Summary:

- Target is facing declining sales due to inflation, high interest rates, and a shift in consumer spending toward services.

- The company is focusing on everyday essentials to win back customers, but still expects sales to remain flat to slightly up in the current quarter.

- Initiating coverage with a hold based on Target’s lack of a strategic growth plan to revive sales and slowdown in consumer spending.

- My analysis specializes in identifying companies that are experiencing growth at a reasonable price.

Massimo Giachetti

Investment Thesis

As I have written before in my Lululemon Athletica Inc. (LULU) article, consumer discretionary stocks are being negatively impacted by slower consumer spending. According to Target Corporation’s (NYSE:TGT) last earnings report the company’s business is shirking. The retailer reported a fourth consecutive quarter of declining comparable sales, blaming a combination of high prices straining wallets and a shift in consumer spending toward services. This news sent Target’s stock price tumbling, in stark contrast to its main competitor Walmart Inc. (WMT), which saw its stock surge after reporting earnings.

Target is facing a tough environment. Consumers are feeling the pinch of inflation and higher interest rates, leading them to cut back on discretionary spending on items like home goods, furniture, apparel, and even food. To try and win back customers, Target is slashing prices on everyday essentials. According to their last quarterly call, the company is cautiously optimistic about a slight rebound in discretionary spending, however, it expects sales to remain flat to slightly up in the current quarter.

In the second quarter, we are planning for a comparable sales increase in the 0% to 2% range. While this is below the growth rate we’d expect to deliver over time, it reflects a continued cautious approach to our near-term outlook, which has served us well in recent quarters.

There are some potential bright spots for Target. The company is launching new initiatives to boost sales, including a revamp of its loyalty program. Additionally, easier comparisons to weaker sales figures from last year could help Target show some improvement in the coming quarter.

Overall, I believe Target faces an uphill battle. As you will read later, the company is battling high debt and a slowdown in consumer spending. These factors limit its ability to be a true growth at a reasonable price candidate. Additionally, economic uncertainty makes earnings volatile, reducing Target’s appeal as a value investment. Given these challenges, I am inclined to initiate coverage with a Hold. However, I’ll revisit my investment thesis if the valuation becomes more attractive.

Management Evaluation

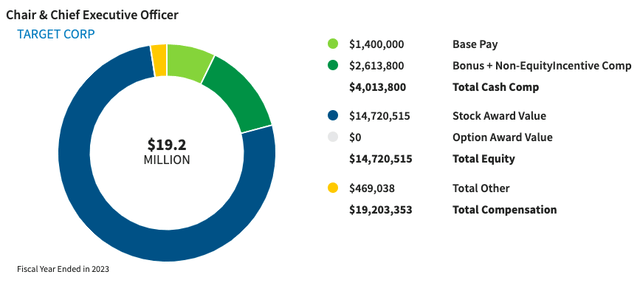

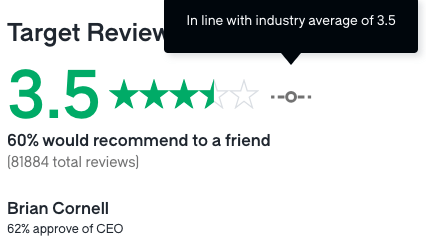

Brian Cornell who joined Target in 2014, has led the company’s focus on both physical stores and digital shopping. While his investment in supply chain and fulfillment made Target’s same-day delivery a reality, I believe there are some questions regarding the company’s next growth stage and there might be a need for a potential new leadership strategy. Interestingly, his approval rating on Glassdoor leans slightly favorable, suggesting employees have a positive view. Further, I view Cornell’s significant stock-based compensation as having a high alignment ratio with the company’s long-term success.

Target COO and CFO roles are currently combined under Michael Fiddelke. While Fiddelke’s experience across various departments at Target since he started as an intern in 2003 is impressive, I believe merging these two critical functions can be challenging. The COO’s main job is to oversee day-to-day operations, ensuring smooth and efficient execution. The CFO, on the other hand, focuses on maintaining and improving the financial health of a company to fund future growth projects, which is a full-time job in itself.

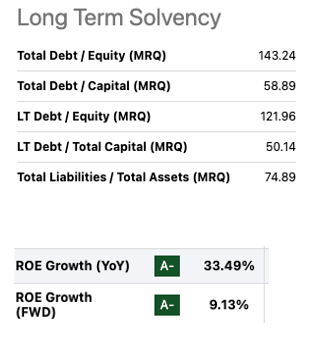

Fiddelke’s tenure as both CFO and COO since late 2009 has seen growth in ROE, with positive forecasts. However, there’s also been a significant debt increase of around 40% to fund expansion plans that haven’t yet yielded the expected results in generating revenue growth.

