Summary:

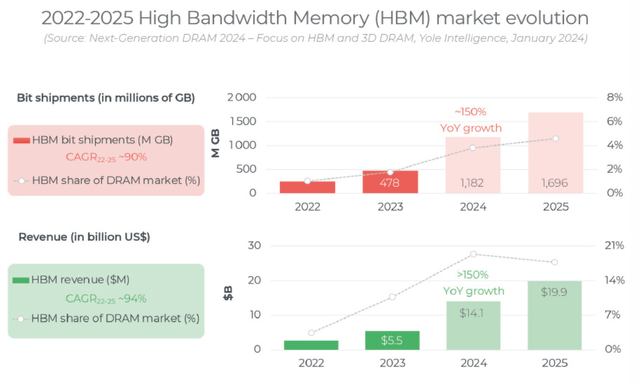

- Micron is set to benefit from accelerating spending on AI products, including high-bandwidth memory solutions.

- An escalating shipment ramp of HBM3E memory solutions could yield a strong margin picture for Micron at the end of the month.

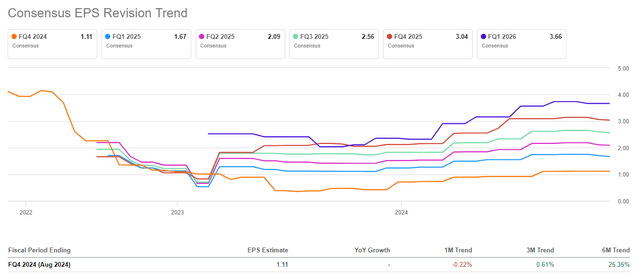

- The EPS revision trend for Micron is highly favorable ahead of the Q4’24 earnings report date on September 25, 2024.

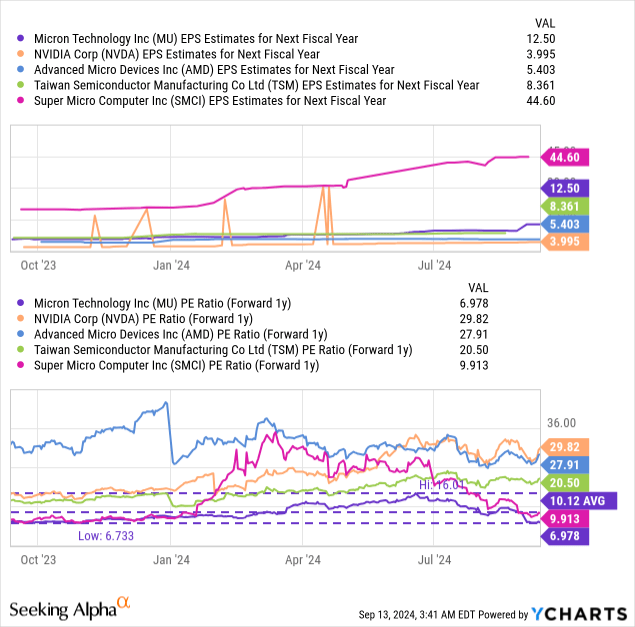

- Micron’s shares trade at an attractive P/E ratio of 7.0X, well below the industry average, presenting a compelling investment opportunity ahead of earnings.

mesh cube

Micron (NASDAQ:MU) is set to report earnings for its fourth-quarter as well as for FY 2024 on September 25, 2024, and I believe the memory and storage company has benefited from accelerating spending on high-bandwidth memory solutions in the last quarter. HBM products are quickly becoming Micron’s top products, and the company is expected to drastically increase HBM shipments going forward. Micron also guided for a significant Q/Q gross margin expansion in the fourth quarter, and the EPS estimate trend is highly positive. I believe Micron is set to crush earnings estimates at the end of the month, and I see shares as a speculative buy before the company reports earnings in the last week of September.

