Summary:

- Rivian missed its 2022 production target of 25,000 vehicles by a smidge.

- The miss was largely expected as we had previously highlighted that ramping up the much-needed second shift, which had only come online at the end of Q3, would be tough.

- But meaningful progress in improving production run-rates through 2022 underscores increasing efficiency and easing supply chain bottlenecks that had previously been a primary culprit for deteriorating investors’ confidence in Rivian.

Justin Sullivan

Rivian (NASDAQ:RIVN) stock opened the year with steep declines of as much as 10% before paring losses to 6% at close (Jan. 3), as investors mull risks of demand destruction across the broader auto sector – including the more resilient EV industry based on market leader Tesla’s (TSLA) consecutive delivery miss – ahead of the looming economic downturn. But despite underperforming its annual production guidance, which we had largely expected, Rivian’s shares remained steady and even etched out gains in pre-market trading Wednesday (Jan. 4).

Rivian produced 10,020 vehicles in the fourth quarter, up 36% from the 7,363 vehicles produced during the third quarter. This brought full year production volumes to 24,337 vehicles, coming in just under the 25,000 it had guided. The stock’s pre-market trading resilience following reports of the miss not only aligns with stabilizing market trends following the year-opening risk-off sentiment, but also suggests investors might have already expected it. Given Rivian’s second shift on the production floor had only started near the end of the third quarter, it would have had to ramp up immediately to double the production run-rate and achieve the 25,000-vehicle annual production target by year-end at the time, which was expected to be a tough feat.

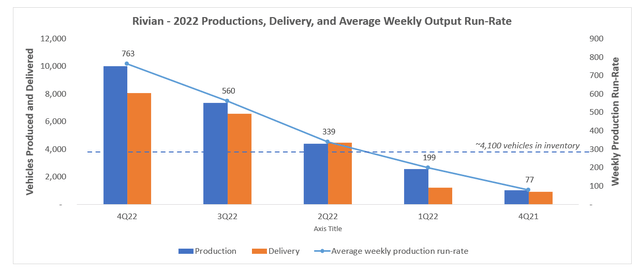

Having produced 10,020 vehicles in the fourth quarter, Rivian’s manufacturing line had ramped up its average weekly production run-rate to about 763 vehicles, up from about 560 vehicles (including consideration of weekends and holidays for comparison purposes) in the third quarter. The actual end-of-period production run-rate likely exceeds 763 vehicles, given consideration of continued ramp-up of its added shift.

Rivian 2022 Productions, Delivery, and Average Weekly Output Run-Rate (Author, with data from rivian.com/newsroom)

The improvements turn a new page for Rivian entering into the new year. It also corroborated industry observations for easing supply constraints, which was a primary bottleneck thwarting Rivian’s ramp-up progress considering earlier start of production delays in late 2021, as well as a tough decision earlier in 2022 to “cut its planned production in half in 2022 to 25,000 vehicles.” But the positive ramp up progress made on production of its R1T pick-up trucks and R1S SUVs, alongside its electric commercial rigs in 2H22 salvages some of the previously lost investors’ confidence in the stock, in our view. Specifically, production ramp-up remains a key focus area for investors, especially as incentives from the Inflation Reduction Act (“IRA”) come into play in 2023, and reasonable progress on its added production shift that had only come online during late stages of the third quarter continues to check the box.

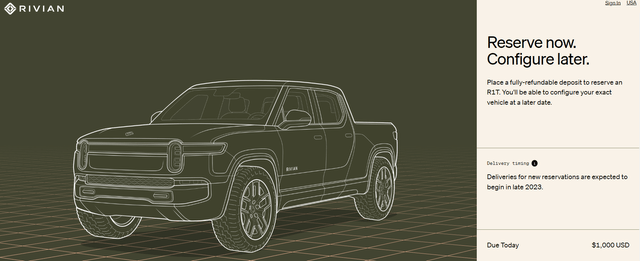

Ramping up production will not only help Rivian convert its order backlog – which totaled about 100,000 vehicles (114,000 net pre-orders on R1 vehicles as of Nov. 7, less ~13,200 delivered vehicles from 4Q21 to 3Q22) during the third quarter, and likely grew in the fourth quarter considering resilient U.S. auto sales still in 2022 (more below) – into revenues, but also allow accelerated monetization flow-through on orders placed after its price hike implemented in early 2022, as well as the anticipated reinforcement of continued demand ahead of IRA incentives that came into effect Jan. 1, 2023. For now, delivery wait times for the R1T and R1S remain extended on new orders to at least late 2023 based on Rivian’s latest update on its reservation site:

Rivian Order Wait Time (Jan 2023) (rivian.com)

While looming recession risks remain a primary overhang on the broader auto sector, with fears spilling over to the more resilient EV segment as of late following Tesla’s ballooning inventory build-up, Americans are likely still in the market for a new rig. Recent research estimates that about 4 million to 7 million Americans were either priced out or still-in-waiting when it comes to buying a car fit for their preferences. And with inventories coming back after two years of chip shortages and broader supply chain constraints show signs of structural easing, many are incentivized to return to auto show rooms this year.

