Summary:

- Southwest Airlines has been in the news lately and not in a good way.

- But the underlying business remains strong as revenues are projected to grow faster than peers like United or Delta Airlines, with net income expected to only slightly trail the same.

- However, the company is trading at quite a higher multiple than those same peers, and I’m not sure if that’s justified given the factors contributing to the revenue-income dissonance.

- As a result, I don’t believe Southwest Airlines is a good airline for stock price exposure at the current time.

Jim Vondruska

Southwest Airlines (NYSE:LUV) has had its fair share of publicity over the past few years. Firstly, the company’s flagship Boeing (BA) 737 Max 8 were grounded due to devastating crashes (in other airliners), which caused most of the company’s fleet to be out of service for more than a year and a half.

Secondly, and more recently, the company’s antiquated scheduling system caused mass cancellations over this past holiday season, which garnered national and international news and caused the company to pay out huge sums of money to customers under Department of Transportation regulations.

Beyond the devastating damages done to the stranded customers, the company faced severe profitability hits as they needed to pay out damages to customers and pay for their fleet to sit idly by until the 737 Max 8 fixes were in place.

Now, while revenues are growing at a faster rate than their competitors, net income growth is projected to remain lukewarm relative to those same competitors, causing price to earnings multiples to be higher than those of other airlines. The question remains whether the company can increase those margins to justify this higher valuation or will they end up being overvalued and need to come down some.

Let’s dive in.

Sales Growth: Quite Better Than Peers

While most airlines are busy moving more and more ‘amenities’ into the pay-to-get category, Southwest Airlines has been reliably consistent with their policies about having a personal item, a carry on and 2 checked bags for free. They provide in-flight snacks, free texting and limited Wi-Fi services for all flights and they do so at virtually the same prices of other major airliners.

Companies like United Airlines (UAL) and American Airlines (AAL) introduced different versions of the basic economy version, which gets you a place on the aircraft and a personal item and most other amenities are purchasable upon booking. Things like seat selection, carryon bags, and checked bags are extra.

Given that the prices are mostly the same as other major airlines (not low cost airlines), they’ve received a lot of intrigue from new customers. That and expansion across the United States and various international markets in North and South America allowed them to grow sales at a faster rate than peers.

Here’s the revenue growth rate projections for the next 3 years:

| 2023 | 2024 | 2025 | |

| Southwest | +14.2% | +6.63% | +6.95% |

| United | +17.0% | +5.48% | +5.87% |

| American | +8.06% | +3.75% | +4.15% |

| JetBlue | +10.0% | +6.96% | +7.14% |

| Delta | +9.69% | +1.87% | +3.28% |

(Source: Seeking Alpha Earnings Projections – LUV – UAL – AAL – JBLU – DAL)

As we can see, outside of United Airlines this year and JetBlue in the next, Southwest is projected to outpace competitors when it comes to revenue growth over the next 3 years. But there’s something else – Southwest Airlines is predominantly a domestic airline while these other airlines operate a good bit in international markets where growth is higher.

Take United Airlines as an example, their domestic operations revenues (the United States) rose by nearly 70% from 2021 to 2022, their last reporting full year, according to their 10-K filing. Their overall revenues, however, rose by over 82%, due to the higher growth rates in the Atlantic, Pacific and Latin American markets.

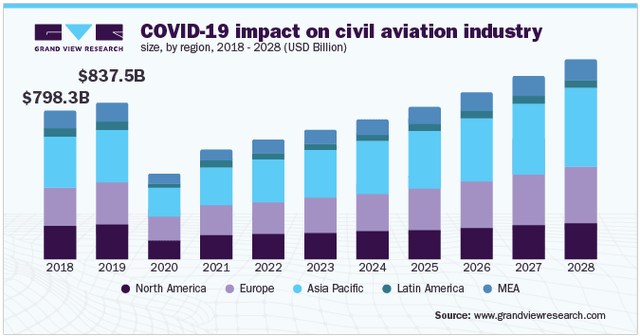

Aviation Industry Growth Rates (GrandViewResearch)

This means that if we account for this growth differential, Southwest would further outperform peers in the domestic (overall) revenue markets. (Author excluded Latin American market, given that Southwest Airlines has some international market there as well).

