Summary:

- Sono Motors is currently developing a disruptive solar technology that may make mobility much more sustainable.

- I assumed that SEV’s injection molding technology will be accepted by automobile manufacturers and other competitors.

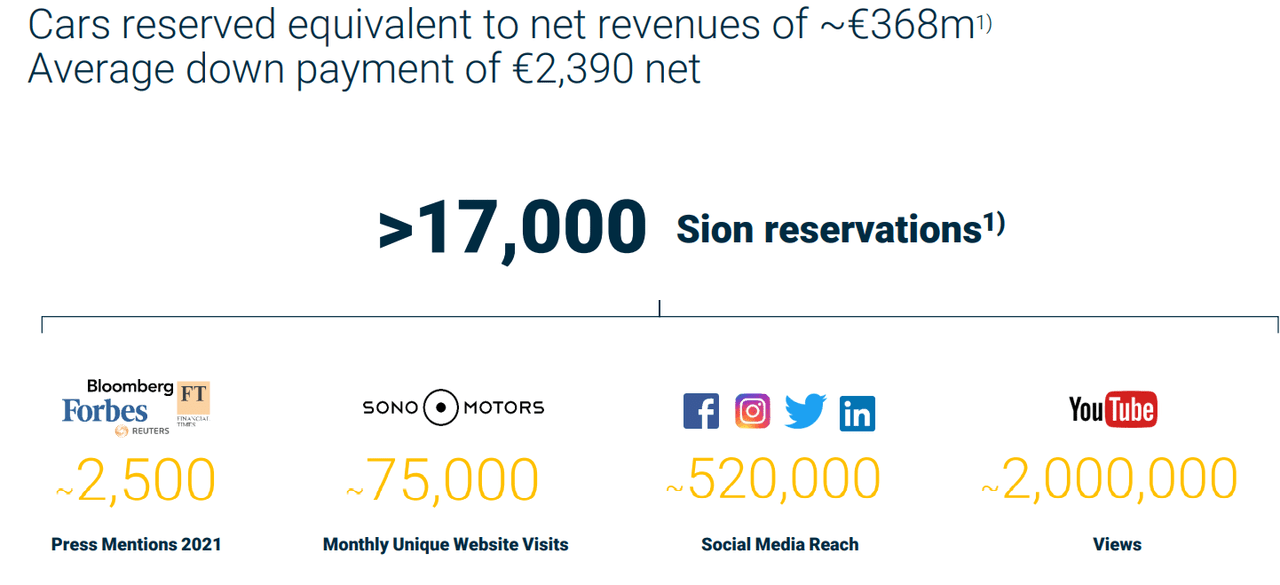

- In a recent presentation, SONO noted 17k reservations, which would be equivalent to net revenue of around €368 million.

gremlin/E+ via Getty Images

Sono Group N.V. (SEV) has already proven that its solar vehicles meet certain customer demands. Besides, the company operates in a market that grows at a large pace. In my view, if management successfully estimates future capital expenditures, and becomes a leader in the next e-mobility wave, positive free cash flow will likely be reported soon. Even taking into account risks from new governmental regulation and underestimation of capex, in my view, the company is trading undervalued.

