Summary:

- Tesla is the most highly valued automaker in the world while being only around the 20th largest by volume.

- Significant business efficiency improvements over the last five years have allowed the company to become profitable.

- Huge growth rates in both output volume and revenue sparked significant rallies for shares in 2021. Future growth prospects remain dependent on a multitude of unreliable factors.

- Valuations have dropped over 50% since record highs in late 2021.

- Uncertain future and high valuation earn Tesla a Hold rating.

jetcityimage

Investment Thesis

Tesla, Inc. (NASDAQ:TSLA) has seen huge growth over the past five years. The company has become one of the most highly valued automakers in the world. The firm was the primary catalyst responsible for making mass-market electric vehicles (EVs) a reality.

With a high-profile CEO in the form of Elon Musk, combined with a polarizing and provocative brand image, Tesla has cultivated significant conversation in the automotive world as the company blurs the lines between tech business and traditional automaker.

Significant uncertainty over the company’s EV future has marred investor sentiment and left the company trading at a significantly lower price point compared to the astronomic highs of 2021.

Therefore, many investors want to understand whether or not a long-term investment opportunity exists with Tesla stock. To gain a better understanding, a fundamental organizational analysis is required along with an intrinsic value calculation.

Company Background

Tesla is one of the most recognizable automakers in the world. Their pioneering mission of bringing battery-electric vehicles to the masses has resulted in the company developing a huge customer base along with significant automotive popularity.

Since their first car in 2008, the company has grown into a $550B automotive giant producing over 1.4 million cars in 2022, up 47% compared to the previous year. Furthermore, these impressive rates of growth have also been present in their income and balance sheets which has resulted in an almost cult-like following from certain investor groups.

Tesla focuses their business model on research and development practices to ensure their range of vehicles has the most innovative and new technology available. A significant portion of the allure Tesla vehicles have is thanks to the highly touted “Full Self Driving” autonomous driving technology.

With many supranational and national governments planning to introduce internal combustion engine (ICE) sales bans in the next 20 years, the possibility of mass adoption of battery-electric vehicle (BEVs) is starting to become a reality.

While Tesla has enjoyed an almost decade-long head start in the BEV vehicle market, the tides are rapidly changing against the automaker. The surge in competing electric vehicles from other firms could begin to erode Tesla’s commanding market position along with reducing overall demand for their BEVs.

Furthermore, the last couple of years since the company’s record high valuations in late 2021 have been less than impressive for shareholders with huge losses being experienced across the board. Significant volatility has also reduced the appeal of holding Tesla shares as many investors seek more stability from their financial instruments.

When combined with the provocative nature of the company’s CEO Elon Musk, it is difficult to determine what the future holds for Tesla.

Economic Moat – In-Depth Analysis

While Tesla is one of the most highly valued automakers in the world, their economic moat is not particularly wide. The key drivers for any degree of moatiness for the company lie in their intangible assets, brand image, and potential engineering competitive advantage.

As Tesla is primarily a luxury automaker, a significant portion of their sales and market appeal rests on the ability for management to maintain a desirable, exclusive and high-end image for the brand.

Over the last decade, the company has cultivated a reputation among consumers for being an industry disruptor and alternative from the “traditional” names in the automotive world. The company prides itself for being different from established automakers and has a culture of questioning why certain business practices are done a particular way, or done at all.

This alternative luxury image Tesla has pursued has cultivated a significant and devoted customer base who hype-up the company and their vehicles. The significant psychological “us-vs-them” mentality the company – along with Elon Musk – promotes is a strong catalyst for dividing opinion among consumers regarding the brand and their range of vehicles.

While some significant distaste exists in the marketplace for Tesla, an equal admiration and dedication to the brand is also present.

However, this brand loyalty is nothing new in the automotive sector. The devotion to Tesla held by some consumers is not distinctly differentiated from the leagues of fans established brands like BMW, Ford or Dodge may have. While a small dedicated customer base is important for companies, mass-market appeal is arguably even more relevant.

