Summary:

- Tesla, Inc. has been disrupting the automotive industry in the past decade, and a new products pipeline suggests that the company is poised to continue setting trends in EV market.

- The company is a profitability rockstar, with immense margins expansion potential as business scale is expected to multiply several times.

- My valuation analysis, along with Morningstar and Argus Research estimates, suggest Tesla, Inc. stock is significantly undervalued.

Justin Sullivan

Investment thesis

Tesla, Inc. (NASDAQ:TSLA) has delivered a stellar financial performance in recent years thanks to the company’s innovative products and cutting-edge technology. Being a dominant player in Electric Vehicles [EV] market, the company is poised to continue its growth trajectory in coming years thanks to its strong brand and position, unique technology, and unique marketing strategy. I have high conviction that these factors will contribute to stock price appreciation given that valuation analysis suggests Tesla stock is undervalued.

About the company

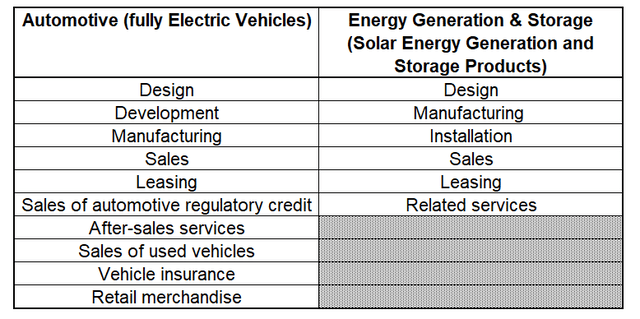

Tesla designs, develops, manufactures, sells and leases high-performance fully electric vehicles and energy generation and storage systems with cross-selling services related to the company’s products. Tesla sells products directly to final customers.

The company operates two reportable segments: Automotive and Energy Generation & Storage. These two segments comprise of following activities.

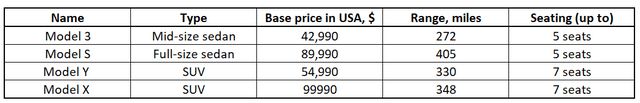

Tesla’s Automotive segment generated about 95% of the total sales in FY 2022, so I would like to dig in more details about this segment to enable readers to get deeper understanding on the company’s major cash generating line. The company currently manufactures four different consumer EV models.

Based on information from tesla.com

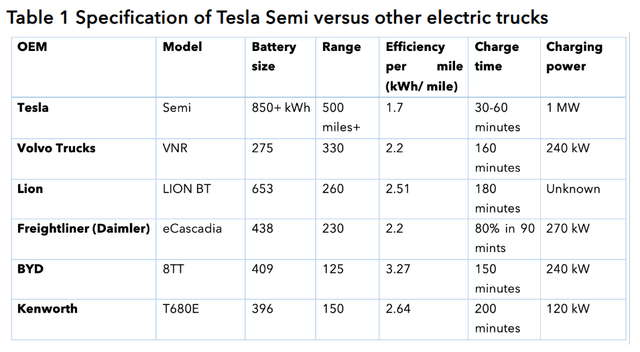

In late 2022, TSLA began deliveries of the company’s first commercial vehicle, which is Tesla Semi truck. The truck has superior technical capabilities compared to competitors, outperforming other battery trucks across all crucial metrics.

Tesla dominates in the United States with a 65% market share of new EV sales in 2022, though the market share decreased in comparison to 2021, as new legacy and EV makers are launching their pioneer models to the market.