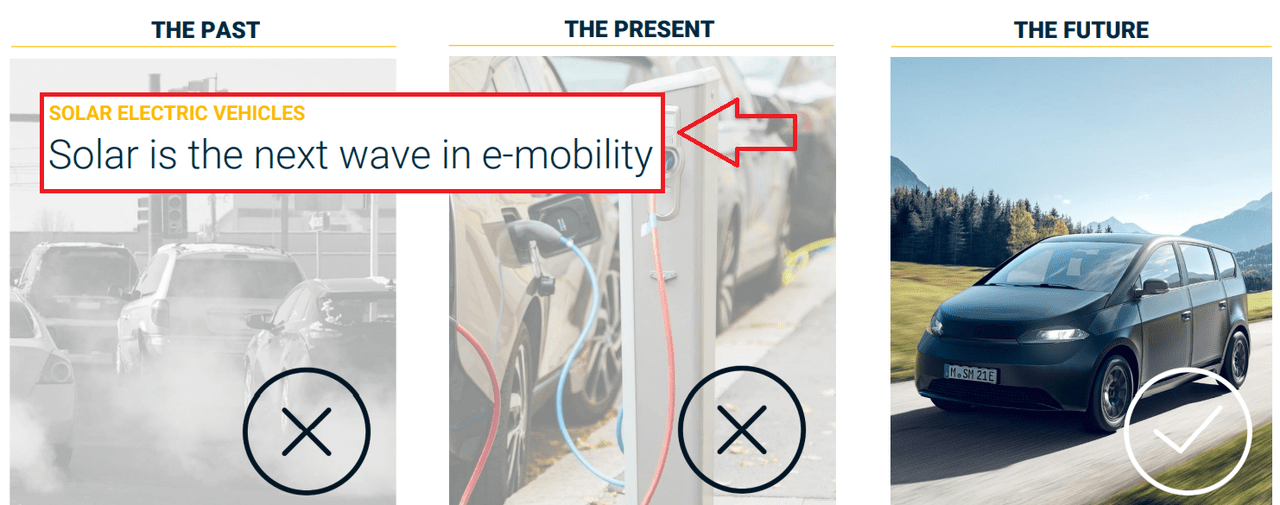

Solar On Every Vehicle

If you think that the electric vehicle is the future, perhaps you are not aware of the revolution of mobility by making every vehicle solar. Sono Motors is currently developing a disruptive solar technology that may make mobility much more sustainable.

Investor Presentation

We don’t know much about the total amount of capital expenditures necessary to design the new factories. However, we do have some information about the demand and the potential net sales. In a recent presentation, SONO noted 17k reservations, which would be equivalent to net revenue of around €368 million.

Investor Presentation

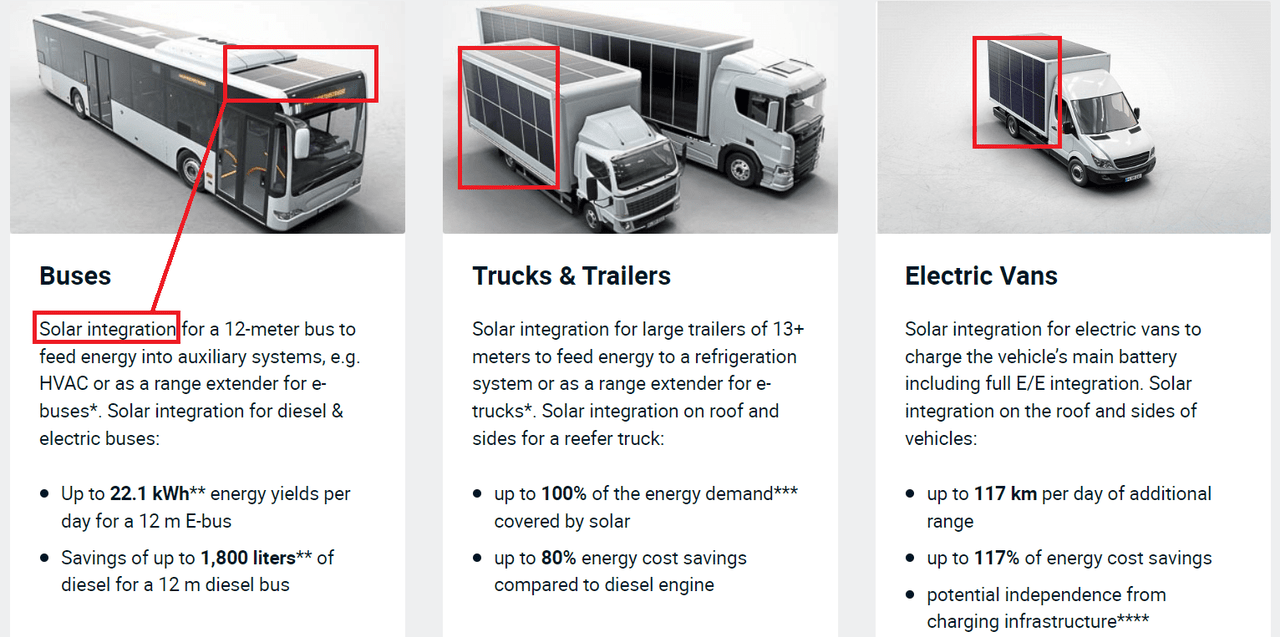

We also know that deliveries are expected to start from 2023, and management plans to manufacture cars, buses, trailers, and electric vans.