This is where Tesla’s intangible assets fail to deliver any real economic moat. While the brand may currently have a popular and relevant image among consumers, changing tastes is a huge threat to any image-dependent organization.

Tesla Ireland | Model S

No matter how strong a brand identity may be, consumers still have essentially zero switching costs when comparing Tesla as a brand to any other automaker. It is just as easy to purchase a Mercedes EQS as a Tesla Model S.

Furthermore, the behavior of CEO Elon Musk apparently has decreased the brand’s popularity, with many previous consumers perhaps choosing to disassociate themselves from the company. The high-profile nature of Elon Musk increases the volatility of Tesla’s brand image, which creates doubt on the sustainability of the brand’s popularity.

While the psychological associations consumers may have to brands can be incredibly strong, the lack of a tangible competitive advantage arising from this popularity leaves Tesla’s brand driving little long-term economic moat for the firm.

Tesla may also have some competitive advantage from the engineering prowess the company holds over the competition. The intangible assets consisting of intellectual property (IP) and battery development knowledge are valuable commodities in the increasingly competitive BEV market.

This technological advantage primarily stems from the significant head start the company has enjoyed in the BEV manufacturing industry and has left the firm with almost a decade’s worth more of research and development over the competition.

Tesla vehicles are technology focused with significant appeal arising from the features and abilities of their vehicles. The speed, performance and range of their vehicles are market-leading which has historically generated strong demand among consumers for their cars.

BYD US

However, the increasing levels of high-quality competition from established automakers such as Chevrolet, BYD (OTCPK:BYDDF) (OTCPK:BYDDY) in China along with European manufacturers such as VW, Mercedes-Benz, and BMW has left Tesla facing a difficult reality. The once unique set of vehicle characteristics is no longer as differentiated from the competition.

While Tesla vehicles such as the Model S, 3, Y, and X are still market leaders in many metrics, they have begun to share this attribute with other competing models. Furthermore, in characteristics such as comfort, build quality, and reliability, Tesla is simply unable to compete with its competitors.

Tesla holds over 3300 patents for various engineering solutions, concepts, and vehicle features. While many have touted this proprietary prowess and suggest other automakers will have no grounds upon which to compete, I believe this argument is fundamentally biased in the automaker’s favor.

Ultimately, patent advantages have been present throughout history in a variety of different industries, businesses, and markets. While advantageous to have, simply holding vast amounts of IP rights does not guarantee commercial, fiscal or operational success.

Many established automakers are incredibly innovative and adaptable companies who boast huge resources for R&D. These companies will undoubtedly find workaround solutions for any patented methods held by Tesla.

Furthermore, given the quality and reliability-oriented business models held by many competitors such as Mercedes-Benz, BMW or Audi (who consistently produce cars which rank as the most mechanically reliable in their respectful classes) will undoubtedly find even more effective workaround solutions.

Many analysts regard Tesla’s cost advantage in BEV manufacturing as being one of the most impressive and least-replicable aspects of the company’s business model. While Tesla has slashed COGS over the last five years by around 50%, the argument that the traditional automakers will be unable to replicate this seems biased.

While Tesla produced over 1.4 million vehicles in 2022 which is a huge number of cars, the world’s largest automaker by volume, Toyota (TM) (OTCPK:TOYOF) produced a whopping 10.5 million cars in the same calendar year.

Tesla is roughly the twentieth largest car manufacturer by volume. While it is true that the company is growing at a rapid pace, the equal devotion from traditional ICE manufacturers to begin ramping up BEV production should be setting off alarm bells at Tesla.

For the past decade, Tesla has held significant economies of scale advantage over the competition. However, the future will see the BEV market become just as competitive as the ICE market has been over the past 50 years.

In this changing space, it is difficult to see how Tesla will manage to maintain any real COGS advantage over the larger automakers simply due to the smaller production output potential held by the company.

