Summary:

- SolarEdge’s stock has dropped by 87% from its peak, indicating a possible further decline in the near future.

- Recent earnings have been disappointing, with a significant decline in earnings and sales.

- The solar industry as a whole is facing challenges due to the sluggish economy and high interest rates, impacting demand and profitability.

Justin Paget

I thought the alternative energy/solar industry bottomed last November. I put out several bullish notes in the sector, including a piece regarding SolarEdge (NASDAQ:SEDG) “SEDG” stock and how it could recover soon. However, whereas stocks like Enphase (ENPH), First Solar (FSLR), and others stopped decreasing, SolarEdge continues making new lows. SolarEdge’s problems may go beyond the industry and could be company-specific, making SolarEdge a riskier investment than some of its competitors in the space.

SEDG Keeps Dropping

The decline in SEDG’s stock has been nothing short of fantastic, plunging by a staggering 87% from its peak of approximately $380 in 2022 to a recent value of around $50. The stock’s consistent pattern of lower highs and lower lows indicates a possible further decline in the near future. The sluggish economy, coupled with the adverse effects of high interest rates on demand, has created a sales and profitability environment that falls significantly short of expectations.

Recent Earnings Disappointment

SEDG’s recent earnings have had a significant impact on its stock performance. The company’s earnings plummeted from around $6 in 2022 to around $4 last year and to roughly (minus $4) this year. The road to recovery from this negative earnings stage may prove to be more arduous than anticipated, and it’s unlikely that SEDG will immediately rebound to $4-5 in EPS.

The most recent report was disappointing. SEDG earned non-GAAP EPS of -$1.90, a 31-cent miss. The $204.4M in venues represented a 78% YoY decline in sales. For Q2, SEDG guided revenues in the $250-280M range, well below the $307M consensus estimate. This dynamic illustrates that SEDG’s demand is substantially worse than expected, and it may take longer for the firm to recover lost market share.

The “good news” is that this doesn’t seem to be a SEDG-specific problem, although its stock is reacting worse to the forecasts. Enphase (ENPH), SEDG’s primary competitor, also posted abysmal guidance, pointing to Q2 revenues of $290-330M, well short of the consensus estimate of around $346M. Therefore, the slow economy/high-interest rate environment continues to weigh heavily on the solar industry here. SEDG received several downgrades, including a $55 hold rating from a previous $75 target at Deutsche Bank.

We Need Change

We need interest rates to come down. Solar systems can be costly, and low rates should improve demand, leading to increased revenue growth in future years. The solar market also depends on new home sales, and lower rates should drive new home sales higher, flooding the solar market with new installation orders. The bottom line is that for SEDG and other solar companies to see growth, we will need to see improvement in housing, and lower rates are vital in moving the housing market in the right direction.

The Fed Is On The Verge Of Cutting

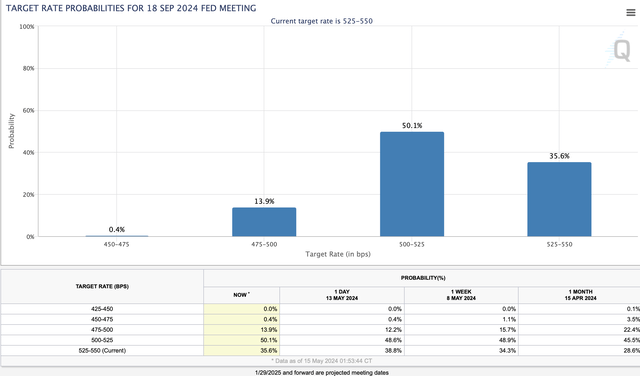

Rate probabilities (CMEGroup.com )

The Fed is on the verge of cutting rates, and there is about a 65% probability that it will cut rates by 25 Bps or more by the September FOMC meeting or sooner. SolarEdge’s outlook could brighten as the Fed nears cutting rates. The company’s sales and profitability should lift in 2025 and beyond, likely making SEDG a solid long-term buy at current depressed valuations.

Earnings Likely To Normalize

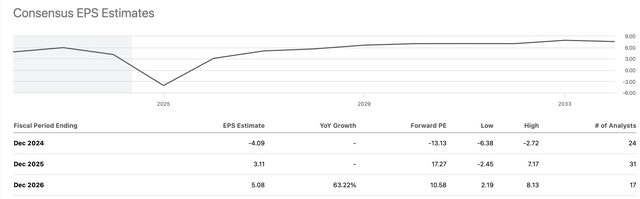

EPS estimates (seekingalpha.com )

SolarEdge’s earnings should recover despite its current challenging phase. While significant uncertainty persists about this and next year’s results, the consensus is clear regarding 2026 EPS. The market expects around $5 in EPS from SEDG, putting the solar company’s forward P/E ratio around 10. This is a relatively cheap valuation if SEDG can live up to the expectations. However, whether the company can meet such lofty estimates remains a “big if” topic for debate, making SEDG an exciting and, at the same time, increased-risk investment opportunity.

Where SEDG could be in the future:

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $1.4 | $2.5 | $3 | $3.5 | $4 | $4.5 | $5 |

| Revenue growth | -53% | 78% | 20% | 17% | 14% | 13% | 11% |

| EPS | -$4 | $0 | $4 | $6 | $7 | $8 | $9 |

| EPS growth | N/A | N/A | N/A | 50% | 17% | 14% | 13% |

| Forward P/E | N/A | 20 | 19 | 18 | 17 | 16 | 15 |

| Stock price | $55 | $80 | $115 | $126 | $140 | $150 | $165 |

Source: The Financial Prophet

I’ve moved my estimates lower since the previous SEDG projections. Moreover, the company’s earnings inconsistencies question its future profitability potential. Still, we could see a constructive turnaround if SEDG can return to sales growth. We may also see increased efficiency and improved profitability as SEDG’s operations normalize, returning to growth in future quarters.

Risks to SolarEdge

SolarEdge’s primary risk may be competition from Enphase, Tesla, and other companies. Additionally, macroeconomic factors could weigh on growth for longer than anticipated, leading to softer demand. Moreover, we could be in a “higher-for-longer” rate regime. This dynamic may make it challenging to keep the housing market in good health. It could also make acquiring credit for costly solar systems and installation fees more challenging. Investors should consider these and other risks before investing in SolarEdge.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ENPH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!