Summary:

- Rocket Lab has a backlog of $1.04 billion, primarily driven by a contract from the Space Development Agency, with $400 million expected to be recognized as revenue in 2024.

- RKLB recently won a contract from the U.S. Space Force for a mission that could lead to additional projects with the agency.

- Despite some skepticism, the company has claimed that Neutron is on track and on budget.

mikkelwilliam

Rocket Lab (NASDAQ:RKLB) is trading close to its all-time lows and has vastly underperformed. However, in my view, the company is making strides in its business. As a growth company, Rocket Lab’s stock RKLB is primarily driven by the story and expectations of future growth. In this case, I believe the company is executing its vision. However, this has yet to be appreciated by the market, in my opinion.

Rocket Lab 2023 Results Demonstrate Continued Growth

Looking at Rocket Lab’s Q4 2023 and full-year results, the company grew a modest amount. Year over year, revenues grew by 16% from $211 million to $244.6 million. It can be expected that Revenue growth would be a bit volatile given the nature of Rocket Lab’s business and that the business is still relatively small. For instance, in Q4 2023 revenue decreased by 11% ending at $7.7 million. According to management, this was primarily driven by having less satellite launches during the quarter but offset by its Space Systems business.

In 2023, Space Systems, which is the more stable revenue source, accounted for 70.6% of Rocket Lab’s business. Revenue growth wasn’t particularly impressive. However, to counterbalance this, Rocket Lab expanded its gross margins by 12%. Combined with the revenue increase, the increased margins resulted in a jump in Gross Profit from $19 million to $51.4 million. Analyst consensus is that Rocket Lab is positioned to turn a profit as early as 2026. The improving financials are a testament to that despite the greater Net loss of -$182 million or -$0.38 EPS for the year compared to -$136 million or -$0.29 EPS loss in 2022.

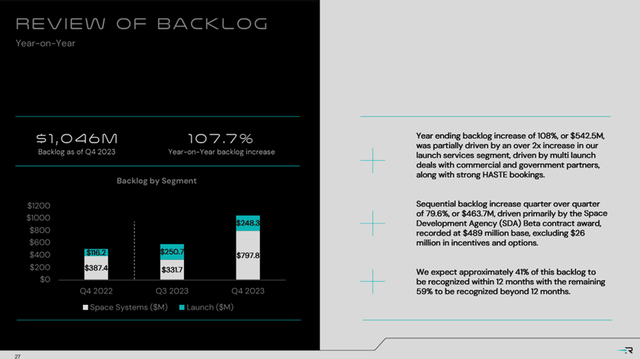

Rocket Lab’s management is guiding for revenue between $92 million and $98 million for Q1 2024. As well as Gross Margins between 24% and 26%. This would be something to watch out for during its upcoming earnings call in early May 2024. However, the company also has a backlog of $1.04 billion in 2023, a 108% increase from a year prior. This backlog is primarily driven by the 18-satellite design, build, and operate contract from the Space Development Agency for $515 million. The company expects roughly $400 million of this backlog to be recognized as revenue in 2024.

Rocket Lab (Investor Presentation)

Rocket Lab Wins Another Key Contract

Recently, the company won a $14.4 million contract from the U.S. Space Force. The mission named STP-S30 will launch a 200-kilogram payload for a new small satellite design called DiskSat. According to Space Systems Command “DiskSat will demonstrate sustained VLEO (very low earth orbit) flight and test a unique, 40-inch diameter, disk-shaped satellite bus that is designed to increase on-orbit persistence,” It is my view that if this project is successful, Rocket Lab could be contracted to for additional projects with the agency.

VELO is of particular interest as it is the orbit used for imaging satellites, communications monitoring, and atmospheric measurements. The STP-30’s mission is complex yet critical, as the experimental payload is important for research experiments and future space systems’ development. Luckily, Rocket Lab has had a track record of success working with the Department of Defense on such projects as the 2021 Air Force Research Laboratory-sponsored demonstration satellite called Monolith and the 2019 STP-27RD mission research and development satellites.

Dependent on the Neutron

Arguably the company’s most critical project is its Neutron launch rocket. The medium-capacity Neutron is designed to have a maximum payload capacity of approximately 13,000 kg. According to the company’s 10-K, the Neutron “will be tailored for commercial and U.S. government constellation launches and ultimately configurable for and capable of human space flight“.

As opposed to the company’s existing Electron, which is designed for one-off projects, this new launch vehicle can a high-flight schedule. In the future, it could even be the Neutron flying cargo and personnel into the International Space Station.

