Summary:

- Salesforce is heading into its earnings report week and investors may question if owning an exposure in the stock or waiting for more visibility.

- The software application industry struggles to consistently recover despite the recent upward movement.

- I update my valuation model for CRM and discuss important price levels and metrics that investors could consider to gain an edge over the stock’s likely price action.

- By considering multiple outcomes and setting up an adequate contingency plan, investors are less inclined to act driven by emotions, as this could come at a higher cost.

- Considering the likelihood of higher volatility and even further weakness, I downgrade CRM to a hold position.

Dzmitry Dzemidovich/iStock via Getty Images

Salesforce, Inc. (NYSE:CRM) stock has lost 60% since the beginning of its downtrend, and while partially recovering its losses in the recent retracement, the stock is still in stage 4 and has been rejected in its breakout attempt. My former valuation of Salesforce suggested a rather fair stock price, while now updating my modelization shows an unfavorable price target. CRM is likely heading into higher volatility next week, and despite a positive movement that cannot be excluded, a continuation of the downtrend is more likely. The elements discussed in this article lead me to downgrade CRM to a hold position.

A quick look at the big picture

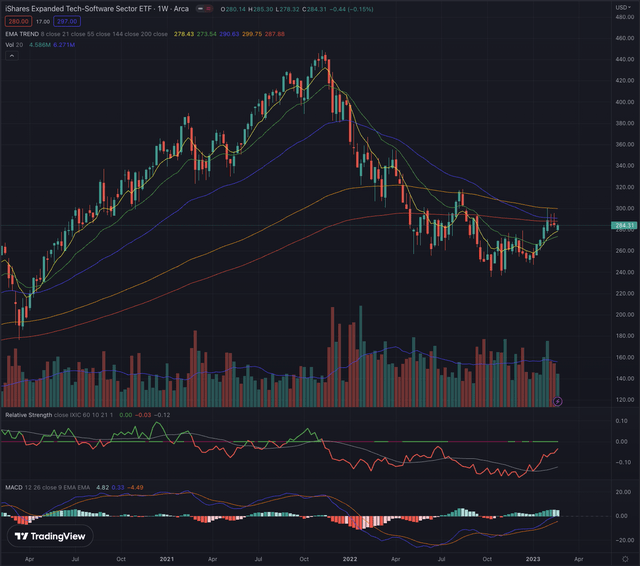

The US technology sector has recorded a strong rally during January and continues to outperform all other sectors in the economy. The application software industry has been severely sold off, resulting in the worst performance among the other industries over the past 12 months. However, the group has been leading the recent rally in the technology sector, along with semiconductors manufacturers and companies in the consumer electronics industry. The extreme negative extension is hinting to the greatest necessity for a retracement, but for achieving this, the industry needs to build significant and consistent relative strength.

The iShares Expanded Tech-Software Sector ETF (IGV) bottomed on October 13, 2022, and reverted in a breakout attempt from its downtrend, by briefly overcoming the EMA200 until reaching the EMA144 on its weekly chart. Although the latest upward movement has been characterized by a stronger momentum, the industry benchmark hasn’t been able to build relative strength, reflecting investor’s hesitancy when compared to the broader technology market, the Nasdaq Composite (IXIC), or more narrowly the Nasdaq-100 tracked by the Invesco QQQ ETF (QQQ). IGV has more recently dropped back into its downtrend, while also the MACD is hinting at a peak in positive momentum.

Where are we now?

