Summary:

- Renowned investor Charlie Munger recently suggested that BYD Company Limited is so far ahead of Tesla, Inc. in China that it is almost laughable.

- We believe Tesla is experiencing huge macroeconomic headwinds, citing various industry and market indicators.

- With BYD beginning to expand internationally, combined with the reopening of China, we question Tesla’s industry-leading margins.

- We offer investors a cautious view given the turbulence Tesla is in when it comes to technical analysis, macroeconomics, and fundamentals.

DKart/iStock Unreleased via Getty Images

Investment Thesis

We personally question the continued leadership position of Tesla, Inc. (NASDAQ:TSLA) in the United States, given the margin compression they are experiencing in China. Moreover, despite numerous analysts raising the issue of competition from legacy automotive, we often do not see BYD Company Limited (OTCPK:BYDDF, OTCPK:BYDDY) as a serious threat to Tesla and its industry-leading gross margins. This article discusses why we think Tesla investors should take a cautious stance from a fundamental and technical standpoint.

Recently, legendary investor and vice chairman of Berkshire Hathaway Inc. (BRK.A) Charlie Munger spoke out about Tesla at the Daily Journal’s (DJCO) shareholder meeting. Although he had high praise for Tesla last time and called it a “minor miracle,” this time he came out with a much more downbeat viewpoint.

Charlie Munger also praised BYD in such light, a company in which Berkshire Hathaway first invested in 2008. We think he certainly has a point that Tesla is getting expensive compared to its Chinese counterparts, which serve as direct competitors, and which are likely to expand more globally in the coming years.

With that said, in the question and answer session of the Daily Journal meeting, an investor asked 99-year-old Charlie Munger, “why would you prefer to invest in BYD compared to Tesla?” To which he replied:

Well, that’s easy. Tesla last year reduced its prices in China twice, BYD increased its prices. We’re direct competitors. BYD is so much ahead of Tesla in China it’s like it’s almost ridiculous.

Now, while he did not really specify further by what measures they are so much ahead of Tesla in China, beyond price increases, he added this:

If you count all the manufacturing space they have in China to make cars, it would amount to a big percentage of all the land in Manhattan Island. And nobody ever heard of them a few years ago.

It is especially important to note that we are talking about the Chinese market here, as Tesla’s main market is still the United States and Canada.

As for production space, Charlie is implying that BYD has much more production space than Tesla. Manhattan Island, for example, is about 23 square miles, with BYD having at least 7 square miles of production space and Tesla having at least 1.2 square miles of production space, according to our estimate.

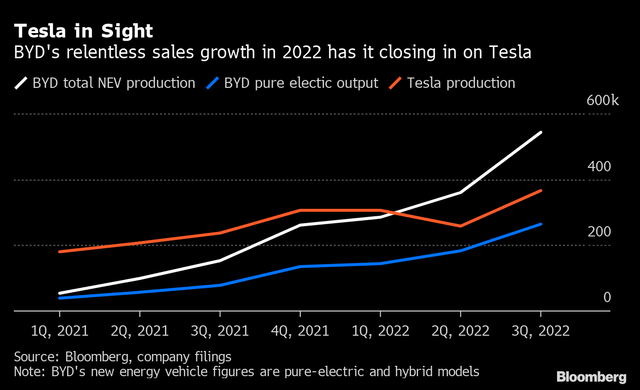

Still, it can be quite misleading, since BYD makes batteries for itself and others, among other products such as rail transportation, commercial vehicles and other electronics. Nevertheless, even for electric vehicle (“EV”) production, Tesla is in sight for BYD.

A China Phenomenon

To return to Tesla’s price cut and BYD’s price increase in China, which Charlie Munger alluded to, it is important to provide some context.

BYD did indeed raise prices twice last year, once in March and once in November. In March, they raised prices between 3,000 Yuan and 6,000 Yuan, and in November between 2,000 Yuan and 6,000 Yuan. Rising prices of battery raw materials and government subsidies expiring at the end of the year were cited as reasons for the price increase.

