Summary:

- Roku jumped an easy Q1 bar, but the underlying numbers remain concerning.

- The streaming industry needs to find a more sustainable model, which likely isn’t good for Roku.

- Roku’s generating negative EBITDA and its stock comp is also out of control.

hapabapa/iStock Editorial via Getty Images

Back in April, I wrote that while the numbers and trends for Roku (NASDAQ:ROKU) looked poor, I was more neutral on the name, as I thought it had lowballed its Q1 guidance. Since then, the stock has treaded water, up less than 1%, while the S&P is up about 7.5%. Let’s catch up on the name.

Company Profile

As a reminder, ROKU is a TV streaming company whose operating system (‘OS’) powers its own streaming devices as well as its own and third-party TVs.

ROKU’s primary business is its platform business, which consists of the sale of subscriptions, video advertising in ad-supported channels, transaction-based content, billing services, and brand sponsorship & promotions. When a user pays for a subscription to a streaming channel on its platform, ROKU generally takes a cut of the sale through a revenue-sharing agreement. For ad-supported streaming services, meanwhile, it gets a percentage of the ad inventory. It also owns a free ad-supported streaming service called the Roku Channel and has an ad buying platform called OneView.

While known for its streaming devices, the company’s streaming devices are often sold around cost or even as a loss-leader to attract users onto its platform. The company has also recently gotten into the smart home market, offering products such as cameras, video doorbells, plugs, light bulbs, and light strips.

Easy Bar Passed, But Numbers Still Ugly

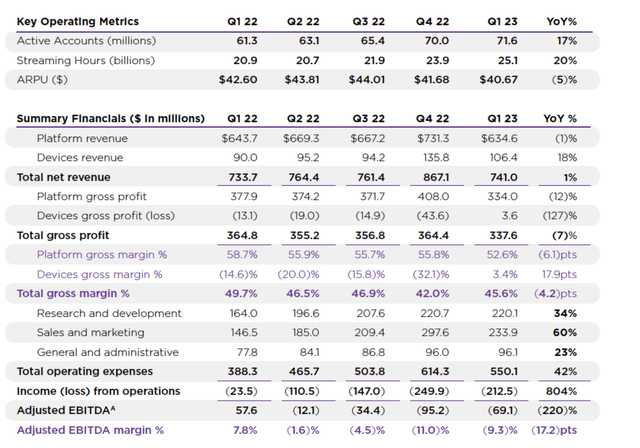

In my initial write-up, I thought that ROKU has set the bar very low for its Q1 earnings and that it would easily surpass these numbers. That did prove to be the case, with the company topping analyst revenue estimates by $33.4 million, or nearly 5%, to come in at $741 million, while its loss of -$1.16 per share was 33 cents better than analyst expectations. Its adjusted EBITDA loss of -$69.1 million, meanwhile, was much better than its guidance calling for a loss of -$110 million.

That said, much of the better-than-expected results came from its devices, where it saw revenue grow 18% to $106.4 million. At the same time, gross margins turned positive. While they were only 3.4%, that was a vast improvement from the -14.6% gross margin a year ago or the -32.1% in Q4. However, the positive gross margins were helped by a $10 million service operator licensing catch-up fee, and otherwise would have been -6%.

Company Presentation

ROKU’s platform numbers, meanwhile, continued to disappoint. Revenue fell -1% to $634.6 million, while ARPU dropped -5% year over year to $40.67. Gross margins dipped -610 basis year over year and -320 basis points sequentially to 52.6%. The company cited a weak scatter market as well as a greater mix away from media and entertainment.

The latter is a real issue going forward, as the streaming model, as Vulture published last month, is broken. In its article, the publication wrote:

“Certain shows that were enthusiastically green-lit two years ago probably wouldn’t be made now. Yet there are still streamers burning mountains of cash to entertain audiences that already have too much to watch. Netflix has tightened the screws and recovered somewhat, but the inarguable consensus is that there is still a great deal of pain to come as the industry cuts back, consolidates, and fumbles toward a more functional economic framework. The high-stakes Writers Guild of America strike has focused attention on Hollywood’s labor unrest, but the really systemic issue is streaming’s busted math. There may be no problem more foundational than the way the system monetizes its biggest hits: It doesn’t.”

With the streaming model not working for most outside of Netflix (NFLX), which doesn’t pay ROKU to be on its platform, the industry is trying to find its footing. The days of looking to grab subs at any cost are likely over, which naturally should hurt ROKU, which was a primary lead generator for these businesses. And with streamers struggling with profitability, their desire to share revenue with the likes of a ROKU will likely start to wane as well. Spotify (SPOT) cut off premium subs using Apple’s (AAPL) billing service to pay, so it’s not much of a stretch to think that streamers could push back in a similar way.

Even some of ROKU’s biggest cheerleaders on Wall Street have become a bit more critical of the company. Needham’s Laura Martin, one of the biggest ROKU bulls on the street over the years, pointed out many of the things she thought the company could do better in a fireside chat with outgoing CFO Steven Louden at a Needham conference in May. This included the company needing to better utilize and monetize its home page, which she said Vizio is doing a better job of, as well as Vizio being better at selling its user data. She said that while Vizio is in only a quarter of the homes that ROKU is in, it’s making $100 million a year selling data to the like of iSpot, Samba, and Samsung, so why does ROKU not have this revenue stream?

Of course, Martin remains bullish on the stock, but she clearly thinks the company can be doing a better job in some areas. Her comments do show the company has some opportunities it can capitalize on the future, but it doesn’t appear to be a priority at the moment.

Valuation and Conclusion

Valuing ROKU is not easy. The current consensus for the full-year 2023 is for ROKU to generate negative EBITDA of -$269.1 million. The company also recorded nearly $360 million in stock-based compensation in 2022, which is a real expense that gets excluded in the EBITDA calculation. Stock comp was up nearly 40% to $96.5 million in Q1, so this number does not appear to be shrinking either.

If you want to go out to 2027, the analyst estimate is for the company to generate EBITDA of nearly $650 million. That places a value of the company of 12x 2027 numbers. Now, of course, whether ROKU can make this huge jump in EBITDA is a big question mark. Yes, the overall ad market is soft, but at the same time, ROKU market saturation is pretty high already, and the streaming industry needs to find a more workable model, possibly at the expense of middlemen distributors like ROKU.

A bullish argument can certainly be made for ROKU and its place in the streaming ecosystem. However, the company is putting up some very poor metrics, and there are a lot of questions surrounding where streaming goes from here. Given the number of ways to stream, under the current state of the market, ROKU’s value proposition in the streaming ecosystem and the cut it takes should be questioned. As such, I remain neutral on the time at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.