Summary:

- Lucid finally started producing more cars, but Rivian still leads the manufacturing race.

- Fewer American customers have ordered Lucid’s cars. It’s a bit alarming.

- Lucid’s international expansion plans are too ambitious, while Rivian expands cleverly.

- Gross margin dynamics is a drama by both companies. Despite the sell-off, the valuation is still insane.

jetcityimage/iStock Editorial via Getty Images

Lucid (NASDAQ:LCID) and Rivian (NASDAQ:RIVN) have become very hyped names and many investors lost money with them over 2021 and 2022. If you’re still invested in Lucid, unfortunately, I can’t bring any good news to you. Rivian looks better, but has its own pitfalls. I believe we’ll likely see lower lows by Lucid and potentially by Rivian as well when the next bear market leg comes.

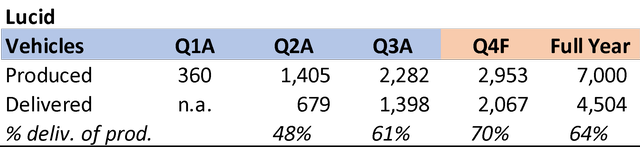

Lucid can’t keep up its production with Rivian

Lucid

Lucid was listed via SPAC in July 2021, and as many SPACs presented, with a forecast that was completely crushed by the reality. Granted, you can blame supply-chain issues for its inability to deliver, but I believe that such a forecast was unachievable under any circumstances. Its ambitious plans were revealed on purpose to attract as much money as possible, and it would have been impossible for Lucid to develop its production capacities without it.

Initially, Lucid targeted to produce 20,000 vehicles over 2022. But early in 2022, it revised the guidance to 13,000. A couple of months later, it decreased again to 6,500-7,000. Therefore, when the management tells you that they are on track with the plan, you need to take it with a pinch of salt. They are on track to meet the updated guidance, but it’s around 70% lower than the initially planned one. As always, the devil lies in details.

Still, Lucid showed some encouraging dynamics. In Q2, its management was reshuffled and the company started increasing production volumes. Lucid managed to quadruple the number of vehicles produced and doubled it again in Q3. It achieved 2,300 vehicles in Q3— a significant improvement compared to only 360 cars in Q1. The key question is if Lucid will be able to achieve the 6,500-7,000 vehicles target as planned.

Author’s work. Financial Statements

Currently, Lucid management claims that 300 vehicles are produced per week. If we multiply 300 by 12 weeks, then we get 3,600 vehicles to be produced in Q4. Of course, you can expect some lower output during the Christmas holidays, but anything above 3,000 should be sufficient to achieve the outlook. I guess that the management could even increase its guidance, but doesn’t want to make too bold promises and prefers overachieving rather than underachieving. As an investor, I like such an approach.

Unfortunately, the story is not as good as it seems at first sight. Lucid reported a huge gap between vehicles produced and vehicles delivered. For example, in Q3, they delivered only 60% of its produced vehicles. Sherry House, Lucid’s CFO explained this shortcoming:

The variance between production and deliveries was primarily a function of vehicles distributed across three areas of the delivery process, vehicles in transit, vehicles awaiting pre-delivery inspection and vehicles awaiting delivery to a customer.

So the management told us that it’s OK to have such a gap. Let’s put a pin in this reasoning and see what is happening with Rivian.

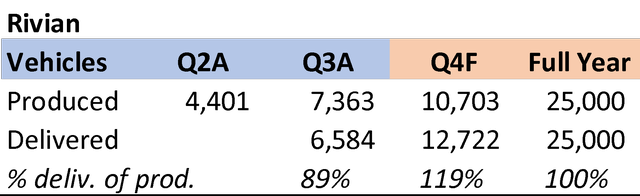

Rivian

With Rivian, the situation looks much better. It’s approaching its 25k vehicle target for the year end, and has no any gap between produced and delivered vehicles. In fact, its number of vehicles delivered exceeds the amount of vehicles produced. It’s a clear sign that Rivian streamlined its inspection procedures. True, we won’t forget its recent car recall, but it’s something that happens with almost every car producer, so I wouldn’t say that it was because of poor inspection procedures.

Author’s work. Financial Statements

Such a difference in the ratio of delivered vehicles to produced cars by Lucid compared with Rivian makes me think that Lucid’s manufacturing is not as well on track as the management claims. It gets even stranger when Lucid’s management tells us that the discrepancy will only widen over the next quarter.

We mature as a business, we’ll continue to learn and refine our in-transit inspection and delivery processes. So in the near to medium term, we expect vehicles produced to placed at a higher volume than vehicle deliveries as we accelerate our production and we initiate international deliveries in the fourth quarter, the latter which requires longer in-transit times.

Summary

Rivian is definitely on track with its guidance. Lucid claims that it’s on track, but a high gap between delivered and produced cars raises some concerns. I’m afraid that 2023 outlook can bring more negative surprises.

Lucid’s reservations go south. Why?

The number of pre-ordered vehicles decreased by Lucid from 37,000 in Q2 to 34,000 in Q3. The management explained it with the fact that customers don’t want to wait too long for a new car:

We did have some cancellations as well. So they’ve continued to be quite modest, low single-digit level of — low single-digit percentage amount of cancellations.

What we did see, just to give you a little bit more context and a lot of people are asking about this is in August after we announced the bring down to the 6,000 to 7,000, we think some of the folks felt that they might be pushed out a little bit too far, and we did see a bit of a spike in August, the still low single-digit in terms of cancellations.

But now that’s normalized to a much more normal rate.

