Summary:

- Snowflake offers an intriguing investment opportunity with healthy financials, a user-friendly platform, and a focus on customer value.

- The new CEO brings AI expertise, aligning with Snowflake’s innovation push.

- Challenges include potential cloud slowdown, competition, and declining customer retention numbers.

- Snowflake’s recent correction offers a compelling long-term entry point, especially with the new CEO’s AI expertise, though a cautious approach is warranted.

borchee

Investment Thesis

Snowflake (NYSE:SNOW), despite its recent correction, offers an intriguing investment opportunity. Their user-friendly platform and focus on customer value are strengths. New leadership brings AI expertise, aligning with Snowflake innovation push. Challenges include potential cloud slowdown and competition. While there seems to be a concern with customer retention numbers (NRR) it might just reflect a strategic shift to focus on larger enterprises. Overall, Snowflake is a calculated risk with high reward potential, but close monitoring of the actions of the new CEO and customer retention is crucial.

Given these factors, I’m initiating coverage with a cautious Buy rating.

Operations

First things first, I will address the white elephant in the room, Snowflake’s stock experienced a brutal correction after its February 28th earnings report. The stock, known for its volatility, plummeted 20% immediately following the report, and then continued to slide over the next month, dropping a total of over 40% to its current price of $150 as of the time of this writing.

It’s important to remember that this drop came after a significant upswing. In the year leading up to the earnings report, SNOW had climbed over 50% and was already up 15% YTD. So, expectations were undeniably high. Unfortunately, the company’s forecast fell short, triggering a correction from those recent gains.

However, there seems to be more to the story than just a weaker forecast. Here are three key factors that I believe likely contributed to the steeper-than expected decline:

- A cloud slowdown: Snowflake, isn’t alone in providing weaker guidance revisions. I follow several software and data analytics companies, including Salesforce (CRM), Palo Alto Networks (PANW), MongoDB (MDB), and Workday (WDAY), have all cited weaker forecasts. This suggests a broader industry trend, not just specific to Snowflake.

- Leadership in transition: adding to this uncertainty surrounding this inherently volatile stock, Snowflake just welcomed a new CEO – literally the day before the earnings call. Historically, such leadership changes can introduce volatility to a stock price as investors wait to see the new direction of the company.

- A longer road to $10 Billion: CFO Mike Scarpelli also announced during the earnings call a revised path to reach its ambitious $10 billion revenue target by 2029. The 2029 plan implied a sustained 30% annual revenue growth. Some analysts found this reset of expectation less aggressive than they were hoping for, especially considering the stock past volatility.

“These changes in our assumption impact our long-term guidance. Internally, we continue to march towards $10 billion in product revenue. Externally, we will not manage expectations to our previous targets until we have more data. We are focused in executing in FY ’24 to ensure long-term durable growth.”

Management Evaluation

Snowflake recent leadership change brings a mix of experience and fresh perspectives. Former CEO Frank Slootman, known for his success taking companies public, including ServiceNow (NOW) and Data Domain, later acquired by Dell Technologies (DELL), stepped down. While lauded for his expertise, Slootman’s background wasn’t necessarily in product development.

Enter Sridhar Ramaswamy, Snowflake’s new CEO. Ramaswamy’s journey is unique- a machine learning (MLL) engineer at Google (GOOG) turned venture capitalist, he co-founded Neeva, a search engine powered by AI technologies including large language models (LLMs) and generative AI. Snowflake’s acquisition of Neeva in 2023 brought not just the innovate technology but now also the mastermind behind it. Further demonstrating his confidence in Snowflake, Ramaswamy recently purchased $5 million worth of company shares.

The financial reins are held by Mike Scarpelli, Snowflake’s CFO. A veteran from ServiceNow who joined alongside Slootman in 2019. Scarpelli boasts an impressive track record. He’s maintained low debt levels and achieved a remarkable 90% FCF growth over the past 3 years. However, the challenge now lies in translating the company’s significant R&D investments into higher revenues streams.

