (traditional content distribution) and pushed forward with the Direct-to-Consumer strategy (a streaming model) to protect and grow the DMED business. Exhibit 1 shows quarterly Linear Networks revenue declining from the previous comparable period, but with the loss of revenue being more than offset by revenue growth in DTC. The plan is working! Except it isn’t.

Exhibit 1:

Source: DIS 1Q23 Presentation, slide 16.

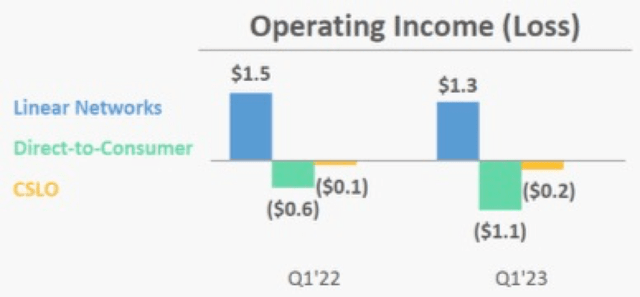

Obviously, looking at revenue alone would be a huge mistake. If we move to the Operating Income line (Exhibit 2), we can clearly see that the transition from a Linear Networks world to a DTC world is proving to be rather financially painful. Do not forget that the figures presented in the charts are in billions. Despite growing revenue over the combined Linear Networks and DTC buckets, at the Operating Income level, Linear Networks plus DTC is now making $700m per quarter less than it was achieving twelve months ago.

Exhibit 2:

Source: DIS 1Q23 Presentation, slide 16.

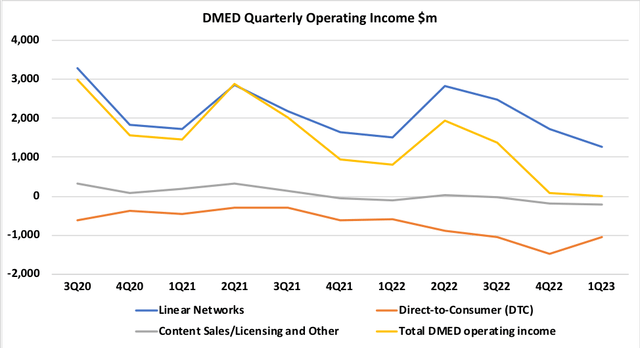

Let’s move beyond the period to period comparison and consider the quarterly trends over time. DMED is comprised of three buckets – Linear Networks, DTC, Content Sales/Licensing and Other. Exhibit 3 plots the components of DMED’s Operating Income results over the last eleven quarters:

Exhibit 3:

Source: author calculations based on DIS quarterly reports.

Content Sales/Licensing and Other has gone from a business generating Operating Income of around $1bn pa, to a business that is making losses (which have accelerated over the last six months, hitting -$212m in 1Q23). DTC’s losses are huge; over the 12 months to 1Q23, total DTC Operating Income was a loss of -$4,475m (as compared with -$4,015m Operating Income in FY22 – so losses are accelerating here also). Worryingly, the rate of decline in Linear Networks Operating Income appears to be increasing.

Looking for a positive point – after a shocking 4Q22, DTC Operating Income wasn’t quite as bad in 1Q23, with a print of -$1,053m. Perhaps the 12-month period to 1Q23 will represent ‘peak losses’ for DTC? For that to be true, 2Q23E needs to produce a DTC Operating Income that beats the 2Q22 loss of -$887m – this could be achievable, at which point Iger might try to declare some sort of victory (and conveniently ignore the shareholder value that has been destroyed as the DTC strategy has been rolled out).

Dividend Restoration & Balance Sheet Strength

In a sensible and prudent move, DIS ceased dividend payments when COVID-19 arrived on the scene. DIS say that the operational cash flow cost of COVID-19 to the business amounts to billions, much of which will have been caused by the huge disruption to Disney Parks, Experiences and Products, DPEP. With the pandemic hopefully behind us, and DPEP almost back to fully normal operation, DIS is now flagging optimism that a modest dividend may be declared before the end of the 2023 calendar year, based in part on their opinion that the company’s balance sheet is strong. The potential restoration of dividend payments appears to have been taken well by investors, but I don’t see this as much to get excited about.

