Summary:

- TSMC is the largest foundry with over 50% market share, making it a solid investment choice for risk-averse investors given broad customer exposure.

- Despite a 60% increase in stock price since January, TSMC remains fairly valued and one of the cheapest among Big Tech/AI companies.

- TSMC has returned to growth in Q1 and has a strong outlook for 2024 and beyond, making it a promising investment option.

Sundry Photography

Investment Thesis

TSMC (NYSE:TSM) is the largest foundry (which makes chips for fabless companies) with over 50% market share, and even higher at the leading edge. That makes it a solid investment choice for risk-averse investors, akin to investing in a semiconductor ETF, in my view.

Although the stock is up 60% since the rating upgrade in January, the increase in earnings estimates and undervaluation at the time (compared to long-term growth prospects) means the stock remains fairly valued, perhaps even being one of the cheapest of the Big Tech/AI companies.

Background

In previous coverage in January, I upgraded TSMC as the share price hadn’t increased much in the wake of the semiconductor downturn in 2023 which it was coming out of, still below its multi-year high. As such, there were quite strong prospects for (a return to) growth, which weren’t priced into the stock yet.

Q1 results and outlook

TSMC has returned to growth for the first time since Q4’22 when it still posted 30% growth. Q1’23 (with its 2% revenue decline) was also the first time since Q2’19 that it didn’t report double-digit growth.

Revenue of $18.2B was up 13% and EPS of $1.38 was also up slightly from $1.31 a year ago. Sequentially, revenue was down 4%. The Q2 outlook calls for $20.0B at the midpoint.

Nevertheless, TSMC did lower its 2024 industry forecast, which now stands at 10% overall and 15-19% for foundry. TSMC does expect to grow faster than the industry at “low to mid-20%” growth. Capex of $30B is expected at the midpoint.

Both gross and operating margins have remained quite robust (above 50% and 40% respectively), although below their peaks.

For AI, despite expecting what seems to be a doubling in revenue, it is only expected to represent a low double-digit percentage fraction of revenue. Given Nvidia’s (NVDA) very high margins, this has led some to question if TSMC couldn’t charge more for those customers. In that regard, TSMC said it expected N3 to take 10–12 quarters before reaching corporate average gross margin, two quarters longer than N5 because it set the pricing very early, with a lot of inflation since then. So while in the near-term it won’t benefit more from AI, TSMC did say it expected N2 to have stronger profitability, although it remains to be seen if the more AI-centric A16 node could have even higher margins still.

Business updates

The main (two-part) trend in the (leading edge) foundry market has been the aim to diversify the supply chain away from Asia/Taiwan, which has resulted in E.U. and U.S. Chips Acts (although Taiwan has also launched its own one more recently). The main company that has been stepping into this has been Intel, which at the same time also launched an effort to regain competitiveness on the technological side.

Although its technological roadmap is indeed nearing completion as planned, so far on the financial side there is still substantial inertia. Notably, Intel announced in February achieving a $15B lifetime deal value (up from $10B in late January and $4B a year earlier). For TSMC, in contrast, its revenue is expected to increase by $15B from 2024 to 2025 alone, according to current estimates.

So altogether, although Intel stands by its goal to become the #2 external foundry by 2030, it still has quite a long way to go before becoming a material risk to TSMC’s financials and stock.

More concretely, TSMC announced A16 to its roadmap for late 2026, while Intel added A14 for around the same time. The main difference between these two nodes, beyond the name, is that A14 is expected to be more like a traditional node, advancing Moore’s Law, whereas TSMC’s A16 node is rather an intra-node of N2, introducing the backside power delivery that apparently has been removed from N2P and which Intel is already introducing in 20A this year.

The initial N2 production ramp remains scheduled for Q4’25, although if Apple remains the first customer to move to the next node (for A16 TSMC has hinted it might be an HPC customer), then the new iPhone in fall 2026 would be the first product with an N2-based chip (barring any M-series chips several months earlier, which does not seem to be the case as TSMC explicitly said it expected a similar ramp as N3).

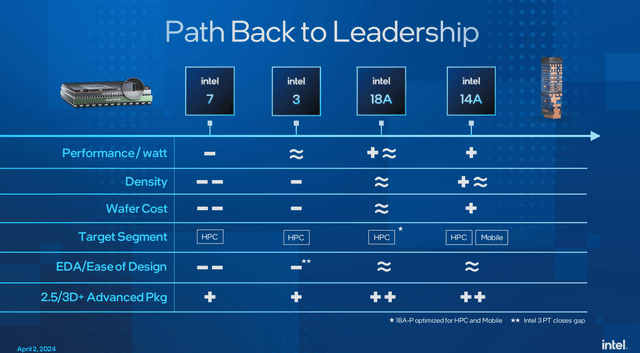

As pretty much the only concrete data (besides guesstimates) available yet, at Intel’s February Foundry event, it had shown a slide of its benchmarking of its competitiveness on all key areas across performance, power, area, density, cost and packaging. While the slide was somewhat confusing as it didn’t clarify against which TSMC node each of Intel’s nodes had been compared to, Intel did conclude that it was only extending its lead (from 18A) with 14A. This is in-line with the expectation of 14A being a full node compared to 16A as intra-node.

Intel

Valuation

The current market cap that has grown to $700B has only recently eclipsed the previous high from early 2021, with Q1 revenue that has grown from $12.8B to $18.2B and EPS from $0.96 to $1.38. This makes for a Q1 run rate P/E of just below 30x, although given the expected growth, the estimate is for a 26x multiple at the current stock price.

While this isn’t a cheap valuation, it is cheaper than the likes of ASML (ASML), Nvidia, AMD (AMD) and Microsoft (MSFT), and with continued growth, this is expected to drop to below 21x in 2025. Although that estimate is based on a consensus estimate of just over $100B revenue, up from $85B in 2024, marking quite strong continued (expected) growth.

Even if this growth doesn’t quite materialize, in the long-term the semiconductor industry remains expected to grow quite materially. Given TSMC’s market position, it should hence be one of the prime beneficiaries of this trend. So from that view, TSMC should quite easily be able to outgrow its current valuation.

Investor Takeaway

Although TSMC has a higher P/E valuation currently than the average of the S&P, it is arguably a higher quality company (with majority market share and leading-edge technology for at least the next several years among competitors with material market share, which Intel Foundry does not have yet) and with more robust growth expectations given its broad customer base in a growing market. Nevertheless, it is (also) one of the cheapest stocks among Big Tech.

For example, compared to Nvidia, its valuation is on the order of 40-50% lower. While, for now, Nvidia still has a much larger growth rate, TSMC has as an advantage with its much broader customer base, which reduces exposure risk to one market (although for now, that is, and perhaps may remain for quite some time, actually an exposure benefit/reward for Nvidia).

One similarity with Nvidia is that for both companies, Intel is one of their strongest competitors, especially looking forward, but likewise for both this risk seems to be years away from (potentially) becoming material financially.

Overall, after a year of decline in 2023, TSMC has returned to growth, with quite a strong outlook for 2024, and likely beyond. While the valuation has become a bit more expensive since the January upgrade (which perhaps may warrant some near-term profit-taking), as described it remains far from expensive, so holding and/or buying the stock would be equally valid.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.