This is where Christian Kleinerman, the EVP of Product and a former YouTube Product manager, comes in. During the recent earnings call, Kleinerman presented a roadmap of new tools and milestone aimed at driving General Adoption:

“Yeah. So, as both Sridhar and Mike mentioned, we expect a number of meaningful GA milestones this fiscal year, starting with generative AI, Cortex will be in public preview very soon, and we expect it to be generally available on and around the Summit’s timeframe. And as Sridhar said, we expect all sorts of interesting use cases of generative AI coming to the data and preserving privacy and security.

Snowpark Container Services is already in public preview in AWS, and we expect it to be generally available in that same timeframe, give or take a couple of months from Summit. And is the ultimate extensibility capability for bringing computation into Snowflake. Iceberg Tables is already on public preview across all three clouds, and will be generally available again, also in the Data Cloud Summit timeframe. Unistore, which enables combining transactional and analytical capabilities in single applications went very recently into public preview in AWS and will be generally available in the second half of the year. And Native Apps, which is how we accelerate time to value for both partners and customers is clearly GA on AWS and Azure, and we’re continuing to round up the enhancement.

So, this is imminent, and we expect a strong showing of product capabilities at the Data Cloud Summit.”

While the leadership change brings a new CEO with a product and AI background in Ramaswamy, I’m reserving a strong positive judgement for now. It typically takes several quarters for a new CEO strategy to unfold. Observing how Ramaswamy steers Snowflake’s product direction and AI integration in the coming quarters will be key.

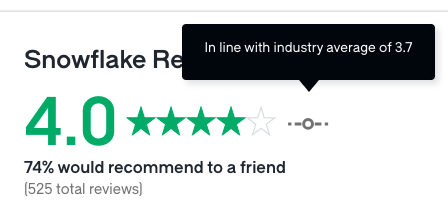

On the positive side, Ramaswamy experience building Neeva, an AI-powered search engine, is relevant. His understanding of product development could benefit Snowflake future offerings. Additionally, Snowflake’s high Glassdoor rating suggests a strong company culture, potentially a good foundation for success under new leadership.

Glassdoor rating (Glassdoor)

Given these factors, I view Snowflake’s management with cautious optimism and giving them a rating of “Meet Expectations” for now.

Financials

As mentioned before, Snowflake recently adjusted its long-term revenue goal. Previously, the company aimed to reach $10 Billion in revenue by 2029, implying a 30% annual growth rate. This ambitious target has reset for now, with no new expectations for a long-term goal.

I believe there are two main factors for this:

- New leadership: the arrival of a new CEO often leads to reevaluation of long-term goals.

- Market conditions: The current economic climate is a contributing factor, higher interest rates affect budgets, Capex, and investments for many of Snowflake’s client base. As previously discussed, many companies in the data analytics sector are adjusting their forecasts downward, suggesting a drag of the cloud slowdown that has been experienced at least since 2023.

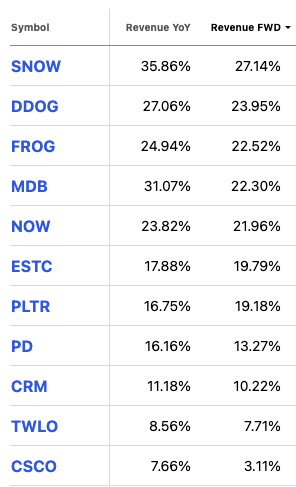

Snowflake’s revised forecast for fiscal year 2025 also reflects a more cautious approach. Their projected revenue growth of 22% falls short of Wall Street’s expectations of 30%. This alignment with industry trends suggests Snowflake is taking a more realistic approach to navigating the current economic landscape.

To gain a broader perspective, let’s compare Snowflake’s revised forecast with the expectations of other data analytics companies:

Seeking Alpha Data Analytic comparison (Seeking Alpha)

By analyzing both internal factors like the leadership change and external market conditions, we can gain a better understating of the rationale behind Snowflake’s reset on their long-term target.