Financials

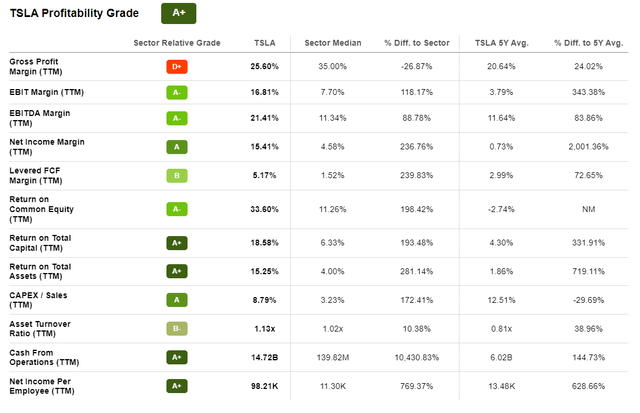

Tesla has the highest Profitability Grade from Seeking Alpha Quant because the company significantly expanded margins in last 5 years and is well ahead from sector median in terms of profitability ratios.

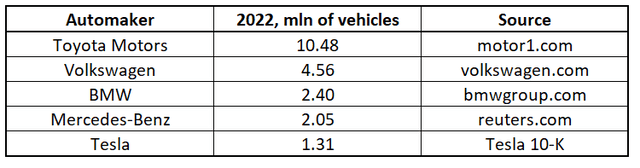

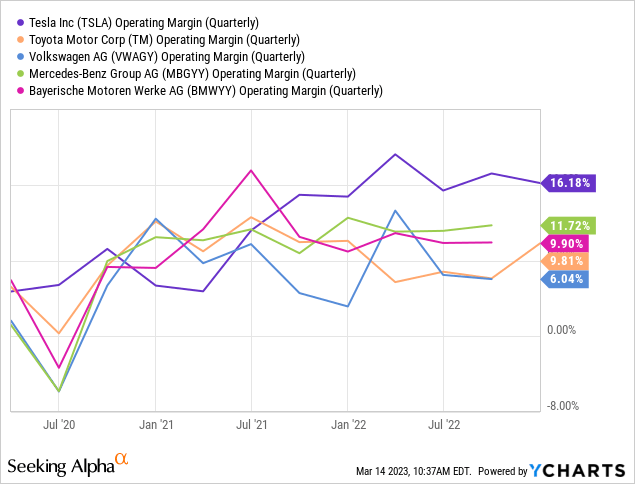

It is important to mention, that Tesla’s profitability is significantly stronger than largest legacy auto manufacturers that have been selling millions of vehicles per year during the last decade, i.e., should advantage Tesla in terms of economies of scale. In 2022 Tesla delivered over 1.3 million, which was a record for the company, but was by far lower than its competitors did.

In spite of the fact that Tesla did not enjoy comparable economies of scale as its competitors did, the company delivered by far the strongest operating margin in the last several quarters.

The most important factor contributing to Tesla’s superior efficiency was an innovation called the Giga Press, a casting machine that replaced the traditional method of welding smaller parts together. By producing larger parts with fewer number of pieces, the company gained competitive advantage in decreasing production costs. For example, the rear underbody of the Model Y used to be made from 70 parts, but with the Giga Press it now consists of just two parts, resulting in a significant reduction in production time and costs. Tesla’s Giga Press technology is a proprietary process, so it is legally protected from being replicated by competitors. Also, even if competitors will find legally viable ways to replicate the technology, it would require vast resources to be invested to modernize legacy automakers’ infrastructure required to start producing large-scale components. So, here I have high conviction that Tesla will continue expanding its margins and competitors will not keep up.

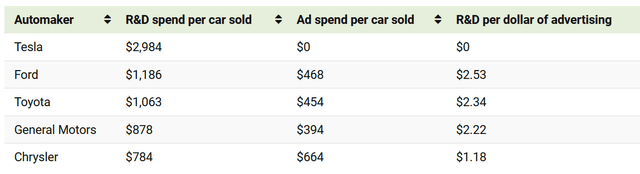

Another point that bolsters my confidence that Tesla will continue to dominate the market with cutting-edge technologies that its competitors will struggle to match is the fact that the company spends the most on Research & Development [R&D] and the least on marketing, compared to other automakers. Instead of spending money on traditional advertising channels, Tesla has focused on developing high-quality innovative products that create a buzz in the public eye.

