Summary:

- Tesla, Inc.’s share price has dropped due to increased competition and price cuts, but long-term investors see value in the stock.

- Recent developments include layoffs, price cuts, and the delay of the low-priced Model 2, causing some analysts to downgrade the stock.

- Tesla’s potential in the robotics industry, led by CEO Elon Musk’s visionary thinking, could be a game changer for the company.

Robert Way

Tesla, Inc. (NASDAQ:TSLA) is facing a number of headwinds lately, and that has driven the share price down to more attractive levels. The electric vehicle (“EV”) market has become more competitive than ever, and Tesla has been implementing price cuts, which, of course, reduces profit margins. I can see why some investors view this stock as expensive, and it is if you have a shorter-term view. However, if you take a longer-term view, I can see why some investors take the opposite view and find tremendous value in this stock.

I was a skeptic for many years, but CEO Elon Musk has proven skeptics wrong over and over. I haven’t written about Tesla since 2013, and at that moment I was bearish. However, I am not bearish today.

There is next-level thinking, and then there is Elon Musk level thinking, which is on an even higher level. This is just to say that he has extraordinary abilities and visions for the future. His ambition and vision has led to huge returns for shareholders over the years, and I think there is a lot more to come. There is, of course, a huge risk investing in a company that is so dependent on the visions and determination of one person, but I think it is worth taking. Elon Musk is only around 52 years old; just imagine how much more he can accomplish for himself and his shareholders over the next few decades.

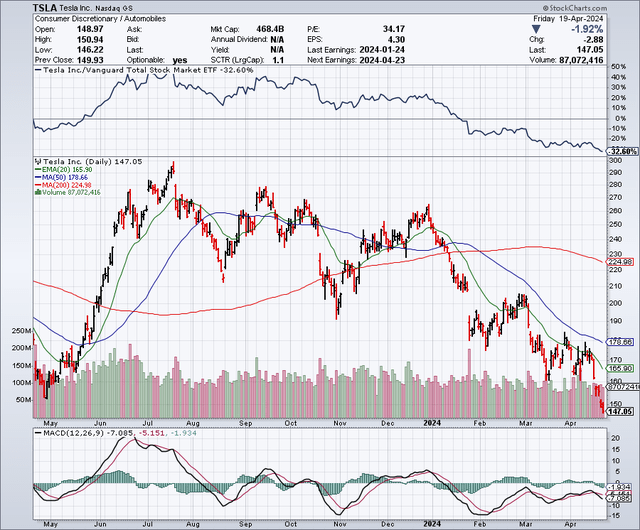

The Tesla Chart

As the chart below shows, this stock traded into the $146 range in April 2023. With the shares now in the $147 range, it seems likely that a lower level could be tested. This could be caused by a market correction, or some negative company-specific news such as earnings. For this reason, I am only buying a small position now, and will add more aggressively if we see the $100 level again.

Recent Developments At Tesla

On April 15, 2024, Tesla announced it would lay off more than 10% of its workforce. Many of the largest tech companies have been laying off employees and cutting costs. This includes companies like Alphabet (GOOGL), Meta Platforms (META), Amazon (AMZN), and many others. A reduction of this size will make the company leaner, and the financial benefits should start really showing up in a couple of quarters.

On April 20, 2024, Tesla announced price cuts of $2,000 for its model Y, S, and X cars. Earlier in April, Tesla reported Q1 deliveries which missed expectations, so this could be seen as a move to boost sales. The EV market seems a bit saturated now, and many EV makers are offering big incentives, so this is not a big surprise to see Tesla responding to market conditions.

Also in April, reports surfaced that a low-priced Tesla, that is often referred to as Model 2 and code-named “Redwood,” would be put on hold. This news definitely disappointed many investors, and the stock dropped on this announcement. It also prompted some analysts to downgrade the stock. The problem with delaying the Model 2 is that it was expected to boost revenues and volumes significantly, since it was to be priced for around $25k. It was also hopefully going to help fend off low-priced competition from China and be one of the first new designs from Tesla in a few years. This Model 2 news prompted an analyst at Deutsche Bank (DB) to drop the price target on Tesla shares from $189 to just $123.

I can understand why the stock dropped on this news, but I don’t think it merits a $66 drop in the price target. I still think Model 2 will happen at some point, and a confirmation of that is likely to cause Tesla shares to pop up.

In addition to all of this, Tesla announced it would recall all the roughly 4,000 Cybertrucks it has produced because of a faulty accelerator pedal. This is not great headline news, but as it only impacts a relatively tiny number of vehicles, the financial impact is likely to be minimal.

Humanoid Robots Could Be Huge

Between electric vehicles, battery storage devices and solar energy, Tesla has a lot going on and significant growth potential with all of these markets. However, I think robotics will be a huge industry in the coming years, and this could be another game changer for Tesla. Currently, everyone is focused on artificial intelligence, or AI, but the next evolution will be when AI converges with mobility (hardware) and that means robotics. The robots that most of us have seen in use are typically made for kids, or to vacuum your floor, so it is difficult to get excited or see any immediate practical usage for a robot that a consumer could buy today. But, that will change, just as tech has transformed products from having limited capabilities into items that we can’t live without today.

