Summary:

- E-infrastructure revenue up by 100% YoY in Q2, showing decent progress in Sterling Infrastructure’s strategic shift in this segment towards highly lucrative data center infrastructure projects.

- Transportation segment revenue grew 54% YoY, with a $1.5 billion backlog and an additional $500 million in potential future contracts.

- Capital expenditures for transportation projects have pressured free cash flow. However, milestone payments in upcoming quarters are expected to improve the cash flow statement.

- High AI-driven demand for data centers currently supports e-infrastructure growth, but any slowdown in demand could lead to a double-digit decline in the share price.

- Despite this risk, I see no strong indications of an imminent slowdown in data center demand. Therefore, I have a Strong Buy rating for STRL stock.

halbergman

Sterling Infrastructure, Inc. (NASDAQ:STRL) has seen its share price take off in the past two years, outpacing the S&P 500 by over 400%.

Many investors believe this is due to the strategic positioning of the company within the booming data center infrastructure sector. And, to be honest, I agree, up to a certain extent. However, one can’t overlook the excellent performance of the company within the transportation segment.

With Q3 2024 earnings set to be released in less than a week, shareholders will be paying close attention to some factors that I discuss in this article.

Among them is the strategic shift in the e-infrastructure segment towards highly lucrative data center infrastructure projects. In Q2 alone, revenue from data centers increased by 100% YoY.

Additionally, I recommend keeping a close eye on the evolution of capital expenditures, particularly in the transportation segment, as these investments have been pressuring free cash flows this year.

I will provide below the rationale behind my Strong Buy rating, including a valuation analysis and a risk section where I discuss the main risk to my bull thesis.

Price Action

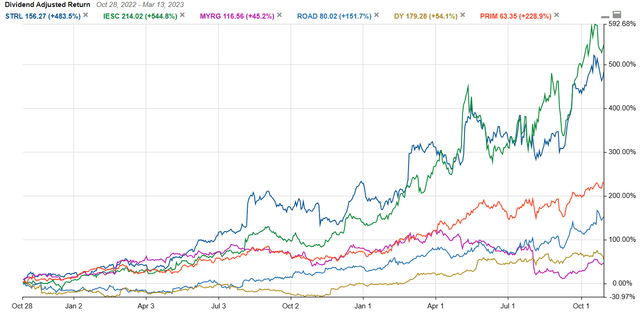

In the past two years, the company has outperformed the S&P 500 by 425%.

Adding a chart to compare this stock’s return with its sector, industry, and the S&P 500 isn’t useful since they all appear mostly flat. A better comparison would be with its peers.

Looking at the latest 14A, I was able to identify a list of what the company believes is their peer group.

Please note that I chose only 5 companies from the list above for the comparison analysis.

In the past 2 years, only IES Holdings (IESC) was able to outperform the company.

I believe IES Holdings is the closest competitor to Sterling, as they both operate within data center infrastructure. However, one can’t forget that these companies are diversified, with Sterling additionally offering building and transportation services.

Strong Growth Driven By E-Infrastructure

There is no doubt the explosive growth of the company was indirectly driven by their exposure to AI. I say indirectly, as the company is heavily engaged in the data center market within its E-Infrastructure segment.

How much do I mean by heavily? Well, during the last earnings call, the CEO noted that data centers now account for over 40% of Sterling’s E-Infrastructure backlog.

Notably, data center-related revenue increased more than 100% in the quarter and now represents over 40% of segment backlog.

The company, mainly through its subsidiary Plateau Excavation, has been awarded major contracts in the data center space this year.

For example, a recent $100 million project involves large scale underground infrastructure for a data center covering 280 acres in the southeastern US.

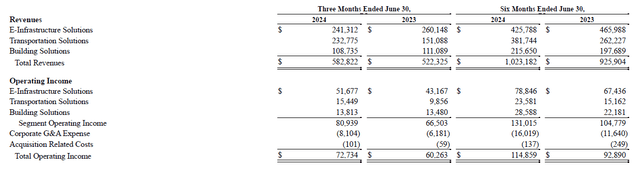

I considered including below a summary of the revenue and operating income per business segment from the latest 10Q.

