Summary:

- Taiwan Semiconductor Manufacturing Company Limited is showing strong revenue and margin expansion potential as new AI chips are launched in quick succession.

- The geopolitical threat is overplayed, which has kept the valuation multiple lower than other semiconductor stocks.

- Taiwan Semiconductor is an ideal pick-and-shovel stock as the AI chip race gains momentum and there are rapid launches of more powerful chips.

- Taiwan Semiconductor’s moat is stronger than other companies like Nvidia which should allow the company to report better margins in the next few quarters.

- Taiwan Semiconductor is trading at a modest 15 times the EPS estimates of 2 fiscal years ahead, which shows the value available in the stock.

BING-JHEN HONG

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) continues to show good bullish sentiment as the artificial intelligence, or AI, chip race heats up. TSM is an ideal pick-and-shovel stock because of the key role played by its manufacturing facilities. Wall Street has pushed Nvidia’s (NVDA) stock to new heights, which has made it quite expensive. Investors looking for better value investments should look at TSM due to its better moat.

Nvidia has a huge market share in AI chips, but this market share will inevitably decline in the next few quarters as Advanced Micro Devices (AMD), Intel (INTC), and other competitors launch their own AI chips in rapid succession. On the other hand, it is very difficult to replicate TSM’s manufacturing prowess. Intel is investing tens of billions of dollars in building new manufacturing plants, but most of them will not start production by 2026 in the best-case scenario. TSM stock has gained over 60% since my previous article on the company when it was mentioned that Intel will face numerous challenges as it ramps up its foundry business to compete with TSM.

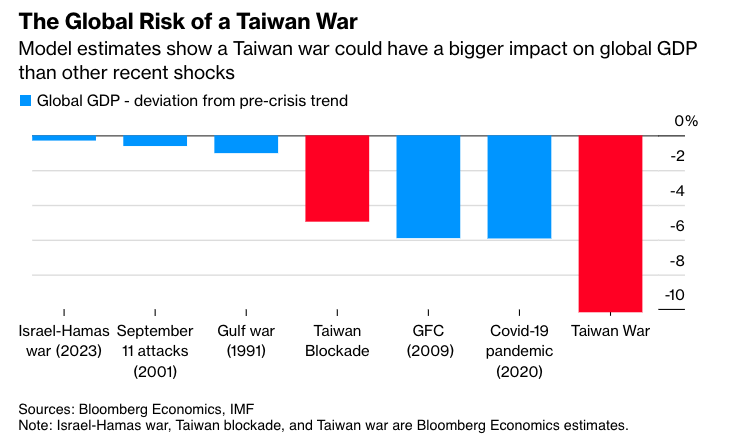

The geopolitical threat faced by TSM is overhyped because any conflict scenario in Taiwan would have a wide repercussion on almost all industries. Bloomberg has estimated that a Taiwan war would cost the world economy a bigger shock than the Great Financial Recession of 2009 and the Covid pandemic. TSM is also diversifying its manufacturing base by building additional capacity in Japan and U.S.

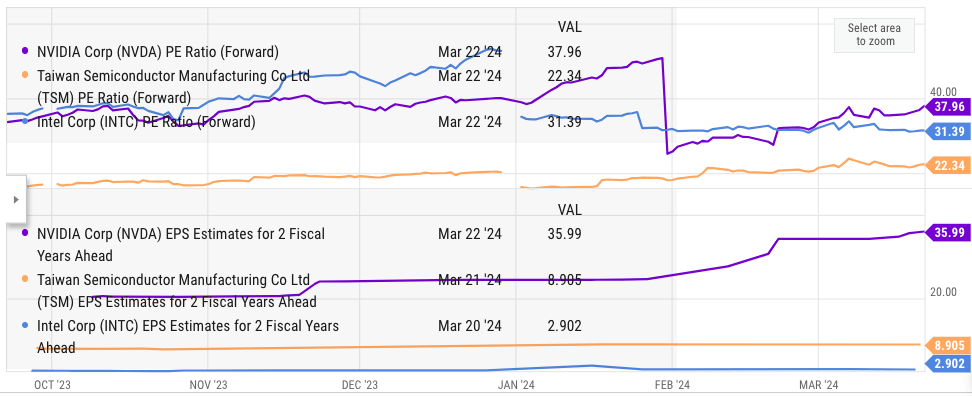

Even if we take a long-term view and compare the EPS estimates for 2 fiscal years ahead, TSM stock provides a better value compared to hot stocks like Nvidia, AMD, and even Intel. TSM is trading at 15 times the EPS estimates for 2 fiscal years ahead while Nvidia is trading at 26.