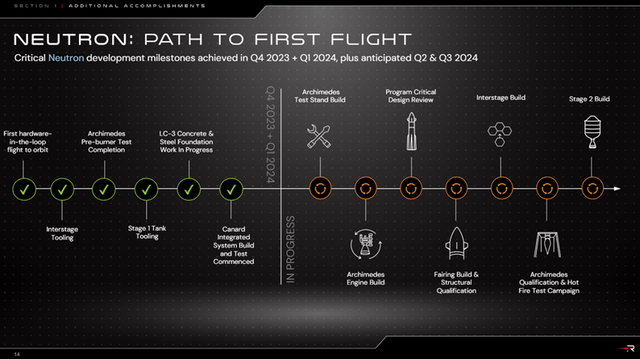

The importance of Neutron to the company’s future growth cannot be overstated. Because of this, Rocket Labs is targeting a somewhat aggressive target for its first launch by the end of 2024. During Q4 2023 the company hit some key milestones for this project. These include infrastructure milestones at Launch Complex 3 as well as establishing a Space Structures Complex for carbon composite spacecraft components.

Some doubts though have been cast on whether or not the company can meet this deadline. In order to qualify for the billion-dollar contracts of the National Space Security Launch program, Rocket Lab’s Neutron must be ready for launch by December 2024. Given the tight deadline, an internal congressional memo claims that Neutron has “no credible path to launch” by that deadline. Although Rocket Labs can still bid for other contracts after the deadline, it would be important to make it; otherwise the company loses ground to its competition.

For its part, the company has claimed that Neutron is on track and on-budget. Management has acknowledged though that everything would have to go its way to hit the deadline. According to the website Spacenews:

An industry source, speaking on background, described a schedule of less than nine months from first engine hot-fire to first launch as “exceedingly optimistic,” citing development timelines for other vehicle programs where it can take years from first engine test to first launch. Later in the call, Adam Spice, Rocket Lab’s chief financial officer, acknowledged a Neutron launch by the end of the year was a “green-light schedule” where there are no problems in the vehicle’s development.

Rocket Lab (Investor Presentation)

Valuation and Conclusion

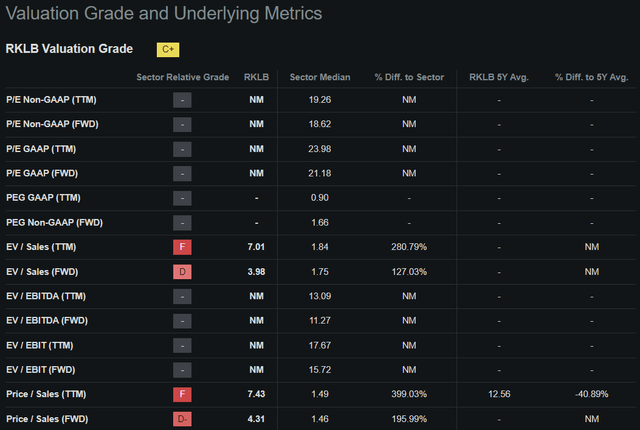

As a fast-growing disruptive company that is not yet profitable, Rocket Lab gets a valuation grade of “C+” from Seeking Alpha’s quant metrics. The company is trading at a TTM and forward price-to-sales ratio of 7.4x and 4.3x. This is a good price provided that the company can start to accelerate its growth. Its historical growth rate (16% for 2024) is not sufficient to justify this lofty valuation.

Fortunately, we can use the company’s current backlog to create a floor estimate for Revenues in 2024. Rocket Lab’s management has indicated that 41% of the $1.04 billion would be recognized as Revenue in 2024. This gives us roughly $426 million in revenues for 2024. This translates to a growth rate of 74% when compared to 2023 revenue of $244.6 million. The company just needs to keep on winning contracts to sustain this growth rate. The key would be its Neutron project, as any delays would be bearish for the stock.

Another key risk to consider is liquidity. Rocket Labs has $476.7 million in current assets. Of which, $162 million is in cash and $82.2 million is in marketable securities. Building rockets is a capital-intensive process; therefore there is always a risk of having to do a share sale. I doubt that this will happen in the short term, though, given the company’s massive backlog and existing cash position. For the long term, though, the company would have to execute on its Neutron project.

As one of the few listed public shares to gain exposure in the burgeoning space industry, Rocket Lab in my opinion could be an interesting pick at these levels. For sure there are a myriad of risks, however the company has a history of executing well.

Quant Valuation (Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in RKLB over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.