Summary:

- Salesforce stock declined 20% in a day after disappointing earnings at the end of May, which seems unjustified.

- The company continues to provide business-critical software and is poised to benefit from long-term trends as companies continue investing in their data and communication capabilities.

- The stock trades at multiples below the historical average due to the recent sell-off, and growth opportunities do not seem to be priced in.

- Therefore, Salesforce receives a “Buy” rating.

JasonDoiy

Introduction

Salesforce (NYSE:CRM)(NEOE:CRM:CA) first came to my attention after the significant decline in the stock price at the end of May. At that time, I read a few articles online and was discouraged by the number of pessimistic takes and the fact that no one was really able to explain what the business did.

Two months later, the stock is up 17% from its dip, but it seems to have a long way to go until a full recovery. The stock chart is hardly exciting, with the stock price being at the same levels as at the end of 2020.

I decided to start covering the company after the dust settled, the number of pessimistic takes declined, and the market had calmer feelings about the company. That time is now.

Salesforce provides business-critical software to various industries, and benefits from strong tailwinds. Its data offerings continue to grow and other features remain highly demanded. The market reaction to earnings slightly missing expectations seems unjustified.

The stock appears undervalued based on historical multiples and the current stock price doesn’t reflect the growth opportunities. Therefore, Salesforce receives a “Buy” rating.

Understanding The Business

Salesforce has always created question marks for me. I understood the company’s purpose in general, but I found it difficult to really understand its software and business proposition. It just seemed easily replicable. So, we’ll start this article by trying to understand the business.

Salesforce calls itself the “global leader in customer relationships management (“CRM”) technology”, hence the stock ticker. It enables companies to connect with their customers through Salesforce software that is enhanced with data and artificial intelligence. The company employs a subscription-based business model.

The main platform is called the Customer 360 CRM platform. It has features to help with many generic business functions. Users can test and choose which of these features they need for their businesses. Some of these features are explained below:

- Sales: Leverages data and artificial intelligence to help sales teams sell faster and smarter. It stores data and makes it easier to track customer leads and progress, forecast opportunities, and deliver quotes, contracts, and invoices.

- Service: Brings all the customer service processes onto one integrated platform. It connects service agents with customers anytime and across multiple channels, including mobile, email, self-service portals, and social media.

- Marketing and Commerce: Provides marketing tools to plan, personalize, automate, and optimize customer marketing journeys. It connects various interactions with the customer across multiple channels to increase conversion and customer lifetime value. Additionally, it provides commerce tools to set up a digital storefront.

- Integration and Analytics: Helps customers with data integration, API management, and automation. Offers analytics solutions to better understand and act on business data.

To summarize, Salesforce aims to help its customers improve their customer interaction by providing tools for different interaction channels, including sales, customer service, marketing, and commerce. It also offers data integration and analytics solutions to identify opportunities and act on them.

These features are crucial for almost all businesses. Every single company has customers it interacts with, and Salesforce allows this interaction to be smoother and improves the overall customer experience, which could result in higher sales, higher customer retention, and satisfaction.

Some of the crucial factors for companies to prefer Salesforce compared to other software products available are its scalability, industry-specific customization, superior data insights, and no-code approach.

In addition to the Customer 360 CRM platform, Salesforce provides Slack, an internal communication application for businesses.

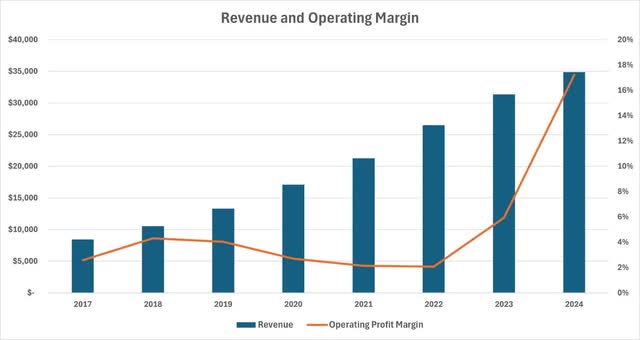

Thanks to the increasing importance of efficient customer interaction and internal communications systems for businesses, Salesforce has managed to remain relevant, increasing its sales and operating margins significantly. It has maintained a stable return on assets (“ROA”) while growing.

The Company Continues To Benefit From Long-Term Trends

Salesforce has been an incredibly steady and growing business since its IPO in 2004. The company has managed to increase sales every single year since then. This is not a coincidence. There are strong growth tailwinds that this company benefits from.

Firstly, the importance of better customer service and interaction has increased significantly over the years. Salesforce states that “52% of customers will abandon online purchases if they cannot find the information they are looking for.” Consumers are now more impatient and want to get what they want with ease. Poor customer relations could result in low customer retention and acquiring customers costs 6-7x more than retaining the existing ones.

As companies understand this, they continue to invest in their customer relation capabilities, which benefits the largest company in the space whose ticker is literally CRM.

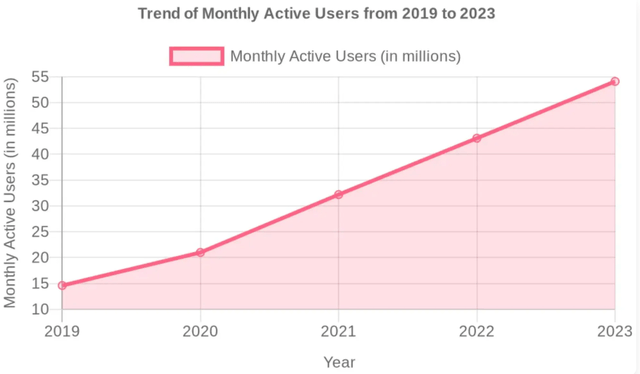

Additionally, especially with the pace at which companies are transitioning to hybrid or remote working environments, the importance of internal online communication has been increasing. Slack, acquired by Salesforce in 2021 in the middle of this transformation, benefited a lot. Its monthly active users increased from 14.6 million in 2019 to 54.1 million in 2023.