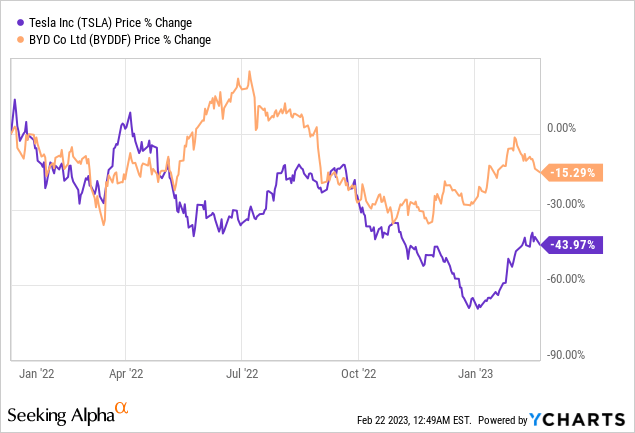

Tesla has essentially lowered its selling price in China twice recently. However, it may be unfair not to note that Tesla, for example, did raise its Model 3 price in China from 250,900 Yuan in November 2021 to 279,900 Yuan, and in March 2022, an increase of 11.56%. That said, they did recently lower the retail price to 229,900 Yuan. That means, measured fairly, Tesla reduced prices by 21,000 Yuan from 2021.

So, it indeed seems that Tesla has reduced its prices, while BYD’s prices have increased significantly. Recently, Tesla also implemented a very small price increase for its Model Y, showing that they can currently hold these margins. But by this logic, we must also consider the profit margins of both automakers.

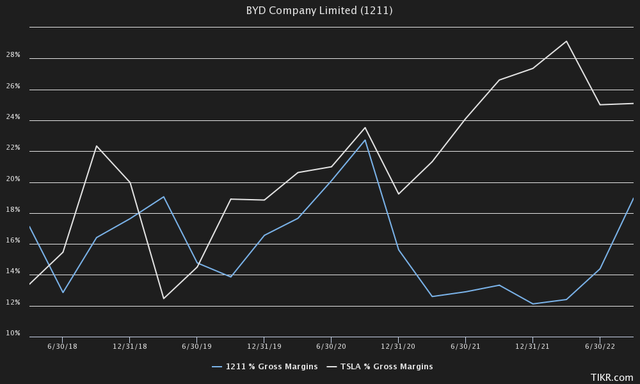

BYD’s gross margins have suffered greatly over the past 2 years as the company faced significant headwinds in 2021 and 2022 to manage production during the covid zero policy in China.

Tesla, on the other hand, also produces cars in the United States, as well as Europe, which had fewer such headwinds from the policy. But currently BYD’s gross margins are recovering nicely, as the economy reopens, and it is business as usual again in China.

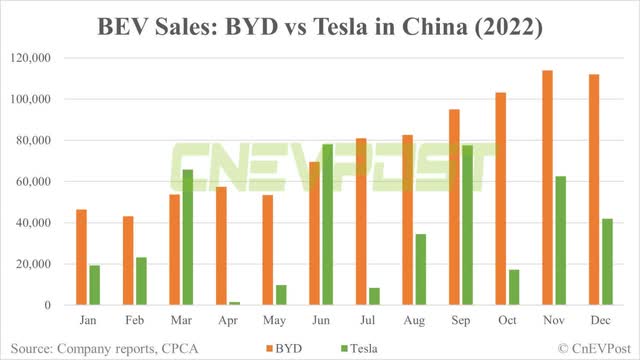

The effect of these price increases and reductions on sales in China take some time to work its way through the system. But if we look at last year’s data, for example, it is noticeable that BYD finally beat Tesla in terms of sales in China itself.