Ideal Pick-and-shovel stock

Using the Gold Rush analogy, Wall Street many times rewards companies involved in selling pick and shovels instead of the companies involved in extracting gold. The AI gold rush is in full steam and investors are looking for an ideal AI play. Nvidia is the biggest name getting all the media attention. It has over 80% market share in terms of AI chips used and has recently launched another flagship chip called Blackwell B200. However, it is inevitable that Nvidia’s market share will come down as AMD, Intel, and other competitors launch their own AI chips. Nvidia’s pricing power will also come under pressure.

It is relatively easy for other companies to launch their own AI chips and AMD’s MI300X is already getting good reviews. However, it is very difficult to build a new manufacturing plant which costs billions of dollars of initial investment and the need to have a highly skilled labor force. Despite, the massive investments announced by Intel in building its own foundry business, it will be at least 2026 or even 2027 before full momentum in production starts.

Within the semiconductor industry, even a six-month period can seem like a long time, and forecasting for 2026 is almost impossible. TSM also has a massive cost advantage in the facilities within Taiwan. It would be very difficult for Intel or other competitors to replicate similar cost structures in other regions with a higher labor cost. Beyond the labor cost, the bigger issue for Intel is about getting enough skilled labor. Even TSM has faced labor shortages in its Arizona plant, which is causing additional delays to production. In this scenario, it is unlikely that Intel will be able to compete effectively with TSM in terms of cost and production capabilities, despite getting massive subsidies.

Overhyping the Taiwan conflict scenario

Semiconductor demand is relatively inelastic which means that demand will be strong even if there is a momentary shortage. We have seen that Russia has been able to maintain its oil production capacity despite launching the destructive war in Ukraine. The main reason is that oil demand is quite stable at 100 million barrels a day and all governments want to maintain a steady supply of oil. Semiconductor manufacturing has a similar place to oil and even in a conflict scenario, we could see smooth operations as much as possible.

Bloomberg has estimated that a Taiwan conflict will cost close to $10 trillion to world economy and its impact will be bigger than the Financial Recession. It is likely that a Taiwan conflict will cause massive sanctions on China which will impact almost all sectors of the economy from smartphone manufacturing to apparel or toys. These sanctions could pose an existential threat to Chinese economy which is already showing headwinds due to the pandemic and flight of foreign capital.

Bloomberg

It should also be noted that China produces a bulk of the raw materials used in semiconductor manufacturing. Hence, even if the facilities are located outside Taiwan, there will be a big negative effect on the supply chain if there is a conflict. It is prudent to look at all the scenarios, but it is likely that Wall Street is overhyping the worst case scenario for TSM by a large margin.

Future stock trajectory

TSM stock has shown a strong uptick in the last few months. Despite the bull run, TSM stock is trading at a lower forward P/E ratio than Intel and Nvidia. Even if we take a long-term view, TSM stock is trading at 15 times the EPS estimates for 2 fiscal years ahead while Nvidia is trading at 25 times. While Intel is trading at close to 15 times the EPS estimate of 2 fiscal years ahead, the company faces challenges in terms of expanding its foundry capacity and also fulfilling the aggressive process roadmap.

YCharts

Figure: Forward P/E ratio and EPS estimates of TSM, Nvidia, and Intel. Source: YCharts.

TSM stock can be seen as a value investment during the AI race. It has a big moat and provides the pick and shovels to almost all major chip designers. The AI industry will inevitably continue to grow over the next few years. However, who gains the biggest margins and profit is still not known. TSM is an ideal position compared to other chip designers because the facilities provided by the company cannot be easily replaced. Investors looking for AI play could consider TSM stock.

Investor Takeaway

TSM continues to show strong growth potential. The AI demand will continue to increase as more services use AI technologies. Nvidia and other chip designers are building more powerful chips but there is intense competition in this field which will hurt the margins over the long run. On the other hand, TSM has a massive market in manufacturing and it is not possible to replace the company. Intel’s foundry investments will take a long time to actually come online and TSM’s still retain a strong cost advantage over Intel.

The geopolitical tensions over Taiwan are overhyped by Wall Street. In case of conflict, we would see a wide range of industries face a massive challenge. The raw material supply chain for semiconductors will also be damaged if there is a conflict. Hence, it is highly unlikely that TSM will face the negative issues due to any geopolitical tensions. At the current price point, TSM stock looks like a good option within the AI industry.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.