Summary:

- RCL remains a Buy, thanks to the excellent consumer demand and the cruise’s robust pricing power, as observed in the higher deposits and growing profit margins.

- The company’s strategic moves, such as effective fuel hedging and efficient operating expenses, have contributed to its improving bottom lines and raised FY2024 adj EPS guidance.

- With the cruise company likely to achieve its ambitious 2025 Trifecta goal in 2024 and the stock finally trading near its historical valuations, RCL remains a Buy at all dips.

Hill Street Studios/DigitalVision via Getty Images

We previously covered Royal Caribbean Cruises (NYSE:RCL) in February 2024, discussing the excellent consumer demand and the cruise’s robust pricing power, as observed in the higher deposits and growing gross profit margins.

Combined with the healthier balance sheet and raised FY2023 Net Yields/ adj EPS guidance, we had maintained our Buy rating then, with the stock’s return by +23% already outperforming the wider market at +2% over the past two months.

In this article, I shall discuss why we are maintaining our Buy rating for the RCL stock, with the company recently reporting an excellent FQ1’24 earnings call while raising the FY2024 profitability guidance, further demonstrating its excellent reversal from the hyper-pandemic woes.

With the cruise company very likely to achieve its ambitious 2025 Trifecta goal in 2024 and the stock finally trading near its historical valuations, we believe that RCL remains a Buy at every dips.

RCL’s Long-Term Investment Thesis Remains Robust After A Moderate Retracement

For now, RCL has reported a double beat FQ1’24 earnings call, with revenues of $3.73B (+12% QoQ/ +29% YoY), adj EBITDA of $1.17B (+17.1% QoQ/ +82.8% YoY), and adj EPS of $1.77 (+41.6% QoQ/ +869.5% YoY).

Much of the top-line tailwinds are attributed to the higher load factors of 107% (+2 points QoQ/ +5 YoY) and expanding Net Yields of $247.20 (+9% QoQ/ +19.5% YoY/ +18.3% from FY2019 levels of $208.88).

These numbers demonstrate the growing consumer demand with discretionary spending still strong, despite the uncertain macroeconomic outlook and the “higher ticket pricing and onboard rates.”

The bottom-line tailwinds are attributed to RCL’s effective hedging for fuel costs, with 61% of its projected consumption volume hedged in 2024, 45% in 2025, and 24% in 2026, well-balancing the impact from the elevated WTI crude oil prices of $82.48 (+15.6% YoY/ +37.4% from 2019 averages of $60) at the time of writing.

We believe that this strategic move allows the management to more accurately project its overall expenses, especially since the conflict in the Middle East continues with no resolution in sight.

At the same time, the management has also maintained an efficient marketing and SG&A expenses of $535M (+6.3% QoQ/ +16% YoY) in FQ1’24, allowing the cruise company to generate an impressive operating margin of 20.1% (+3 points QoQ/ +10.7 YoY/ +1.1 from FY2019 levels).

Perhaps this is why the RCL management felt confident enough to raise their FY2024 adj EPS guidance from the original number of $10 (+47.7% YoY) to $10.80 (+59.5% YoY) at the midpoint.

This is further aided by the visibility provided by the robust FQ1’24 customer deposit balance of $6B (+13.2% QoQ/ +13.2% YoY/ +57.8% from FY2019 levels of $3.8B).

Combined with the FQ1’24 adj EBITDA per APCD of $95.56 (+14% QoQ/ +67.2% YoY), it is apparent that RCL is on track to achieving its Trifecta financial goals in 2024, with triple digit EBITDA per APCD, ROIC in the teens, and double-digit EPS, one year earlier than the prior guidance in 2025.

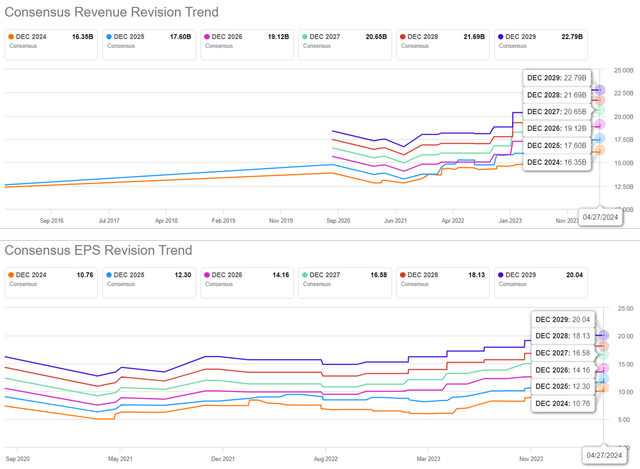

The Consensus Forward Estimates

Seeking Alpha

As a result, we can understand why the consensus have raised their forward estimates, with RCL expected to generate a promising revenue and net income growth at a CAGR of +11.2%/ +27.9% to $19.11B/ $3.96B through FY2026.