These vehicles will be produced through contract manufacturing with customer deliveries expected to begin in the second half of 2023. Source: Prospectus

Company’s Website

Base Case Scenario Would Include Rapid Development Of The Manufacturing Facilities And Rapid Acceptance Of The New Technology

Under my base case scenario, I assumed that SEV’s injection molding technology will be accepted by automobile manufacturers and other competitors. If other car manufacturers decide to follow the SEV’s business innovation, SEV’s fame and sales growth may grow:

Solar cells are typically inflexible and developed for flat surfaces that have the same exposure to sunlight, such as rooftops. Through a multi-year development and testing process, our solar experts and automotive engineers developed an injection molding technology, which is or is expected to be covered by our various patents. Source: Prospectus

I am also assuming that SEV’s pricing strategy will help target a large number of clients. If the company meets the demand of the mass market, revenue growth will likely be impressive:

The Sion’s net entry price of currently €25.1 thousand, coupled with its expected electric battery range based on the WLTP standard of up to 305 kilometers, or up to 190 miles, and its solar-charging capability, set the Sion apart from other electric mobility options. Source: Prospectus

SONO is enjoying a market that is expected to grow a CAGR of 36.4% from now to 2028. I believe that future sales growth will grow close to that of the target market:

Solar Vehicle Market is expected to reach CAGR of 36.4% by 2028. (Source)

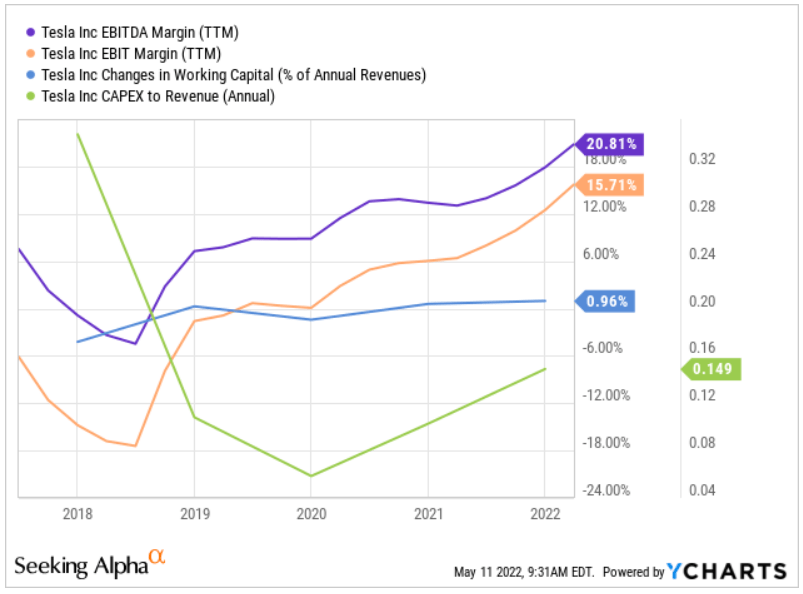

SONO compares itself with Tesla, Inc. (TSLA), so I believe that we can compare both companies. In my view, we could use the financial figures of TSLA to understand how SONO will do in the future.

While other car manufacturers such as Tesla, Inc., have successfully commercialized pure battery electric vehicles, electric vehicles with a self-recharging component based on solar modules have not yet been introduced into the car market and remain commercially unproven. Source: Prospectus

