Summary:

- Rivian’s stock has plummeted nearly 50% since its July 2024 peak, completing a stunning round trip to its June 2024 lows.

- Rivian’s lowered production forecast and ongoing supply chain disruptions raise concerns over its profitability growth prospects.

- Rivian’s long-term profitability hinges on ramping up production. It needs to execute immaculately even as it faces increasingly intense competition.

- Investors who failed to heed my caution and chased its previous surge have likely learned a hard lesson.

hapabapa

Rivian Disappoints Again – What’s New?

Rivian Automotive, Inc. (NASDAQ:RIVN) investors have endured a torrid Q3, as dip-buyers who bought RIVN aggressively at its June 2024 lows have likely given up. Accordingly, RIVN has dropped markedly since the surge to its early July 2024 peak. As a result, the stock of the fledgling EV maker has fallen nearly 50% since then, confirming its deep bear market reversal. The stunning collapse also saw the stock revisiting lows last seen at its June bottom, completing an incredible round trip.

In my previous RIVN article, I urged investors to be cautious about buying its dips, as buyers likely reacted well to its recent Volkswagen (OTCPK:VWAGY) partnership. However, I indicated that the company’s unprofitability is expected to remain a critical impediment. Hence, I wasn’t convinced about its potential bottoming signal and emphasized that it wasn’t an “automatic signal to go long.”

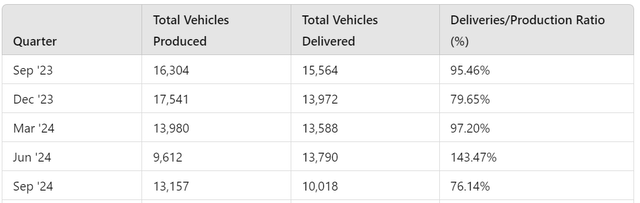

Rivian’s quarterly production and delivery metrics (Rivian filings)

Rivian’s outlook accompanying its third-quarter production and delivery update has vindicated my caution, as its production suffered due to supply chain challenges. Accordingly, the EV maker produced 13.16K vehicles in Q3 but only delivered just over 10K vehicles. Critically, the company lowered its production forecast for the full year, indicating a production guidance of between 47K and 49K vehicles.

Rivian Maintained Its Delivery Guidance, But It Isn’t Enough

Rivian anticipates ongoing supply chain disruption affecting its R1 and RCV platforms. It highlighted that these challenges have “become more acute in recent weeks and [are expected to] continue.” Despite that, Rivian had already highlighted supply chain problems at a September conference, although investors didn’t receive complete clarity over its revised production cadence then. Hence, I assess most of the “damage” inflicted on RIVN’s downtrend bias has likely occurred over the past few weeks. Despite that, management remains steadfast in its 2024 delivery guidance of between 50.5K and 52K vehicles. As a result, Rivian anticipates a tepid low single growth over 2023’s performance, behooving caution over its high-growth thesis.

Wall Street analysts have become more cautious about Rivian’s profitability trajectory, suggesting the company might miss its internal outlook regarding its gross profit growth inflection from Q4. As a result, I expect further downgrades of Rivian’s medium- and long-term profitability growth prospects, even as it needs to assure investors of its ability to overcome significant production headwinds.

Rivian’s application for a federal loan to restart its Georgia facility program is likely aimed at assuring investors about its long-term production outlook. As a reminder, the company expects the facility to be partially operational by the third quarter of FY2027, providing a much-needed boost to its production capacity.

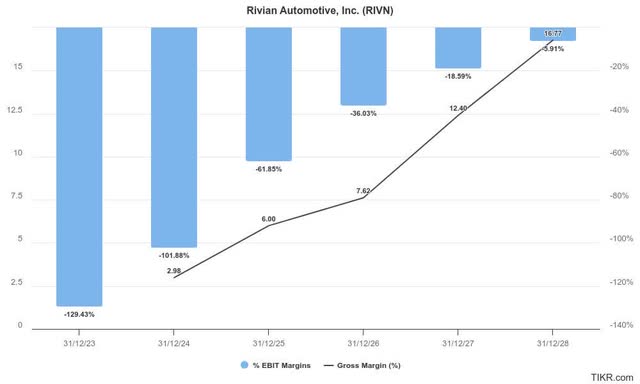

Rivian profitability estimates % (TIKR)

As seen above, Rivian’s ability to ramp up its production markedly is critical to its profitability growth prospects through 2028. As a result, investors must assess the expansion of its Illinois facility to a total installed capacity of 215K. The improved production cadence will depend on how quickly the EV maker can get its Georgia facility online, expected after the R2 launch at its Illinois facility.

