Summary:

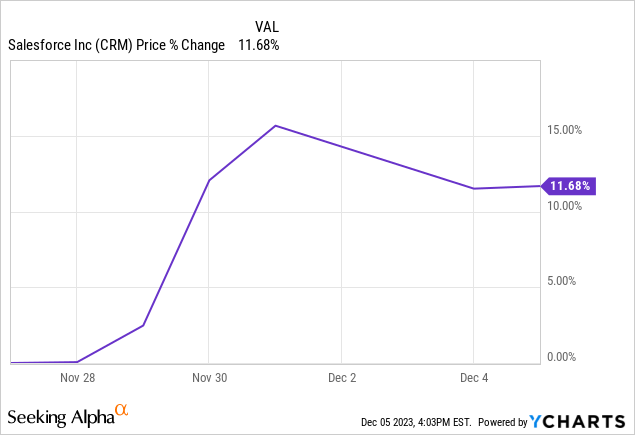

- Last week, Salesforce reported its Q3 results and the stock shot up more than 10%.

- We look at the nuts and bolts of the earnings release and why CRM stock shot up.

- Salesforce can be a great AI stock. In the article, I explain why.

- The company is in a different phase now, returning money to investors through stock buybacks.

- CRM’s valuation looks reasonable, even after the 10% jump.

Jemal Countess

Introduction

I think that we’re cautious about saying, oh, it’s all green shoots, everything is going, we’re back to normal. But at the same level, we are honest with you that we have a lot of green shoots and in products, in geographies.

– Founder, Chairman and CEO Marc Benioff on the Q3 conference call

It’s been almost 4 years ago I wrote about Salesforce (NYSE:CRM), so I wanted to provide an update, as the company has changed significantly in the meantime. Salesforce reported its Q3 results last Thursday.

Why did CRM stock go up after reporting Q3 earnings?

Let’s look at the Salesforce Q3 2024 earnings to see why the stock surged. That’s not a typo, mind you. The company’s fiscal year is one year ahead of the calendar year.

In its latest quarter, so Q3 2024, CRM announced a non-GAAP EPS of $2.11, surpassing estimates by $0.05. Revenue for the quarter reached $8.72 billion, a solid 11.2% increase year-over-year, in line with the market expectations. The GAAP operating margin stood at 17.2%, while the non-GAAP operating margin was significantly higher at 31.2%. The main difference stems from stock-based compensation.

The company’s current Remaining Performance Obligation (‘cRPO’) amounted to $23.9 billion, marking a 14% growth from the previous year, or 13% on a constant currency basis.

As a reminder, cRPO is the money that is already under contract (‘RPO’) that will be recognized over the next 12 months (the “current” part of cRPO). In other words, cRPO is a good predictor of revenue growth for the next 12 months. At 14%, this looks good. Add a few new customers and it could exceed 15%. That also makes it very likely that Salesforce will beat the revenue growth estimates for next year.

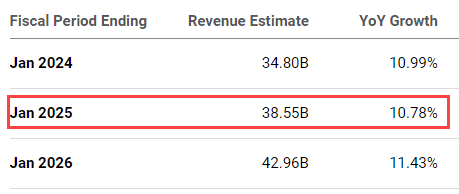

Seeking Alpha

The total RPO in Q3 came in at $48.3 billion, up 21% year-over-year, which indicates more longer-term big deals. More about that later in this article.

Looking ahead, the company has initiated its Q4 FY24 revenue guidance, projecting figures between $9.18 billion and $9.23 billion, indicating a 10% year-over-year growth. Because of the cRPO, I think this is conservative guidance. Management expects non-GAAP diluted earnings per share to be in the range of $2.25 to $2.26.