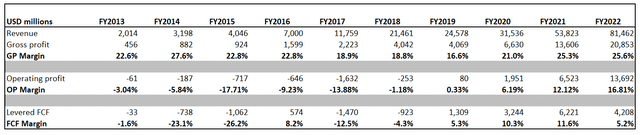

This unique approach to manufacturing and marketing has enabled Tesla to achieve outstanding results over the past decade. The company’s revenue and gross margin growth has been staggering, increasing more than 40-fold over the decade, representing a CAGR of more than 50%. Operating margin and free cash flow growth have been immense as well.

The company has very strong balance sheet with low debt to equity ratio of 6.3% and current ratio above 1.5. In October 2022, S&P Global upgraded Tesla’s credit rating to investment grade of BBB.

According to the company’s management, Tesla is expected to deliver 1.8 million vehicles, indicating a 38% growth in deliveries number. There might be an upside in deliveries numbers by the end of 2023, according to Elon Musk:

So, if it’s a smooth year, actually, without some big supply chain interruption or massive problem, we actually have the potential to do 2 million cars this year. We’re not committing to that, but I’m just saying that’s the potential. So – and I think there would be demand for that, too.

Valuation

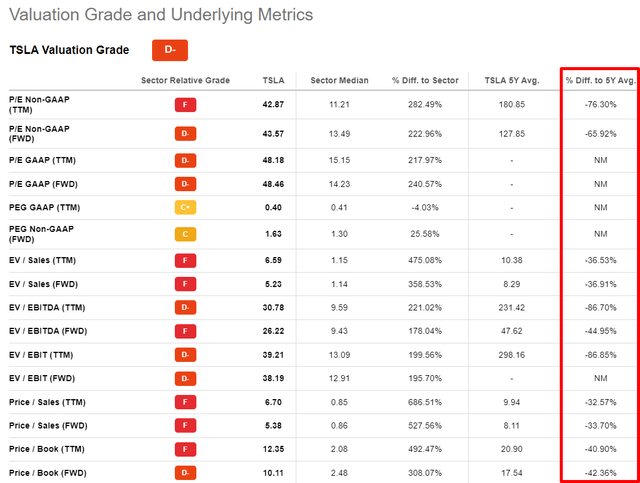

The market values TSLA stock with very generous premium because of the company’s vast potential to revolutionize the automotive industry and be one of the leading entities to execute global transition to renewable energy. The charismatic visionary leader, Elon Musk, is the second major factor of investor’s strong belief that TSLA valuation is worth it. That is why I am not surprised that the company’s valuation ratios are higher than industry averages by the factors from two to seven. Therefore, as part of multiples analysis, I believe it would be more fair to compare current multiples to historical averages. This comparison suggests that the stock is currently undervalued, especially given the company’s growth perspectives.

However, for me, pure multiples analysis does not provide sufficient evidence on the stock undervaluation. Tesla has been an amazing growth story in the last decade and consensus estimates project revenue to grow at above 20% CAGR in the next decade. Therefore, to assess TSLA fair value I believe the best option would be to exercise the Discounted Cash Flow [DCF] model.