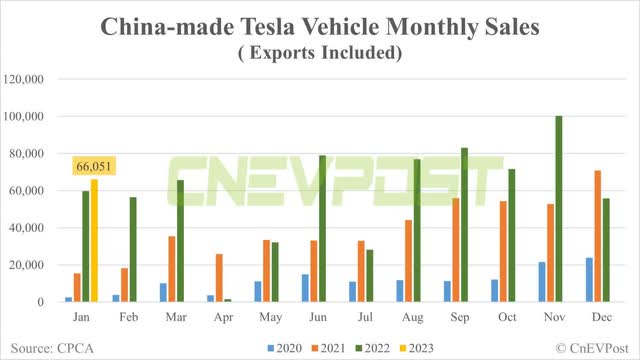

On the other hand, Tesla uses China mainly as an export center, while BYD currently sells mainly in China. But even if we include exports, Tesla seems to be facing quite a slowdown when looking at year-on-year comparisons.

Setting exports aside and looking at Tesla’s monthly deliveries in China, we see that the January price cuts have already shown a good portion of their effect. Although sales reportedly reached 26,843 vehicles, it is important to note that this growth was seemingly at the expense of margins as Tesla cut prices from 2021 prices.

So with BYD raising prices and returning to previous and more healthy profit margins, Tesla does indeed appear under pressure from its Chinese counterparts.

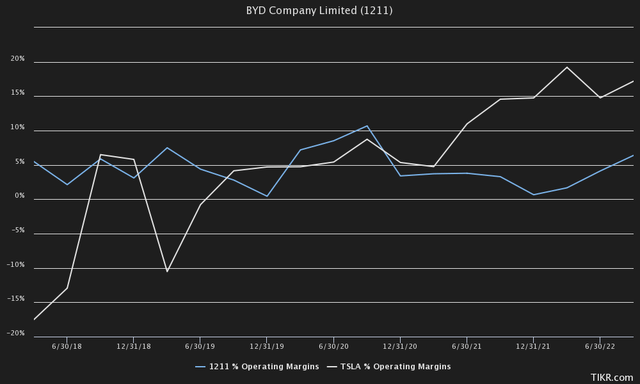

Tesla is also known for its industry-leading operating margins. While BYD’s gross margins have improved dramatically, its operating margins appear to be following suit, but not yet back to their usual 2020 levels.

To get back to Charlie Munger: while he dismissed this criticism of Tesla, Berkshire Hathaway did sell some BYD last year, presumably in a sign that it was getting expensive as well.

When asked if he was selling for purely economic reasons, or if it might rather have had something to do with U.S.-China relations, he had the following to say:

Well, BYD is selling at about 50 times earnings. That is a very high price. On the other hand, they’re likely to have increased their auto sales by another 50% this year. We sold part of ours about a year ago at a much higher price than it’s selling for now.

Although Munger mentions that they sold at “a much higher price than it is selling for now,” Berkshire has actually continued to sell. In fact, they recently sold over $2.6 billion worth of shares in the past 6 months.

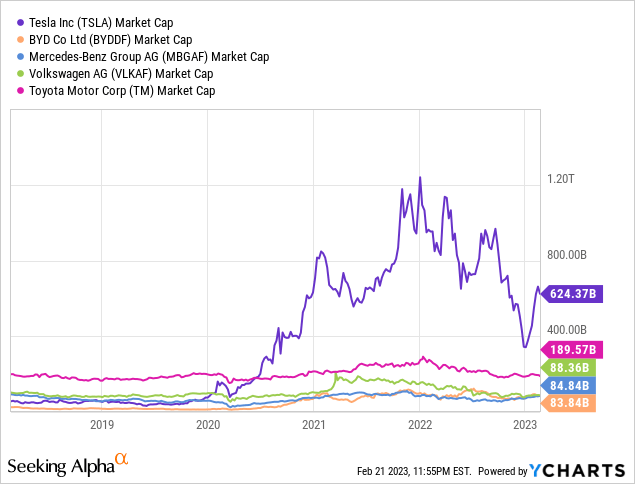

You can understand why some people will sell BYD stock at 50 times earnings. At the current price of BYD stock, little BYD is worth more than the entire Mercedes Corporation (market capitalization). So it’s not a cheap stock, on the other hand it’s a very remarkable company.