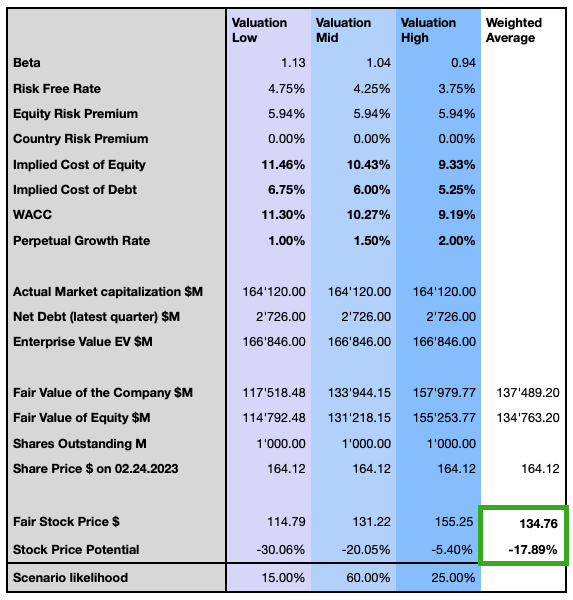

In my article “Adobe Vs. Salesforce: Which Stock Is The Better Investment?” published on October 25, 2022, I discussed the fundamentals of Salesforce and valued the company based on three scenarios. My analysis suggested a rather fair valuation of CRM, and even in the most optimistic scenario, the stock offered a limited upside potential. I particularly underscored the company’s extremely low ROIC, lower than its Weighted Average Cost of Capital [WACC], as based on this metric, the company is incapable of building value for its investors and even destroying it.

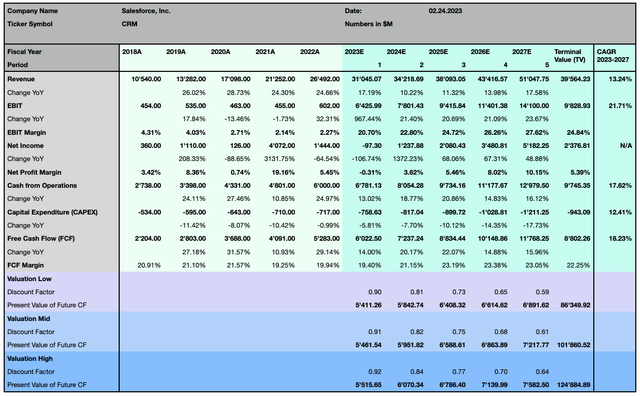

A quick look into the updated fundamentals and a revision of my valuation model shows an even worsening expected outcome for the stock.

Author, using data from S&P Capital IQ Author

The valuation considers a tighter monetary policy, a higher equity risk premium, and an adjusted cost of debt which will undeniably be a reality in many economies worldwide in the coming years and lead to a higher WACC. While the topline estimations are becoming more pessimistic, the street consensus for the bottom line estimations has been slightly improved, but the rather higher divergence in estimations hints at overall difficult visibility and uncertainty.

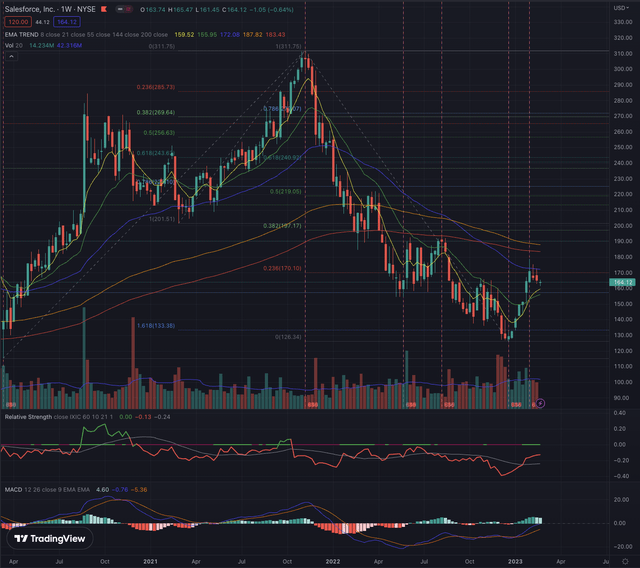

CRM has bottomed on December 22, 2022, after losing 60% from its ATH market on November 9, 2021, and immediately retraced part of its losses, leading the stock to temporarily overcome its EMA55 on its weekly chart, but got rejected on higher sell-side volume.

CRM could reduce its negative extension, but hasn’t been capable of building relative strength when compared to the Nasdaq Composite (IXIC), and its MACD is suggesting likely exhaustion of the recent positive movement. Investors should consider that despite the recent rally which was overdue for negative extension, CRM will need to build up significant relative strength for a consistent reversal, and this should also be reflected in the IGV, as the company has the highest ponderation above 9% in the benchmark’s holdings.

The stock is in stage four, and the major issue in this kind of situation is the massive technical, but also psychological, overhead resistance that the stock has to overcome before possibly setting up a new uptrend.

What is coming next in CRM stock?