Consider these past predictions for computers:

1977: Ken Olsen, founder of Digital Equipment Corporation, once said, “There is no reason anyone would want a computer in their home.”

1985: The New York Times once stated, “For the most part, the portable computer is a dream machine for the few…the real future of the laptop computer will remain in the specialized niche markets.”

I bring these examples because for most people, if you have lived without something for much of your life, it is harder to see why you would need or want some new device like a computer. I think this is probably how most people feel about robots. But, I think people will change their mind and just like a personal computer is a much-needed item these days, a personal robot will also eventually be in most homes.

The Optimus robot is potentially going to be the next big thing for Tesla; it is clearly not the Cybertruck. Some reports suggest that in terms of robotics, Tesla is way behind when compared to some companies. While that is a concern, I believe Elon Musk will be able to catch up quickly. He has been able to land rockets back on earth, and I am sure he and his team will get this figured out. Some competitors have been at this for many years, so it is not surprising that they might be ahead in some areas. But, what Tesla has that other companies don’t have is a network effect which could be part of an ecosystem where your home is equipped with many Tesla products, such as solar, an autonomous vehicle, and an Optimus robot, all of which are compatible and in sync. It’s also important to remember that Musk came from behind in the auto and space industry and ended up leapfrogging competitors.

I Want To Invest With The Greatest Visionary Of Our Time

I feel that Tesla shares are expensive compared to most stocks I would buy, but Tesla and Elon Musk are revolutionary in terms of vision and product development. For this reason, it makes sense for me to bet on Musk with a small portion of my portfolio. Every time some analysts and investors have counted him out, he proves them wrong. Tesla has been and probably will continue to be one of the best growth stocks of this generation. Musk has been a step ahead with his futuristic visions, whether it was being the first truly successful EV maker, or his push into renewable energy, his goals for full self-driving vehicles, reusable rockets, and humanoid robots. That’s why I think owning shares of Tesla is a way to own the future.

What I like right now, is that buying a share in the future doesn’t cost as much as it did a few months ago. Tesla shares have seen a significant decline, and there seems to be plenty of negative sentiment, which is what I have seen during past bottoming out phases for this stock. Tesla is one of the most oversold stocks in the market now. I like to buy on pullbacks and when investors are not so excited about a stock, and then sell when they are.

One Of Tesla’s Largest Shareholders Sees The Stock At $1,500 In 6 Years

Ron Baron, who runs the Baron Partners Fund, believes that Tesla shares could trade for $1,500 by 2030. This prediction is based (in part) on the idea that Tesla will be selling 20 million cars per year. For a while, it seemed like the demand for EV’s was growing, but now more people are realizing that consumers want Teslas, not so much EV’s.

Potential Downside Risks

Elon Musk might be the biggest potential downside risk, in that if he leaves the company, the “Musk Premium” will leave the stock as well. My other concern is that Elon Musk could be spread so thin with so many companies that he plays a key role in. I don’t know how he does it all, and yet he does seem to be able to manage. The EV market is getting increasingly competitive, and there are concerns that very low-priced Chinese EVs are going to start impacting the global EV market even further in the coming years.

The upcoming earnings report is a potential downside risk. Tesla is expected to report Q1 earnings on Tuesday, April, 23, 2024, after the market closes. According to Earningswhispers.com, the consensus estimate is for $0.49 per share in earnings on revenues of $22.71 billion. It appears that these estimates are fairly low, and yet it also seems that many investors and analysts are expecting a miss on these numbers. With the stock down significantly going into this Q1 report, the set-up looks decent to me. However, I want to be prepared for the stock to go lower after this report, and I am more concerned with guidance for the rest of 2024, than with this quarter. Guidance and commentary about new plans or strategies could move the stock big in either direction.

My Buying Strategy

As always, I try to be gradual when buying new positions, but especially so when a stock or the market in general is in a downtrend. Since Tesla is in a downtrend, (and now the market seems to be as well), I am only buying a little at a time. I want to be able to add more if Tesla shares decline further after it releases earnings. I am also considering options, specifically selling put options which offer large premiums.

In Summary

Tesla shares have declined significantly in the past several months. Major selloffs like this in the past have always been buying opportunities. If you compare Tesla to other auto sector stocks, you will probably find it tough to buy this stock. Tesla shares will likely never look cheap, and they never looked that cheap during past major declines, but again those big pullbacks ended up being great buying opportunities.

I don’t know of any other entrepreneur who has the tremendous future vision that Elon Musk has, and I think the market is underestimating his abilities. So many of the companies he has founded have had incredible breakthroughs, from landing reusable SpaceX (SPACE) rockets back on earth, to brain implants at Neuralink. That’s why owning Tesla could be a great way to own the future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.