Summary:

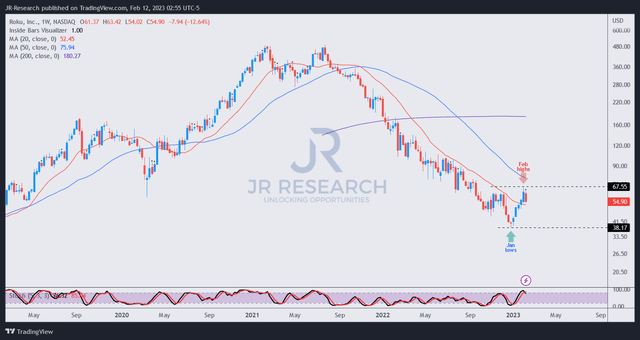

- Roku stock’s recent stunning performance, outpacing the S&P 500 since its January lows, left bearish investors reeling in disbelief.

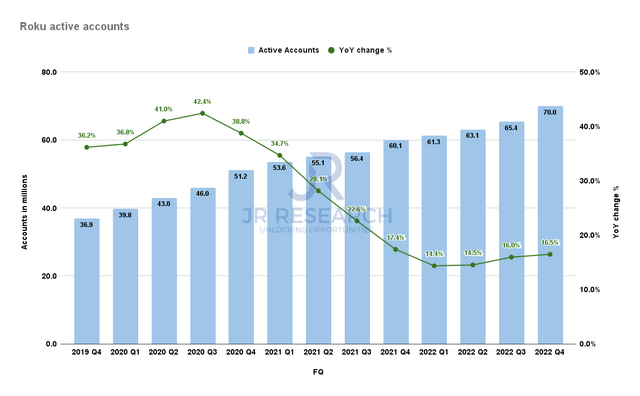

- Roku reported active accounts growth of 16.5% YoY, reaching 70M, as the company silences skeptics predicting a structural slowdown in growth.

- As Linear TV continues its secular decline, Roku stands to reap the rewards of the accelerating shift to ad-supported VOD and FAST streaming.

- Google’s battle against Microsoft in search advertising heats up, intensifying the competition for Roku as YouTube sharpens its competitive edge to capture market share in streaming.

- Is it time to capitalize on the recent surge in ROKU buying before its upcoming earnings release?

Justin Sullivan

Roku, Inc. (NASDAQ:ROKU) is preparing to report its FQ4’22 earnings release on February 15. It has also significantly outperformed the S&P 500 (SPX) (SPY) since our last update in December.

Accordingly, ROKU surged nearly 75% from its January lows toward its highs two weeks ago. Therefore, investors could be confused why the market still re-rated ROKU, even though the ad market is expected to remain weak in 2023.

We believe an industry re-rating has been underway, led by Netflix (NFLX), since last year. We updated NFLX investors in a July 2022 update that the stock has been battered so severely, inflicting maximum pain on sellers/weak holders. However, its price action had already turned bullish at those pessimistic moments.

As such, ROKU has likely benefited from an industry re-rating, suggesting that the worst of the ad market downturn could be over. However, as the market is forward-looking, we should expect Roku to still report weak numbers in its upcoming earnings release. Coupled with a still uncertain macroeconomic outlook and cautious advertiser spending, we don’t expect CEO Anthony Wood & his team to proffer investors optimistic guidance for 2023.

Hence, investors might need to wait until H2’23 before Roku could start to post better performance if the macro headwinds improve.

Wall Street’s consensus estimates suggest that Roku could continue delivering negative revenue growth through H1’FY23 before an inflection by FQ3’23. However, Roku is not expected to deliver adjusted EBITDA profitability until FY24.

As such, Roku is still susceptible to more intense competition from its ad-supported streaming competitors, notably Netflix, which is expected to gain market share at Roku’s expense (as discussed in our December update).

Moreover, Roku might also need to contend with Google (GOOGL) (GOOG), as it faces a monumental AI faceoff with Microsoft (MSFT) in search advertising. Therefore, we believe Google may be looking to pull all levers to bolster YouTube’s appeal in ad-supported VOD or AVOD and free ad-supported streaming (FAST) to mitigate the impact on its search surfaces.

In early January, YouTube was reported to be discussing expanding its FAST line-up, which could open up a more competitive landscape with Roku. Moreover, its NFL Sunday Ticket is an essential win for YouTube to offer premium sports programming to draw more viewers to its platform. Google CEO Sundar Pichai stressed:

YouTube’s NFL Sunday Ticket will accelerate [growth] by helping to drive subscriptions, bring new viewers to YouTube’s paid and ad-supported experiences and create new opportunities for creators. (Google FQ4’22 earnings call)

Moreover, Disney (DIS) CEO Bog Iger’s decision to separate ESPN from its media division into a standalone segment in its recent earnings highlighted the importance of sports programming moving ahead. It’s getting increasingly clear that Disney could potentially transit ESPN into a full-fledged sports streaming platform in the future as Linear continues its secular decline. Iger highlighted:

ESPN+ actually has grown nicely for us, and it’s shown us that the ESPN brand can be enjoyed and can be expressed well as a streaming brand. And I think that we are going to continue to look at that as a potential pivot for ESPN away from the linear business. But we are not going to do that precipitously. We are not going to do that until it really makes sense from an economic perspective. (Disney FQ1’23 earnings call)

We shared our view on the economics of YouTube’s NFL ticket, suggesting a challenging path toward profitability. However, Google can leverage its profitable segments to drive its investment in NFL streaming, improving its competitive edge further.

Roku active accounts (Company filings)

As such, we are pleased that Roku announced in early January that its active accounts crossed the 70M mark, as seen above, representing a 16.5% YoY increase. Hence, Roku demonstrated that it was still able to generate active subscriber growth in late 2022, despite a highly challenging year for the company.

Notwithstanding, investors should remain focused on average revenue per user (ARPU) growth to ascertain Roku’s ability to drive incremental monetization. However, that metric wasn’t disclosed, so investors should carefully parse its upcoming earnings release for management’s commentary.

Despite that, Roku’s active accounts growth seems to have plateaued and appears to be recovering. That should help to allay some fears that the platform’s growth could be moving into a structural decline, suggesting that Roku’s secular growth drivers remain intact.

Moreover, Roku also announced a deal with Warner Bros. Discovery (WBD) in late January, bringing WBD’s “branded FAST channels to The Roku Channel.” We believe it’s a significant deal for Roku to expand its premium library in partnership with WBD, which could lift engagement with its users, driving monetization and ARPU accretion.

Hence, we should expect positive commentary from management on the deal and the economics of the potential benefits.

ROKU price chart (weekly) (TradingView)

With ROKU’s significant recovery from its January lows, it also formed a potential top, but not a bull trap at its February highs.

As such, investors should expect a near-term consolidation, as ROKU also pulled back last week following the surge.

Hence, we urge investors to consider waiting for a consolidation first before pulling the buy trigger.

Rating: Hold (Revise from Speculative Buy).

Note: As with our cautious/speculative ratings, investors must consider appropriate risk management strategies, including pre-defined stop-loss/profit-taking targets, within an appropriate risk exposure.

Disclosure: I/we have a beneficial long position in the shares of ROKU, MSFT, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you’ll also gain access to exclusive resources including:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!