Summary:

- Rivian announced new quarterly records for production and deliveries, while raising its yearly guidance for 2023 production to 52,000 vehicles.

- Q2 revenues exceed expectations, beating the street by roughly $100 million, and the non-GAAP loss was much smaller than expected.

- Despite progress, large losses and ongoing cash burn may lead to another capital raise in the future.

Mario Tama

After the bell on Tuesday, we received second quarter results from Rivian (NASDAQ:RIVN), seen in this shareholder letter. The electric vehicle maker has been making steady progress in its production ramp over the past year, but it has come with large losses and cash burn. The latest set of results show that things are improving, but I’m not yet ready to suggest buying shares.

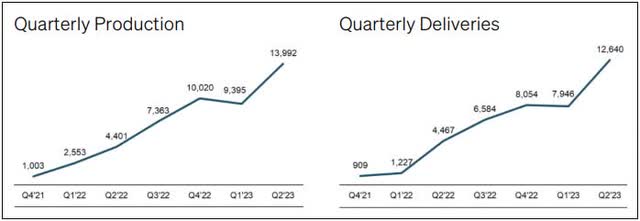

For Q2, Rivian announced new quarterly records for both production and deliveries as seen in the graphic below. While this isn’t a surprise for a startup like this, the growth numbers were nice and sent the stock higher. With progress continuing, management raised its yearly guidance at this report for 2023 production to 52,000 vehicles, up from 50,000 previously. I should note, however, that the initial forecast was a bit disappointing, as analysts went into this year looking for over 60,000 units.

Rivian Production and Deliveries (Q2 Shareholder Letter)

For the quarter, Rivian reported total revenues of more than $1.12 billion, which included $34 million from the sale of regulatory credits. This number was up dramatically from last year’s much lower volume quarter, where total revenue was just $364 million. The more important part, however, is that Rivian beat the street by roughly $100 million, and the raised production guidance should lead to higher revenue estimates moving forward.

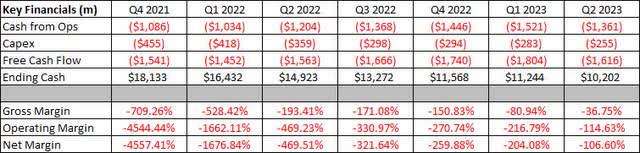

The main problem for Rivian has been its financial picture. Launching a vehicle company from scratch is very expensive, as we’ve seen with a number of names in this space in recent years. As the graphic below shows, margin percentages continue to improve, but the company is still losing a lot of money. Rivian’s cost of goods sold is still well above revenue levels, but hopes are that gross profitability can be reached sometime next year.

Rivian Q2 2023 Financials (Company Filings)

A lot of the percentage improvement above is due to revenue levels starting to really jump, topping $1 billion in Q2 for the first time. Rivian still did lose nearly $1.2 billion in the quarter on a GAAP basis, which is a large sum of money when annualized. The good news is that the non-GAAP loss was roughly 31 cents per share better than the street expected. Rivian expects to get to positive gross margins next year, but that still means net losses will be generated for some time when you throw in all the operating expenses here.

In addition to raising production guidance, Rivian management now expects an adjusted EBITDA loss of $4.2 billion, an improvement of $100 million from guidance at the Q1 report. The company cited strong progress in its cost reduction efforts, but that is not really a major change to the forecast in my opinion. Capital expenditure guidance for the year was also cut by $300 million due to the timing of expenses, and this spending will be heavily weighted towards the second half of this year.

I have previously rated Rivian a hold, and I’m sticking with that rating here today. My main issue is that another capital raise will likely be needed in the next year or so, and that could offset any positive sentiment from surging revenues and reduced losses. The company burned over $1.6 billion in Q2, finishing the period with just over $10 billion in its cash pile, and that’s after raising nearly $1.5 billion already this year through convertible notes.

My hold rating is also based on two factors that basically cancel each other out. On one hand, the stock goes for less than 3 times expected 2024 revenues, which is currently less than half of the more than 6 times next year’s projected sales that EV leader Tesla (TSLA) goes for. On the flip side, however, I am worried about the US economy struggling later this year and into early 2024, which could have a meaningful impact on the auto industry. We’ve already seen numerous price cuts across the EV space this year to spur demand, and I don’t see Rivian immune if we end up seeing a recession. As a point of reference, street analysts had an average price target just over $26 going into Tuesday’s report, which is only a dollar above where Rivian is trading in the after-hours session.

In the end, Rivian announced another quarter of progress with its Q2 results, but there is still a lot of work left to be done here. Revenues came in much higher than the street expected, and cost controls are starting to work nicely. However, large losses are still being generated, and significant ongoing cash burn could likely lead to another capital raise in the next few quarters. While the valuation is favorable when compared to an established EV player like Tesla, looming US economic clouds could be an overhang for the next 6-12 months. I continue to rate this name a hold, but would be willing to upgrade to buy in another quarter or two if some of these headwinds calm down and the company strengthens its balance sheet a bit more.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.