Summary:

- Rivian’s weaker than expected earnings sheet and outlook for FY 2024 production especially caused panic selling among investors last week.

- Despite an expected flat production volume in FY 2024, Rivian achieved record production in Q4’23 and is narrowing its losses.

- Gross-profit-per-unit economics are drastically improving.

- Rivian’s balance sheet is strong, with a long liquidity runway and a net cash position representing 52% of the company’s market cap.

- Shares are trading at a 66% discount to the 1-year average P/S ratio.

DNY59

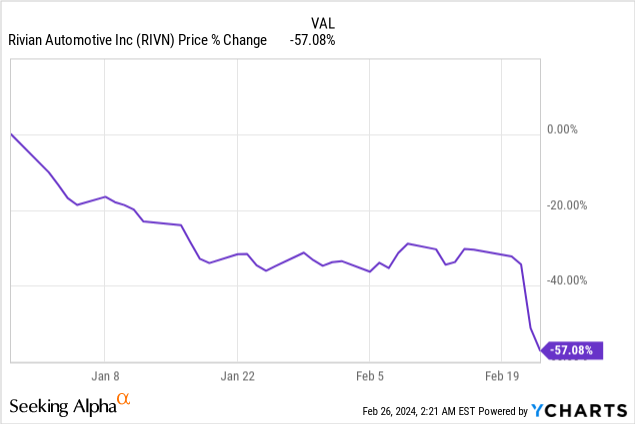

Selling panic seems to have gripped investors after electric vehicle company Rivian Automotive (NASDAQ:RIVN) submitted a weaker than expected earnings sheet for the fourth-quarter last week. The reason for the sell-off was that Rivian guided for a flat production volume in FY 2024, which has destroyed investors’ expectations about a possible acceleration of production growth this year. Rivian’s Q4’23 production, however, reached an all-time record at 17,541 electric vehicles and the company is continuing to make progress in terms of narrowing its losses. Additionally, the balance sheet is in great shape and hands investors a very high safety margin based off of Rivian’s net cash position. With shares losing about one-third of value since earnings (more than half in 2024 YTD) and Rivian being close to becoming a single-digit stock, I believe the EV maker is in an ‘all-in’ kind of buying situation!

Previous rating

In November 2023, I rated Rivian a strong buy — Best Value In The Large-Cap EV Market (Rating Upgrade) — because the EV firm raised its production outlook in Q3’23 and the production growth trend was pointing upwards. With losses narrowing and, importantly, Rivian making progressing in reducing the amount of money it loses per vehicle sold, I believe remains a strong buy after Q4’23 earnings. Given the high cash position on Rivian’s balance sheet, I believe investors are exaggerating the risks.

Rivian’s production accomplishments in FY 2023, outlook for FY 2024 disappoints

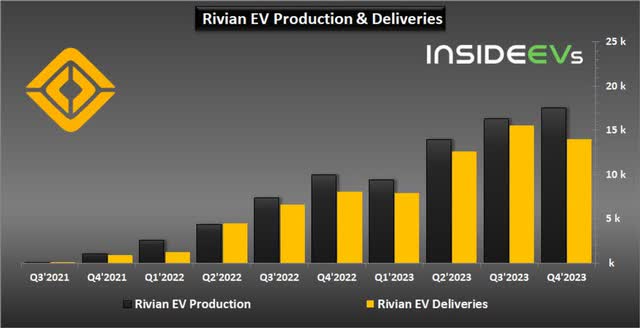

Rivian produced 17,541 electric vehicles in Q4’23, showing 75% year over year production growth. At no point in the company’s history did Rivian achieve a higher quarterly production volume than in Q4’23. Fourth-quarter deliveries totaled 13,972, showing 73% growth year over year.

In FY 2023, a total of 57,232 electric vehicles rolled off of Rivian’s production belts, which was 135% more than in the year-earlier period. The production number for FY 2023 beat Rivian’s previous guidance of 54k electric vehicles by 3,232 units. Deliveries hit 50,122 electric vehicles, showing 147% year over year growth.