Previous rating

I rated shares of Micron a buy in June as the chipmaker started to ramp up shipments of its high-bandwidth memory products HBM3E. Micron benefited from strong demand for NAND products in the last quarter, which spurred the company’s top-line growth as well: Micron Knocks It Out Of The Park In Q3 (Rating Upgrade). Going forward, Micron is set to benefit from growing AI spending and, specifically, the related ramp of its high-bandwidth memory products that are expected to see a massive shipment increase in the next year. The biggest appeal of Micron ahead of the company’s earnings release for Q4 is its undeservedly low valuation based off of earnings, in my opinion.

Shipment ramp for HMB3E continued in Q4

Micron benefits from growing demand for its high-bandwidth memory solutions, HMB3E, which the company started to ramp up in Q3’24. This product is geared towards AI applications and Micron is selling its HBM3E to companies like Nvidia (NVDA) which are themselves seeing massive increases in their GPU shipments to Data Centers. This increase in shipments likely broadened in the last quarter as companies continued to spend a ton of money on upgrading their IT infrastructure and readying it for AI applications.

Since Micron said in its last quarterly earnings release that its HBM products are accretive to margins, I would expect a strong earnings release from Micron at the end of the month. HBM shipments are expected to surge, especially this year and next year, as companies invest billions of dollars into their Data Centers.

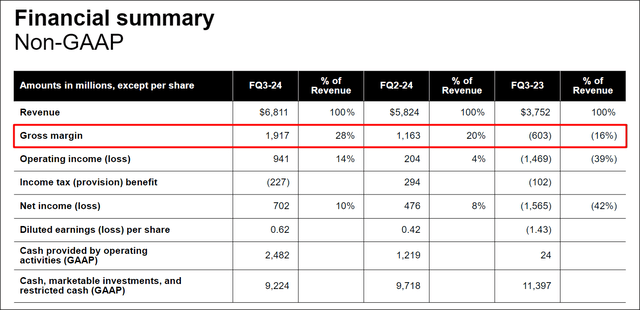

Micron achieved non-GAAP gross margins of 28.1% in the last quarter and guided for margins of 34.5% +/- 1 PP, meaning at the mid-point of guidance, investors can expect a 6.4 PP sequential margin improvement. With HBM products being high-margin, and Micron starting to scale HBM product shipments in the last quarter, Micron has enormous surprise potential at the end of the month… something that analysts have started to wake up to as well.

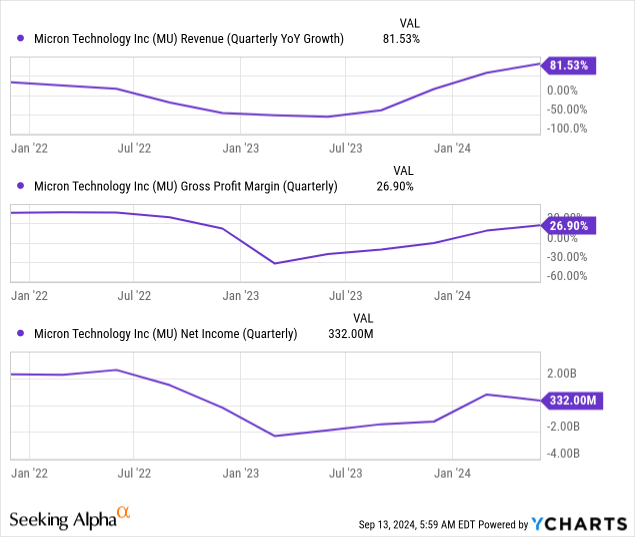

Revenues, gross profit margins and Micron’s net income have all seen positive momentum in the last several quarters, with all key metrics bouncing up nicely amid surging demand for high-bandwidth memory solutions. Chances are that this trend continued in the last quarter and the EPS estimate trend for Micron is highly favorable.

Favorable estimate trend ahead of Q4

Earnings estimates have consistently been revised upwards for Micron in the last ninety days, indicating that analysts as a whole are getting more optimistic about Micron’s margin and earnings potential. This growing optimism is tied to the success Micron had in the third-quarter, in which it ramped up HBM shipments. According to Micron’s accompanying statements when it released earnings for Q3’24, the chipmaker expects “several hundred million in HBM revenue in FY 2024” and “multiple $Bs in revenue from HBM in FY25.”

