Summary:

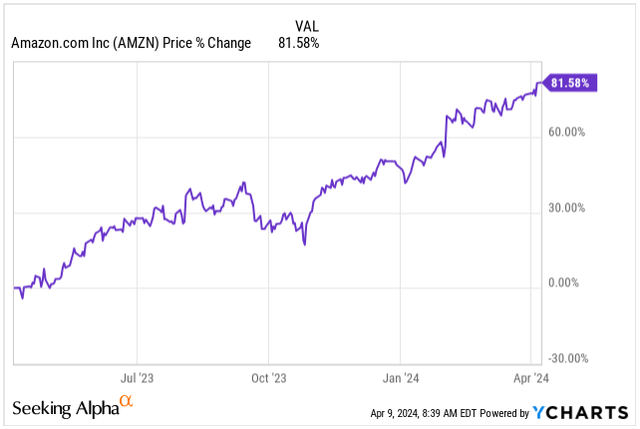

- Amazon.com, Inc. has been running hot with 81.6% return in a span of 12 months, driven by fundamental improvements.

- The Q4 earnings report showed strong double-digit growth across all segments amid strong holiday season and continuous business investment.

- The end of 2023 and the beginning of 2024 mark a transitory year, with the company’s laser focus on improving profitability and becoming more efficient.

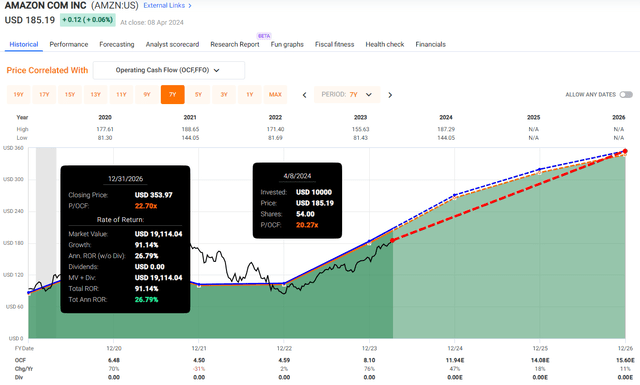

- Trading at 20x its P/OCF, the company is undervalued compared to historical standards, with growth not showing weakness.

jetcityimage

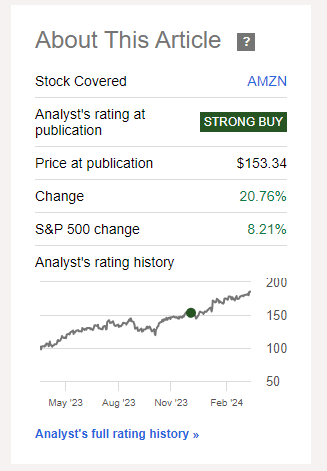

The last time I covered Amazon.com, Inc. (NASDAQ:AMZN) in December, writing an article on the company’s path to $220 share price by 2024, I was challenged by many SA readers that I was too optimistic on my revenue growth and EPS assumptions.

While I am hesitant to declare victory just yet, the stock is in a clear upward trajectory, returning 21% in a span of less than four months, not only driven by general market sentiment, but by fundamental improvements in its profitability, lower cost to serve customers, AI integrations in AWS and more.

Last Coverage (Seeking Alpha)

While the stock is certainly not the cheapest it has ever been, currently priced at 20.27x its blended P/OCF, it’s trading well below its historical average, even though the forward growth expectations are not muted by any means.

Let me show you why I think it’s still a good time to buy Amazon’s shares, with a potential price target of $356 by the end of 2026.

Business Update

Amazon, being the undisputed leader in e-commerce in the US and Europe, as well as the market leader of the cloud business with its AWS, has rewarded its shareholders handsomely with the stock being up 81.6% in a span of only 12 months. With a $1.92 trillion market cap, the company is now the fourth most valuable in the US.

The company is running hot with the tailwinds of the AI narrative, which has pushed major averages on a year-to-date basis up close to 10%, mainly driven by the large caps.

It’s not only market-driven optimism which is pushing the stock higher, instead, the company’s fundamentals have improved significantly through double-digit net sales growth as well as profitability improvements. I am expecting 2024 to be the “year of efficiency” so I doubled down on the stock prior to its Q4 2023 earnings call at a share price of $145, already enjoying attractive returns.

