Summary:

- Snowflake faces decelerating growth and cyberattack concerns, leading to a bearish outlook.

- The company forecast a significant deceleration in key product revenue growth to only 20% in FQ4.

- Despite promising future prospects with AI technology, the stock’s rich valuation at 12x forward sales suggests Snowflake still needs to trade lower.

enter89

Snowflake Inc. (NYSE:SNOW) entered earnings in a precipitous place, facing decelerating growth after multiple cyberattacks hit confidence in the business. The AI data company confirmed the fears, sending the stock back to test the lows. My investment thesis remains Bearish on the stock with no turnaround in sight and a stretched valuation, as if the company was still producing premium growth rates.

Source: FINVIZ.com

Sales Deceleration

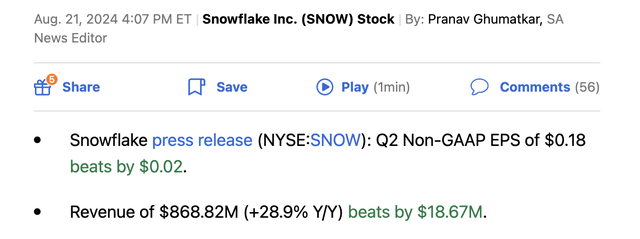

While Snowflake spent the majority of the earnings call discussing new AI technologies, the company forecasted a major slump in growth rates for FQ3. The company still reported strong sales in the July quarter as follows:

Source: Seeking Alpha

The AI data company reported sales grew just under 29%, already down from nearly 33% in the prior quarter. The sales deceleration really picks up speed in the current quarter and into year-end.

Snowflake guided to FQ3 product revenue of up to $855 million, up 22% from FY24. The product revenues are only forecast to grow $26 million sequentially on the high side and only $21 million at the low end.

At the end of the day, Snowflake outlined a promising future, but the company continued to guide towards the worst fears in the stock market of decelerating growth. The key product revenue growth isn’t expected to turnaround in the 2H of the year with following forecasts based on guidance for $3.356 billion for FY25 for 26% growth:

- FQ4E – $884.6 million, 20% growth

- FQ3E – $852.5 million, 22% growth

- FQ2A – $829.3 million, 30% growth

- FQ1A – $789.6 million, 34% growth

Back in FQ3’24, product revenues grew $58 million sequentially from FQ2 on a much smaller base of $640 million. For this reason, the consensus analyst revenue estimates actually appear aggressive, with Snowflake growth rates only dipping to a trough at 20%.

Source: Seeking Alpha

Remember, total revenues include professional services at about half the growth rate of products. Snowflake is only producing ~$40 million in quarterly revenues in this category, but this works to cut overall growth rates, with product revenues ending FQ25 already sliding to only 20%.

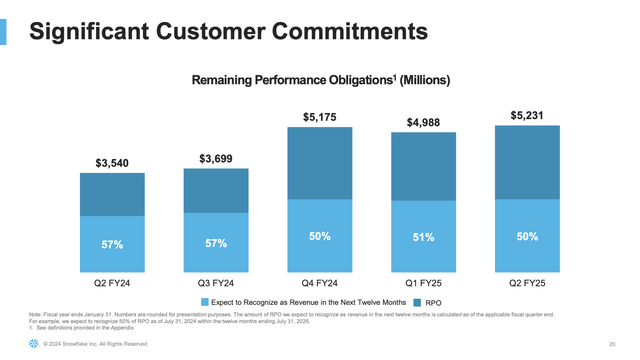

Snowflake rightfully wants investors to focus on RPOs with remaining customers obligations reaching $5.2 billion for 48% growth. The big key to this story is that the RPOs beyond the next 12 months is the balance actually accelerating.

Source: Snowflake FQ2’25 presentation

The AI data company reported ~$2.6 billion in current RPOs and a similar $2.6 billion in long term. Back in FQ2’24, the RPOs were 57% focused on the next 12 months for $2.0 billion.

The massive growth in RPOs is for non-current, going from roughly $1.5 billion last FQ2 to $2.6 billion now. The key is Snowflake getting customers to make longer contractual commitments, but the AI data company has several top 10 customers that operate on month-to-month contracts at times to cloud the benefits of the RPOs.

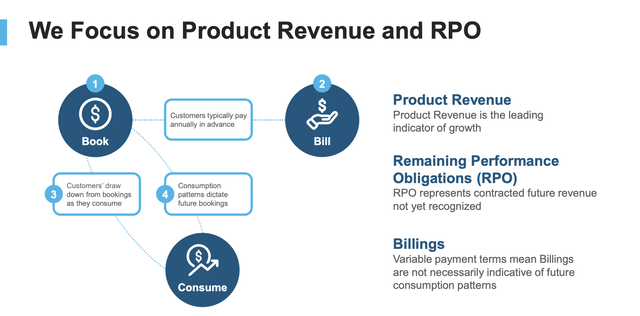

Besides, management actually tells investors that product revenue is the leading indicator of growth, not RPOs. In this case, the leading indicator of growth isn’t healthy.

Source: Snowflake FQ2’25 presentation

Naturally, the concern here is that Snowflake still faces the lingering impact of the cybersecurity issue, with data held in their systems stolen due to customers lacking sign-on controls. The additional CrowdStrike (CRWD) cybersecurity issue in July has to further complicate the story for Snowflake, regardless of whether the AI data company is responsible for the cybersecurity issues.

The company discussed great progress with 2,500 customers now using AI software. Unfortunately, the CEO made this comment about the revenue impact of the new product features focused on AI products like Cortex on the FQ2’25 earnings call:

The forecast product revenue based on observed behavior, our FY 2025 guidance includes contribution from Snowpark as previously stated. Our guidance does not include material contribution from a new product features. Our forecast does include revenue headwinds associated with performance improvements.

Still Priced For Perfection

The stock has fallen nearly 50% already this year, yet Snowflake is still priced for near perfection. The market and the company have not faced the reality of key product revenue is in massive deceleration mode.

Snowflake still trades at 12x FY25 revenue targets of $3.5 billion. The stock has a fully diluted market cap of $41.4 billion based on 360 million diluted shares outstanding.

At the same time, the company has limited profits, with non-GAAP gross margins of only 5% in the last quarter. Snowflake generates massive cash flows with most customers paying contracts up front, leading to the generation of free cash flow margins nearing 30%, but the company still has to absorb the expenses from those contracts in the future.

The company ended July with a cash balance of $3.9 billion, but Snowflake unwisely spent the last year repurchasing shares. The company spent $400 million on share buybacks during FQ2 and has spent an incredible $916 million in the 1H of the fiscal year, though the diluted share count has only dipped by 4 million shares YoY from the 363 million level.

A big reason for the small share count reduction was Snowflake spending $516 million during FQ1 to only repurchase 3 million shares at an average price of $173. The company was not discerning enough to repurchase shares at a reasonable price.

Takeaway

The key investor takeaway is that Snowflake has a promising future using incorporating AI into data systems with the ability to take unstructured data and turn the information into useable data. Unfortunately, the AI data company still faces major headwinds leading to decelerating product growth and major questions entering FY26 next year.

Investors should continue to watch this stock from the sidelines, with the worst fears being realized now and no real explanation from the company of when product growth troughs.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to end August, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.