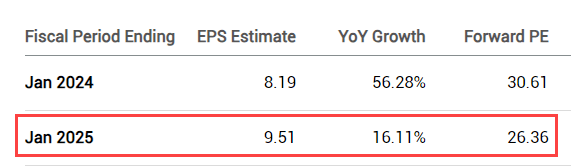

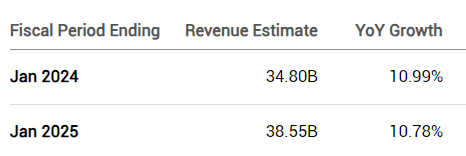

For the full-year FY24, the revenue guidance was narrowed to a range between $34.75 billion and $34.8 billion, which would mean an 11% increase from the previous year. The estimated EPS for FY24 was set between $8.18 and $8.19. At the current price of $250.66, that means a current-year, including Q4 guidance, PE ratio of 30.6.

Full-year FY24 GAAP operating margin guidance is expected to be 14.5% on a GAAP basis, and 30.5% on a non-GAAP basis. With a wink-wink-nudge-nudge, founder, Chairman, and CEO Marc Benioff told his CFO on the conference call she’d better beat that guidance.

The company also revised its operating cash flow growth projections for FY24 upwards, now anticipating an increase of 30% to 33% year-over-year. This is possible because Salesforce foresees CapEx to be just 2.5% of its revenue, which shows the platform’s scalability.

All these elements were received well by the market and that’s what made the stock go up quite a bit after the earnings.

After the earnings, the company announced a mixed-shelf offering for an undisclosed amount, which slightly brought down the stocks.

Salesforce’s Position Right Now

Months ago, I wrote an article for my subscribers about the 5 Stages of Profitability. In that article, I wrote this about companies like Salesforce:

A Category Move Often Means A Stock Price Move

You’ll see that when companies move from one stage to the next, there is often a change in their stock price as well, positive or negative. Those moves are sometimes short-lived but can also last for a few years.

(…)

Salesforce has repurchased significant chunks of stock now and it will continue to return capital to shareholders. But don’t expect this to boost the stock price anytime soon. It will take time before it gets appreciated more. That’s why I don’t add to my Salesforce position too quickly. Just nibbling every now and then, one or two shares at a time. Of course, what you do is your own decision.

I’m still bullish for Salesforce over the long term and I think it’s a great company, but I have seen this picture before. It still could go down more before other types of investors start to get interested.

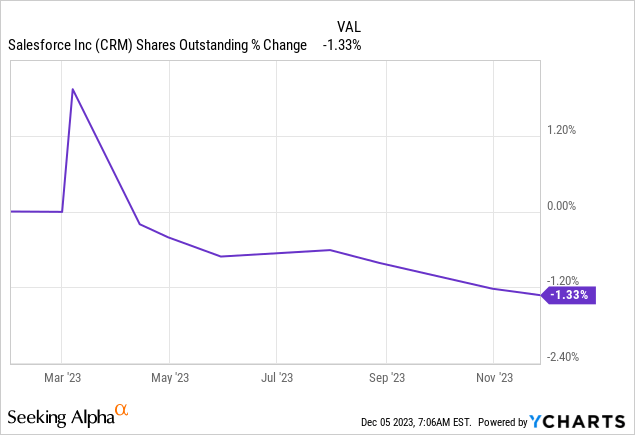

I think this is important to understand. In Q3 2024, the company repurchased $1.9 billion worth of shares, returning money to shareholders. Now, just to make sure, a part of that money is meant to neutralize the dilution effect from stock-based compensation. But the number of shares outstanding did go down, as you can see from this chart.

You should expect this effect to continue and probably even accelerate in the next few years, as the effect of stock-based compensations that were tied to Salesforce’s acquisitions started to decrease and that too should stabilize over the next few years. Even right now, stock-based compensation was just 8% of revenue, not that high in the software industry.

Management also knew it had to adapt to the new situation. Founder, Chairman and CEO Marc Benioff on the Q3 conference call:

We knew we had to focus on increasing profitability, productivity, operational excellence across the board.