In the last ninety days, there were 20 EPS upward revisions for Micron compared to just 4 downward EPS revisions, leading to a highly favorable up/down EPS revision ratio of 5:1. Analysts currently expect $1.11 per share, compared to a loss of $1.07 per share in the year-earlier period. I am slightly more optimistic and expect EPS in the neighborhood of $1.20-1.25 per share, given the ramp of high-margin HBM3E shipments in Q4’24. Therefore, I believe Micron has a reasonable chance of delivering a handsome earnings beat at the end of September.

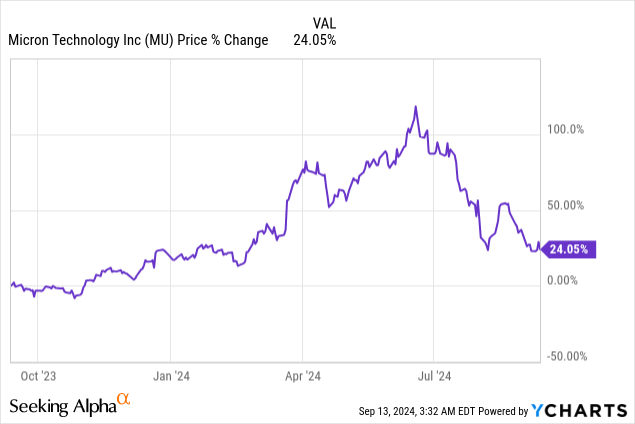

Low valuation based off of earnings

One of the key advantages with Micron is that shares trade at a very attractive, below-average price-to-earnings ratio ahead of the company’s Q4 earnings report. Since my last work on the chipmaker, shares of Micron have declined by a massive 36%, but not because the top line or margin outlook for the company have deteriorated. Shares of chip and AI hardware makers have broadly sold off lately, which affected Micron, Nvidia (NVDA), AMD (AMD), Taiwan Semiconductor Manufacturing (TSM) and Super Micro Computer (SMCI)… all of which have suffered large valuation draw-downs since June.

Shares of Micron are currently trading at a price-to-earnings ratio of 7.0X… which is well below the industry group average of 19X. Micron is also considerably cheaper than its historical P/E ratio of 10X in the last year.

Given the excessive decline in Micron’s share price since June and the massive shipment ramp for HMB3E that is expected for 2025, I believe the risk profile has dramatically improved here lately. I believe Micron could be valued at a P/E ratio of at least 10X, which would be in-line with its historical valuation, which calculates to a fair value of $125 per share (based off of a consensus FY 2025 EPS estimate of $12.50). In the longer term, I see a higher value if Micron executes well on its HBM-driven growth strategy and succeeds in expanding its gross margins.

Risks with Micron

The biggest risk for Micron, as I see it, relates to the company’s margin trajectory… which in the past has proven to be highly cyclical. With AI spending showing no signs of slowing down at the moment, I believe Micron has a good chance of maintaining higher gross margins. However, if companies were to cut back drastically on AI spending, say during a new recession, then Micron’s high-flying memory and storage business would likely slow down fast.

Final thoughts

Micron has a very good chance, in my opinion, to crush estimates for the fourth-quarter as companies continue to spend on their AI transformations and therefore also on Micron’s HBM3E solutions that are specifically geared towards artificial intelligence applications. With Nvidia and AMD both seeing significant top-line momentum in the last quarter, there is no indication that large enterprise customers are slowing down their spending…which should have greatly benefited Micron. Further, Micron’s margin forecast for Q4’24 implies a significant 6.4 PP consecutive margin expansion Q/Q which reflects the company’s shipment ramp of high-margin HBM products. I believe the surprise potential is very significant, and I am up-grading shares of Micron to strong buy ahead of the earnings report on September 25, 2024.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU, AMD, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.