Summary:

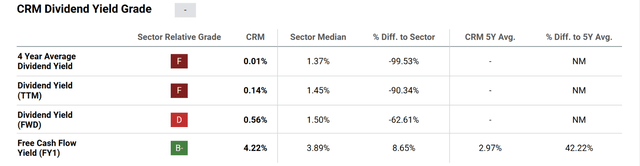

- Salesforce has started paying cash dividends recently.

- Its dividend initiation demonstrates its capital allocation flexibility and the potential for steady yet robust growth ahead.

- It also allows the application of more traditional valuation models (e.g., the discounted cash flow model), which points to some discounts despite its near-record stock price.

John M. Chase

Salesforce started paying cash dividends

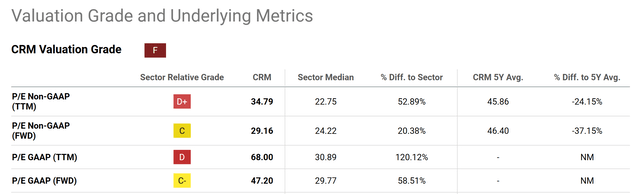

Among the stocks in the Dow Jones Industrial Average, Salesforce (NYSE:CRM) is (or at least used to be) some kind of an outlier. Salesforce’s P/E ratio is noticeably higher than the Dow Jones Industrial Average (and many times higher than some constitutes in the index). The Dow index is well known for tracking established companies, valuing them based on steady profits (reflected in a lower P/E). Salesforce, however, is a high-growth tech stock and demands premium P/E (as seen in the chart below).

Seeking Alpha

One difficulty of analyzing high-growth stocks is assessing the growth rates, which can be highly nonlinear and defeats many of the typical valuation models. The good news for CRM – or bad news depending on your perspective – is that it started to pay a cash dividend. Recently, for the first time in the company’s operating history, the board of directors recently initiated a quarterly dividend in the amount of $0.40 per share. To me, this reflects both Salesforce’s robust profitability and also management’s confidence in its profitability to stabilize and grow at a sustainable pace going forward.

Thus, now it makes more sense in my view to apply more traditional valuation models (e.g., the discounted cash flow model) on the stock, which is the goal of this article. And you will see that such an analysis points to a substantial discounted valuation despite the stock’s large price rallies this year, pointing to more upside ahead (so I suppose it’s good news after all).

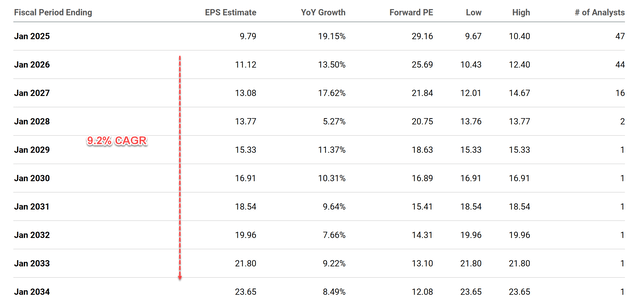

CRM stock: EPS growth outlook

The chart below shows the consensus EPS estimates for CRM stock in the next 10 years. As seen, analysts indeed predict a steadier growth in CRM’s EPS over the next decade. Overall, the growth is predicted at a compound annual growth rate (“CAGR”) of 9.2% over this period, in contrast to the highly nonlinear rates in the past (e.g., its EPS grew at a CAGR of over 26% in the past five years). More specifically, according to the forecast, its EPS is estimated to grow at a double-digit rate for a few more years and then begin to stabilize. For example, its EPS is projected to be $9.79 for FY 2025, representing an annual growth rate of 19%, followed by another two years of growth at 13.5% and 17.6%, respectively.

The P/E ratio is expected to shrink in tandem. As aforementioned, its current P/E (of over 29x) can be off-putting. But it quickly shrinks to the teens starting in a few years based on the FWD EPS.

Of course, the question here is if such growth projections are plausible at all. Next, you will see that my answer is yes given the many growth opportunities ahead, CRM’s robust return on capital employed (“ROCE”), and its capital allocation flexibility.

Seeking Alpha

CRM stock: Growth catalysts and fair price estimation

I’m, in general, supportive of tech-related securities with AI-driven themes given the explosive growth potential, and this is a category that Salesforce falls firmly within. Furthermore, CRM is in a unique position on this front with its balanced mix of its traditional cloud offerings and emerging AI opportunities. Thanks to the robust cash flow from its mature products (again, as reflected by the initiation of its cash dividends), it can sustainably support the development of newer products and features, such as its AI-driven capabilities. Looking ahead, I expect its R&D spending to be more elevated and also heavily skewed toward bolstering the AI portfolio. In particular, I see good promise with its use of generative AI for client experiences and the healthcare sector. For these reasons, I think a CAGR of around 10% as implied by consensus estimates above is totally plausible for the next 7~10 years.

