Summary:

- Schwab is still battling the inverted yield curve, and the need to pay their clients a 5.35% money market yield.

- The net interest margin jumped from 1.89% to 2.02% in Q1 ’24. Morningstar noted SCHW saw its first sequential revenue increase since Q3 ’22.

- Like JPMorgan the week prior, Netflix’s selloff on Friday, April 19th, 2024, may have been due more to how technology traded last week, and then on Friday, than on the changes in Netflix’s fundamentals.

- The supposedly big negative to NFLX was the disclosure that Netflix management was going to stop disclosing net paid adds and memberships.

blackred

Originally published on April 21, 2024

Schwab

Schwab (NYSE:SCHW) reported their Q1 ’24 results last Monday, April 15th, 2024.

The stock is still battling the inverted yield curve, and the need to pay their clients a 5.35% money market yield, as this cash-sorting – moving funds from lower-yielding bank deposits to the higher-yielding money market funds – pressures net interest income, but the big plus to the quarter was “net new asset” growth of $88 billion, about half of which came in during the month of March ’24.

The net interest margin jumped from 1.89% to 2.02% in Q1 ’24. Morningstar noted SCHW saw its first sequential revenue increase since Q3 ’22.

Schwab’s valuation is pretty fair where it’s trading at currently, since the internal model values SCHW at $88, while Morningstar puts a $73 fair value estimate on the stock.

SCHW’s all-time-high was $96 in early February ’22. Trading at 21x expected ’24 EPS, and expecting 9% EPS growth this year, you’d have to think at this point that very few fed funds rate cuts are baked into the EPS assumptions in ’24.

Schwab’s EPS were revised higher after the latest earnings report, while revenue estimates are more or less in-line with where they were pre-release.

The biggest fundamental reason Schwab could be considered undervalued is that since the Fed started raising rates in early ’22, Schwab’s pre-tax margin has fallen from the low 50% range to 37.9% as of Q1 ’24’s earnings. Schwab will eventually return to that 50% pre-tax margin, but it will likely require a normal yield curve and a lower fed funds rate than today.

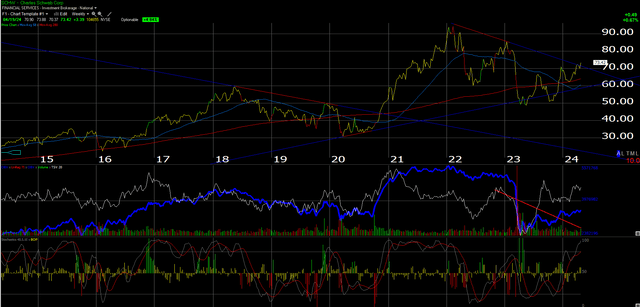

Watch this chart:

This chart shows SCHW starting to break or push above its downward-sloping trendline off the $96 high from February ’22. This post from April 4th ’24 notes that two stocks are probably pretty good tells for a potential change in Fed monetary policy, and they are SCHW and the regional bank ETF (KRE).

Schwab was having a tough time trading above $73, which I thought was an important technical level, but this blog’s technician (@GarySMorrow on X) thought SCHW was trading nicely after Q1 ’24 earnings, and last Friday’s action reflected that, as does the above chart, with SCHW closing above $73 on above-average volume.

It’s a fundamental opinion, but I do think Schwab will need fed funds reductions and an easier Fed to get back to its all-time high, but that represents “where the puck is going to be”.

Schwab Summary: Like Wayne Gretzky’s famous maxim “we want to skate where the puck is going to be, not where it has been”, you have to consider Schwab’s history to make a case for the stock.

Schwab – and all 3rd party custodians – had to deal with zero interest rates (ZIRP) from 2008 to Q3 ’16, and then deal with Covid and ZIRP again from Q1 ’20 to Q1 ’22, and then deal with multiple 50 basis point fed funds rate increases starting in ’22 and interest rate levels not seen since the early 2000s, and an inverted yield curve today.

Under ZIRP from 2008 to 2016, Schwab had to waive all of their management fees on the money market funds, which this blog calculated at its peak in 2014-2015 of costing SCHW about $0.55-0.56 per share in EPS, during that time.

Now the cash-sorting and inverted curve is costing Schwab again, but in ways that are difficult to quantify (at least I have yet to see a Street analysis estimating what the fed funds and the yield curve could be costing Schwab in terms of “suppressed EPS”) but we have to assume some impact since the normal state of the financial world is a normally-sloped Treasury yield curve.

Especially after the TD Ameritrade merger, I suspect there is more EPS earnings power, with the yield curve and the current Fed dynamic acting like a beach ball being pushed underwater, but what Schwab needs (in my opinion) to realize full value, is a lower fed funds rate and a normally-sloped yield curve.

Schwab has been a top 10 holding since post-2008, given its cost leadership. Schwab was the first to go to zero commissions in October 2019 and Fidelity and other so-called discount brokers followed.

In the ’90s the stock traded off of “average daily volume” stats, as all the so-called discount brokers did, but after 1999, Schwab rotated into becoming an asset gatherer, and weathered the 2000 to 2009 decade, but the stock remained under its ’99 high of $51 per share, until 2017-2018. Mr. Schwab founded Schwab in 1974 (when he was still at Stanford I think) and when “big bang” was passed (stock commissions were deregulated).

