Summary:

- Salesforce delivers strong results and emphasizes the role of AI in driving productivity gains.

- The company’s valuation at around 20x next year’s EPS is considered cheap.

- Salesforce’s profitability, double-digit revenue growth, and focus on AI-driven productivity make it an attractive investment opportunity.

Jemal Countess

Investment Thesis

Salesforce (NYSE:CRM) delivers a very strong set of results, where its underlying profitability shines strongly. But most importantly, as always, it’s all about the outlook. And here Salesforce impresses here too, by acquiescing that its growth rates have slowed down, but how AI will deliver tremendous productivity gains, and that ”customers [will] begin to adopt these new AI technologies and understand they need to invest and grow to be able to achieve this kind of next level of productivity”.

Simply put, Salesforce makes the argument that there’s still more upside left down the road.

And for my part, I have to say, despite Salesforce being a well-known and highly followed company, I have to say that its valuation of around 20x next year’s EPS is cheap for what it offers.

Rapid Recap

In my previous bullish Salesforce analysis, back in June, titled Do Not Throw in the Towel, I said,

Salesforce’s guidance was in line with the consensus. But investors wanted more. This is what’s happening right now in the markets.

The mega-caps stocks that are believed to benefit from AI are seeing their share prices increase. But if their earnings report doesn’t immediately awe investors, investors are moving on to the next alluring company.

Even though the share price is down premarket, I make the case that investors would do well to stick with this stock.

How much changes in 90 days? Investors that didn’t buy into the story then, and abandoned this train, didn’t stick around to benefit now.

Why Salesforce? Why Now?

Salesforce is the default go-to customer relations platform. But Salesforce is a lot more than this. Investing in Salesforce is about buying into Salesforce’s CEO Marc Benioff’s vision that it can deliver against its massive aspirations, whatever they may be.

Presently, as discussed on the earnings call, Salesforce now has 5 different priorities, with the number one priority being profitability. We’ll discuss more on Salesforce’s profitability imminently. But before that, as a reference point, consider this quote from the earnings call,

In our second quarter, our non-GAAP operating margin rose to 31.6%. That’s up over 1,000 basis points year-over-year. And this is the second quarter in a row, our operating margin is up 1,000 or more points year-over-year.

There may be some investors who are taken aback at times by Salesforce’s focus on hard rhetoric. It’s not for everyone. But when it came time to step up and deliver, Salesforce did just that and continues to guide towards more growth to come ahead.

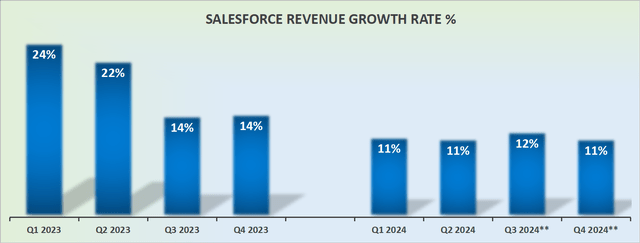

Revenue Growth Rates Still in the Double Digits

Salesforce is old school when it comes to tech companies. Listed nearly 20 years ago, Salesforce consistently declares that it is well-positioned for the future. And even though its growth rates are not bedazzling anymore, it’s still delivering double-digit top-line growth.

Benioff described during Salesforce’s earnings call how AI productivity is likely to reshape businesses by increasing company’s productivity and saving time and money.

Here’s another quote from the earnings call,

[…] I think many of our customers and ultimately, all of them believe they can grow their businesses by becoming more connected to their customers than ever before through AI and at the same time, reduce cost, increase productivity, drive efficiency and exceed customer expectations through AI.

Benioff goes on to describe how Salesforce provides enterprises with a single point of ”truth”, or platformization, which will be an important driver for Salesforce’s future prospects.

Salesforce is a Profit Raking Machine

For a long time, Salesforce was a narrative-led story stock, where one had to buy into Benioff’s vision. Today, that’s no longer the case. This is a highly profitable enterprise that is gushing cash flows.

More specifically, Salesforce’s latest guidance points to its cash flows ending at around $8.1 billion, at the high end. This would imply that on a y/y basis, its cash flows would be up 27% y/y.

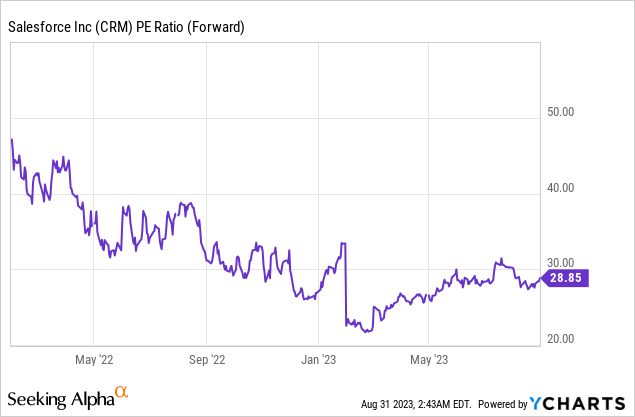

For a business that is priced at approximately 28x this year’s EPS, this is a very reasonable entry point for new investors.

Furthermore, if we were to presume that into next year, Salesforce continues to repurchase shares, it’s possible that next year’s EPS could reach around $11.30.

For this figure, I’ve assumed that Salesforce’s EPS will increase next year by around 40% from $8.06 of non-GAAP EPS this year. A figure that I believe is perfectly achievable. Not only due to Salesforce’s increased focus on improving its underlying profitability but also through deploying excess free cash flow towards share repurchases.

As a point of reference, fiscal 2024 is expected to end up increasing its EPS by around 57% compared with fiscal 2023. Accordingly, as you can see, I’m not making any heroic assumptions about next year.

On the contrary, I’ve baked in the assumption that next year’s EPS will increase at a slower pace than what we are expecting to see this year. This means that looking out to next year, Salesforce is priced at 20x next year’s EPS. If you think about it, that’s really reasonable.

As a point of reference, you can see that historically, Salesforce has traded for around 30x forward earnings. Even if my estimate that next year’s growth of 40% EPS turns out to be too aggressive, investors are still left with a margin of safety, as the company would be priced around 25x forward earnings, down from its historical average.

Risk Factors to the AI Adoption

AI doesn’t come for free. Even if Salesforce highlights the significant AI gains, getting started with AI can be expensive. There are upfront costs to adopt AI and then, you’ll need to pay skilled people to run the software.

Along these lines, beyond ongoing maintenance costs, finding these experts can be a bit like hunting for rare treasures. In Silicon Valley, these developers are not easy to come by, and when you do find them, they might ask for a king’s ransom to work for you.

The AI vision at this point in time is high in narrative and low on easily quantifiable impacts. Meaning that this ”renewed growth” may not pull through in the end.

The Bottom Line

Salesforce’s recent report highlights impressive profitability and a positive outlook, emphasizing the role of AI in boosting productivity, even if the AI win is challenging to quantify.

The company’s valuation, around 20x next year’s EPS, is attractively priced. With a robust non-GAAP operating margin of 31.6% in Q2 and continued double-digit revenue growth, Salesforce remains a dominant player in customer relations.

CEO Marc Benioff sees AI-driven productivity as a game-changer, enhancing customer connections and reducing costs. Salesforce’s focus on a single source of “truth” through platformization is a key driver of its future success.

Its ability to generate significant cash flows makes it a compelling investment, trading at approximately 20x next year’s EPS. In short, Salesforce offers a promising investment opportunity due to its profitability, growth prospects, and appealing valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.