Net Income Growth: Not All That Great

When it comes to net income, however, Southwest Airlines has some improvements to make as they’re more or less in-line with most other airliners, despite the fact that they are growing revenues at a faster clip.

Here’s how their net income figures are projected to fare against major competitors over the next 3 years:

| 2023 | 2024 | 2025 | |

| Southwest | +138% | +42.2% | +23.7% |

| United | +227% | +19.4% | +21.6% |

| American | +302% | +47.6% | +54.9% |

| JetBlue | N/A | +159% | +57.4% |

| Delta | +62.1% | +32.3% | +17.2% |

(Note: JetBlue reported a 2022 loss, owing to the N/A year-over-year change)

The main reason why this growth being in-line with the industry at-large is that Southwest’s price to earnings multiple (P/E ratio) is quite higher than peers which can be a valuation concern.

Let’s take a quick look at P/E ratios for the year mentioned above.

| 2023 | 2024 | 2025 | |

| Southwest | 12.3x | 8.64x | 6.98x |

| United | 6.37x | 5.34x | 4.39x |

| American | 8.03x | 5.44x | 3.51x |

| JetBlue | 19.1x | 7.37x | 4.68x |

| Delta | 7.41x | 5.60x | 4.78x |

Multiples Suggest Company Is Overvalued

Given that the company isn’t projected to improve net income any more than any other airliner, it’s hard to see why their high multiples are justified. The only way this is possible is the prospect of their net income growth pacing with their revenue projections, relative to its competitors.

Meaning, if the company is set to grow its sales at a faster clip than competitors and they can eventually make it to a point where they would have similar margins as those competitors, it’s likely they’ll also outperform those companies when it comes to earnings per share – thus justifying a higher P/E.

The answer to this question lies in how one might view their operating environment, driven by the classic 3 factors affecting profitability.

Gross Margins Should Improve

Southwest has not yet gotten its gross margins up to a similar place as before the pandemic and it’s had a hard time doing so given the aforementioned negative factors. Currently, the company’s gross profit margin is around 25%, while in 2019 it was just over 31%, the full year before the global pandemic.

Ticket pricing is the largest contributor here and it’s unclear if flight prices are going to keep heading up after this long stint of inflation we’ve been seeing. Business air travel has also been sluggish to return to normal and Southwest has been very open about pushing sales several times a year, which can suggest that the average price per paying passenger will be lower in order to attract customers.

Operating Expenses Can Remain High

Operational costs were also hit by the high inflation and wage increases will also have some longer term effects on operating expenses. In the shorter run, however, I expect the company will incur higher expenses on behalf of system upgrades, flight crew increases and various payments to customers which are still being processed for stranded travelers.

Revenues rose by 50.8% in 2022 compared to 2021 and operating expenses rose by 46.4% over the same time period. It is noteworthy, however, that in the last year the company reported roughly the same ballpark in revenues, operating expenses were about 20% lower, owing to things like wage inflation, general inflation, higher maintenance costs and other factors.

Conclusion: Not So Sure About This One

Whether or not airlines can recover fully after the devastating global pandemic is a big question on investors’ minds. But Southwest Airlines has another problem, beyond their stranded passengers and negative news coverage: I believe they are overvalued.

When we compare the company to peers, while they are projected to grow revenues at a slightly faster clip than its peers, cost of revenues and operating expenses, some short term and some longer term, remain higher than peers – causing lower net income growth.

These higher expenses, I believe, will persist longer than the market currently expects and thus justify that the company’s share price currently trades at around the same multiple as its peers.

This means that I believe the company is fairly valued at around 7.5x their 2024 projected earnings per share. At a projected EPS of $3.93, that would project fair value of around $29.50 per share, lower than they are currently trading at by around 15% as of their latest trading price.

As a result of these factors, I am slightly bearish on Southwest’s price action, even as their underlying business model may allow them to grow sales at a faster clip than competitors. If investors are looking for exposure to airline stocks, I don’t believe Southwest Airlines is the one to go at current times.

Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Opinion, not investment advice.