Summary:

- Teladoc’s stock fell ~97% from its peak, but recent changes, including a new CEO, present a high-risk, high-reward opportunity.

- Positive year-over-year trends in integrated care members and chronic care enrollment, but effective monetization of these members remains a challenge.

- However, Teladoc’s strong FCF and cheap valuation, trading at 4-5 times FCF, make it a potential turnaround candidate.

Solskin

The Teladoc Health Investment Thesis

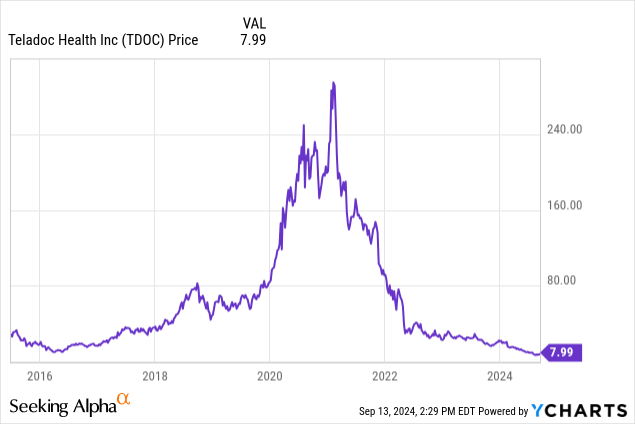

Teladoc Health (NYSE:TDOC) is one of the stocks that had a crazy run during COVID and then fell hard. In this case, Teladoc stock fell ~97% from its all-time high of $294. In other words, if Teladoc were to regain the all-time high, it would be a 36 bagger from the current level of $7.99.

Exactly one year ago, I wrote an article about Teladoc because I believed the telemedicine sector had great potential and Teladoc is a leader in the sector. And my conclusion at that time was that I did not see them as a buy at $25 because the low guidance as well as the low growth scared me.

But a lot has changed at this company in the last year, and at the current price, I see value in the stock. Therefore, I would like to upgrade my rating as I see a good upside for Teladoc over a 5-year time frame.

What Has Changed In The Last Year?

The most impactful change occurred just a few weeks ago when Teladoc named a new CEO. And a new CEO is a really big deal, but sometimes it is what is needed, especially when a stock is getting hammered like Teladoc is. A breath of fresh air is often the catalyst for a turnaround.

The other thing that had a big impact is that they withdrew the guidance for FY2024 as well as the 3-year outlook. And with a new CEO who needs to get an overview of what is going on in the company, I can understand this move, but it could still be a red flag. But a turnaround is always high risk, and that is how I rate Teladoc right now. High risk, but perhaps also high reward.

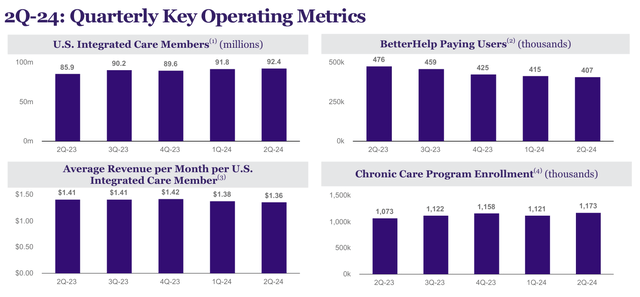

Teladoc Q2 Presentation

So when we look at the US integrated care members and the chronic care program enrollment, we see positive year-over-year trends. Both continue to grow. However, the decline in average revenue per member had a negative impact on revenue. And I think one of the biggest challenges for the new CEO will be to find a way to monetize those 92 million members more effectively. If they can do that, the company will be on the road to success.

I still believe that telemedicine or virtual healthcare will be a big part of our lives in 10 years. There are so many positive aspects. You save time by not having to wait in a waiting room, and you can get in touch with the best doctors from anywhere in the world. A family member who lives in London and is very busy at work swears by the ease with which his doctors can examine him and discuss the results.

And if a provider can get its way, it will benefit from strong network effects and high barriers to entry due to privacy and health laws in different countries. This could result in a huge competitive advantage.

What Are The Positive Aspects?

Teladoc has been FCF positive every year except 2020. And in 2023, they managed to be FCF positive on an adjusted SBC basis. And I expect SBC adjusted FCF to grow, as I think SBC will continue to decline and net cash flow will increase.

For example, SBC’s development is that it was at $55 million in Q2/23 and fell to $42 million in Q2/24. While FCF per share growth has averaged ~64% annually over the last 5 years. And with a market cap of about $1.3 billion, annual FCF of about $250 million to $300 million, which, I think, is realistic, would result in the company trading at 4 or 5 times FCF. A cheap valuation, I think.

An EV/sales multiple of 0.66 also seems cheap for a company that is currently not growing as exponentially as it used to, but has the potential to do so again. Teladoc could return to 10%+ revenue growth rates with a successful turnaround.

Teladoc’s Debt Situation

There are currently $1.6 billion of convertible notes outstanding, of which $800 million mature in 2025. And convertible notes are a form of debt that also offer the possibility of being converted into equity. And here it will be interesting to see whether the notes will be repaid or whether they will be converted into equity at a discount, which would dilute shareholders.

But even if they had to be repaid, the $1.16 billion in cash and positive FCF should be enough to cover the $1.6 billion. So the $800 million in 2025 should not be a big threat for the time being, as there will still be about $360 million in cash left after that, and another $200 to $300 in FCF is likely to be generated, which should push the cash position to roughly $500 million by the end of the year 2025.

Conclusion

Yes, Teladoc has a troubled past with the $18.5 billion Livongo merger, the BetterHelp acquisition, and its heavy spending on advertising and customer acquisition, but it still has a 90% customer retention rate. Additionally, Teladoc has the problem that sentiment towards the stock is very negative right now.

But the positive FCF that the new management can use for acquisitions and growth is the positive aspect that I like. Of course, this is a risky investment, but the cash position and FCF should protect against the downside, and if the growth engine kicks in again and profitability rises, this could be a worthwhile investment.

Therefore, I will probably build up a small position in the near future to add or reduce depending on the quarterly results. I think the stock has fallen enough that the risk/reward ratio has changed for the better and the stock price does not currently reflect the fundamentals behind the stock.

Since it takes time to see the effects of a new management team, I think the time horizon is more like 5 years, as it usually is for me, and the stock could fall further in the near future, depending on the next earnings results. But long term, I see great potential for Teladoc.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.