While Rivian surpassed its production goal in FY 2023 by more than 3k electric vehicles, the EV maker has guided for a production volume of only 57k electric vehicles in FY 2024 which implies that Rivian will produce 232 electric vehicles fewer EVs this year than in FY 2023. This was a major bummer, triggered a number of down-grades for the EV maker and caused Rivian’s share price to tank 35% after earnings. The 57k production target was submitted by Rivian, likely over concerns over waning demand for electric vehicles which also hurt Lucid Group (LCID). I believe, however, that the auto market will transition to only EVs in the long-term, which should be a tailwind for Rivian. In my opinion, Rivian submitted a conservative guidance here and the company has a good chance of out-performing its production target.

While the growth outlook for FY 2024 was not great, the electric vehicle company is making massive strides in terms of improving its profitability, however.

Improving gross-profit-per-vehicle trajectory

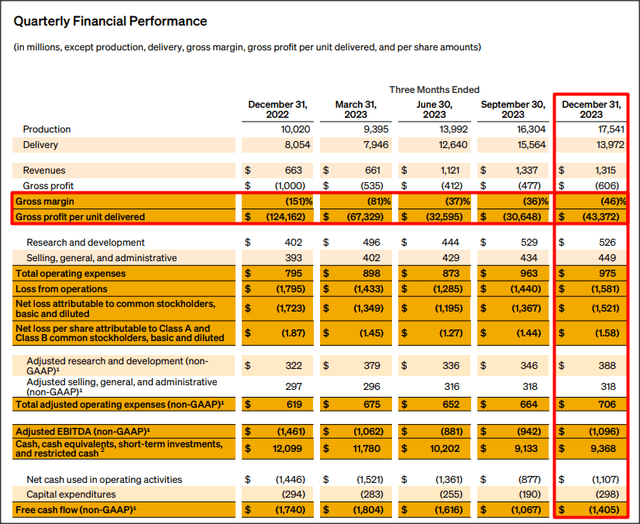

Rivian’s Q4’23 results were very solid in two respects: 1) Revenues nearly doubled (+98%) on a year over year basis to $1.32B, and 2) The EV company’s losses are narrowing rapidly: Rivian’s gross losses declined 39% year over year to $606M. Obviously, Rivian needs to do a bit more here, but the trend points in the right direction.

I believe the real take-away from Rivian’s Q4’23 earnings report was not the outlook for FY 2024 production, but rather the trajectory of gross-profit-per-vehicle that is seeing massive improvement as well.

In Q4’23, Rivian lost $43,372 per electric vehicle it sold. While the loss is clearly too high, a growing production volume and the benefits of economies of scale have allowed Rivian to drastically reduce the amount of money it loses per vehicle sold in the last twelve months. In the year-earlier period, Rivian lost $124,162 per vehicle, meaning the EV maker has improved its unit economics by $80,790 per vehicle. These improvements can be traced back to scale benefits, as Rivian has grown into a significantly higher annual production volume in the last year.

Expectations for FY 2024

Rivian is likely going to have to cut its operating expenditures in FY 2024 in order to improve profitability and further improve unit economics to offset concerns about flat production growth. Headcount reductions and operating expenditures are trends that I am tracking, together with Rivian’s gross-profit-per-unit. Rivian may also raise new capital in FY 2024 through the sale of convertible notes, which is something that would extend Rivian’s liquidity run-way.

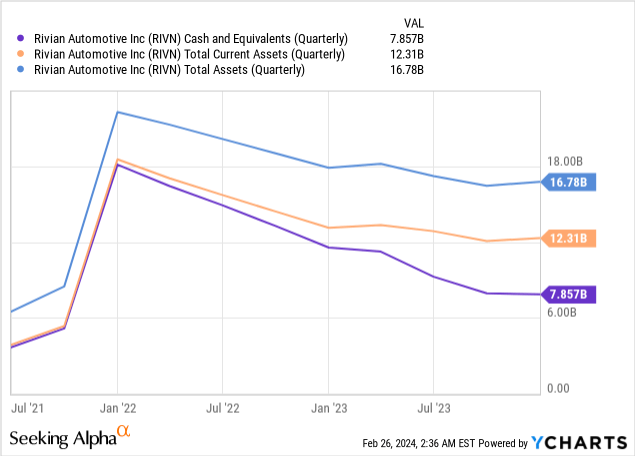

Rivian’s balance sheet: market cap is made up of 52% in net cash

Rivian had $7.85B in cash hoarded on its balance sheet, while total assets calculated to $16.78B at year-end. This implies that Rivian’s cash alone represented 47% of its total assets (56% including short term investments of $1.51B) which implies not only a long liquidity run-way, but also a high safety margin for investors: Rivian had $4.43B in long term debt on its balance sheet at year-end which calculates to a net cash position of $4.94B. This in turn represents $5.21 per-share in net cash or ~52% of the company’s market cap.

