Summary:

- Tesla, Inc. operates in an incredibly competitive, capital-intensive, low-margin industry that buried many companies along the way.

- Established automakers have funds, intellectual property, and decades of experience in the automotive field to catch up with Tesla’s technology and execution.

- Tesla’s cheapest models remain substantially more expensive than best-selling cars in various parts of the world. However, the price is very often the decisive purchase factor for customers.

- Can Tesla be a pioneer in the auto industry and structure itself so that it can offset typical obstacles car makers have to face?

Matt Cardy/Getty Images News

Thesis

Tesla, Inc. (NASDAQ:TSLA) operates in an incredibly competitive, capital-intensive, low-margin industry that buried thousands of companies along the way. Yet, Elon Musk’s wonder child has made its way to the elite, became a predecessor of electric vehicles (“EVs”), and it’s currently the highest market cap automaker on the globe. Nevertheless, once the Fed-ignited stock euphoria driven by themes such as EVs, AI, disruption, and innovation fades, reality will verify the soundness of the valuations of numerous companies, including Tesla.

The electric automaker has achieved the unachievable, namely becoming a worldwide player in the car industry which has an exceptionally high barrier to entry. What is more, the company reached profitability and delivered over 1 million vehicles in 2022 alone. The milestones that the company has been achieving, combined with the controversial but often smart, strategically-oriented moves of its leader Elon Musk, attracted the attention of the retail crowd as well as big funds. The money supply in the pandemic-driven boom was the final factor that let investors bid Tesla stock price to fundamentally unexplainable levels. Although it declined substantially over the last year, the business still remains overvalued. What is more, the outlook for Tesla looks cloudy, with the business it operates in being brutal. Can Tesla be a pioneer in the auto industry and structure itself so that it can offset typical obstacles car makers have to face?

Terrible Business Economics

Competitive advantage – also called a moat – and business economics are some of the most important aspects that define a great company. Unfortunately, Tesla struggles with both of them.

When an industry with a reputation for difficult economics meets a manager with a reputation for excellence, it is usually the industry that keeps its reputation intact.

– Warren Buffett

The car industry is known for its cyclicality and high complexity on multiple levels. It also requires large amounts of capital to operate. These are just a few, but very strong reasons that make the car industry terrible to operate in regardless of the management excellence.

The car industry involves high fixed costs, such as building and equipping manufacturing facilities, research and development expenses, and marketing and advertising costs. These costs must be incurred regardless of how many cars are produced. Regardless of how innovative a car manufacturer is in the current time, it has to keep on innovating by pouring more and more money into R&D to stay competitive. Tesla’s R&D expenses increased in 2022 by 19%, when compared with the prior year. However, it’s still low relative to the company’s revenue.

Additionally, developing a new car model can take several years and involves significant investment in research, design, and testing. This long development cycle can tie up capital for extended periods of time, as automakers invest in the development of a product that may not generate revenue for several years.

Lastly, the car industry relies on complex global supply chains, with components sourced from multiple countries and regions. Managing these supply chains requires significant investment in logistics and inventory management, which can freeze capital which also confirms the capital-intensive nature of the industry.

Tesla is a precursor of the production of electric cars on a big scale. The company used to be a single player in this disruptive space. With its aspirations beyond the automotive industry, it became perceived as a firm whose business economics would fundamentally differ from the leading car makers such as Volkswagen (OTCPK:VWAGY), Ford (F), or Toyota (TM). The moat, hype, and vision seemed to be there. However, this perception started fading as Tesla expanded globally and gained significance worldwide. Since the company generates 88% of its revenues from the automotive segment, it’s becoming clear that it’s a car company with eventually alike business economics, cost structure, and headwinds just as its peers, which points to another problem – competition.

Pricing Power And Competition

Competition is one of the biggest issues being more and more visible and disregarded by many Tesla bulls. Established automakers have funds, intellectual property, and decades of experience in the automotive field to catch up with Tesla’s technology and execution. Once the distance between the EV leader and its contenders becomes small enough, the advantage Tesla still has may be gone forever.

