Summary:

- StoneCo is diverging from its fintech origins, and is more like a bank with each quarter.

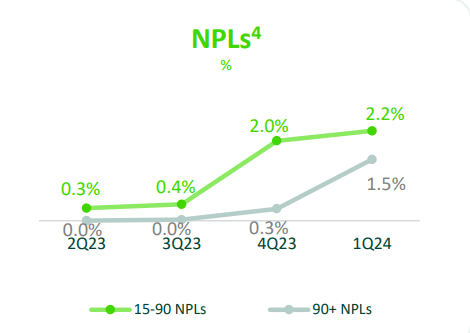

- Facing challenges with increasing non-performing loans. Investors should keep an eye on this.

- Paying 10x forward profits seems cheap, but details matter.

sarra22/iStock via Getty Images

Investment Thesis

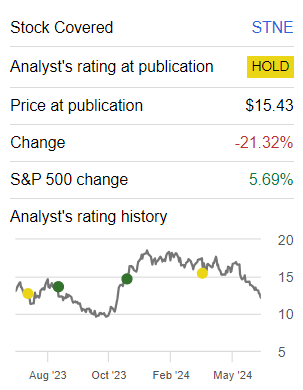

I believe I’m one of the few analysts on Seeking Alpha that in 2024 doesn’t have a BUY rating on StoneCo (NASDAQ:STNE). My rationale with StoneCo is that it’s a bank. And a bank carries a bank-like multiple. Not a fintech-like multiple.

What’s the difference? A fintech carries no balance sheet risk.

Allow me to elaborate on the bull and bear case. StoneCo is a beautiful story for investors who want exposure to Brazil’s under-banked population. However, a beautiful story can only trick some of the people for some of the time.

STNE Q1 2024

Crucially, its non-performing loans are starting to tick up higher. So, yes, the stock isn’t too expensive. I estimate the stock to be priced at 10x forward adjusted net income.

And yet, the problem here is that this set of results appears to echo my previous stance, that StoneCo has already delivered the best of its growth prospects. And as we look ahead, the risk-reward isn’t as beckoning as it once was. As such, I remain neutral on STNE (and one of the few analysts who is neutral).

Rapid Recap

Back in March, I was quick to admit my mistakes. In fact, I put out this admission right in the title of my analysis. The reason why I was no longer bullish on STONE at the time:

I was looking at StoneCo as a fintech and valuing it as such. But with time, StoneCo has become more of a bank with associated credit risk and less of a fintech.

I had enough foresight at the time to admit my mistake. In a game where time is money, being able to rapidly admit one’s mistake and change one’s mind is perhaps the only way to ensure one outperforms the market.

Author’s work on STNE

Since I turned neutral on STNE, its stock has been falling and has underperformed the S&P 500 by more than 25%.

StoneCo’s Proposition Laid Out

StoneCo Q1 2024 delivered a mixed earnings report. In their financial services division, StoneCo showed moderate growth in payments and banking, accompanied by substantial y/y increases in active client bases. Additionally, their payments sector demonstrated a significant rise in TPV (Total Payment Volume), fueled by enhanced client engagement.

Nevertheless, StoneCo encounters challenges. Firstly, they must optimize capital allocation and manage exposure to non-core assets. For instance, although their software segment improved, certain areas like TAG (a third player, owned by Stone) saw a decline in revenue, dropping by 47% y/y.

Moreover, despite achieving higher take rates and TPV growth, StoneCo must carefully calibrate pricing strategies to sustain revenue expansion while maintaining competitiveness in the market.

Given this background, let’s now discuss its fundamentals.

Topline Will Struggle in 2024

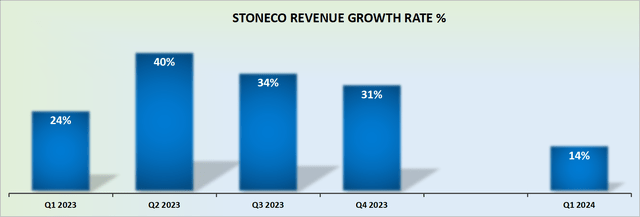

StoneCo’s Q1 2024 revenue growth was 14% y/y, which is a respectable increase. However, this immediately underscores a key issue for investors.