Salesforce Stock Price

Salesforce had a decade of high revenue growth, but in this higher-interest environment and at this scale, it finally focuses on profitability and quality of earnings. I’m a seasoned growth investor, which means I don’t care too much about stock price volatility, but entering this new category, for Salesforce, it probably means both its stock price and its earnings will become less volatile.

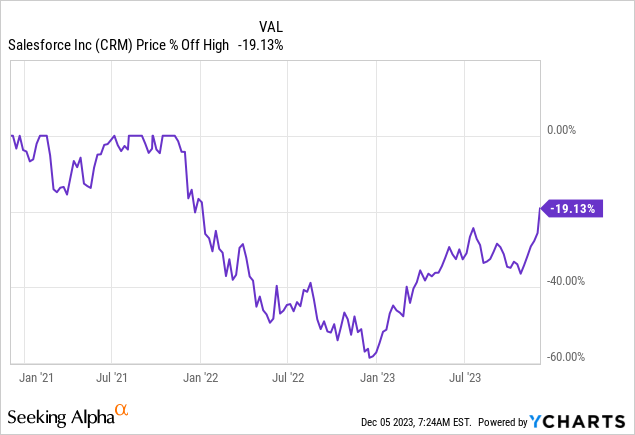

Nonetheless, the stock is up more than 87% over the past year.

Of course, that can only be seen in the light of the previous drop in Salesforce’s stock price of about 60%. The stock is still down more than 19% from its all-time high. Until the most recent earnings, that was still almost 40%.

I expect this to stabilize over the next years, although you can never know with the stock market. Just look at what happened to Meta (META), for example.

Salesforce Q3 earnings call: 3 headlines

Marc Benioff highlighted three key developments for the quarter.

number one, that we have 80% growth in deals more than $1 million. (…)

Number two, we have a great new product. And everyone knows here at Dreamforce, Data Cloud. You can see in the quarter 1,000 new Data Cloud customers. (…)

And the third thing is, these Einstein GPT Copilots that we’ve delivered. These Einstein GPT Copilots, this is a product we didn’t really even have an imagination around a year ago. Of course, we had Einstein. Of course, we could see the incredible growth of Einstein. I mean now, Einstein with predictive and generative combined, is doing 1 trillion transactions a week, that’s amazing. But more amazing is that 17% of the Fortune 100 are now Einstein GPT Copilot customers. And this is a product that is just coming to market.

I think these three show that Salesforce is not done growing yet. Of course, at this scale, the company’s revenue growth should not be expected to be 25%+ but I could see mid-teen percentage growth for a long time to come. RPO growth of 21% also shows Salesforce has gas left in the tank.

If we zoom in on the huge surge in deals of $1 million and more, which were up by 80%, this was driven by tighter integration of all of Salesforce’s clouds. Marc Benioff on the call:

Nine of the top 10 deals included six or more clouds. Think about that. Nine out of our top 10 deals included six or more clouds. So that we have amazing clouds, Sales Cloud, Service Cloud, Marketing Cloud, Platform, our Commerce Cloud, Slack, Tableau, MuleSoft, but think about it, how they’re bringing all of those things together, Data Cloud, they’re bringing it all together into a cocktail. That’s amazing.

The average ARR, annual recurring revenue, per win on the Data Cloud deals more than tripled compared to last quarter, which is pretty astonishing.

Is Salesforce A Good AI Stock?

Of course, nowadays, every single company tries to convince investors that they are an AI company or they implement AI and will benefit greatly from it. This is questionable. Just like with every big revolution, there will be winners and losers. This context is important to separate the wheat from the chaff.

Looking at it through this lens, I think Salesforce is clearly a company that will benefit from AI. The reason is clearly formulated by Marc Benioff on the conference call:

We’re the only platform that are bringing CRM and data and AI and trust together for our customers in a way that enables them across every industry to be more successful, faster, be more productive, more efficient.