Before the pandemic, the stock’s dividend yield was running at well below 2% pa. Even if we get back to those historical levels (which will take some time), a sub-2% pa dividend yield is not enough to grab the attention of income-focused investors. In terms of the balance sheet, I would agree that there is now capacity to recommence dividend distributions. At FY19 (pre pandemic), DIS had total debt of ~$47.0bn and net debt of ~$41.6bn. Debt levels blew out during the pandemic, but DIS maintained high cash balances which kept net debt relatively static. At 1Q23, debt is slightly higher than FY19 levels, at ~$48.4bn, whilst net debt is comfortably below FY19, at ~$39.9bn.

Investors who are assuming that DIS will use its balance sheet strength to materially ramp up dividend payments should be mindful that DIS may soon need to deploy balance sheet firepower to acquire the 33% of Hulu that is currently held by NBC Universal. If either party exercises the option, DIS is likely to need to outlay something in the order of $10bn to acquire NBC Universal’s share in the entity.

In May 2019, the Company entered into a put/call agreement with NBCU that provided the Company with full operational control of Hulu. Under the agreement, beginning in January 2024, NBCU has the option to require the Company to purchase NBCU’s interest in Hulu and the Company has the option to require NBCU to sell its interest in Hulu to the Company, in either case at a redemption value based on NBCU’s equity ownership percentage of the greater of Hulu’s then equity fair value or a guaranteed floor value of $27.5 billion.

Source: DIS 1Q23 Form 10Q, page 8.

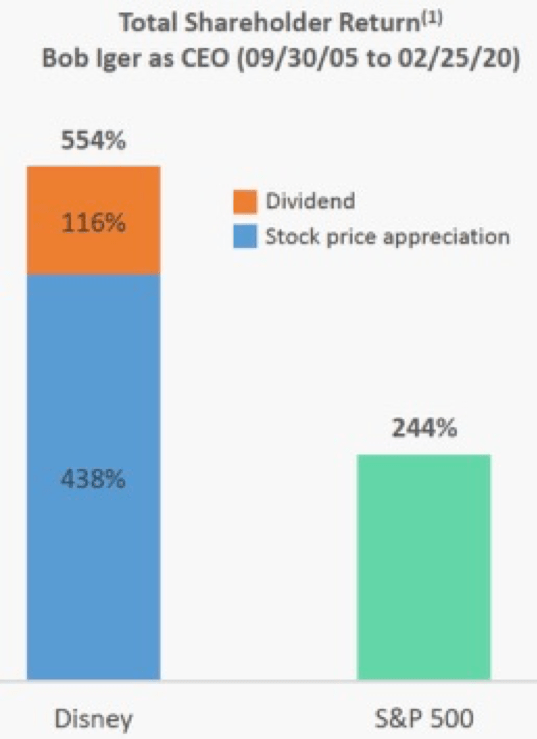

As a final point on the dividend restoration topic, I found the references on slide 11 of the presentation directly linking Bob Iger to dividend payments rather bizarre. I can’t recall ever seeing a company presentation pump up the influence of a CEO on dividend payments in this manner and it seems odd that the Board would allow such wording. I’m left with the uncomfortable feeling that the Board has been captured by ‘Cult of Iger’ thinking. The message to investors appears to be – ‘don’t worry, Bob Iger is back, dividends are coming’. I’d counter that message with – ‘but he’s only here for two years!’.

Source: DIS 1Q23 Presentation, slide 11.

Source: DIS 1Q23 Presentation, slide 11.

Cost Reduction Program – Valuation Implications

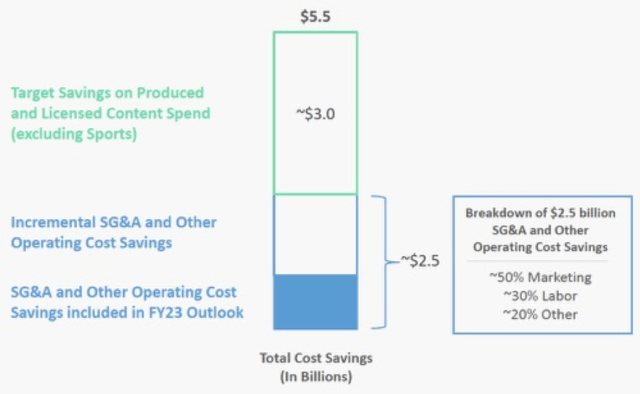

As set out in Exhibit 4, DIS has announced a $5.5b pa cost reduction program. For the twelve months ending 31 December 2022, total DIS group expenses excluding restructuring and impairment charges came in at -$77.85bn. The announced cost reductions therefore equate to around 7% of group expenses (excluding restructuring and impairment charges). Around $1bn of cost savings are expected to be achieved in FY23E, with the balance captured by the end of FY24E.