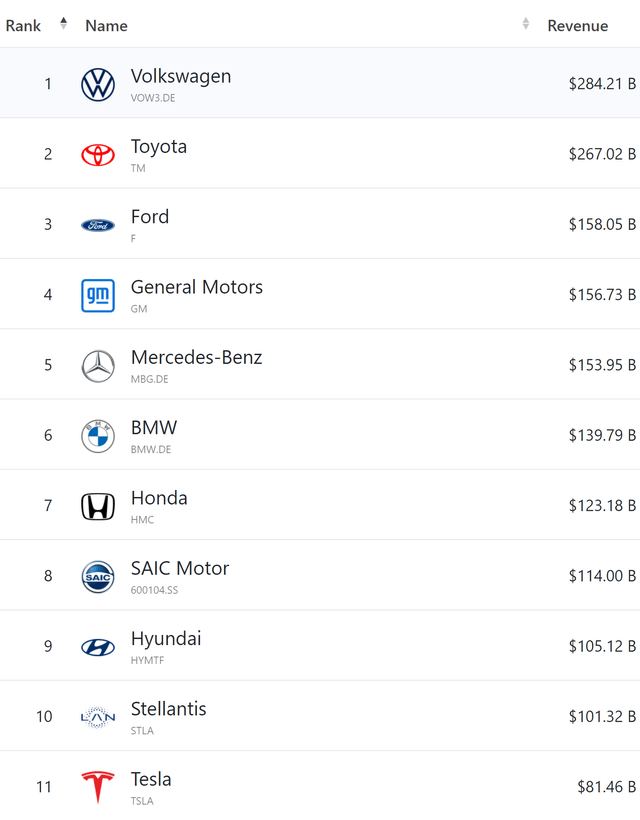

Car Makers’ Sales (Companies Market Cap)

Tesla doesn’t make the top ten in terms of revenue. However, its market capitalization is still the highest at $569.94 billion, with Toyota being not even remotely close valued at $181.27 billion. That’s because the market expects exponential growth and applies corresponding multiples. The question remains how severe the reevaluation will be when the market participants will start projecting lower growth than now.

When it comes to rivalry with other car makers, the top five competitors are not passively participating in the race, with Volkswagen planning to invest more than €30 billion ($35 billion) in electric vehicles by 2025 or laying out objectives to build six gigafactories in Europe by 2030. After launching its ID.3 and ID.4 electric cars, Volkswagen is setting the bar higher by releasing the concept of the ID.2all. The car is meant to be the most affordable electric vehicle starting from €25,000.

Toyota has recently introduced several electric vehicles, including the bZ4X SUV and the Lexus UX 300e. The company is also investing in solid-state battery technology, which they claim will allow for longer driving ranges and faster charging times.

Ford has committed to investing $22 billion in electric vehicles by 2025 whereas General Motors (GM) has set a goal to only sell electric vehicles by 2035. Both American car makers are unveiling new electric models such as the F-150 Lightning, Mustang Mach-E, Hummer EV, Cadillac Lyriq, or the Chevrolet Bolt EUV. Each of the manufacturers is also investing heavily in battery technology and building new plants.

Mercedes Benz (OTCPK:MBGAF) has similarly introduced several electric vehicles to their lineup, including the EQS sedan and the EQC SUV. The company plans to inject €40 billion ($47 billion) into electric vehicles by 2030. Mercedes Benz is also investing in battery technology, with plans to build eight gigafactories around the world.

Tesla remains a relatively small automaker compared to its traditional rivals in terms of vehicle sales, revenue, and net income. However, the company has grown rapidly in recent years thanks to its innovative electric vehicle technology, high customer satisfaction, and strong brand recognition. As a result, Tesla has a much higher market capitalization than its peers, which reflects investors’ undisturbed optimism about the company’s future prospects. Nevertheless, key markets remain dominated by other manufacturers. In addition, the current macro situation has worsened the overall environment which has forced the EV maker to reconsider its prices.