Moreover, with the advancements in artificial intelligence, companies have started to invest more in their data capabilities to extract more business-critical insights and act on them. This has meant higher demand for Salesforce’s existing integration and analytics features.

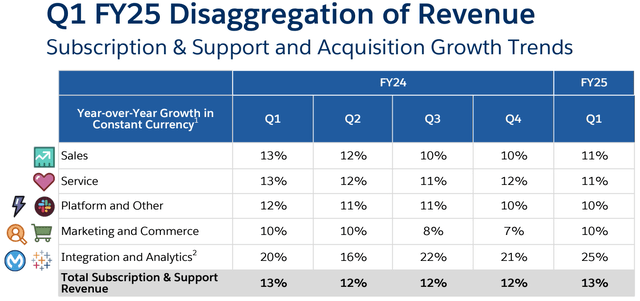

The table from the company’s Q1 2025 earnings presentation shows revenue growth by features of the Customer 360 platform. The integration and analytics sales have grown significantly more than other features every single quarter since Q1 2024 and have shown the highest growth in Q1 2025. This indicates that the demand growth remains high.

Salesforce Q1 2025 Earnings Presentation

Finally, the company significantly benefits from switching costs. Once a customer starts using the Salesforce platform, it requires time, effort, and money to switch to another CRM platform. This helps Salesforce retain customers better.

The Recent Stock Decline Shows What The Market Values

The company released its Q1 2025 earnings on May 29th, and it is safe to say that it disappointed investors.

Although revenue increased nearly 11% year-over-year, it slightly missed the consensus. Operating cash flow and free cash flow were significantly up year over year.

Management maintained the full-year FY25 revenue guidance, indicating an increase of 8%-9%, and initiated the second quarter revenue guidance, indicating an increase of 7%-8% year-over-year. Despite the revenue growth guidance, these growth rates were slightly lower than expected, and investors immediately punished the company.

The stock, which had been performing in line with the broader market since 2020, declined 20% within the day.

This seems like a huge reaction to a small miss in sales compared to what was expected. However, judging the market is rarely useful in these situations. The more important thing is to understand the mindset of investors.

Clearly, investors care about growth, and want to see Salesforce continue selling and earning more. This understanding helps us evaluate Salesforce as an opportunity better. I do believe the company will continue to benefit from the mentioned long-term trends, and initiatives like trimming the workforce should help the company become more profitable.

Valuation

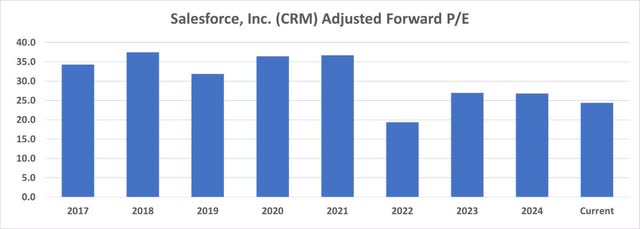

Projecting earnings accurately is always difficult for software companies, as evidenced by the last quarter and the recent decline in stock price. Therefore, I will be evaluating the multiples that this company trades at. There are two approaches: comparing the multiples to the broader sector and comparing the current multiple to the historical.

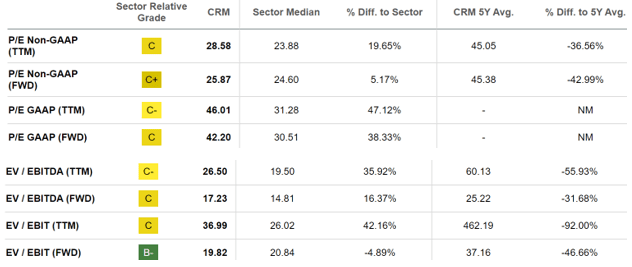

Seeking Alpha’s valuation grades help us understand the multiples relative to the sector the company is in and to Salesforce’s 5-year average multiples.

Seeking Alpha

We observe that price-to-earnings and various EV-to-profits multiples appear either in line with or slightly above the sector median. However, all of these multiples are lower compared to Salesforce’s 5-year average.

This observation is similar to my calculations. Observing the adjusted price-to-earnings trend over the last eight years shows that the stock was priced at higher multiples before, indicating room for upside.

The market seems more pessimistic about Salesforce’s future than it was before, and with sustained growth opportunities, this pessimism appears unjustified.

Conclusion

Salesforce is not an easy business to understand. To some, it may appear easily replicable or unnecessary. However, historical trends suggest otherwise.

The company provides critical business software required for internal and external communications. It directly affects users’ relationships with their customers, helping them retain and increase sales. Additionally, users find it difficult to switch to another CRM tool once they start using Salesforce due to high switching costs.

Companies increasingly realize the importance of a good CRM tool, and this trend is likely to continue. As the largest company in the industry, Salesforce is poised to benefit. With the recent decline in the stock price, it appears undervalued compared to historical levels.

That is why Salesforce receives a “Buy” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.