This is compared to the previous estimates of +10.7%/ +23.7% and its direct peer, Carnival Corporation (CCL), at a CAGR of +7.1%/ +79.1% to $26.49B / $2.32B over the same time period, respectively.

Much of RCL’s bottom-line tailwinds are also attributed to the moderating net-debt-to-EBITDA ratio of 3.94x in FQ1’24, down from the peak of 12.91x in FQ4’22 and lower compared to CCL’s still hefty net-debt-to-EBITDA ratio of 7.55x in FQ1’24.

Combined with the lower weighted average interest rates of 5.75% (-0.31 points QoQ/ -0.6 YoY), we expect to see a reduced interest headwind ahead, especially since the market has priced in a Fed rate cut in 2024 as the EU Central Bank similarly signals the first cut by June 2024.

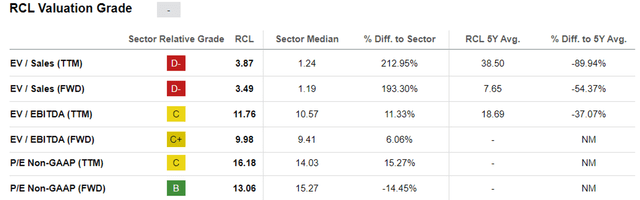

RCL Valuations

Seeking Alpha

As a result of these developments, it is also apparent that RCL has finally grown into its previously premium 2022 EV/ EBITDA of 18.01x/ FWD P/E of 29.07x, with these valuations moderating to 9.98x/ 13.06x by the time of writing, nearing its 3Y pre-pandemic mean of 10.84x/ 13.05x, respectively.

When compared to the sector median of 9.41x/ 15.27x and CCL at 8.59x/ 15.10x, it is apparent that RCL is inherently attractive here.

So, Is RCL Stock A Buy, Sell, or Hold?

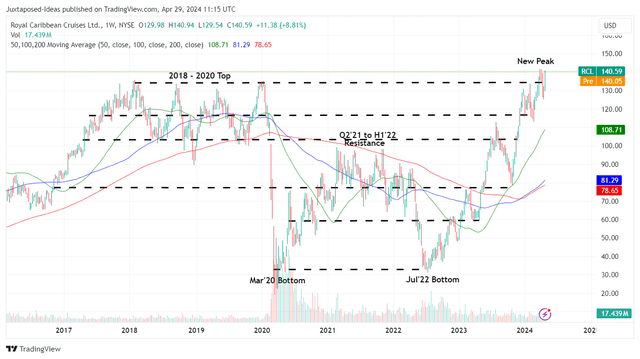

RCL 7Y Stock Price

TradingView

The same has been observed in RCL’s stock prices, with it continuing to be well-supported at the 2018-2020 top of $130s and the stock also quickly rallying to retest its new peak of $140s after the promising FQ1’24 earnings call.

For now, based on the LTM adj EPS of $8.69 and the FWD P/E valuations of 13.06x, it appears that the stock continues to trade at a premium compared to our estimated fair value of $113.40.

Then again, based on the raised consensus FY2026 adj EPS estimates to $14.16, there seems to be an excellent upside potential of +31.5% to our long-term price target of $184.90.

Combined with RCL’s impressive recovery by +70% from the October 2023 bottom and by +332% from the July 2022 bottom, well outperforming the wider market at +21% and +40%, respectively, it is apparent that the stock continues to enjoy massive bullish support thus far.

Does this mean that we will continue rating RCL as a Buy here? Yes, but with one caveat.

With the stock charting new heights at the time of writing, it may be better to wait for part of the optimism to be moderated before adding, especially since it reports a growing short interest of 6.3% at the time of writing, nearly double from a year ago.

Based on RCL’s trading pattern thus far, interested investors may consider adding after a moderate retracement to its previous trading ranges of between $110s and $120s for an improved margin of safety, with those levels also nearer to its fair value.

Do not chase this rally.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.