Seeking Alpha

Overall, I believe Target’s team seems committed to the company’s long-term success, as evidenced by Cornell’s high alignment ratio. However, I believe there are concerns that must be addressed. Combining COO and CFO duties can slow effectiveness. Fiddelke’s operational experience is valuable, so he should keep the COO role as he knows the company inside and out but someone with more experience should take on the CFO role. Separating the roles could optimize leadership and financial oversight. While Cornell’s team deserves time to implement their vision, I don’t believe there is a sound strategic growth plan in place to turn around revenues. Considering all the factors I am inclined to give the new team a “Do not meet expectations”.

Glassdoor

Corporate Strategy

Target’s corporate strategy is to offer competitive prices while focusing on a curated product selection, trendy collaborations, and a pleasant shopping environment. The company invests in its own brands like Threshold for home and Goodfellow for menswear to provide unique products and higher margins (see table below). It also tries to compete with other stores by integrating online shopping with in-store pickup and delivery options.

I have created the table below comparing Target’s current strategy to some of its current competitors:

|

Target |

Walmart |

Kohl’s Corporation (KSS) |

The TJX Companies, Inc. (TJX) |

Amazon.com, Inc.(AMZN) |

|

|

Corporate Strategy |

Balance value & experience, strong private label brands, omnichannel focus |

Everyday low prices, vast selection, focus on efficiency |

Value oriented department store, focus on national brands & private labels |

Treasure hunt shopping experience, brand-name discounts |

Online retail giant, vast selection, convenience, fast delivery |

|

Revenue Growth direction |

Flat |

Steady growth |

Flat |

Steady growth |

Steady growth |

|

EBITDA Margin |

8.18% |

6.05% |

8.39% |

12.68% |

16.35% |

|

Other important factors |

Strong digital presence, focus on a loyalty program |

Strong supply chain, emphasis on low prices |

Strong private label brands, focus on promotions |

Focus on curation and treasure hunt experience |

Diversified revenue stream. Wide variety of fulfillment options. |

Source: From companies’ website, presentations, Seeking Alpha

I believe Walmart seems to be navigating the current economic climate much better according to their latest earnings report. Their strategy centered on value focus resonates with budget-conscious, driving sales and market share gains even among higher-income shoppers. This highlights the core difference: Target leans on discretionary items like clothing and home décor, while Walmart prioritizes staples like groceries. So, Target’s sales are more vulnerable to economic shifts, making it a more consumer discretionary-like company.

Valuation

Target currently trades at around $147.74 after it dropped around 10% after it reported earnings in late May.

Employing a conservative 11% discount rate ((r)). This represents a hurdle rate that an investor expects to receive considering the time value and inherent risk of that investment. To calculate it, I used a 5% rate for time value in addition to a 6% average market premium.

Then, using a simple 10 year two staged DCF calculator, I reversed the formula to solve for the high-growth rate. I assumed a terminal growth rate of 4%, which I consider to be a conservative constant perpetuity growth rate for a going concern company.

I chose this rate as I am assuming the FCF growth rate during the high growth period will increase from the current level over the long term and eventually decline to the 4%. Then I used the following equation:

$147.74 = (sum^10 FCF (1 + “X”) / 1+r)) + TV (sum^10 FCF (1+g) / (1+r))

Solving for g = 5.5%

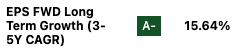

This suggests that the market currently anticipates Target’s FCF to grow at a rate of 5.5%. However, there are no expectations for future growth on FCF on Seeking Alpha that I can use for comparison. Therefore, I will use a more normalized growth rate and use the expected EPS growth as a more normalized long-term growth in future FCF:

Seeking Alpha

Comparing growth rates suggests the market is primarily pricing in a decline in sales, but not fully factoring in the strategic risk associated with the lack of a clear turnaround plan for revenue growth. While the 15% EPS increase, over the long term, provides a starting point, it doesn’t account for capital expenditures and cash generation.

Therefore, while the current stock price at 5.5% FCF growth might reflect some of the risks, I believe there’s a more significant strategic risk concerning the company’s ability to revive sales which the market is not currently pricing. Therefore, I am inclined to rate the stock a Hold rather than a Buy until more information becomes available on their strategic growth plan.

Technical Analysis

The stock price momentum has been improving and seems like it created a support level at around $143.50. I believe the stock might continue to stay around $143 – $160 range for now until more information becomes available. I will revisit my investment thesis as needed.

Next earnings report is estimated to be August 22nd.

Takeaway

Target’s sales are declining due to inflation, high interest rates, and a shift of spending toward services. I believe price cuts on essentials are a temporary fix. While leadership seems committed, I have a concern about the combined COO/CFO role and most importantly, that there is a lack of a clear plan to revive sales. Target’s strategy of value-curated experiences sets them apart, but I am inclined to start my coverage with a Hold reflecting current economic headwinds and the lack of a revenue growth plan.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Rating systems don't consider time horizons or investment strategies. My articles aim to inform, not to make decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.