Q1 was expected to be the easiest quarter to compare this year. Thus, despite management reaffirming its 2024 outlook, particularly for its Micro and SMB clients (“MSMB”) Total Payment Volume (“TPV”) to grow by more than 18% y/y, isn’t gaining a lot of credence with investors. Essentially, the market remains skeptical about StoneCo meeting its 2024 guidance.

Additionally, with increasingly tough comparables starting next quarter, investors are debating whether to take profits now or continue holding StoneCo shares.

To further complicate matters, the Software segment, which was supposed to be a major growth driver, only grew by 3% y/y. This minimal growth does little to change the perception of StoneCo as a likely commoditized payment processor, banking solutions, and credit services provider for micro, small, and medium-sized businesses-some of the most vulnerable sectors of the economy with high failure rates, increasing StoneCo’s risk of defaults.

In summary, I am increasingly convinced that StoneCo is primarily a banking company. And on top of that, its comparables will become increasingly challenging with each passing quarter of 2024.

Given this context, let’s now discuss its valuation.

STNE Stock Valuation — 10x Forward Adjusted Net Income

Now, there’s good news and bad news. Firstly, the good news.

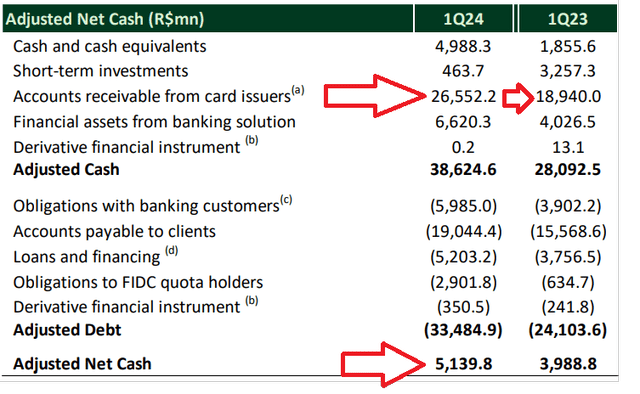

StoneCo holds around R$5.1 billion in cash, which is approximately 26% of its market capitalization.

The downside is that to expand its core business, StoneCo needs to take on substantial obligations. Currently, this isn’t an issue since, as mentioned, StoneCo has plenty of cash on hand.

However, to achieve its growth goals, StoneCo will need to incur even more debt to support its micro and small-business clients.

Moreover, the bullish scenario could see StoneCo increasing its adjusted net income to about R$2 billion (around $400 million). Yet, growing a company’s bottom line significantly without a corresponding rise in the top line is challenging.

A company can boost its bottom line faster than its top line for a while by cutting costs. Many tech companies do this. But for a bank, reducing administrative expenses while increasing debt and growing its bottom line without top-line growth is a difficult task.

Overall, I believe there are easier investment opportunities available right now, even within the fintech sector.

The Bottom Line

As I assess StoneCo’s recent trajectory, it’s clear the company is moving towards a banking-oriented model rather than remaining purely fintech-focused.

Moreover, as StoneCo faces increasingly challenging comparables in 2024, its growth rates are likely to decelerate. This slowdown in growth will impact investor sentiment and the valuation multiple they are willing to assign to the stock.

Next, despite its initial appeal as a fintech firm, StoneCo’s evolving strategy increasingly emphasizes banking services and the accompanying credit risks, marking a fundamental shift in its operational focus.

This shift implies that StoneCo’s growth rates could moderate in the near future.

In summary, if StoneCo continues to be seen more as a bank with associated credit risks rather than a fintech entity, this will likely impact its valuation metrics moving forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.