Ycharts

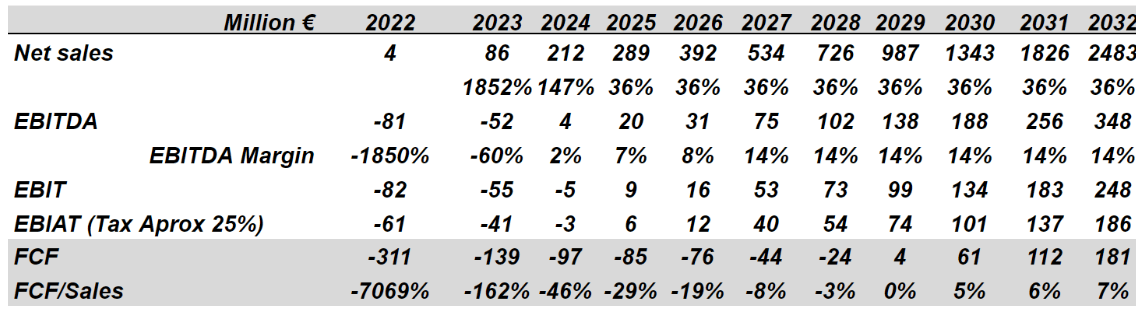

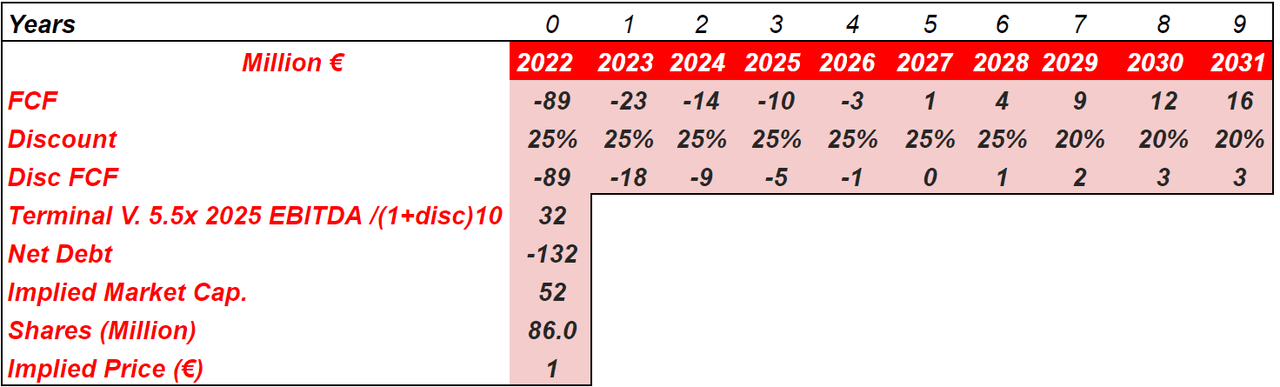

I used some of the optimistic figures reported by other analysts as well as the expected sales growth for the solar vehicle market. My results include 2032 sales of €2.4 billion. My DCF model also includes an EBITDA margin close to 14% and free cash flow margin of 7% that SONO will likely reach by 2027 and 2032 respectively.

marketscreener.com

If we assume a discount of around 15% in 2022 and 10% in 2031 as well as an exit multiple of 8x, I believe that the implied market capitalization could be close to €600 million. The fair price would be close to €8.

Author’s Expectations

There Are Many Risks From Underestimation Of Necessary Capital Expenditures, Governmental Regulation, And Consumer Trends

I identified several major risks coming from the demand side and risks related to capital expenditures. First, if management is not successful in assessing future government regulations, consumer demands, and technological trends, sales may not grow as expected:

The market for electric vehicles, particularly solar electric vehicles, is still rapidly evolving, characterized by rapidly changing technologies, price and other competition, evolving government regulation and industry standards, as well as changing or uncertain consumer demands and behaviors. Source: Prospectus

Besides, I am worried about the total amount of capital expenditures that SEV will need to develop its production facilities. If the total amount of capex is significantly larger than the total amount of cash flow from operations, free cash flow will likely not grow as expected. In this case scenario, investors will have to wait for a long time to recover their investment:

We currently expect that we will need to spend at least €440 million, of which a bit more than a quarter for capital expenditure, between January 2022 and the second half of 2023 for additional development activities, start of serial production and overhead costs in this period. Source: Prospectus