If you look closer, the E-Infrastructure solutions segment has experienced a decline in the past year.

I have to admit that seeing this decline made me sweat. However, once you dive deeper into the report, the earnings call and the Q2 press release, the company gives a valid, and in my view, encouraging justification for this decline.

The company is undergoing a strategic shift in project focus within this segment, transitioning away from smaller, low margin projects.

Understanding The Shift In E-Infrastructure

The company has been redirecting its resources away from smaller commercial and warehouse projects due to their diminishing profitability.

Therefore, revenue from small commercial and warehouse work dropped by over $30 million compared to Q2, 2023.

The company is focusing now on large-scale, high-margin projects, including data centers and manufacturing facilities.

Why am I so excited about this shift? Well, aside from indirect benefits from the company’s exposure to the current boom in AI, operating margins have improved by 480 bps, reaching a solid 21.4%.

As mentioned before, data center revenue improved by 100% YoY in the last quarter. Therefore, I believe that their increasing exposure to the data center market will only improve their profitability margins (at the cost of lower revenues).

If you read my previous articles, you probably know by now that I highly favor companies that focus on high margins rather than high revenue.

The Company Is Still Well Diversified

The growth in the transportation solutions segment in the past year is quite impressive, with a 54% YoY increase in the last quarter.

As a side note, this segment is focused on transportation infrastructure projects, including highways, roads, bridges, and storm drainage systems.

The backlog of this segment increased to $1.5 billion, reflecting a 5% YoY growth. Additionally, Sterling’s pipeline of probable projects within this segment outside of signed contracts is valued at $500 million.

In my view, there is a strong indication that revenue in this segment could continue to grow in the next year. Not only due to the $500 million in potential new contracts, but also due to milestone payments bound to be released in the next quarters.

As an additional note, Sterling works in phases, starting with design work before construction phases are released. The initial design typically represents a small fraction of the total project’s value of around $1-2 million. However, subsequent construction phases can contribute significantly more, with individual construction phases valued at around $30-50 million.

During Q2 2024, Sterling secured initial design contracts for several significant highway projects. Therefore, I believe that revenue, and especially cash flows, will improve in the next quarters.

Fundamentals

The income statement shows strong annual revenue growth in the double digits. Operating and net income follow, with a TTM increase of 27% and 35%, respectively.

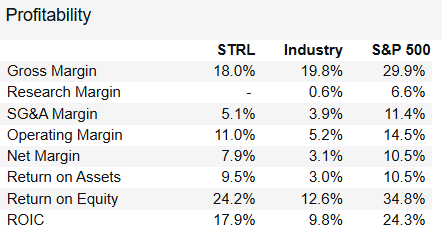

In terms of profitability, the company is above the industry average for engineering and construction.

stock rover

The balance sheet shows a healthy company, with a negative net debt of $152 million at the end of last quarter.

As shown below, cash and equivalents have risen significantly over the past year, while total debt has slightly decreased.

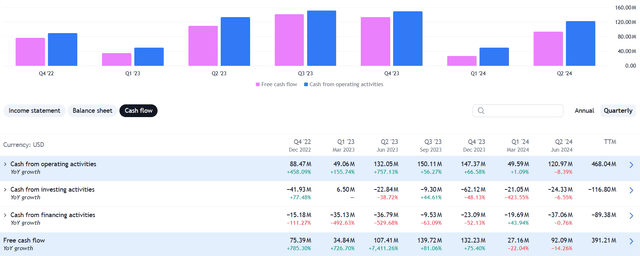

However, I have to admit that the cash flow statement is not as attractive as the income statement.

In Q1 and Q2 this year, free cash flows have declined in the double digits.

However, I am not overly concerned as the decline was driven by increased capital expenditures due to the expansion of the transportation segment. Therefore, I believe the decline in free cash flow is temporary. As soon as the milestone payments from large-scale projects will come in over the next quarters, I expect free cash flows to improve.