Pricing

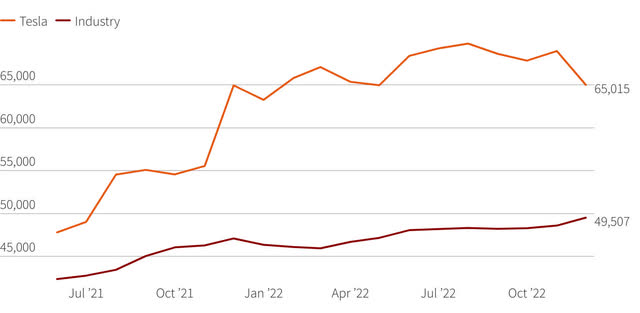

With increased competition, the prospect of recession, and higher interest rates Tesla was forced to lower prices to sustain growth at the expense of profit. The company slashed prices globally on its vehicles by a staggering 20%. Being the innovator and disruptor had allowed Tesla to keep prices elevated. However, once the demand slowed, the company was forced to make a reversal from its strategy.

Still, Tesla’s cheapest models remain substantially more expensive than best-selling cars in various parts of the world. In this industry, with a huge variety of vehicles and a wide choice, the price is very often the decisive purchase factor for customers. It may explain why in 2022 electric cars still accounted for a small fraction of the total sales dominated by much more affordable non-EV models. It raises concerns that when Tesla reaches a certain scale, its sales won’t grow nearly as rapidly as over the last three years. If this gets recognized by the market participants, the company’s valuation will be severely altered and the stock price will follow.

Tesla’s Price Gap in the U.S. Market Before the Price Cut (Kelly Blue Book)

On a positive note, Tesla’s decision to lower prices may correlate with production efficiencies. As the firm continues to produce more vehicles and improve its manufacturing processes, it is able to achieve greater economies of scale and cost savings. These cost savings can then be passed on to consumers in the form of lower prices. Besides that, Tesla’s prices are affected by currency fluctuations. If the value of the US dollar strengthens relative to other currencies, it may be able to lower its prices to remain competitive in those markets. However, currency fluctuations may be volatile, thus setting prices based on currency changes should not be the company’s strategy. Lastly, lowering prices may help to stimulate demand for Tesla’s vehicles, particularly during times of economic uncertainty. By making its vehicles more affordable, Tesla can attract more buyers and increase its market share.

Looming Recession

If the recession materializes, Tesla will most likely experience regardless of its vehicle prices. During times of economic downturn, car sales tend to decline as consumers cut back on spending and prioritize their essential needs. Here are a few numbers to illustrate the historical influence of the recession on the car industry:

-

The Great Recession (2008-2009): During the Great Recession, the U.S. auto industry suffered a significant decline in sales. In 2009, total U.S. auto sales fell to 10.4 million vehicles, a drop of more than 20% from the previous year. This decline in sales led to the bankruptcy of General Motors and Chrysler, two of the largest U.S. automakers.

-

The 1980s Recession: In the early 1980s, the U.S. auto industry also experienced a notable decline in sales due to the economic downturn. Between 1980 and 1982, total U.S. auto sales fell from 10.4 million vehicles to 6.9 million vehicles, a decline of more than 30%.

-

The Oil Crisis of the 1970s: In the 1970s, the oil crisis caused by the Arab oil embargo had a significant impact on the auto industry. Consumers began to demand more fuel-efficient vehicles, and sales of large, gas-guzzling cars declined sharply. In 1974, total U.S. auto sales fell to 8.1 million vehicles, a drop of more than 20% from the previous year.

These numbers illustrate how recessions and economic downturns have historically had a significant impact on the car industry, leading to declines in sales and, in some cases, bankruptcies of major automakers.