Rivian’s valuation compared to other EV makers

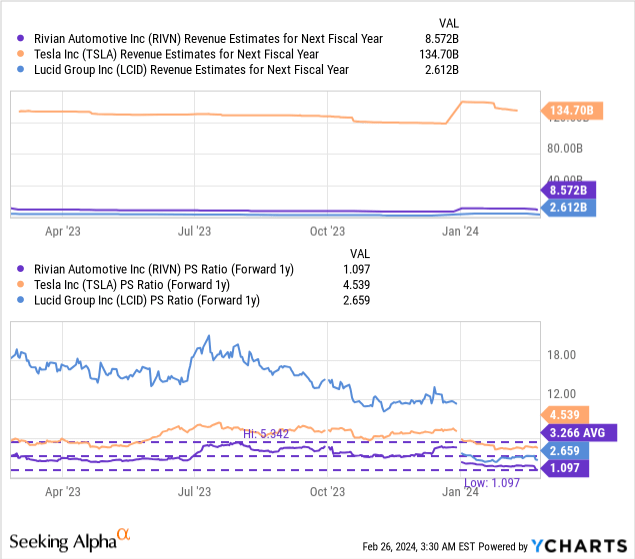

After last week’s massive value destruction, which caused the EV maker to lose $5B in market cap, Rivian is now trading at a distressed valuation multiplier, in my opinion. Rivian’s shares are trading at just 1.1X FY 2024 revenues, compared to an average P/S ratio of 3.3X in the last year. Tesla (TSLA) is by far the most expensive EV maker in the U.S., but also has the financials, the production volume and the name recognition to back this valuation up. Even Lucid Group (LCID), which I am extremely disappointed with, has a higher P/S ratio of 2.7X. Most EV makers, with the exception of Tesla, are loss-making, so using a revenue-based revenue multiplier makes sense here, in my opinion.

Last time I covered Rivian I pinned a fair value of $22 on the company’s shares, which I am not prepared at this time to change, chiefly because of Rivian’s massively improving unit economics. Rivian has proven to be a very volatile stock, which has traded at an average price-to-revenue multiplier factor of 3.1X in the last three years. The industry average P/S ratio including Tesla, Rivian, Lucid and NIO (NIO) — all pure-play EV makers — is 2.34X. If Rivian managed to revalue to this industry average P/S ratio then shares could be valued at $22. As revaluation catalysts, I would name narrowing losses, operating expense improvements and improving unit economics.

I believe the reason for Rivian’s very low revenue multiplier is that investors overreacted to the firm’s guidance for FY 2024. Obviously, the guidance was not great, but Rivian has a very strong balance sheet and its losses are narrowing rapidly. I believe the market’s reaction was overdone last week and I believe investors are dealing with a very attractive, all-in, engagement opportunity here.

Risks with Rivian

The outlook for FY 2024 production was a huge disappointment, but the risk profile, in my opinion, has improved considerably as the company’s losses are shrinking. Going forward, the gross-profit-per-vehicle figure is worth tracking, as is Rivian’s general trajectory in terms of production (2 metrics I am monitoring). What would change my mind about Rivian is if the company lowered its FY 2024 production guidance or saw deteriorating unit economics.

Closing thoughts

Rivian is very close to becoming a single-digit stock (at the time of compiling this article, Rivian’s shares are trading at just $10.07). The EV maker’s market cap has lost more than one-third of its value after earnings, which seems to be an exaggerated reaction. Rivian’s growth outlook is not great, admittedly, but the company is making huge progress in terms of reducing its losses: in the last twelve months, Rivian has cut its losses (on a gross profit basis) by more than $80k per vehicle. From a valuation point of view, Rivian is now also a bargain, selling for just 1.1X FY 2024 revenues, 66% below its historical valuation. Lastly, Rivian has a huge safety margin at a $10 price point, as the company’s net cash represents a massive 52% of the company’s market cap!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN, TSLA, BYD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.