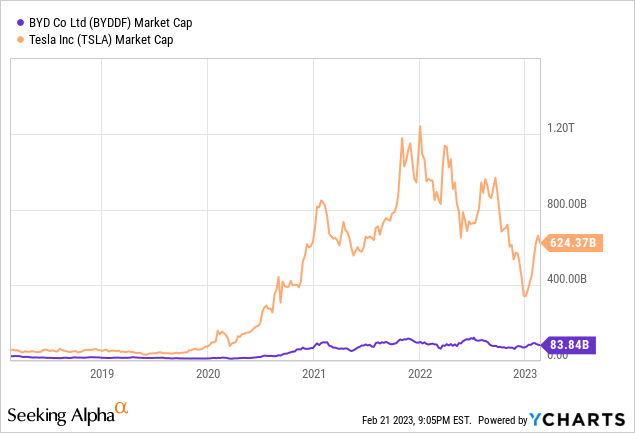

Therein also lies the major divergence. Tesla is currently miles ahead of its competitors in terms of market cap. Although that could be justified because of its industry-leading margins.

But what if those margins come under pressure, in an auto market known for its cutthroat competition? Or perhaps it should not be valued as a car company?

A Long History

Elon Musk’s Tesla, and BYD as a competitor, go way back. In an interview, back in 2011, Elon Musk was asked what he thought of competitors who were also ramping up competition. When asked if he saw them as competitors at all, he didn’t think so.

Have you seen their cars? I don’t think they have a great product. I don’t think it’s particularly attractive. The technology is not very strong, and BYD as a company has pretty severe problems in their home turf in China. So I think that their focus is, and rightly should be on making sure they don’t die in China.

Fast-forward 12 years, and BYD has overtaken Tesla in China when it comes to sales. Tesla’s management team also seems to have changed their stance when it comes to their Chinese EV competition.

The Chinese are scary; we always say that. (Zachary Kirkhorn, Q4 Earnings Call)

Elon Musk’s attitude also seems to have changed, listening to the fourth-quarter earnings call. They noted that their Chinese counterparts are putting up quite a fight, unlike the legacy auto industry, which keeps falling behind Tesla and BYD.

I think we have a lot of respect for the car companies in China. They are the most competitive in the world, that is our experience and the Chinese market, it is the most competitive. And so we would guess, there are probably some company out of China as the most likely to be second to Tesla.

Macroeconomics & Valuation

Tesla not only faces potential headwinds from its competitors, which are currently shining in China and expanding globally, but also a huge macroeconomic headwind that not many seem to recognize.

With the most inverted yield curve since the 1980s and U.S. 10-year yields hovering near 4%, it seems that both the economy and stocks may struggle. If we fall into a recession, as we and Elon believe will be the case this year, it is well known that of all sectors, the auto industry will suffer a lot.

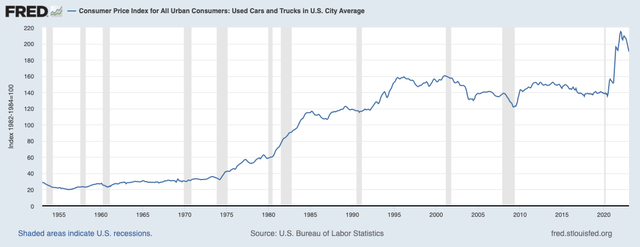

We already see this in used car market data, for example, where in 2022 there was a huge mismatch between supply and demand, with prices of certain used cars selling above sticker price.

In general, we saw high inflation in 2021 and 2022, as was also reflected in the auto industry. With monetary expansion, while supply chains were quite limited, more money went after fewer goods. But now, with quantitative tightening and rising interest rates, those conditions are being reversed.