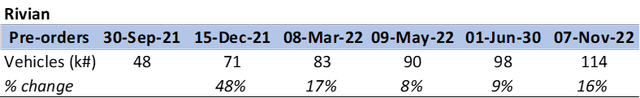

Yes, it can be the reason. But if we look at Rivian, we see the healthy, consistent growth of reservations despite quite a long waiting time. Assuming 25,000 cars are provided per year, we get a waiting time over 4 years. With Lucid, the waiting time would be around the same. Granted, the production pace is expected to increase over the next few years, decreasing the waiting time. But such a simplified analysis allows us to compare the two companies.

Author’s work. Financial Statements

I wouldn’t say that the decreasing reservation number is a red flag to me, but I still don’t like the explanation given by the management. I think the declining trend may be linked to lower marketing expenses. This isn’t bad— it’s actually good to have a focus on costs. But why not talk about this openly? And if people really don’t want to wait and you consider your pre-orders healthy, then why expand internationally?

Too much too quickly: Lucid’s international expansion

It’s pretty clear why Lucid expanded to Saudi Arabia. It has its key shareholders there and a huge order backlog. But it’s not quite clear to me why Lucid is also expanding in Europe. It didn’t even go to London or Paris, but instead the most conservative German-speaking cities: Munich and Zurich. I hope the guys have done some profound market research before making this step. But aren’t they concerned that it would only increase waiting time by customers and discourage them from making purchases?

Rivian expands to Europe in a much smarter way: via partnership with Mercedes.

This is what the official press release said:

The joint venture mirrors the common objectives of Mercedes-Benz Vans and Rivian: both companies plan to rapidly scale the production of electric vans to help the world transition to cleaner transportation.

I really see a lot of potential in this step. Mercedes has a strong European footprint and an advanced self-driving capability. You may be surprised but it’s much more advanced than Tesla’s. You can read about it here in more detail. On the other hand, Rivian has a strong expertise with electric vehicles, making the cooperation a win-win for both players.

So far, it seems that Rivian is better positioned than Lucid. But as always, there is a catch.

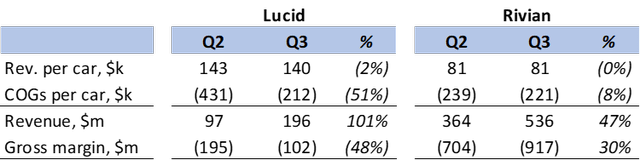

Rivian also has a problem: gross margin.

Rivian’s gross margins decline faster than the revenue grows. The more cars it produces, the more money it loses. It’s a concerning sign, and I was really puzzled by this dynamic.

Initially, Rivian claimed that its plant in Normal, Illinois was able to produce 150,000 vehicles. So it seemed to me that higher production numbers should lead to lower average fixed costs and thus better costs per vehicle. And it’s partially true, the increase in produced cars decreased COGs per vehicle. But only by $20,000. It still costs $220,000 to produce the vehicle, which is sold at roughly $80,000. And the most strange thing is that the management said that the production was actually close to the maximum capacity:

As we ramp closer to the installed capacity within the plant in Normal.

It means that the increases in vehicle roll-out will be primarily due to the employment of the second shift. It definitely contributes to lower costs per car, but a significant increase in the manufactured vehicles requires continued Capex.

The situation in Lucid is different. Its gross margin decreases with production ramp up. And I’m really glad to see it. The key question is how quickly it will develop going further. The management has already put cautious messages saying that the development required investments in the logistics center.

Author’s work. Financial statements

Valuation

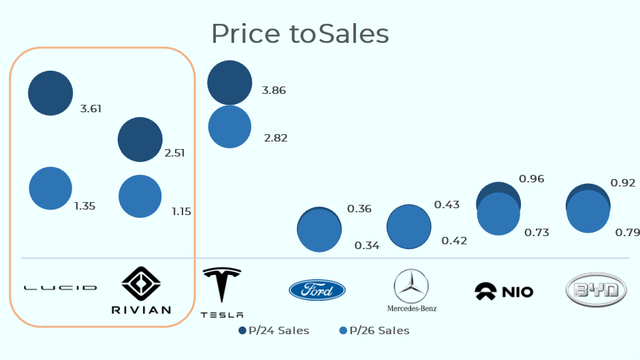

Even though Lucid performed worse than Rivian, its price / 2024 sales is higher than Rivian’s. Interestingly, the price / 2026 sales of both stocks is roughly the same. It means that the market expects Lucid to accelerate revenue growth in later years, while Rivian will reach maturity earlier. Does this sound plausible? Not to me.

It’s difficult for me to buy the argument that the company struggling to produce at scale can cost more than the producer that has already shown a solid track record. Although Rivian burns a lot of cash, Lucid is not profitable either. Given the looming recession, Wall Street counts every penny now. I believe Lucid’s share will decline before it reaches some kind of fair value.

Author’s work. Seeking Alpha

Bulls say

Bulls would say that both companies produce innovative cars and have no real competition from established car players. As soon as the Fed pivots, both players will be appreciated by the market and the stock price will jump.

Conclusion

So far, the verdict is clear. Rivian will win the race against Lucid, even though Rivian has massive issues with profitability. Such a huge cash burn doesn’t allow me to put Buy for Rivian. It’s a Hold for now. If something changes, I’ll be happy to update you.

We’re here to earn from the stock markets and not just to produce another amusing article. Our latest Lucid sell analysis allowed us to earn 32% on Lucid, and I hope that this analysis will bring even greater gains.

In the meanwhile, keep riding the cycle.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in LCID over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.