Amazon’s stock has been on fire following its Q4 earnings report, reporting $170B in revenue after a strong holiday quarter, well above the expectations of $166.3B, and teasing investors with strong guidance for Q1 2024.

All segments delivered well above the expectations in Q4, leaving any doubts of weakening consumer or shrinking business investments behind:

- North America: $105.5B vs. $102.9B expected, 13% up YoY.

- International: $40.2B vs. $39.0B expected, 17% up YoY.

- AWS: $24.2B vs. $24.22 expected, 13% up YoY.

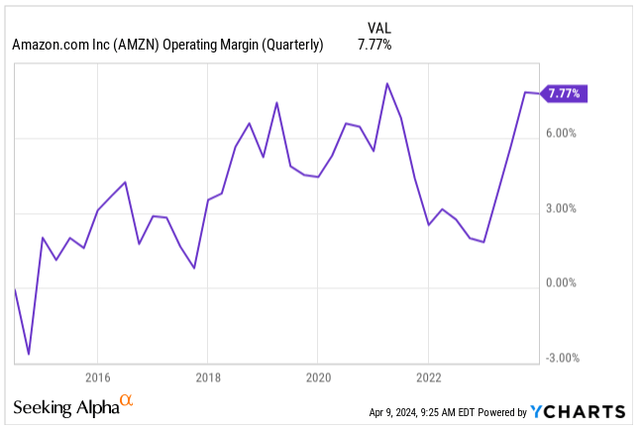

Operating Income of $13.2B has confirmed the narrative of the efficiency improvements, coming in significantly higher compared to the company’s own guidance of $7B to $11B. The Operating Margin came in at 7.8%, compared to less than 2.5% for the same period last year.

Operating Margin (Seeking Alpha)

Free cash flow, the metric I watch the most for businesses that are known for heavy investments into their own businesses, such as Amazon or MercadoLibre, Inc. (MELI), has improved significantly and reached a record inflow of $36.8B for the trailing twelve months, compared to an outflow of $11.6 billion ended December 2022.

Net Income has been slightly impacted by the valuation loss (non-operating expense) of $0.1B from the investment in Rivian Automotive, Inc. (RIVN), reaching $10.62B or EPS of $1.00 for Q4 2023.

Altogether, Q4 marked a new chapter for Amazon with meaningful, double-digit revenue growth, and significant operating income improvements driven by the regionalization of the US fulfillment network leading to the fastest-ever delivery speed and lowering the cost to serve.

For Q1 2024, the company now expects to deliver revenue of $138.0B to $143.5B, 12% YoY growth at the upper end of the range, and $8.0B to $12.0B or 2.5x improvement from the $4.8B reported at the end of Q1 2023.

Cloud business unit AWS has delivered 13% YoY revenue growth and reigns supreme with a 31% market share, however Microsoft Corporation’s (MSFT) Azure revenue has increased by 30% during the same quarter and analysts now estimate that Azure, which was about half as big as AWS five years ago, is now three-quarters its size.

Being the key growth driver for Amazon, seeing AWS market share under threat is a hard pill to swallow as Microsoft’s cloud is growing faster thanks partially to its relationship with OpenAI, given the first mover advantage and superior adoption in AI, to which Amazon now has to play catch-up.

We are already seeing major investments from large-cap tech companies into data center infrastructure, fueling rallies in stocks like NVIDIA Corporation (NVDA) and Advanced Micro Devices (AMD), which I am expecting to continue for most of 2024 and beyond as the three major cloud providers including Alphabet Inc. (GOOG), (GOOGL) are battling for the position of the superior cloud provider with AI integration.

To close the perception and growth gap with Microsoft, Amazon has now completed the $4 billion deal with AI startup Anthropic, the developer of the chatbot Claude, an alternative to ChatGPT.

While the results of the investment in Anthropic remain to be seen, Amazon is now clearly playing catch-up in the AI integration against Microsoft. To enable users of AWS to build generative AI applications, using a range of large language models or “LLMs”, Amazon has already launched the Bedrock application last year.