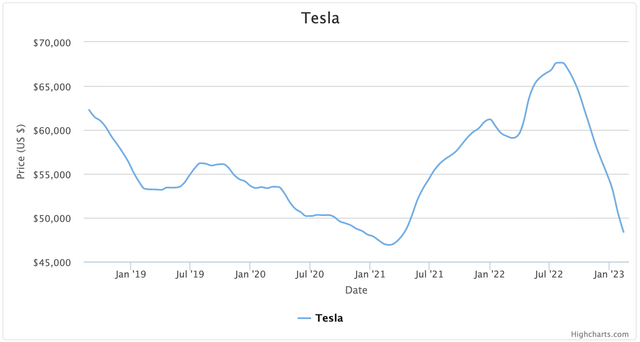

In our view, it is no wonder that Tesla has had to lower its prices for new vehicles since October, as the average price for a used Tesla fell from a high of about $67.6K in August, back to the base price of about $48K where it stands today.

This also makes us wonder if Tesla’s ever-increasing margins over the past 2 years were not the result of a mismatch between supply and demand, rather than Tesla’s superior value proposition.

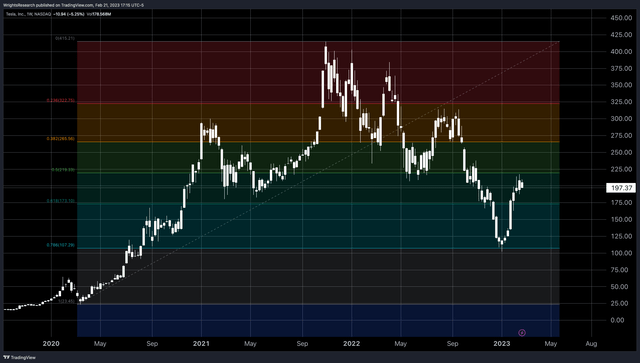

We typically don’t love throwing technical analysis into the mix, but we have noticed a pretty significant development recently regarding Tesla’s technicals. First, Tesla seems to have lost its center of gravity, and its relentless trend that it had between 2019 and 1H 2022.

If we overlap a Fibonacci retracement, Tesla’s chart seems particularly unsettled. After it bounced off the $100 support line perfectly, it came back up to approach the $220 resistance line, or the 50% retracement. It was rejected exactly at that level, indicating that it is likely to fall again.

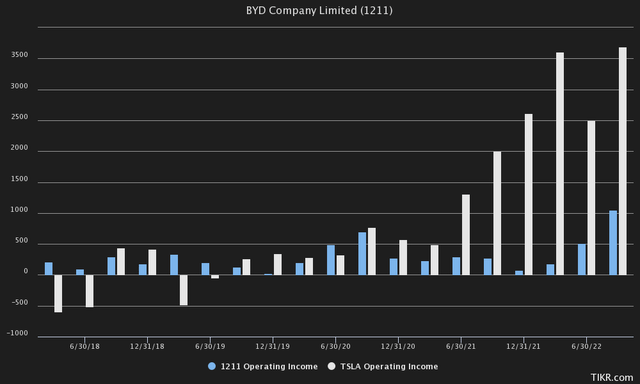

In terms of valuation, it is still important to note that Tesla has a market capitalization of $624 billion, compared to about $103 billion for BYD. Nevertheless, Tesla has indeed made more than 3.5 times more operating income compared to BYD.

But on a relative valuation, that does mean that Tesla is still nearly twice as expensive as BYD on a Q3 operating income level. And we think this gap between Tesla and BYD operating income will narrow even further as BYD’s operating margins return to earlier, healthier levels.

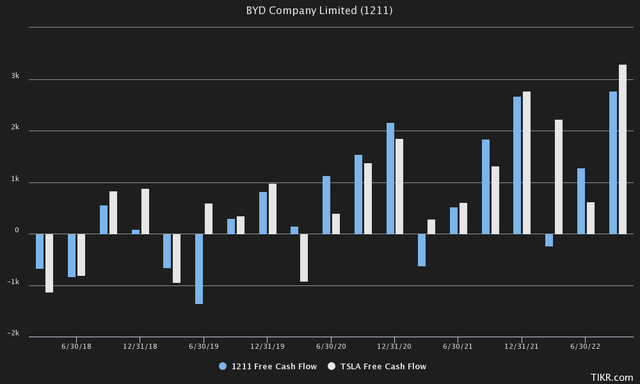

From a Free Cash Flow perspective, it is even more remarkable at what premium Tesla is trading at. The free cash flow of BYD and Tesla are very similar, despite Tesla being valued at 6x BYD’s market value.