Despite that, I expect Wall Street estimates on RIVN to reflect increased caution over its ability to achieve gross profitability in 2025. The company anticipates turning profitable on an adjusted EBITDA basis in FY2027.

However, I assess it likely depends on whether its production roadmap is in place and how Rivian navigates the competitive challenges in the core US market. It would be remiss for investors to understate the challenges EV leader Tesla (TSLA) has faced in its Q3 delivery update. Even the Elon Musk-led company has faced significant obstacles in outperforming its 2023 delivery performance. Therefore, the combination of macroeconomic headwinds, relatively high interest rate impediments, and an increasingly competitive environment could hinder Rivian’s progress. Investors are urged to remain cautious, given the increasingly bearish sentiments hampering its valuation re-rating opportunity.

RIVN Stock: Improved Valuation Belies Its Weak Profitability

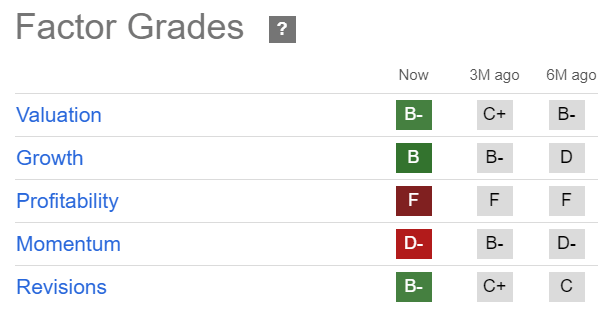

RIVN Quant Grades (Seeking Alpha)

RIVN’s valuation has improved over the past three months (from “C”+ to “B—”), although caution must be heeded, given its “F” profitability grade. Hence, a lowered production ramp will likely affect its ability to improve its gross margin profitability in Q4. Investors and analysts will likely scrutinize management’s commentary in its upcoming Q3 report and guidance update for insights to potentially adjust Rivian’s gross margin trajectory.

Is RIVN Stock A Buy, Sell, Or Hold?

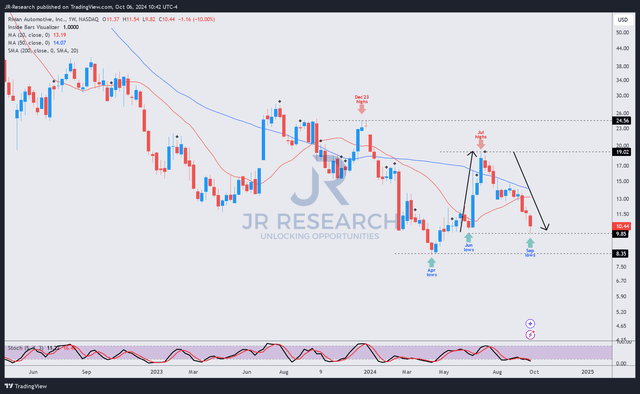

RIVN price chart (weekly, medium-term) (TradingView)

As seen above, RIVN’s collapse re-tested its June 2024 lows last week, digesting the spike that led to its July 2024 top. Hence, I assess that there could be a mean-reversion opportunity for speculative investors betting on a near-term bullish reversal.

Notwithstanding its potentially improved price action prospects, my confidence in Rivian’s ability to ramp production and deliver its medium- and long-term outlook has weakened. The company still faces critical supply chain bottlenecks, indicating the challenges underpinning its execution.

With competition in the EV industry expected to intensify further, Rivian seems poorly positioned against the EV leaders and legacy automakers. As a result, dip-buyers looking to buy into its recent battering are reminded to be agile with their positioning and exposure, given its fundamentally weak thesis. However, a bearish thesis seems poorly timed, given the potential mean-reversion setup as RIVN fell into deeply oversold zones.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!