Impressive Growth

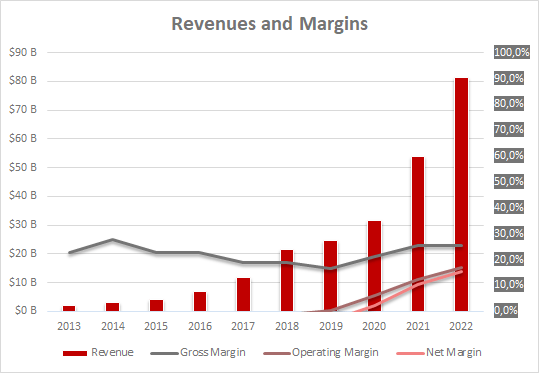

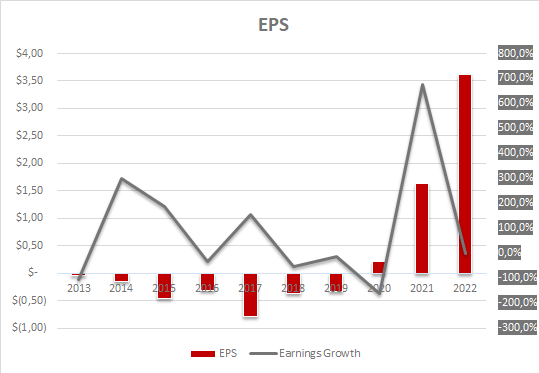

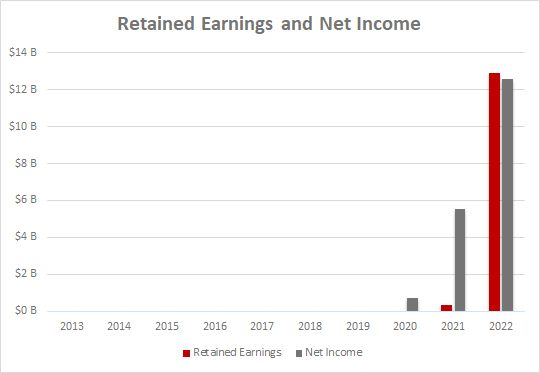

Tesla’s revenues have been steadily increasing over the past few years, with a significant jump from FY 2020 to FY 2021, and another major increase in FY 2022. Additionally, after several years of losses, Tesla turned a profit in FY 2020 and has continued to do so in the subsequent years, with an impressive net income in FY 2022. It’s worth noting that Tesla’s revenue growth is driven in large part by their sales of electric vehicles, particularly the Model 3 and Model Y, and their energy storage products.

Tesla’s Revenues and Margins (Author – Financial Data from Seeking Alpha) Tesla’s Earnings per Share and EPS Growth (Author – Financial Data from Seeking Alpha) Tesla’s Retained Earnings and Net Income (Author – Financial Data from Seeking Alpha)

While fully recognizing the impressive growth, investors have to keep in mind how unique the last two years were from the macro perspective. The COVID-19 pandemic and the actions taken by governments and central banks to combat its economic impact had an influence on Tesla’s sales and financial performance.

One factor that likely contributed to Tesla’s sales during the pandemic was the increased demand for electric vehicles. With people spending more time at home and many industries, including transportation, shifting to remote work and online services, there was a reduced need for traditional gasoline-powered vehicles. This may have led more people to consider electric vehicles, which offer a more sustainable and environmentally friendly alternative.

Additionally, the pandemic led to a significant increase in the money supply in many countries as governments and central banks implemented stimulus measures to support their economies. This increase in liquidity and available credit made it easier for some consumers to purchase a Tesla vehicle, particularly with the company offering financing options. In a high-interest environment, the demand may slow with fewer people purchasing new vehicles or choosing cheaper models.

Valuation

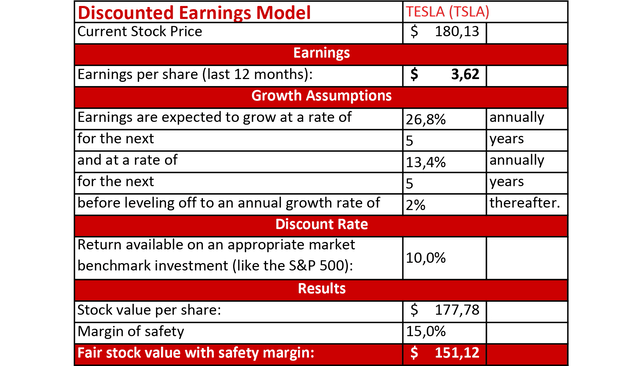

In the valuation process, a discounted earnings model (DEM) was used. The following input data was applied:

- Tesla’s earnings per share will grow 26.8% with a compound annual growth rate (CAGR) over the next five years.