Exhibit 4:

Source: DIS 1Q23 Presentation, slide 7.

It is slightly misleading to refer to the reduced spend on content as a cost saving. A more accurate description in my view would be that this $3bn pa represents a lower rate of ongoing investment in content product. For valuation purposes, I am therefore only interested in the $2.5bn pa of non-content-related savings. When companies announce cost savings, my general rule of thumb for valuation purposes is to assume that 50% of the announced cost reduction falls to the bottom line. Assuming a tax rate of -23%, cost savings for valuation purposes of $1.25bn pa and an earnings multiple of 15x, I land at an addition to value of $14.4bn – which currently equates to ~7.9% of the DIS market capitalization.

With such a large cost reduction program, it would be imprudent to overlook negative knock-on effects on revenue. It’s possible, and probably likely, that DIS can reduce headcount in many areas without much impact on revenue generation, but there will be some roles lost that will hurt the revenue line directly. Turning to marketing – it would be ridiculously optimistic to assume that a reduction in marketing spend of $1.25bn pa would not have negative consequences for future revenue generation.

If we are thinking about value implications, we’d better not forget about the restructure charge that will be associated with the cost saving program. The 1Q23 Form 10Q (relevant extract below) gives investors a very clear heads-up that DIS will soon book a large charge for restructuring and impairment in order to fund the cost saving program and operating segment changes. An accurate estimate of the likely restructure and impairment charges is pretty much impossible, but if pushed for a number, at this stage I’d guess at a cash cost of something in the range of $1.5bn to $2.0bn before tax.

As contemplated by the leadership change announcement, Mr. Iger formed a committee to advise him on a new organizational structure and operational changes within the Company to address the Board’s goals. Upon implementation of these changes and related changes to our financial processes, we expect to report our operating segments differently than we do in this report. In addition, the new organizational structure and operational changes may result in material restructuring and impairment charges.

Source: DIS 1Q23 Form 10Q, page 25.

Improving Returns on Content Investment

For a good while, the bull case for DIS seemed to boil down to ‘content is king and Disney has the best content around’. When the perceived wisdom is that content drives value, sensible metrics such as ROI tend to be pushed into the background and concerns regarding the cost of content production and promotion are dismissed as being short-sighted.

Iger’s move to reduce costs is sensible enough. I’m sure that there is plenty of organisational fat that can be trimmed, and that the cost-out strategy ought to have a marginally positive influence on returns. But there’s nothing particularly novel in a cost-out strategy, and organisational fat has a habit of working its way back into a business over time.

I’d have a higher degree of confidence in the prospect of DIS driving improved shareholder value if there was more focus and transparency in regard to the ROI relating to content production, particularly for DTC. The adage that ‘content is king’ rings true to me – but without a strong ROI discipline, one-eyed focus on content can be a source of risk rather than return. It is possible that the new organizational structure announced by Iger (which in essence gives creative leaders more authority but also more financial accountability) will deliver the ROI discipline necessary to stop and partially reverse the value destruction associated with the DTC strategy.

And, as I said before, our new organizational structure will re-establish the direct link between content decisions and financial performance. This is one of the most important steps we can take to improve the economics of our streaming business.

Source: CEO Bob Iger, DIS 1Q23 Transcript, page 6.

Summary & Conclusion

As discussed in my previous notes on DIS, my current approach to building an investment case for the stock is to firstly consider the value that can be attributed to components of the company that I regard as stable (in the context of generating sustainable earnings over time). I place Disney Parks, Experiences and Products along with corporate costs and assumed ongoing restructuring expenses in this ‘stable’ bucket. I then work out what implied value the market is placing on the less stable components of the business (this bucket includes Disney Media and Entertainment Distribution, which is the primary source of uncertainty in regard to sustainable earnings) and determine whether or not this implied value is reasonable.

In December 2022, with DIS trading at ~$100 per share, I landed at a Hold rating. With DIS shares (coincidentally) again trading at very close to $100 per share, after taking into account of a) the strong 1Q23 result for Disney Parks, Experiences and Products, b) the value implications of the announced cost reduction program, and c) the potential for future improvement in DTC driven by increased focus on content ROI, I upgrade DIS to a Buy rating.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer

This writing is for informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. This article is not an investment research report, but an opinion written at a point in time. The author’s opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. Any and all opinions, estimates, and conclusions are based on the author’s best judgment at the time of publication, and are subject to change without notice. Past performance is no guarantee of future returns.