But mass market and premium ($100,000-plus) segments are likely to prove more resilient ahead of the looming downturn, since affluent buyers remain relatively less sensitive to tightening financial conditions, while the majority of the 4 million to 7 million prospective buyers are likely in the market for cheaper options hence putting off on pulling the trigger on a new car over the past two years. Meanwhile, mid-range options face a trickier near-term outlook, as the typical middle-class household remains most recession-prone – more than three-quarters of American middle-class households have started to tighten their belts due to the weight of persistent inflation and rising interest rates. This is further corroborated by recent declines in dealership sticker prices, which not too long ago had benefited from supply shortages over the past two years. MSRP declines in the segment averaged $2,000 in December, and will likely fall further in the months ahead, stripping mid-range auto dealerships of their “price maker” status as near-term demand wanes due to surging interest rates on auto loans (financing remains the top payment option for new car purchases, representing close to 10% of cumulative consumer debt among Americans).

And where does Rivian fit in all of this? Admittedly, priced as a mid-range to semi-premium offering, the R1 series’ order backlog might become increasingly prone to deceleration within the near term as their target consumers will likely punt off big ticket purchases until mounting macroeconomic uncertainties clear up. Although reservations today only require a $1,000 deposit that’s fully refundable and does not require commitment until order configuration and confirmation, which likely will not come until late 2023 or early 2024, car purchases – especially lifestyle-specific ones like Rivian’s – are likely last on the average middle-class consumer’s mind. Even the $7,500 purchase incentive under the IRA, which Rivian will be eligible for, is unlikely to “meaningfully move the needle” on stimulating acceleration in retail demand within the near-term due to stiffening macroeconomic headwinds.

However, we believe the company remains well-positioned for resilient demand from fleet buyers – not so much from operators of commercial construction fleets, but rather rental fleets when it comes to the R1 series. As discussed in one of our earlier coverages on the Rivian stock, the R1T pick-up trucks are lifestyle vehicles built to “keep the world adventurous forever,” which effectively writes off much of the opportunities stemming from heavy-duty work categories. Yet, the R1 series make ideal options for car rental and ride-share programs and companies looking to diversify their fleets as EV adoption gains momentum, especially with extension of the $7,500 tax break under the IRA for said purchases. For instance, Hertz (HTZ) has made a name for itself in markets last year after associating the brand with EV monikers like Tesla and Polestar (PSNY), underscoring further commitment from the rental car industry to aboard the transition to electric. Meanwhile, EV subscription start-up Autonomy also is chiming in on the build-out of an electric fleet economy for the consumer market, which would entail further TAM expansion in the industry with added support under the IRA, and reinforce Rivian’s longer-term growth opportunities. Autonomy has already ordered 1,000 Rivian vehicles for its platform, a deal that is estimated to ring in $72.1 million for the EV start-up.

However, the timeline for Rivian deliveries to Autonomy remain uncertain and undisclosed, which circles back to our foregoing discussion that ramping up production remains a key investor focus area. Specifically, whether Rivian can capitalize on said growth opportunities continues to hinge on its ability in ramping up productions to meet demand and gain share in the burgeoning industry.

With its valuation coming back closer in line with the broader industry after rising interest rates and recurring execution mishaps within Rivian and across EV upstarts dulled the company’s “record-breaking IPO” premium from less than two years ago, the stock warrants another glance – perhaps later in the year when there is greater clarity on mounting macroeconomic uncertainties spanning protracted supply chain disruptions, persistent inflation, looming recession, and rising interest rates. For now, while we applaud Rivian on its consistent operating progress in the past year, its shares’ performance will likely remain highly vulnerable to further declines in tandem with the broader market given the combination of anticipated near-term growth risks across the auto industry, as well as its unprofitable and long-duration nature that continue to bode unfavorably under the currently risk-off market climate.

Disclosure: I/we have a beneficial long position in the shares of PSNY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!