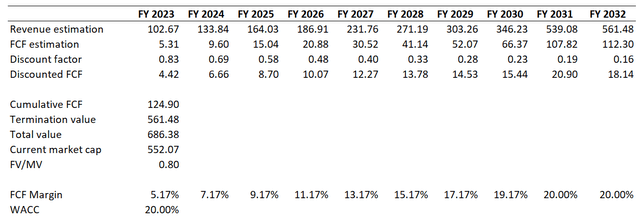

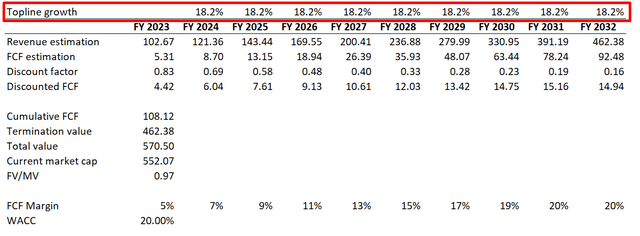

Here I would simulate two possible scenarios implementing different top-line growth rates. Gurufocus currently estimates a rather high WACC for Tesla at about 21%, so I think it makes no sense to simulate scenarios with higher WACC here. I also will not simulate more loose WACC since the Fed does not seem likely to pivot in the foreseeable future, despite the financial sector demonstrating struggles. For base case scenario revenue projections up to FY 2032, I use consensus estimates. Free cash flow [FCF] margin starts at TTM level of 5.17% in FY 2023 for DCF purposes and, based on my judgment, is set to improve by 200 basis points each year hitting close to 20% by FY 2030 and then staying flat. After incorporating all the above assumptions together, I arrived at a discount of about 20% for Tesla stock.

Given the fact that competition in the EV market is intensifying significantly, I think that for DCF purposes we should challenge the top line growth. Bloomberg projects EV market to grow at a CAGR of 18.2% to the year 2030. So, for the second scenario simulation, I incorporated an assumption that Tesla’s revenue will grow at the overall EV market’s CAGR. Even in this case, DCF outcomes suggest that the stock is fairly valued.

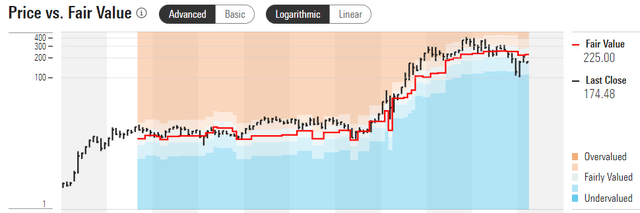

While performing valuation analysis I also referred to third-party resources which share their views on the stock fair value. Morningstar Premium estimates TSLA’s fair value at $225 per share, indicating about 30% upside potential. Based on the below chart you can see that Morningstar’s estimations of TSLA’s fair stock price have been on point.

Argus Research is even more optimistic than their colleagues from Morningstar, assigning a buy rating to the stock with the 12-month target price at $257 per share indicating almost 50% upside potential. However, it is worth to mention that previously Argus Research estimated target price for TSLA much higher, at $374 per share.

I am not as optimistic as Morningstar and Argus Research on the extent of the upside potential, but still, my Tesla valuation analysis indicates TSLA stock is about 20% undervalued at current levels.

Risks to consider

While pros for investing in Tesla stock are very robust, investors should also be aware of risks inherent to investing in the company’s shares.

First, Tesla’s stock price is very volatile, meaning that investors can suffer significant losses in a short period of time. The volatility is usually driven by Elon Musk’s twitter account, which is unpredictable for investors.

Second, TSLA shares are trading with significant premium in comparison to other EV producers due to the fact that the company is by far at the forefront of technological innovation. In case the technological gap between Tesla and competitors narrows, the premium to TSLA stock price will deteriorate as well.

Third, the automotive industry is highly competitive with the company facing significant competition from both legacy automakers like Ford Motor Company (F) and General Motors (GM) as well as innovative EV makers like Rivian Automotive, Inc. (RIVN) and Lucid Group, Inc. (LCID), which are major local competitors within the United States. Competition from European and Asian legacy automakers is even tougher across the whole world, including their domestic markets.

And last, but not least, a major part of Tesla’s valuation comprises its growth prospects linked to launch of future products and services. Any failures to meet these expectations will affect expected cash flows, thus undermining stock price.

Bottom line

To conclude, Tesla, Inc. stock is a strong buy given its current attractive valuation and future growth prospects, which I am convinced of based on its excellent past results and unique approach to manufacturing and marketing the company’s products and services. Last year’s selloff was mainly not due to factors directly related to Tesla’s performance or foreseeable future prospects. The Tesla, Inc. fundamentals remain strong, and the competitive advantage as an electric vehicle trendsetter is still in the hands of Elon Musk

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.