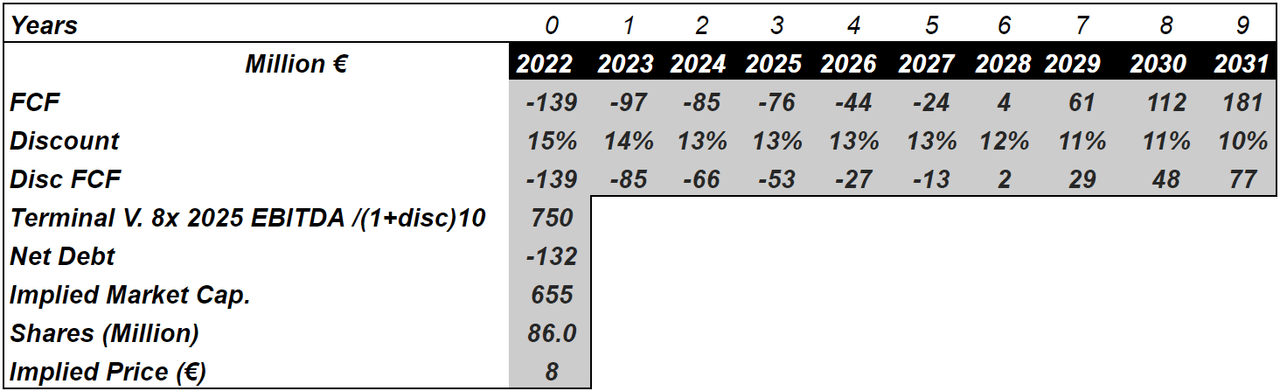

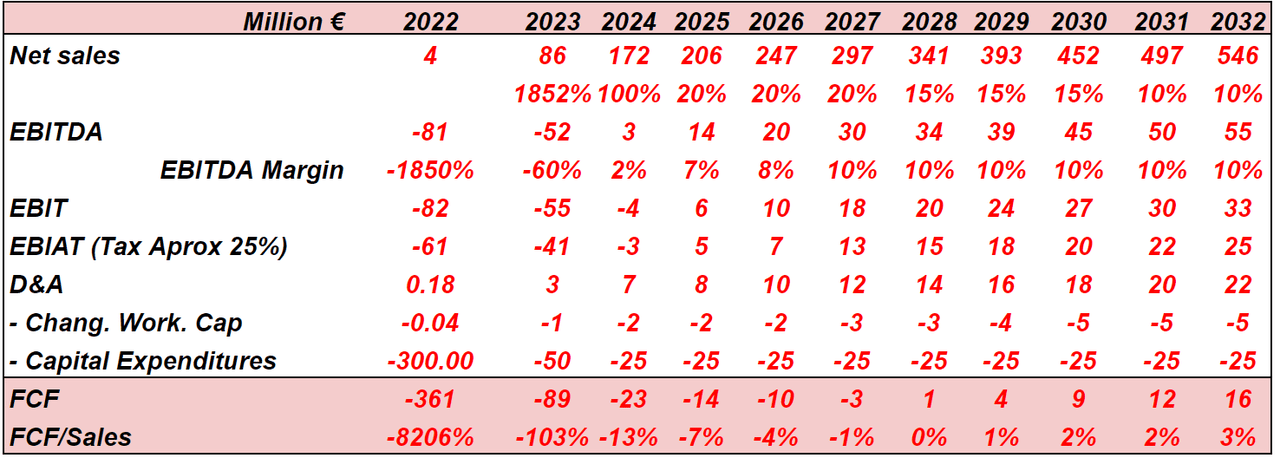

With sales growth around 20% from 2024 to 2027 and 15%-10% from 2028 to 2032, I obtained 2032 sales close to €550 million. Also, with an EBITDA margin around 10% from 2027 to 2032 and capital expenditures of €300 million in 2022, 2032 free cash flow would not be far from €15 million.

Author’s Work

With a discount of around 25% and an exit multiple around 5.5x, the implied price would be close to €1-€1.5.

