Summary:

- Q1 2024 earnings missed expectations, with revenues facing headwinds from deliveries and lower ASPs, while free cash flows missed by a significant margin.

- While positive that Tesla is bringing forward the launch of new models, this remains ambiguous, especially on the development of the true Model 2.

- Full self-driving, or FSD, is no longer constrained by infrastructure, FSD Version 12 seems to have positive feedback so far.

- While Tesla is currently in conversations with one major automaker about licensing FSD, a deal is likely not imminent.

- While Tesla shares rallied on media reports about Tesla having received conditional approval to deploy FSD in China, the details of this are not exactly clear yet.

Richard Drury

Tesla, Inc. (NASDAQ:TSLA) rallied more than 30% following earnings on hopes about its full self-drive, or FSD, new model launches, and more, but has since seen share price come down after the optimism faded away.

In the article below, I analyze Tesla’s recent Q1 earnings release and share my views on the current opportunity, updating my valuation according.

In summary, I see the run-up in TSLA share price as unsustainable given the headwinds Tesla continues to face in the near term. I prefer to focus my efforts on fundamentals rather than narratives in investing and based on that, I have actually revised my financial forecasts down after the Q1 2024 miss.

That said, I remain optimistic about Tesla in the long term and remain Buy-rated on the name. I have previously researched and written about Tesla on Seeking Alpha, which article can be found here.

Q1 2024 missed expectations

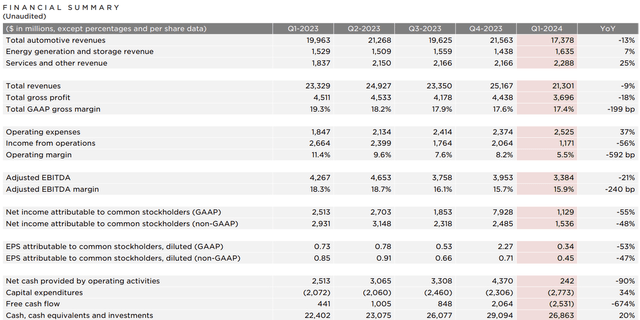

Revenues came in at $21.3 billion, falling short of consensus expectations by 2%. On a year-on-year basis, revenues fell 9% due to lower vehicle average selling prices and a decline in vehicle deliveries due to Model 3 updates in the Fremont factory and Giga Berlin production disruptions. However, that was partially offset by higher FSD revenue recognition due to the release of the Autopark feature in North America.

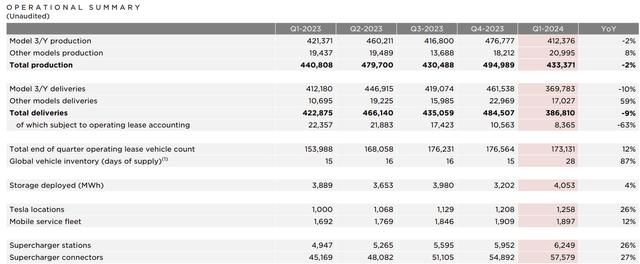

As can be seen below, the total deliveries for Q1 2024 were down -9% in the quarter, which contributed negatively to the revenue decline. The business continues to grow, with the number of Tesla locations growing 26%, the number of Supercharger stations and Supercharger connectors growing 26% and 27% respectively. Additionally, the storage deployed in Q1 2024 was up 4% from the prior year.

Gross profit came in at $3.7 billion or 17.4% gross margin, compared to consensus expectations of 16.5% gross margin. Automotive gross profit margin ex-credits came in at 16.4%, higher than the consensus expectations of 15.1%. The beat in margins were not explained, but likely due to higher FSD revenue recognition from the release of Autopark feature.

Operating income came in at $1.2 billion in the quarter, or a 5.5% operating margin. Operating income was down 56% from the prior year, which was also negatively contributed by the headwinds described above for the revenue decline, and also higher operating expenses as Tesla invested more in AI, cell advancements and other R&D projects, along with the incremental costs of the production ramp of Cybertruck. Again, this was partially offset by the higher FSD revenue recognized due to the release of the Autopark feature in North America, along with the growth in gross profit in the Energy Generation and Storage business.

Non-GAAP EPS came in at $0.45, falling short of consensus expectations by 8%.

The worst result was probably free cash flow, which came in at negative $2.5 billion, significantly worse than the consensus expectation of just negative $0.4 billion in free cash flows.