You want to own the stock before the Fed changes the monetary policy from neutral to easing. More stock is being bought for client accounts with existing positions, in small lots, as the technical position improves.

Netflix

Like JPMorgan (JPM) the week prior, Netflix’s (NASDAQ:NFLX) selloff on Friday, April 19th, 2024, may have been due more to how technology traded last week, and then on Friday, than on the changes in Netflix’s fundamentals. This blog’s earnings preview for Netflix noted the numerous upgrades by analysts before the April ’24 earnings release, which is usually not a good thing.

The supposedly big negative to NFLX was the disclosure that Netflix management was going to stop disclosing net paid adds and memberships.

I lived through 2007 and the lead up to 2008, and watching retail merchants like Walmart (WMT) and Starbucks (SBUX) tell the Street that they were going to stop disclosing monthly retail sales, and watched the stocks get hammered, but they were stopping the monthly comps reports more immediately than Netflix is stopping membership updates.

What ameliorates the Netflix news is that Netflix is going to continue to disclose three more quarters of data, (through Q4 ’24) rather than stop it suddenly, which should assuage investor concerns that there is a big problem with memberships.

The US/Canadian markets are at what Morningstar thinks is a 60% household penetration already, so now with password sharing crackdown nearing an end, there is likely to be less growth in the US/Canadian markets, but Southeast Asia and non-US should continue to develop.

Still, less information is never good, but after reading the conference call notes, and absorbing the various commentary on NFLX’s Q1 ’24 results, I still think the advertising business and what NFLX does with live sports will mean more to revenue and margins, than the traditional subscription business.

Like every business, Netflix’s business and business model is evolving, and that’s probably a plus.

I’ve always judged Netflix by its content and my interest in watching what movies are currently available. Reading a sell-side note on the content, one analyst thinks that because the business has become so competitive that some of the bottom-ranked market share streaming models will try and offload some of their better content to Netflix, to bolster returns and margins.

I seriously wish they would, since there is a lot out there I’d like to watch and when I search for it on Netflix it’s never there.

(One example is Tom Hanks’ Greyhound on Apple TV. In the last few weeks, being on a WWII submarine kick, I’ve searched for Das Boot and U541, both great movies on Netflix, and couldn’t find them. I’d love to watch those flicks on Netflix and would even pay a small fee to watch it, like I do now on Amazon Prime streaming (some movies require a rental fee on Prime)).

There are so many great movies out there, even some very old, that I’d love to watch on NFLX, but they just aren’t there.

NFLX’s EPS and revenue estimates rose after Thursday night’s report, despite the stock reaction.

Here’s how NFLX’s full-year 2024 EPS estimate has changed in the last 5 quarters in terms of its expected YoY growth rate:

- 3/24: 51% YoY EPS growth expected ($18.06 estimate)

- 12/23: 40% ($16.03 EPS estimate)

- 9/23: 30% ($15.81 EPS est)

- 6/23: 29% ($15.15 EPS est)

- 3/23: 28% ($14.27 EPS est)

Netflix has just come off two years, 2022 and 2023, of what for them is subpar EPS growth of -11% and +22%.

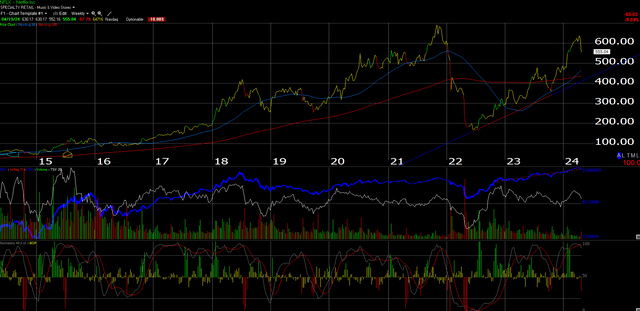

The chart:

This weekly Netflix chart shows the stock will likely move around in this consolidation between the $700 high in late ’21 and the lows, with the expectation that a test of that upward-sloping trendline will hold as well as the 200-week moving average.

Your stop limits on NFLX should be the 200-week moving average if the stock approaches it, and then the trendline as the 2nd level of support. Both are sitting around $400-437 currently, but this will change with daily trading.

Quick summary: The two important segments in development that I think will determine future returns will be the advertising business and the live sports.

Again, the Mike Tyson-Jake Paul boxing event will be a good litmus test of the Netflix audience reception of this kind of thing, and more importantly how management will learn from the event and then how they plan on developing it further. The stock is not cheap – even with the cash flow and free cash flow improvement at 33x to 35x cash flow and FCF respectively.

Total summary: Both Schwab and Netflix stocks are dominant business models that have “flexed” their models over the years to better position the businesses to evolve into what the marketplace wanted.

There is no question after the post-2008 world, Schwab’s model has been penalized, first by ZIRP and now the yield curve inversion – and with Schwab’s total asset growth, there is more “earnings power” built into that model, but I do think we need to see a positively-sloped yield curve, and some kind of financial system stability.

Frankly, I just don’t know yet what normalized earnings power for Schwab would be in a better yield curve scenario, although I suspect it’s much higher.

Watching Netflix’s advertising business develop and the live sports will be (in my opinion) what gives the stock its next substantial move higher if that should happen.

Advertising should be a higher-margin business and benefit from live sports. In the meantime, NFLX stock will likely bounce around here for the next 90 days, waiting for Q2 ’24 results.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.