Summary:

- Institutional investors bought as much as 5.3% of Tesla, Inc.’s total shares outstanding in the last 13F reporting cycle.

- These investors were bearish on the auto manufacturing industry in general, which makes their purchases in Tesla all the more prominent.

- There are multiple reasons to buy Tesla’s stock at current levels.

jetcityimage

It seems like Tesla, Inc. (NASDAQ:TSLA) is once again surrounded by fear, uncertainty and doubt. Many investors feel the stock’s recent rally is unjustified, that it is overbought, and that intensifying market competition is going to eliminate the company’s growth potential going forward. But while retail investors engage in these bear arguments, a broad swath of institutional investors has been aggressively accumulating Tesla’s shares in recent weeks. This suggests that Tesla’s shares still have ample upside potential which should dissuade investors from falling into this bear trap. Let’s take a closer look to gain a better understanding of it all.

Institutional Buying Spree

Let me start by saying that institutional investors don’t have a crystal ball and they certainly don’t always get it right. However, these investors tend to have access to certain resources – such as access to company managements, analyst teams to conduct scuttle butt research, supply chain connections and research reports, amongst others – which can give them an edge over retail investors. So, tracking their trading activity can sometimes, if not always, provide us with leading insights about the Street’s ever-evolving sentiment pertaining to any given company and its associated growth prospects.

In Tesla’s case, one group of 1422 institutions collectively sold 130.9 million of the company’s shares whereas another group of 1340 institutions collectively bought roughly 298.5 million shares in the last 13F reporting cycle. This resulted in a net institutional buying of approximately 168 million shares in the said time frame. To put things in perspective, Tesla has 3.16 billion shares outstanding which means these institutions bought nearly 5.3% of its entire share total within a span of just 1 quarter. This, in my opinion, is a very aggressive pace of institutional buying for any stock out there.

For the record, the last 13F reporting cycle spanned from October through December, and the data was fully released only last week. This means this institutional trading data is still fresh and relevant to our discussion here.

But having said that, I also wanted to understand if these institutions grew particularly bullish on Tesla or if they were bullish on the auto manufacturing industry in general. After all, if this turned out to be an industry-wide trend, then Tesla wouldn’t stand out of the crowd and our discussion would end right here. So, I pulled the institutional trading data for 33 other auto manufacturing stocks, that are also listed on U.S. bourses, to get a broader perspective.

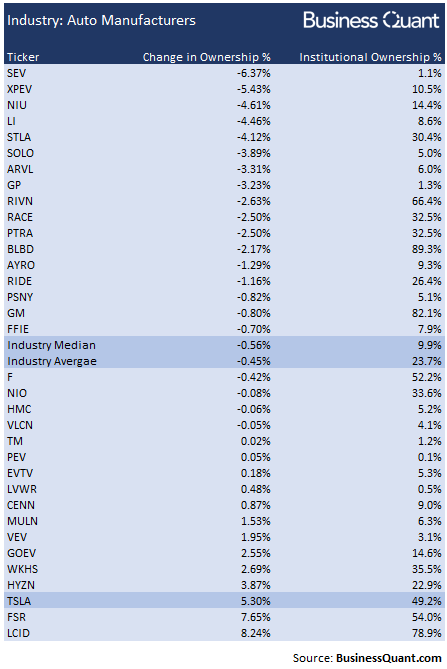

Interestingly, 21 stocks in our study group saw net institutional selloff in the last 13F cycle, whereas only 13 stocks saw institutional buying. But note in the table below how Tesla saw one of the largest institutional buying in the auto manufacturing industry. In addition to that, also note how institutions now own 49.2% of the company’s total shares in Tesla, which is at one of the highest levels seen in the industry.

BusinessQuant.com

On a separate note, Tesla’s key personnel have actively sold off their shares in the company in recent months. I don’t think that’s indicative of a bearish stance, as these share sales might have been initiated to foot the tax bill arising from their capital gains. We saw a similar dynamic playing out with Palantir (PLTR) as well. So, as far as Tesla’s insider sales are concerned, I believe it would be a cause of concern if they continue in 2023 as well.

But other than that, it’s evident that institutional investors grew bearish on the auto manufacturing industry in general, but these investors made sure to actively accumulate Tesla’s shares in the last 13F reporting cycle. But it leads us to an important question – why are these institutions growing so bullish on Tesla in the first place?

Reasons for Optimism

For starters, there was a great deal of worry up until a few weeks ago, that smaller electric vehicle (“EV”) manufacturers such as NIO Inc. (NIO), XPeng Inc. (XPEV), Li Auto Inc. (LI) and Lucid Group, Inc. (LCID) would gain market share with their aggressive pricing. Since we’re in a recessionary period, the general rationale was that industry-wide deliveries would stagnate and these younger EV manufacturers would grow at Tesla’s expense.

But per our database at Business Quant, Tesla outgrew most of its smaller peers during Q4 and blasted past all bearish concerns. This suggests that the bear case was exaggerated, Tesla’s recent decision to cut prices aided its delivery growth, and that its customer-base isn’t being diluted by more affordable EV offerings.

As the semiconductor shortages have begun easing, EV manufacturers across the globe will no longer be supply constrained and will be able to furnish deliveries comfortably. On the other hand, sub-par EV brands that were selling solely because others were out of stock or had unbearably long delivery periods, are now likely to struggle to sell vehicles as their value proposition will fade away. So, I believe that 2023 will be when the wheat will separate from the chaff and that Tesla will continue growing deliveries at its elevated pace. This, however, won’t be a valid scenario if recessionary pressures intensify and there’s widespread demand destruction across the globe.

Lastly, Tesla’s shares are trading at roughly 7.5-times their trailing twelve-month sales. This figure may seem huge in isolation but it’s actually considerably lower than its historic levels. The chart below indicates that the stock was trading at over 26-times its trailing twelve-month sales during its recent bull run. The moderation in Tesla’s valuation multiple makes it attractively priced, especially for investors with a multi-year time horizon. This, in my opinion, is another reason why institutional investors bought Tesla’s shares in recent weeks whilst being bearish on the auto manufacturing industry in general.

Final Thoughts

I’d like to clarify that institutional ownership data is based on trades that have already taken place in the past and it isn’t always indicative of future price action. But having said that, if the bear case surrounding Tesla, Inc. truly held merit and posed a legitimate threat to the stock, then a broad swath of these institutional investors would have cut their holdings in the EV manufacturer in a bid to protect themselves from the inevitable losses. But they aggressively bought Tesla’s shares in large quantities instead.

This suggests that institutional investors are heeding Tesla’s bull case and aren’t too worried about the bearish narratives surrounding the company. This should reassure Tesla’s long-term shareholders that there’s still plenty of upside in store for them and panic selling at this point will not do any good. So, in light of the aforementioned factors, I’m bullish on Tesla, Inc. stock. Good Luck!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.