Summary:

- Suncor Energy stock is still attractive despite trading near a 52-week high.

- It trades at ~10x FWD P/E only, yet offers many profit catalysts.

- I expect increases in oil prices, improved capacity utilization rates, and contributions from recent acquisitions and capital improvement projects.

PM Images

Suncor Energy: Still attractive near 52-week high

In 2023, Shark Tank’s Kevin O’Leary made the following comments about energy stocks:

“I love energy. Everybody hates energy… Go where people hate it. Energy is the driving pivot.” O’Leary said. “The cash flow, the distribution… that sector is looking golden right now.”

And we wrote a few articles on Suncor Energy Inc. (NYSE:SU) that echoed his above prediction. A most recent example is shown below. In that article, I argued that this leading energy stock from Canada is probably more golden than many of its U.S. peers, as reflected in its cheap valuation and strong cash generation. The buy thesis has worked out so far, as seen in the charts below. The total investment return for SU has outperformed the total investment return for the overall market (approximated by the SPDR S&P 500 ETF, SPY) since 2023.

A working bull thesis tends to defeat itself eventually. As prices advance, valuation expands, and risks heighten. Specific to SU, at a price of around $40, it now trades near a 52-week high and near its peak price in multiple years.

However, in the remainder of this article, I will argue that there is still large upside potential ahead. SU is still reasonably valued despite the large price rallies in the past 1-2 years. The company may be facing some EPS headwinds in the near term, but these are only temporary in my view. Finally, the generous dividend and share repurchase plan add further downside protection (and also serve as an additional sign for its reasonable valuation).

SU stock outlook: profit drivers

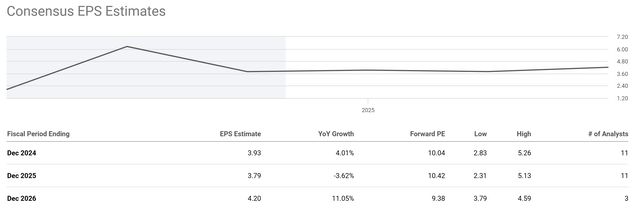

The next chart describes consensus EPS estimates for SU stock in the next 3 years. As seen, analysts estimate that its earnings will show a modest growth in FY 2024 followed by a small decline in FY 2025.

I agree with this outlook, as I do see a few headwinds facing the company in the next 1-2 years. The top uncertainties in my mind are the wavering energy pricing, foreign currency effects, and also the rising operating costs. However, I view these headwinds to be only temporary, and consensus seems to share this view. As seen, they project a strong rebound of its EPS in FY 2026. To wit, its EPS is estimated to be $4.2 in FY 2026, representing an 11% increase from the prior year. BTW, the implied forward P/E ratio is about 10x only for FY2024 and would further shrink to 9.4x in 2026.

I see a couple of strong catalysts that can support a large EPS advancement in the next 1-2 years. First and foremost, I think the current oil price is too low and expect it to increase. The detailed analysis is provided in my other article, and I will only quote the final conclusion here so I can better focus on SU.

Historically, oil prices have been rising more rapidly than inflation. However, the price appreciation of oil between 2014 and now did not even keep up with inflation. If oil prices were to rise in tandem with CPI during this period, it would be about $114 per barrel now. Besides inflation, I see a few more catalysts that could drive oil prices higher on both the supply and demand ends such as production cuts by the OPEC (Organization of the Petroleum Exporting Countries).

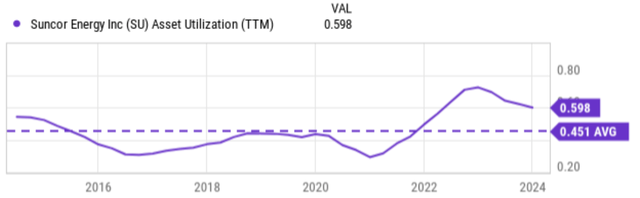

Second, I expect SU’s capacity utilization rate to improve, especially its refining capacity utilization rate. The chart below describes SU’s asset utilization rate compared to its historical average. As seen, its asset utilization rate currently sits at 0.598. The good news is that it is far above the historical average of 0.45x and also far above its bottom level (as low as around 0.3x) as it suffered in the wake of the COVID-19 pandemic. However, the current level is slightly below its recent peak level of ~0.7x. I expect management to focus on improving productivity moving forward and expect the refining capacity utilization rate to be in the 92%-96% range for the next few years.

Finally, I also expect its recent acquisitions and capital improvement projects to begin contributing to the bottom line. SU acquired TotalEnergies EP Canada Ltd. in late November 2023. It now owns the remaining 31.5% interest in Fort Hills. Following the acquisition, SU allocated a sizable budget (around $6.3 billion-$6.5billion) for CAPEX improvement (mostly towards the Oil Sands production). The improvement program is on track in my view and should begin to add to its income streams in the next 2 years or so.

Other risks and final thoughts

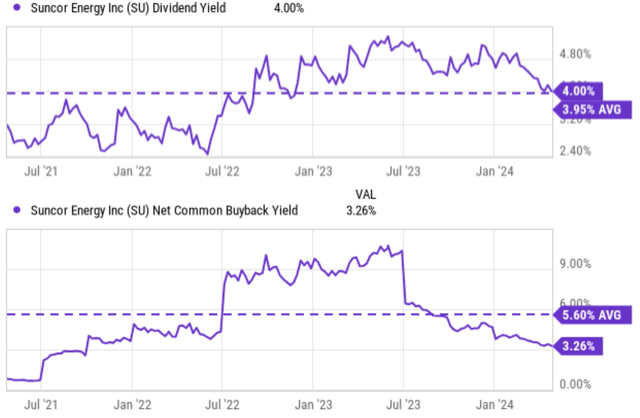

As aforementioned, its generous dividends and share buybacks are additional upside risks. According to the next chart, SU’s current dividend yield is about 4%, slightly above its historical average of 3.95% in the past 3 years. A 4% yield is quite generous in my view already. But in the case of SU, it’s not even the major mechanism the company uses to return capital to shareholders. As seen in the bottom panel of the chart, SU’s current common buyback yield is on average 5.6% over the period, higher than its cash dividend by a good margin. I view the generous dividends and share repurchases as good indicators for the company’s robust cash flow, strong capital allocation flexibility, and also its reasonable valuation.

On the negative side, SU faces the same set of risks common to other energy stocks. These risks include commodity price volatility, geopolitical risks, regulation policies, etc. A recent example involves the penalty SU faces for pollution permit violations. The Colorado Department of Public Health and Environment is fining the company US$10.5 million for exceeding emission limits for sulfur dioxide, carbon monoxide, and nitrogen oxide between 2019 and 2021. Here I will concentrate on the risks that are more specific to SU compared to other energy stocks. The top one on my mind is its reliance on Canadian oil sands. SU is a major producer of oil sands, a resource specific to Canada. Extracting oil sands is a more complex and expensive process compared to traditional oil drilling. This could add uncertainties to SU’s production costs higher (and can put it at greater risk from stricter environmental regulations and public pressure to reduce carbon emissions).

All told, despite Suncor Energy’s recent price rallies, I still see compelling upside potential and thus reiterate my BUY thesis. The company’s valuation is attractive despite a near 52-week high price. The 10x 2024 forward P/E ratio is reasonable in absolute terms and about 20% discounted from the sector’s median. I see strong drivers in the next 1-2 years to give its EPS a substantial boost. These drivers include my outlook for a rise in oil prices, SU’s enhanced capacity utilization rates, and contributions from recent acquisitions and capital improvement projects.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If you share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.