Summary:

- SolarEdge has experienced a significant decline in value, losing 81% over the past year and facing competitive challenges in the residential solar market.

- The company is losing its competitive advantage against rivals Enphase and Tesla, who have superior access to capital.

- SolarEdge’s liquidity profile is alarming, with limited cash and ST investments and immense inventory buildup.

- The solar industry should slow for years as high rates make solar less attractive to buyers.

- In my opinion, SolarEdge may need to pursue dilutive equity sales soon based on the rate of its cash-flow declines.

nattrass

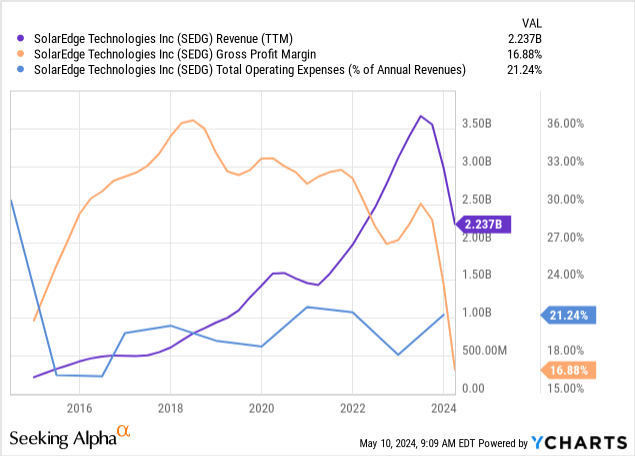

SolarEdge (NASDAQ:SEDG) was a darling of green energy investors. It was among the most popular solar stocks and rose by over 400% from the mid-2010s to its 2021 peak. However, it collapsed over the past year, losing 81% of its value and retracting back toward its IPO price. That has come amid a significant decline in its sales and a massive cut to its gross margins, pushing its operating margins into deeply negative territory. See below:

There are a few causes of this drawdown. One is that the residential solar market is slowing down, with installations likely falling in 2024. Some government subsidy programs have ended or changed (such as in California). However, the greatest impact is higher interest rates, labor, and material costs, making solar less economical than traditional utilities. This change may last until interest rates decline, which may take years, or until electricity prices rise, which seems more likely.

Of course, SolarEdge’s massive decline is beyond what we’d expect from the stagnation in residential solar installations. The company faces competitive failure and has tremendously deteriorated its balance sheet and liquidity profile. At its current price, investors are likely wondering whether or not it is likely to fall further or is a deep value fire sale opportunity. To better determine that, we must consider its fundamentals in light of the macroeconomic backdrop.

In my opinion, at its current trend, it may face financial strain by around 2025-2026 unless it can turn its performance around. The company’s cash and ST investments equal its current liabilities. It also has long-term investments and inventories, giving it sufficient near-term liquidity. However, in my opinion, its negative operating cash flow is so large that, in comparison, its liquidity profile is weak.

SolarEdge Losing its Competitive Advantage

In the US and Europe, solar inverters, which turn solar DC power into more useful AC power, are dominated by SolarEdge and Enphase (ENPH). Solar inverters constitute a significant cost of solar projects. The two were founded in 2006 and have had direct competition since then. Enphase likely gained a slight advantage in recent years. Like Enphase, SolarEdge also sells many other products needed for solar projects, including software and hardware. Per its 10-K, inverters account for just under half of its sales, next to optimizers and batteries.

Both companies are struggling with Tesla’s (TSLA) aggressive rise. Tesla is creating most of the products, potentially more than the other two. The company is taking market share from the other two during a critical period where the entire industry is seeing its sales slow. Tesla has a significant advantage due to having a broader vertically integrated production base and, most importantly, having a ton of capital through its equity. Tesla can sell at a loss or aggressively expand its production using its massive capital base to push these smaller firms out of the market.

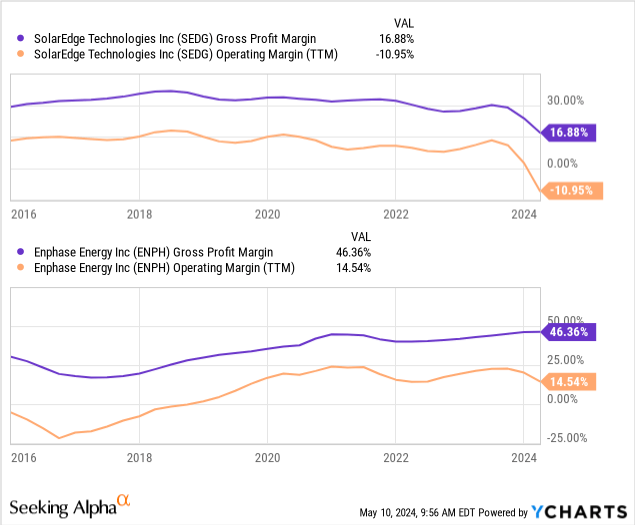

SolarEdge is worth $3B today, while Tesla is around $550B. Although I believe Tesla is significantly overvalued, it can use that market capitalization to raise immense cash. Tesla has $27B in cash and ST investments today, while SolarEdge has just $680M as well as $268M in long-term investments. Likely, Tesla can sell products at a loss and undercut SolarEdge, until it is not in the market. Still, both Enphase and SolarEdge are seeing similar sales declines. However, SolarEdge’s profit collapse is far more apparent:

Enphase remains profitable despite the difficulties, whereas SolarEdge is losing a great deal and has seen its gross margins slip for years. Fundamentally, that is a sign that SolarEdge is losing its competitive edge against Enphase and Tesla.