Looking further out, my method for estimating the terminal growth rates involves the use of ROCE and reinvestment rates. It’s detailed in my other articles. So I will only quote the end results:

The method involves the return on capital employed (“ROCE”) and the reinvestment rate (“RR”). The ROCE for CRM has been around an average of 41% in recent years. Assuming an RR of about 5% on average (which is the average for large mature companies), its terminal organic growth rate would be ~2.05% (41% ROCE x 5% RR = 2.05%). Note this number is the real growth rate without inflation. To obtain a notional growth rate, one would need to add an inflation escalator. Assuming an average inflation of 2.5% would bring the nominal growth rate to 4.55%, quite close to the consensus estimates above.

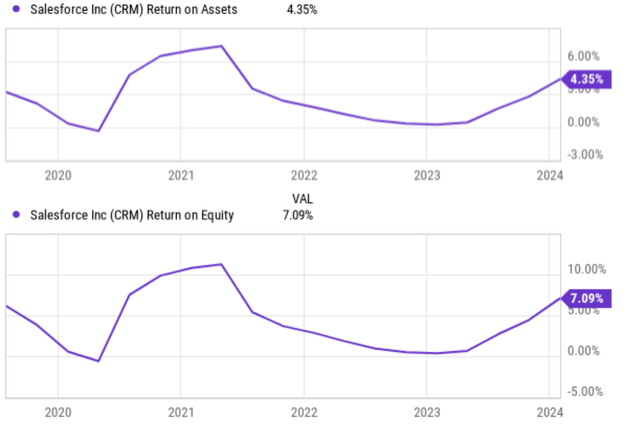

Note that common quote metrics (such as ROA and ROE shown below) severely underestimate its profitability in my view. As a high-tech company, the actual resources it needs are far smaller than the total equity or assets on its book. In my ROCE, I considered the resources necessary for its operation to include only these items: Receivables (about $11.4B), payables (about $5.7B), inventory (which is non-negligible for CRM), and net PPE (plants, property, and equipment, about $6B).

Seeking Alpha

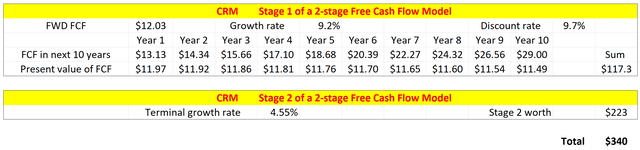

With the growth rates estimated above, I will next estimate its fair price using a discount FCF (free cash flow model). In particular, I will apply the following two-stage FCF model (see my earlier article for details):

The model uses a higher growth rate in the first stage and a lower rate in the second stage to capture its terminal growth. There are a total of three key parameters in the 2-stage FCF: The discount rate, the growth rate in stage 1, and the terminal growth rate. For the discount rate, I relied on the so-called WACC, the weighted average cost of the capital model. The discount rate for CRM has been about 9.7% on average in recent years following the WACC model.

For stage 1, I will use the 9.2% growth rate based on consensus estimates. For the terminal growth rate, I will use the 4.55% I estimated above. For its FCF, I used $12.03 per share inferred from the FY1 FCF yield as shown in the chart below.

With all these parameters, the second chart below summarizes the results from the two-stage model. As seen, despite the off-putting valuation grades, CRM’s fair price turns out to be around $340 per share. Compared to its current price of $288 as of this writing, I consider the margin of safety to be wide enough to accommodate the uncertainties in the inputs.

Seeking Alpha

Author

Other risks and final thoughts

Another upside risk worth mentioning is the repurchase of its shares. The company is also buying back its own stocks. In addition to the cash dividend, the current repurchase authorization was recently boosted by an additional $10 billion, adding another indication of its capital allocation flexibility and also the reasonable valuation of its shares.

In terms of downside risks, like other cloud-based software companies, CRM faces the challenge of maintaining rapid customer acquisition in a maturing market, while also ensuring smooth integration with constantly evolving technologies. Additionally, security breaches are a constant threat. Although, given CRM scale and visibility, I consider the risks of cyberattacks and security breaches as a more unique downside risk. CRM systems house significant customer data, pretty much every aspect of a business’s proprietary information, which is what makes CRM services so powerful and sticky. But this also makes CRM a prime target for cyber attacks (e.g., you can see more in-depth coverage following this link).

All told, my conclusion is that the positives far outweigh the negatives under current conditions. While CRM’s P/E ratio may appear high, its growth trajectory justifies the premium. In a nutshell, I consider it an excellent GARP stock (growth at a reasonable price). Its recent dividend initiation (plus share buybacks) demonstrates its financial strength, cash generation capability, and capital allocation flexibility. This financial flexibility, combined with its high ROCE, allows CRM to invest in innovation, to maintain its competitive edge in the cloud-based market, and to growth at a robust rate in the long term. When such growth rates are considered, the stock is quite reasonably valued (and may even features some discounts) despite its near-record stock prices.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.