In my view, the Q1 2024 results were certainly not inspiring and there is the risk of further negative earnings revisions. For example, we saw that Q1 ’24 revenues came in soft at just $21.3 billion, which was below consensus expectations. To be clear, consensus expectations already steadily deteriorated from $25.7 billion after Q4 ’23 results to $21.7 billion before the Q1 ’24 earnings due to the trend in pricing and deliveries.

Similarly, we saw operating income missing expectations by about 9%, which had already fallen 32% since the Q4 ’23 earnings results.

That said, the focus on Q1 ’24 earnings was diverted due to mentions about autonomous robotaxis and the acceleration of the launch of new models, which brings me to the next section.

New model launches

After the Reuters article on April 5 that Tesla looks to scrap its low-cost car, there might have been some investors pricing in a lower chance that this might even happen.

In the earnings call, Tesla clarified that they are not only continuing to work towards the launch of new models, but also, it is planning to bring forward the start of production from the second half of 2025 to early 2025. Tesla was not exactly clear on this and suggested that these new models include more affordable models.

These more affordable models are now expected to utilize both the next-generation platform and the current platform, which means that Tesla is now intending to use the current manufacturing lines it is using for its current vehicle lineup.

Tesla expects that when ramped, this should bring more than 3 million in vehicle capacity and allow these new models to be launched more quickly and efficiently, without needing any new factories or large new production lines.

To be fair, the details remain scarce on the nature of the products accelerated. Without this clarity, there are some concerns that the actual Model 2 line up has been delayed, and the so called “more affordable” models may actually be less additive “de-contented” versions of existing models.

While this may be a more capital expenditure efficient way to accelerate the launch of its low-cost vehicle, this appears to leave more questions to be answered.

Firstly, it does look like this new strategy may result in achieving less cost reduction than previously expected,

These new vehicles, including more affordable models, will utilize aspects of the next generation platform as well as aspects of our current platforms, and will be able to be produced on the same manufacturing lines as our current vehicle line-up.

This update may result in achieving less cost reduction than previously expected but enables us to prudently grow our vehicle volumes in a more capex efficient manner during uncertain times. This would help us fully utilize our current expected maximum capacity of close to three million vehicles, enabling more than 50% growth over 2023 production before investing in new manufacturing lines.

The positive here is that this new product strategy and 2024 volume growth outlook could mean that EV sentiment could start improving by this spring or summer.

Secondly, there is a lack of clarity whether the new models coming out will be a true new “Model 2” or additional variations of the current Model 3/Y.

Thirdly, this does suggest that there were challenges with the new “unboxed” manufacturing process, though Tesla states the robotaxi will still utilize this strategy.

Also, to be conservative, I think it’s important to note the execution risk when it comes to accelerating production. We have seen Tesla’s initial difficulties with manufacturing the Model 3, and we have also seen similar difficulties with the Cybertrucks this year.

FSD

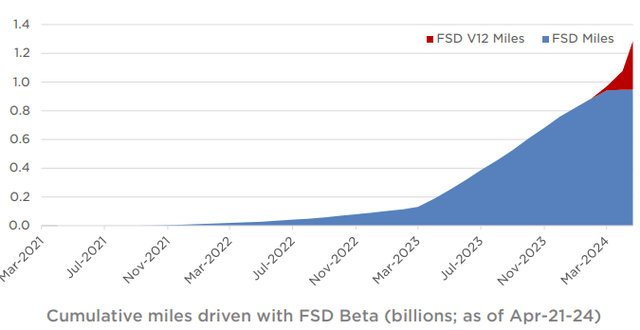

FSD Version 12 was launched in earlier in 2024, with more than 300 billion miles driven using Version 12 thus far. Tesla also transitioned to Hardware 4.0, which is its latest in-vehicle computer with improved cameras and increased inference processing power.

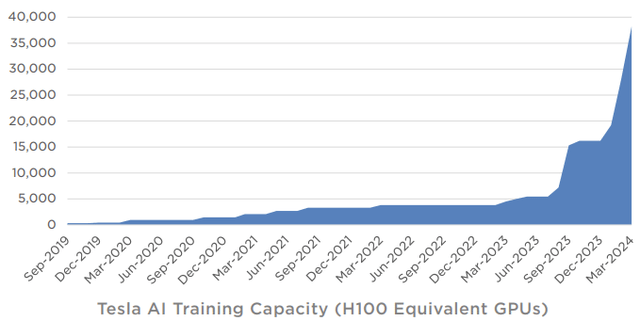

Tesla expanded its AI training capacity in Q1 ’24, more than doubling its training compute sequentially.