If you are unfamiliar with how AI and large-language models work, it’s crucial to understand this. The three components here are intertwined and very important. Large language models and all other forms of AI work with gigantic databases. Companies have huge databases, but they don’t trust players like OpenAI with their information, because too much of it is confidential, proprietary, or private. In other words, if they are out in the open, competitors can work with them as well and customers can feel betrayed that the data they trusted was safe are out in the open now.

That’s where companies like Salesforce can have the upper hand. Companies don’t want to hand over the data that are crucial for their business to companies like OpenAI, Microsoft (MSFT), or Google (GOOG) (GOOGL).

Benioff gave more explanation:

I think it’s pretty clear at this point that because of the way AI is built through open source, that these models are very much commodity models, and these responses are very much commodity responses.

I think this is a great point. Indeed, if you look at ChatGPT and other LLMs, you get pretty standard answers, which may not apply at all to your company or organization. To make the LLMs much more usable for companies, they need their data collection. That’s where Salesforce can help. And the Data Cloud is extremely important there. Again Benioff:

They have to have their data set together to make AI work for them, and that is why the Data Cloud is so powerful for them.

That’s also why Salesforce’s large deals, +$1M, were up so much, by 80%. The customers want all of their data combined to gain insights through AI. Every large deal was centered around the Data Cloud, Benioff said.

The reason why companies jump on the AI wagon is not just to be hip; of course not. Benioff explains why companies want AI:

Look, they realize unemployment is just so low. Where are they going to hire more people? It’s so hard for them to hire, they’re going to have to get more productivity from their employees. They’re going to do that through this great new technology, and we’re going to help them make that happen.

If you are still not fully convinced that Salesforce can make a difference in AI, Benioff gave a great example of the difference between LLMs like OpenAI and Salesforce’s Einstein GPT Copilot. The first is what OpenAI can do as well, the second is what only Salesforce’s Einstein can do.

I’m saying to the copilot, hey, now can you rewrite this email for me or some — make this 50% shorter or put it into the words of William Shakespeare. That’s all possible and sometimes it’s a cool party trick.

It’s a whole different situation when we say, I want to write an e-mail to this customer about their contract renewal. And I want to write this e-mail, really references the huge value that they receive from our product and their log-in rates.

Should You Buy, Sell Or Hold CRM Stock Now?

Well, that’s always a personal question, of course. Some may not like the dilution, which is double that of Microsoft as a percentage of revenue. Some will not like the big acquisitions Salesforce has done in the past. Others will not like Marc Benioff and his outspoken personality. So, this is only for those open-minded about investing in Salesforce.

Let’s look at the valuation. If you look at the analyst consensus, you see that Salesforce’s stock trades at 26 times next year’s earnings.

Seeking Alpha

I have already shared before in this article that I think the assumptions will be too conservative. With the RPO up 21% and cRPO 14%, I think the next 12 months will have higher revenue growth than the consensus of 10.78%.

Seeking Alpha

As a consequence, I think EPS growth will also be higher than the consensus, especially because Salesforce is really focusing on margins. Its non-GAAP operating margin for the quarter was 31.2%, up 850 basis points year-over-year, following an increase of 1,000 basis points in the previous two quarters.

Higher revenue growth and margins could mean the stock trades at 23 or 24 times next year’s EPS. I think that’s a very reasonable valuation for the stock of a company that has proven over the last decade+ that it can execute and deliver what the market wants.

Conclusion

This was a strong quarter and my Salesforce investment thesis remains fully intact. With its Data Cloud collection, Salesforce seems to have found the right solution for this time and that can help them grow at low-to-middle teen percentages for years to come. The stock is priced reasonably for long-term investors, even after the stock jumped more than 10% after the earnings.

In the meantime, keep growing!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Potential Multibaggers focuses on stocks that have the potential to go up 10x or more over the next decade.

Potential Multibaggers is for long-term investors who want to fill their portfolio with potentially life-changing returns and have the patience and equanimity to hold through volatility.

We focus on long-term fundamentals, not short-term noise.

Go from market noise to clarity and start the free trial now!