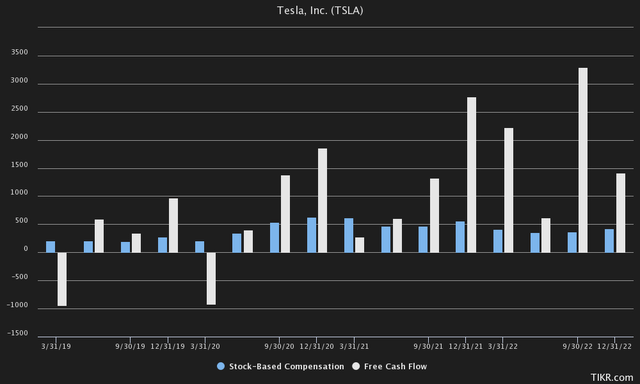

And that doesn’t include the share-based compensation included in Cash From Operations, which at Tesla makes up a lot as opposed to its Free Cash Flow.

So overall, we think BYD is a significantly more interesting investment opportunity, both in terms of relative valuation and recent execution. And yet, for some like Berkshire, BYD may still be overvalued at 40.57x third-quarter annualized operating income.

Then there is the argument of BYD’s global expansion. Currently, BYD is successfully rolling out its vehicles in Europe and Australia, which also poses a serious threat to Tesla’s market share in key markets. It was also revealed last month that Ford (F) was even in talks with BYD about selling its factory in Germany. And even though BYD currently dominates only in China, it should not go unnoticed that this is the largest car market.

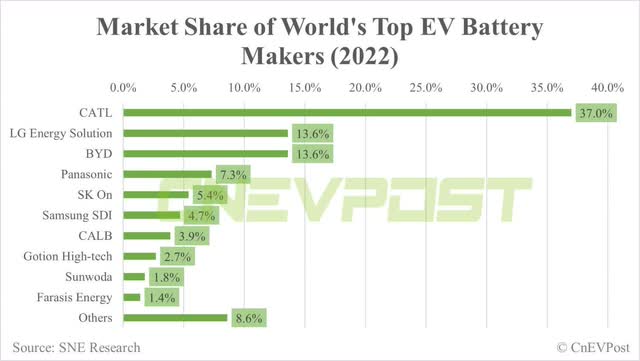

Currently, the EV manufacturers with the largest margins, such as Tesla and BYD, seem to have one thing in common: they are very vertically integrated. This is very different from the old car industry, where many of these manufacturers are making losses on their EVs.

The Bottom Line

Is Charlie Munger right that Tesla has fierce competition from BYD in China? We think so. Are they as far ahead as he claims? It depends, as we believe Tesla still has a much broader focus beyond batteries and electric vehicles.

The auto industry is and will likely remain a low-gross-margin sector because it is such a large industry to serve. If Tesla is to maintain or expand its industry-leading margins, we believe it is unlikely to come from hardware alone. This is like Apple (AAPL), which is an exception as well when it comes to the margins it has thanks to a huge and impenetrable moat with its ecosystem. But even those Tesla ventures, like FSD, have shown lackluster results recently.

If Tesla wants to become the most valuable company, as Elon’s aspirations are, it will likely have to come from one of Tesla’s other pieces like its fully self-driving software, AI or robotics like Dojo in which Tesla can differentiate itself from competitors with a wide moat. Until then, we believe they will face strong competition from vertically integrated BYD, which manufactures its own batteries and even sells them to third parties like Tesla and Hyundai.

We believe Tesla, Inc. is facing too many headwinds on the macroeconomic, competitive and technical fronts and give it a hold rating. We also would not bet against the company, given its volatility. In a recent macro article, which you can read here on Seeking Alpha, we explained why we think long-duration assets like Tesla could get crushed soon.

But to end on a more positive note for BYD and Tesla, one thing is certain: legacy automakers are most likely to experience the worst upheaval this year.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.