The company made it a point to demonstrate the vast core AI infrastructure it has built in the past few years. Tesla’s AI training is no longer constrained by infrastructure, as it currently has about 35,000 H100s, and likely to end with 85,000 H100s by the end of the year.

Tesla AI training capacity (Tesla)

I think another thing that was mentioned in the earnings call was that Elon Musk mentioned that Tesla is currently in conversations with one major automaker about licensing FSD.

It does not sound like this will result in an imminent deal, and would likely require three years of integration before start of production.

China FSD

While Tesla shares rallied on media reports about Tesla having received conditional approval to deploy FSD in China, the details of this are not exactly clear yet.

I certainly see this as a positive development, since Tesla being able to deploy FSD in China would improve its competitive position in the country. Given the intense competition in China, this is definitely a positive development for Tesla.

That said, the impact on future demand is debatable.

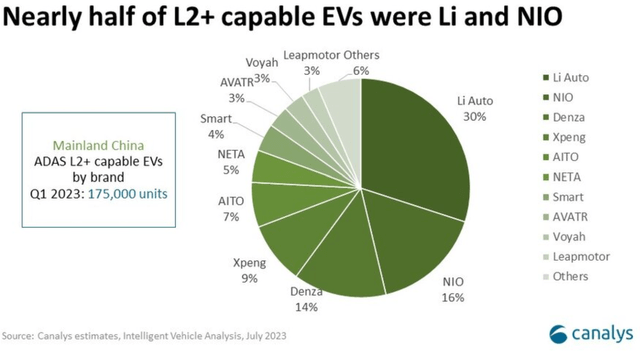

Firstly, there are many competing L2+ systems that already exist in China, and it is unclear how FSD will benchmark against those. As seen below, as of July 2023, NIO Inc. (NIO) and Li Auto (LI) made up nearly half of the electric vehicles with L2+ capabilities.

L2+ Systems in China (Canalys)

Secondly, it also remains unclear when FSD can actually be deployed because there are uncertainties about whether regulatory approvals are needed or what conditions the company must meet before FSD can be made available in China.

Lastly, there is the question whether the training that is done in China can actually be applied outside of China, and I assume the answer to that is no due to data security concerns that China may have.

As a result, while the initial thought is that this is a positive development, it is not one that changes the thesis.

Valuation

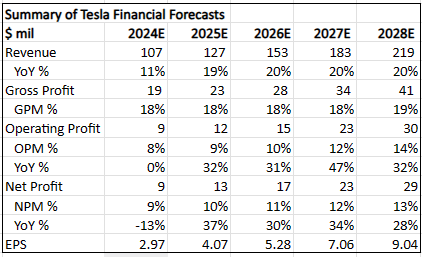

I have revised revenues for Tesla down by 2% on average, considering the miss in revenues as a result of weaker deliveries and pricing, and the incremental positive impact from FSD.

I have revised operating income down by 10% to consider the poorer margin profile in the near-term.

To be fair, my revised EPS for 2024 while conservative is still 15% higher than the consensus expectations.

Summary of my 5-year financial forecasts for Tesla (Author generated)

As a result of the changes in financial forecasts after the 1Q24 earnings, the intrinsic value for Tesla goes down to $154.

As a reminder, in my earlier article, I applied a 60x 2024 P/E and 50x 2026 P/E for the 1-year and 3-year price targets.

Again, applying 60x 2024 P/E and 50x 2026 P/E for the 1-year and 3-year price targets gets me to $178 and $264, respectively.

Conclusion

While there have been some efforts to boost the stock sentiment, I do not see the Q1 ’24 results and commentary as positive.

The change in product strategy suggests that there are challenges with the new “unboxed” manufacturing process, and there is a lack of clarity whether the new models coming out will be a true new “Model 2” or additional variations of current Model 3/Y.

Progress on the FSD front is positive, but there is unlikely to be anything material contributing from FSD licensing in the near-term.

There’s lots of hope and optimism priced into Tesla right now, and I do not particularly like the current setup for the company because too much has been priced in too fast.

I invest based on fundamentals, and this rally is not something I wish to chase now.

All in all, I remain Buy-rated on Tesla, Inc. for the long haul, and the valuation does imply upside in the long-term from here. That said, the stock is not a good buy now given that much of the positives have been priced in, including the acceleration of new models, FSD in China and autonomous vehicles. In the near-term, Tesla likely will continue to be challenged due to the macroeconomic environment and intense competition, especially in China.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 50% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!