Summary:

- This is a technical analysis article. Salesforce, Inc.’s CEO just beat the invading activists to the punch by reporting good earnings and forecast.

- You have to wonder what the “value added” contribution will be for the activists to gain control the future of the company.

- Is the sum of the parts worth more than the whole? Or is there so much “fat” in the company that the activists can improve the buybacks or get a dividend?

- Will it follow the Apple model of dividends and buybacks and avoid the valuation problem indicated by a terrible PEG?

- We think Salesforce, Inc. is overvalued at current levels and the activists will add very little value going forward. However, the “smart money” may know something we don’t.

Jemal Countess

Marc Benioff, CEO at Salesforce, Inc. (NYSE:CRM), is hoping he can keep churning out good earnings reports to beat off the activist invaders. With this current earnings report and forecast, he pulled a few rabbits out of the hat. It remains to be seen if he can continue to cut costs and increase earnings.

In checking with Seeking Alpha’s quant ratings, we see good marks for Revisions, Profitability and Momentum. The good earnings report and forecast just released confirmed those ratings. However, SA gives Valuation and Growth low marks, and we can see that in the latest earnings and forecast.

I would like to know how the activists are going to solve those challenges. Usually, activists go after undervalued companies. That’s not CRM. Then they go after poorly managed companies. That sounds like CRM before this latest earnings report. Now the activists can’t claim poor management.

Activists like good cash positions and good cash flow as well as low debt. CRM has all of that. So the activists can use that to flow money out of the company into shareholders hands. Marc’s next move to fight the activists likely would be a big acquisition using debt to finance it.

If the activists stay friendly with the CEO, they may be able to work out an accommodation, as was done with Apple (AAPL) and all its cash. Marc might be persuaded to increase shareholder value, and ignore other “stake holders” except the shareholders.

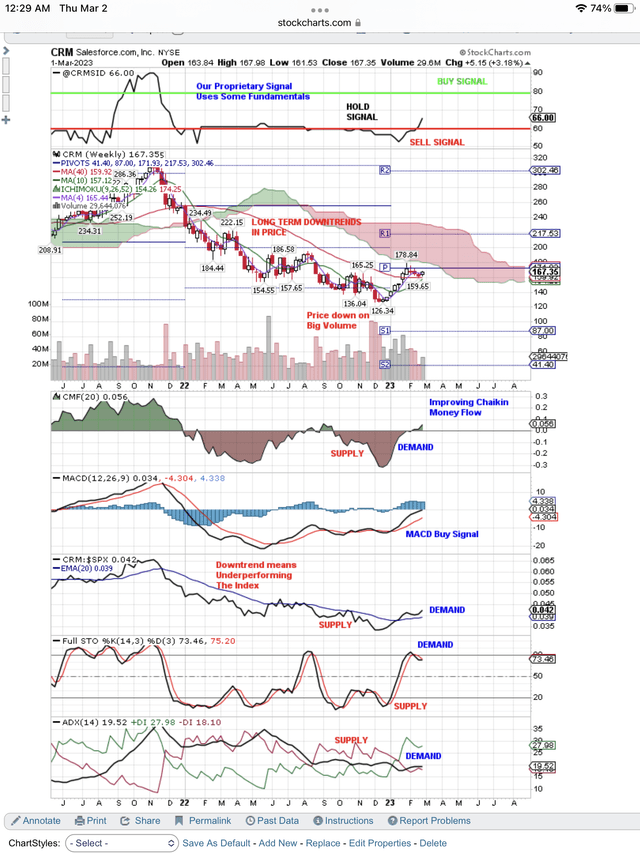

At the top of the chart below, you can see our proprietary Buy/Hold/Sell signal. It has improved from a Sell Signal to a Hold Signal before earnings were announced. After the close and the earnings announcement, price jumped almost 16% to $194 in after-market trading. (This is not shown on the chart below.)

Also, this jump in price confirms all the improving signals you see on the chart below. There was a strong change from Supply to Demand as price shot up from the bottom at $126. The activists have already made plenty of money buying the bottom.

CRM, with this rise in price, is still facing a Valuation challenge. The PEG is terrible because of the relatively low growth compared to the high P/E. Price rising because of a good earnings report does not solve the PEG challenge. The high PEG implies that price will drop to retest the bottom.

As technicians, we just watch the signals. Right now the signals on the chart below are taking price higher. If Valuation and Growth are real problems, then we will see Sell Signals on the chart below. If we see the Sell Signals, we will know why. If we don’t, then we will ride the activist bounce higher as long as our proprietary signal at the top of the chart keeps improving.

Here is the weekly chart with all the positive signals before CRM earnings were reported:

Salesforce continues its bounce off the bottom (StockCharts.com)

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CRM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: We are not investment advisers and we never recommend stocks or securities. Nothing on this website, in our reports and emails or in our meetings is a recommendation to buy or sell any security. Options are especially risky and most options expire worthless. You need to do your own due diligence and consult with a professional financial advisor before acting on any information provided on this website or at our meetings. Our meetings and website are for educational purposes only. Any content sent to you is sent out as any newspaper or newsletter, is for educational purposes and never should be taken as a recommendation to buy or sell any security. The use of terms buy, sell or hold are not recommendations to buy sell or hold any security. They are used here strictly for educational purposes. Analysts price targets are educated guesses and can be wrong. Computer systems like ours, using analyst targets therefore can be wrong. Chart buy and sell signals can be wrong and are u sed by our system which can then be wrong. Therefore you must always do your own due diligence before buying or selling any stock discussed here. Past results may never be repeated again and are no indication of how well our SID score Buy signal will do in the future. We assume no liability for erroneous data or opinions you hear at our meetings and see on this website or its emails and reports. You use this website and our meetings at your own risk.

Use our free, 30 day training program to become a succesful trader or investor. Join us on Zoom to discuss your questions.