One of the things to understand is the high uncertainty in revenue of data analytics and warehousing companies. Most of these companies, including Snowflake, use a data consumption or per-use pricing model (DaaS), unlike traditional SaaS subscriptions. This DaaS model offers flexibility for customers but can also lead to revenue volatility. I call it a pay-as-you-go approach, and it likely contributed to Snowflake rapid growth at the beginning, as customers weren’t locked into upfront costs.

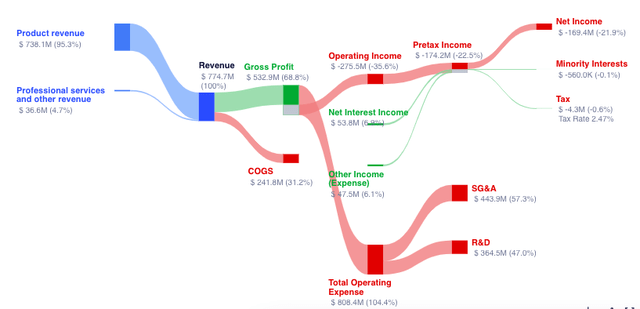

However, there’s a double-edged sword here. Recent efforts to improve platform efficiency through R&D, which you can see below is a big portion of Snowflake’s operating costs, while allowing customers to run more queries for the same or even less money, could dampen future revenue growth. While these optimizations are essential for staying competitive, they may come at the expense of some short-term revenue growth.

Snowflake’s recent stock drop echoes concerns from last year regarding their ability to maintain a high growth rate and lower guidance. While some analysts view this as a repeat loss of confidence, it might also reflect a necessary “reset” of expectations. The arrival of a new CEO often prompts reevaluation of growth targets. The coming quarters will be crucial in understating the new leadership’s approach and its impact on Snowflake’s future trajectory.

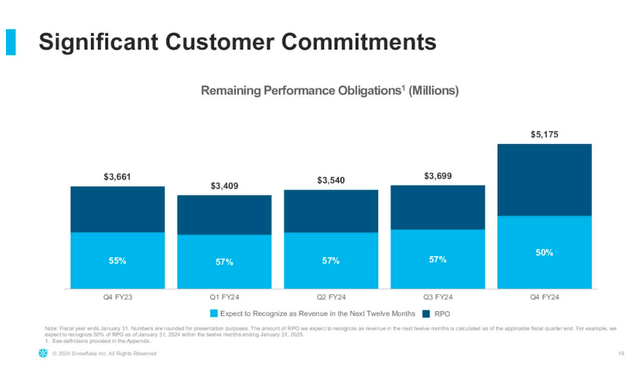

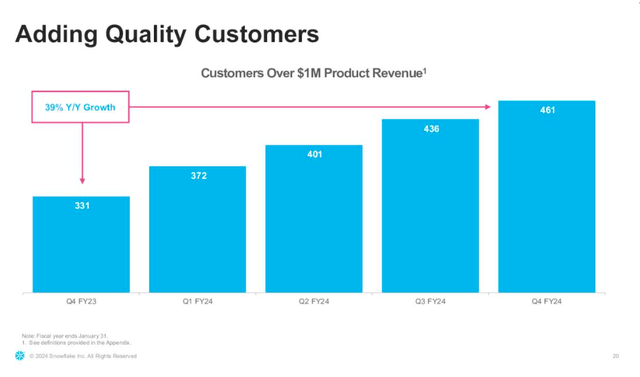

On the positive side, Snowflake’s latest earnings report paints a relatively optimistic picture. They boast solid YoY growth and a healthy backlog of customer commitments (RPO), indicating future revenue potential.

SNOW earnings slides (Seeking Alpha)

The main potential risk to consider is their declining Net Revenue Retention rate (NRR), which is a key indicator that has been dropping for the last 7 quarters. This suggests a potential struggle to retain existing customers, even while acquiring new ones. However, for me this demonstrates Snowflakes focus on efficiency metrics rather than obtaining new customers which should improve customer retention in the long term.

SNOW earnings slide (Seeking Alpha)

Further, Snowflake’s strong FCF and low debt position provide them with a financial cushion to navigate these challenges. Ultimately, the company’s success will hinge on its ability to retain existing customers while capitalizing on the AI revolution under its new leadership.