Amazon’s CEO, Andy Jassy, who built his career in the AWS business unit well, acknowledges the importance of AI applications, expecting AI to drive billions of dollars in revenue over the remainder of the decade, ensuring the company does not miss the opportunity, which could leave the company behind in the race.

The reason why AWS is so important to Amazon’s future success is that while the business unit represents only 14.2% of total net sales, it represents close to 55% of the total Operating Income.

The remaining 85.8% of the Net Sales are represented by Amazon’s retail business and advertising. The retail business grew by 13% in North America during the last quarter and brought in $6.5B in Operating Income, compared to a $240 million loss a year prior, driven by the already mentioned restructuring efforts and lower cost to serve customers.

Amazon remains the largest e-commerce business worldwide and with its ever-growing appetite for expansion, the company has now announced same-day delivery of medications in some parts of the US. While the efforts are now limited to specific areas, which the company can easily cover with small facilities, I am expecting the rollout in most metropolitan areas over the next couple of years, further strengthening its logistic dominance and attractiveness for customers.

The advertising business, which many consider to be the next growth engine of Amazon, has brought in $14.7B in revenue in Q4, representing 27% YoY growth and claiming the title of the fastest-growing business of the company.

While the revival of double-digit growth across all its major businesses is a very optimistic step forward, we should not forget that Amazon faces competition from other major retailers which will challenge its dominance over the next few years, alongside an FTC lawsuit accusing the company of inflating prices and overcharging third party sellers, which could result in a major settlement if proven guilty.

Valuation

I often hear investors claiming that Amazon is exorbitantly expensive and that buying the shares presents little to no margin of safety. Probably that is the same reason why many investors missed the 10x gain over the past 10 years.

While the company does generally trade at the high end of the valuation spectrum (by conventional standards), the question is how to value a company which instead of focusing on bottom-line expansion is prioritizing investments into its businesses to build a core advantage over competitors.

On a blended P/E basis, the stock is currently trading at 57.15x its earnings. Indeed, expensive.

If we assume the company is expected to grow its EPS on average 35% annually over the next three years, on a forward P/E basis, by the end of 2026 the company is expected to earn $6.94, the valuation would be 26.6x its earnings, being much more reasonable by my standards.

Instead, I prefer to value Amazon based on its Price to Operating Cash Flow or “P/OCF” as this valuation approach shows better the cash generation potential of a company which does not prioritize bottom-line growth.

Since 2003, Amazon’s stock traded on average at 25.52x its P/OCF, with annual OCF growth of 28.7%.

The growth is expected to slow down a bit over the next few years to an average of 25.3%:

- 2024: OCF of $11.94E, YoY growth of 47%.

- 2025: OCF of $14.08E, YoY growth of 18%.

- 2025: OCF of $15.60E, YoY growth of 11%.

Naturally, with decelerating growth, we need to adjust our expectations at what valuation the stock should be trading.

Today Amazon’s P/OCF is 20.27x, which seems rather low, considering the deceleration we speak about is only 2.5% off from its 21-year average.

In my view, a fair valuation for the stock would be 22.7x its P/OCF, assuming the 25.3% of the next three years comes to fruition.

This would imply a share price of $353 by the end of 2026 or a potential annual ROI of 26.8%.

Compared to today’s stretched valuation of the market, with diminishing ROI potential, I expect Amazon to deliver well above what the rest of the market will deliver over the next few years, hence my “Strong Buy” conviction, even after an 81.6% return in just 12 months.

Takeaway

Amazon has rewarded its shareholders with a very attractive 1,000% gain over the past decade, even though many investors were calling for a rich valuation all along, missing the major success story.

The company is now undergoing a major transformation, switching its focus from top-line growth to bottom-line improvements, which will significantly improve its profitability, driving down the valuation by conventional standards.

While we should not expect similar returns of the past decade, even after 82% ROI in a span of just 12 months, the company remains attractively priced for what I expect to be a very successful 2024, driven by lower cost to serve customers, AWS growth reacceleration thanks to AI integration and continuous growth of the ad-business.

Major retailers in the US may try to challenge Amazon’s e-commerce dominance and the FTC lawsuit against the practices of the company could inflict damage on its bottom line, yet I remain convinced the company is on a path to deliver attractive double-digit returns for investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.