SolarEdge’s Liquidity Profile is Alarming

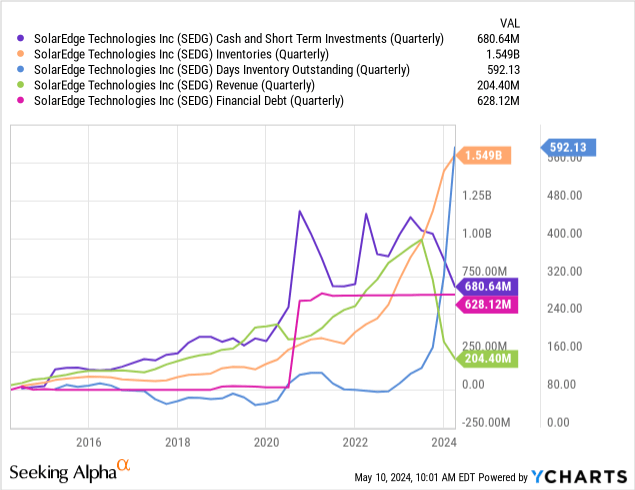

SolarEdge’s market capitalization of $3B gives it minimal access to liquidity. In my opinion, the company can sell shares if it might eventually need to raise capital, but that will be very dilutive given its potential capital needs. SolarEdge had $680M in cash and ST investments at the end of last quarter. Its inventories were very high at ~$1.55B, but its sales collapsed, pushing its day’s inventory outstanding to unsustainably high levels. See below:

The company’s financial debt and interest costs were not significant until recently, as its market capitalization is lower. Realistically, its access to debt capital is likely very limited going forward, as it cannot make substantial payments today. To reduce its inventories, the company will likely need to lower prices, further pressuring its profit margins.

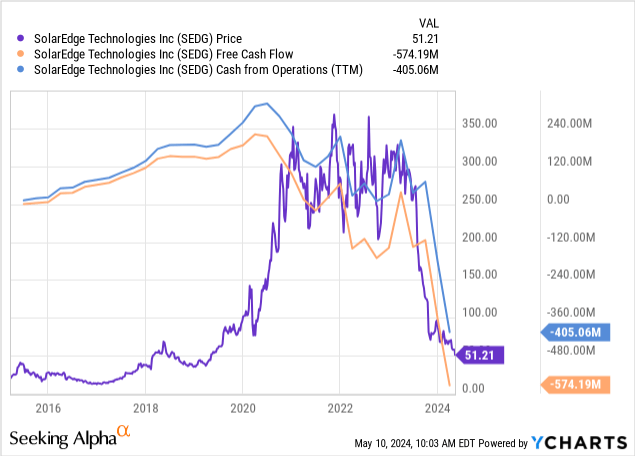

In my opinion, given its cash flow trend, the company cannot survive for very long without raising its cash position. See below:

Without a sharp reversal in profitability, I feel the company will face serious pressure by 2025-2026, even if it may raise some cash. The market’s reaction to a capital-raising announcement will likely determine much of that. Its life may be extended if it can maintain its market capitalization while selling equity. However, looking at its trend and the recent negative investor sentiment toward green energy, I’m not sure it will manage that scenario well.

The Bottom Line

Overall, I’m not convinced that SolarEdge will certainly face serious financial issues, but I believe it is a possibility that remains underappreciated by investors. The company’s liquidity and balance sheet management is, in my opinion, very poor, as it allowed its inventories to rise tremendously while its sales and gross margins collapsed.

While I believe in solar as a long-term solution, it’s not particularly economical today in most of the world due to high interest rates. The effective price of owning solar through a loan has risen dramatically since 2022, with interest rates often around 9%, not considering some of the “buydown” strategies used by solar firms (raising loan prices and lower rates to take advantage of the government refund program).

Furthermore, with global supply chains still under strain and geopolitics threatening to exacerbate that strain, production costs are rising. SolarEdge is so far unable to pass those costs on to buyers, particularly with giants like Tesla aggressively taking market share.

In its annual report, SolarEdge also details the risks associated with its Israel headquarters. The company’s operations are focused in that region, which is exposed to trade turbulence and other factors today that are important for investors to understand. As I’m not aware of all of those issues, investors should refer to its annual report pgs. 25-26 on that matter.

I would not short-sell SEDG at its current price, as it could rebound with investor speculation or exuberance, and it may manage to improve its cash flow. As seen in AMC and others, speculative fervor can save SEDG by pushing its price and allowing it to sell equity and raise cash. Indeed, with enough money, SEDG may survive this period, restructure, and make it through as a profitable company. That said, I believe the risk weighs toward the downside, with financial strain potentially resulting from reduced access to capital, stemming from its negative cash flow, poor balance sheet, and lack of investor interest.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.