Corporate Strategy

Snowflake’s new CEO and CFO, Mike Scarpelli, provided their public address at the Morgan Stanley Technology Conference in March following the company’s earnings report. This presentation sheds light on their key strategic priorities:

- Prioritizing User Accessibility: the core tenet of success for Snowflake has been its user-friendly platform that could be operated with simple SQL Commands and integration for multiple users.

- Shifting Focus to customer value: it’s clear that Snowflake is placing greater emphasis on maximizing value for existing customers. This is reflected in the restructuring of their salesforce to prioritize customer consumption over solely acquiring new clients. This strategic shift aligns with the observed decrease in retention rates and focuses on the largest enterprises.

|

Snowflake |

Databricks (PRIVATE) |

Amazon Redshift (AMZN) |

Microsoft Azure Synapse Analytics (MSFT) |

Google BigQuery (GOOG) |

Teradata Vantage (TDC) |

|

|

Type |

Data Cloud Platform (DaaS) |

Unified Data Analytics platform |

Data Warehouse as a Service (DaaS) |

Data Warehouse & Analytics Service |

Data Warehouse as a Service (DaaS) |

Enterprise data Warehouse |

|

Strengths |

Easy to use, high performance and secure |

Open source, flexible, good for data science workloads |

Cost-effective, good for basic data warehousing needs. |

Integrated with Azure ecosystem, good for large-scale analytics |

Serverless, highly scalable, cost-effective |

Mature, reliable solution for complex workloads |

|

Weaknesses |

Can be expensive for complex workloads |

Stepper learning curve, requires data engineering expertise |

Limited functionality compared to snowflake and Databricks |

Lock-in to Azure ecosystem |

Can be complex to manage for some users. |

High upfront cost, complex licensing |

|

Pricing |

Per second compute & per byte storage with various editions |

Varies based on cluster, instance, and type size and data processing needs |

Per hour instance pricing, with reserved instances offering discounts |

Pay per use model based on data processed and stored |

Pay per use model based on data processed and stored |

Subscription-based model |

I’ve created a table above to highlight some risks that Snowflake is facing. While the company has established itself as a leader in the data cloud space, it faces competition from several players:

- Frenemey Partnerships: some of Snowflake’s key partners, like Amazon and Microsoft, also offer competing data warehousing and analytics solutions. While these partnerships provide Snowflake with access to a wider customer base, they also create a potential conflict of interest.

- Databricks – An upcoming direct competitor: Databricks (PRIVATE), it’s a major player with a recent $43 billion valuation raising just over $500 million in a Series I round from NVIDIA (NVDA) and Capital One (COF) possess a significant threat. Their ability to offer more options and cater to a broader range of users, especially those with sophisticated needs, could potentially attract those customers with more complex needs and the ability to spend more.

Valuation

SNOW currently trades at around $155.

Employing a conservative 11% discount rate and using a reversed DCF analysis approach, I arrive at an implied Free Cash Flow growth rate is 30%.

It’s important to acknowledge Snowflake’s impressive historical FCF performance. Since becoming FCF positive in 2021, they’ve increased it over 6.5x, with a 40% increase just last year and just under 90% over the last three years.

Considering these factors, combined with the recent leadership change under Sridhar Ramaswamy and the potential of AI tools to leverage their existing customer base, there’s reason to believe Snowflake can maintain strong FCF growth, especially when cloud spending picks up.

In the near term, based on technical analysis, I anticipate SNOW stock price to trade within a range of $140-$170. A significant drop to below $130 would warrant a revaluation of my investment thesis.

Takeaway

I believe that Snowflake’s recent correction presents an interesting entry point for long-term investors and while the new CEO impact remains to be seen, the company’s strong financial health, with low levels of debt and robust FCF growth, offers them flexibility. This positions them well to navigate current economic headwinds and invest in high-growth AI projects, levering the new CEO’s expertise in this area. Given these factors, I initiate coverage with a cautious buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.