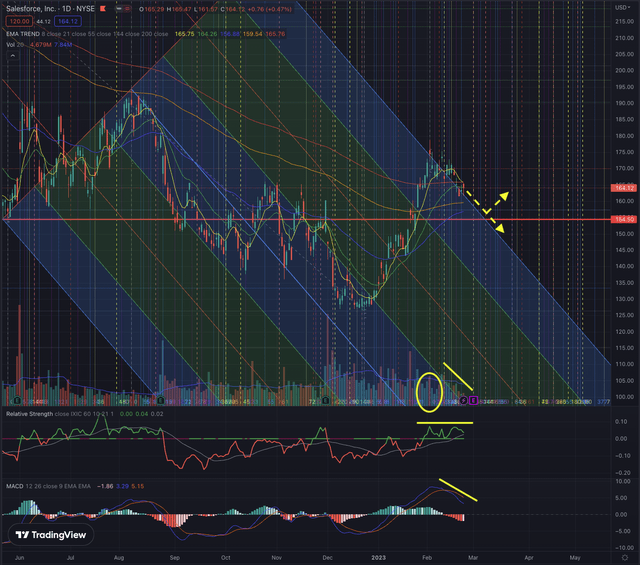

While I made my observations on CRM’s weekly chart, it’s now important to zoom in and confirm my assumptions on the daily chart, a time frame I use to define the next tactical steps in my investment strategy.

Other than being rejected at its EMA55 in its weekly chart, the stock also dropped under its EMA200 on its daily chart, a very strong combination of overhead resistance that explains why the stock halted in its rally, also seen in the exhaustion in buy-side volume while the stock was peaking.

It’s important to note that the trading volume has been significantly dropping in the past few sessions, which is normally leading to a stronger movement in the price action. The stock is also heading toward its Q4 and FY2023 earnings release, expected to be published on March 1, 2023, which could explain the hesitancy and could lead to a sudden increase in volatility.

Would I load up on CRM before the upcoming earnings release? Absolutely not. There is no hurry to buy the stock right now as it is a very speculative situation. Even if the stock would set up a strong positive movement, which I consider rather unlikely, investors can always jump on the train once the breakout from its downtrend has been confirmed on strong volume and significant relative strength.

The chances are instead relatively high, that the stock continues to fall back along or even into the down-trending channel, and will test support at its EMA55 on its daily chart, or its EMA21 on its weekly chart, a strong trailing resistance that has been pushing back the stock during its downtrend. CRM could then rebound if these supports hold, but I would not want to be invested in the stock if it breaks below these price levels, and would set my stop loss slightly under the EMA55 on the daily time frame.

The discussed scenarios and the updated valuation modelization are forming an unfavorable risk/reward profile, which leads me to downgrade CRM to a hold position.

The bottom line

Technical analysis is not an absolute instrument, but a way to increase investors’ success probabilities and a tool allowing them to be oriented in whatever security. One would not drive towards an unknown destination without consulting a map or using a GPS. I believe the same should be true when making investment decisions. I consider techniques based on the Elliott Wave Theory, as well as likely outcomes based on Fibonacci’s principles, by confirming the likelihood of an outcome contingent on time-based probabilities. The purpose of my technical analysis is to confirm or reject an entry point in the stock, by observing its sector and industry, and most of all its price action. I then analyze the situation of that stock and calculate likely outcomes based on the mentioned theories.

The application software industry has been the weakest group in the technology sector during the past year. Although the industry could retrace some of its losses, it is still lacking significant relative strength that could project it out from its downtrend. I updated my valuation model and Salesforce seems to be overvalued in most of the considered scenarios. The stock could head into surging volatility, while chances are higher seeing the stock dropping further, as it got rejected on its strong overhead resistance. It is not the time to build exposure in CRM, and investors interested in the stock could wait until after the upcoming earnings release, while actual investors could set their stop losses slightly under the discussed support area, to avoid being trapped if the stock falls back significantly into its downtrend.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: All of my articles are a matter of opinion and must be treated as such. All opinions and estimates reflect my best judgment on selected aspects of a potential investment in securities of the mentioned company or underlying, as of the date of publication. Any opinions or estimates are subject to change without notice, and I am under no circumstance obliged to update or correct any information presented in my analyses. I am not acting in an investment adviser capacity, and this article is not financial advice. This article contains independent commentary to be used for informational and educational purposes only. I invite every investor to do their research and due diligence before making an independent investment decision based on their particular investment objectives, financial situation, and risk tolerance. I take no responsibility for your investment decisions but wish you great success.