- Growth will slow down in the following five years and settle at 13.4% CAGR.

- Perpetual growth after the period of ten years will equal 2.0%

- The discount rate is 10.0%.

- A margin of safety is applied and equals 15.0%.

Discounted Earnings Model (Best Case) (Author – Financial Data from Seeking Alpha)

The result indicates that Tesla is currently overvalued by 23.9%. It’s fair price corresponds to the Price to Earnings (P/E) ratio of 41.7. It’s worth noting that the assumed growth outlook is relatively high, especially considering the micro and macro headwinds. If the projection for the next ten years gets lowered to 13.4%, the result changes dramatically.

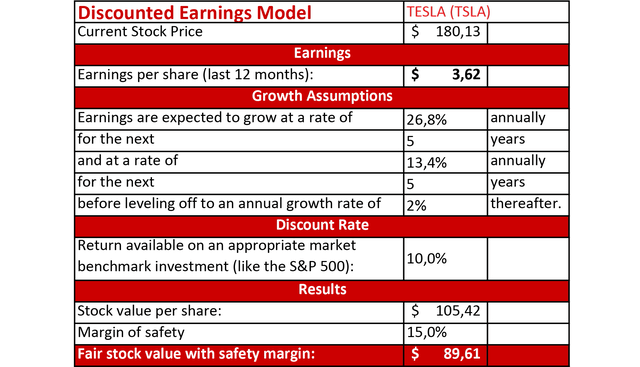

Discounted Earnings Model (Normal Case) (Author – Financial Data from Seeking Alpha)

With reduced expectations, Tesla’s intrinsic value amounts to $89.61 which is significantly lower than the share price it’s trading at. It, however, corresponds to the P/E ratio of 24.8 which is much more digestible from the value investment perspective. At this point, an investor has to assess his assumptions and go forward with preferably conservative projections in order to reduce the investment risk. On the other hand, Tesla might belong to the basket of “too tough to understand” which is perfectly fine and one can go ahead and keep on researching other businesses.

We have three baskets for investing: yes, no and too tough to understand.

– Charlie Munger

Conclusion

Multiple microeconomic arguments are suggesting an uneasy path for Tesla. In addition, persisting inflation and macro headwinds make the outlook even harder to assess. Thus, a more conservative approach to valuing the company should be pursued. It implies an application of lower multiples which in the end results in lower intrinsic value. Based on the presented valuations the stock is overvalued and represents a substantial downside risk whereas the reward looks disproportionally small.

Tesla, Inc. operates in a highly competitive market, with other major automakers such as Volkswagen, Toyota, General Motors, and Ford also entering the electric vehicle market. What might still speak for Tesla is its strong brand reputation and innovative products. However, Tesla operates in a terribly tough industry where pricing power doesn’t exist among car manufacturers. Cyclicality and a looming recession can have an impact on Tesla’s sales in a short term, particularly as consumers may be less willing to make large purchases such as a new car during times of economic uncertainty. Lastly, capital intensive nature of the business and the innovation the company is forced to constantly invest in don’t make it a great business. The situation may of course evolve and Tesla may find a way to gain a sustainable competitive advantage. Nevertheless, as of today, there are too many uncertainties and the valuation remains too high.

On the other hand, the shift towards electric vehicles is expected to continue, and Tesla’s focus on sustainability and innovation could give it an advantage in a recessionary market. Moreover, the company is expected to continue to grow in the next few years, with increasing sales and profitability. Tesla plans to expand its product line with the launch of new electric vehicles, including the Cybertruck and the Roadster, as well as continue to develop its energy storage products. These may be growth drivers that, at least partially, may justify the high Tesla, Inc. stock price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.