Additionally, we can’t overlook the fact that the company’s free cash flow (TTM) sits at $391 million.

Valuation

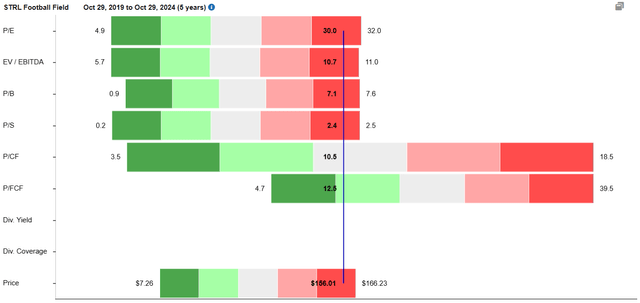

A quick look at the chart below, shows most valuation ratios trading very close to the 5-year maximum range.

A notable exception is P/FCF.

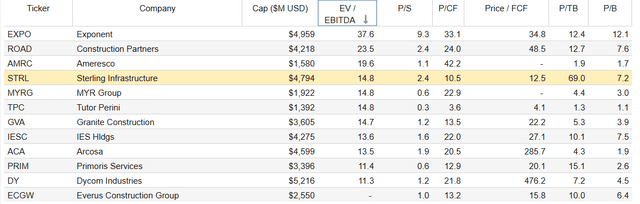

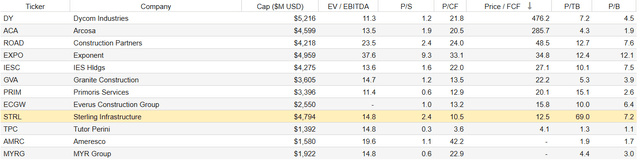

Let’s compare now these rations to some of the industry peers (notice not all of them are direct competitors).

If we use EV/EBITDA as the comparison metric, the company is the fourth-most expensive in the comparison group.

However, when using P/FCF as the comparison metric, the company sits in the lower half of the table.

In my view, there aren’t enough signs to indicate the company is overvalued, despite the significant increase in the share price.

Risks

In my view, when the current surge in AI growth inevitably slows down (when the music stops, so to speak), the share price will likely see a double-digit decline.

I agree with most investors that the sheer increase in the share price might not be fully backed up by fundamentals.

Don’t get me wrong, the fundamentals of the company look great, the balance sheet shows decent liquidity and negative net debt, and the company is trading at relatively decent valuation ratios when compared to its industry peers.

However, I agree that there might be some AI hype priced into the stock. How much, I don’t know. And I make the bold statement that no one knows, considering the spectacular performance of the company outside of the e-infrastructure segment.

My bull thesis is based on the fact that the AI hype has not come to an end yet. Therefore, I believe there is plenty of room for growth in the next year or so.

Conclusion

To wrap up, I rate Sterling as a Strong Buy as the company is well positioned in the highly lucrative data center infrastructure market, especially benefiting from the current AI surge.

Data center revenues are up over 100% YoY, and I see potential for further growth here as AI adoption continues to drive data infrastructure expansion. However, the company is well-diversified and doesn’t rely only on the e-infrastructure segment for growth. As a matter of fact, the transportation segment delivered an impressive 54% YoY growth with a strong $1.5 billion backlog.

On the fundamentals side, the company’s revenue, operating, and net income growth are outpacing its industry, with a healthy balance sheet marked by negative net debt. Although free cash flow has declined this year due to an increase in capital expenditure, I expect this trend to reverse in the upcoming quarters as large transportation infrastructure projects complete milestones.

There are some risks to consider. Any cooling in AI-driven demand for data centers may cause a double-digit decline in the share price. Such a slowdown will directly impact growth within its e-infrastructure segment, leading to a decline in operating margins and profitability, despite potential improvements from the transportation segment.

However, for the moment, I haven’t seen any clear signs that the AI growth will come to an abrupt stop (let me know in the comments if you do). Therefore, I have a Strong Buy rating for this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.