Author’s Work

Risks: SEV Is A Foreign Private Issuer, The Russian War, And The Facilities In Finland

SEV was incorporated in The Netherlands, so the company may not have to comply with certain rules established by the securities law in the United States. SEV may not have to be as transparent as companies registered in the United States:

As a foreign private issuer, we are not required to file periodic reports and consolidated financial statements with the SEC as frequently or as promptly as domestic registrants whose securities are registered under the Securities Exchange Act of 1934. Source: Prospectus

Besides, SEV expects to manufacture certain models in Europe. I am not sure whether judges in the United States will be able to impose sanctions against SEV as most assets may be far from the United States. I am also a bit concerned about the recent invasion of Russia and the effect of the war in Finland, where management expects to produce certain models:

The Sion will be produced in Uusikaupunki, Finland by the contract manufacturer Valmet Automotive, with the aim of ultimately using 100% renewable energy.

In February 2022, the government of Russia invaded Ukraine across a broad front. In response to this aggression, governments around the world have imposed severe sanctions against Russia. These sanctions disrupted the manufacturing, delivery and overall supply chain of vehicle manufacturers and suppliers. Source: Prospectus

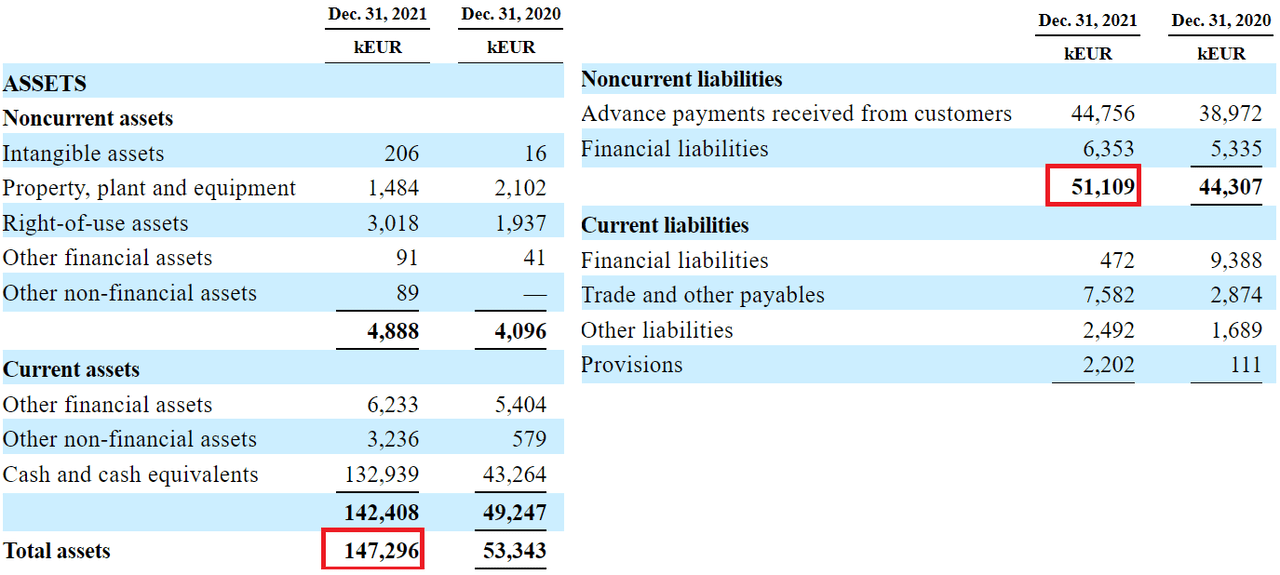

Balance Sheet: Cash In Hand Is Equal To €132 Million, And The Market Capitalization Is Below €330 Million

I believe that the current market capitalization is too low, not only because of future free cash flow generation. As of December 31, 2021, SEV reported €132 million in cash and no financial debt. Besides, management already reported €44 million in advance payments received from customers, which will help finance future capital expenditures. Considering that the current market capitalization is below €330 million, I would say that SEV is undervalued.

Prospectus

Conclusion

Already reporting a significant number of reservations, SEV has already proven that the technology suits the demands of many customers. The company is also operating in a target market that grows at a CAGR of more than 33%, so I would be expecting significant sales growth in the coming years. There are obvious risks, and the stock is not for everybody. We don’t know whether governmental regulation and underestimation of future capital expenditures could be detrimental to SEV’s business model. With that, I believe that the future free cash flow would justify significantly higher price marks than the current stock price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SEV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.