Therefore, it is once more difficult to argue that Tesla holds any real engineering or COGS advantage from a pure vehicle perspective in 2023. The increasing competition from other automakers has not fundamentally degraded the product offering of Tesla vehicles, but comparatively, their hugely differentiated product range is now more homogenous than ever.

One significant advantage Tesla holds over the competition is their charging network. The significant extent to which Tesla has developed their proprietary charging infrastructure has allowed the company to become a market leader in the BEV charging business.

The unparalleled spread of charging points combined with most of these being some of the fastest chargers available is perhaps the single largest asset in Tesla’s entire business operation. Furthermore, Tesla has begun opening up their proprietary chargers to non-Tesla vehicles in a welcomed move towards universal charging infrastructure.

Their extensive charging network is one of the last remaining pull factors consumers consider when deciding whether or not to purchase a Tesla vehicle over a competing product. Now that Tesla is opening their network to other automaker vehicles, this last remaining competitive advantage could begin to result in decreasing long-term vehicle sales.

I fully believe Tesla could gently begin pivoting their business model to primarily being a battery manufacturing and charging company providing more of a service-oriented set of products. This would provide the company with a potentially sustainable exit from the hugely competitive automotive industry and instead cement the company as a consumer-oriented energy provider.

Therefore, I believe Tesla has a narrow economic moat at best which is faced by a huge number of threats moving forwards. Many of their core moat drivers are volatile factors with little tangible fixations to reality. Their charging infrastructure is perhaps the single most important differentiator for the company.

Financial Situation

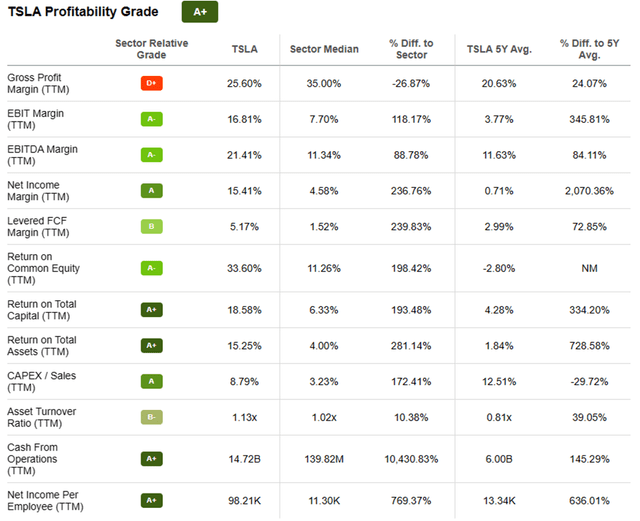

Tesla has been a relatively profitable firm for the last five years. Their 5Y AVG EBITDA margins of 11.63% combined with a 5Y average ROIC of 5.59% while not outstanding, are still quite healthy from a profitability perspective. Unfortunately, the company has a negative -1.97% 5Y AVG ROE along with a 27% deficit in gross profit margins compared to the sector median.

While the $14.72B the company has generated in Cash from Operations is impressive, the lack of impressive supporting profitability metrics places some doubts over the company’s business operations.

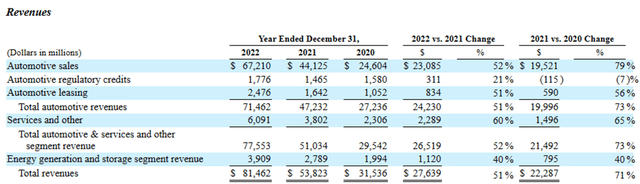

In FY22, Tesla generated $81.46B in total revenues. This represents a massive 51% increase compared to the same period in FY21. The company’s core business of automotive sales saw revenues increase by 52%.

Clearly, FY22 was a year of huge growth for Tesla which saw many different elements of their business expand thanks to significant increases in manufacturing capacity and delivery proficiency.

This was primarily due to an increase of 347,024 Model 3 and Model Y deliveries, and an increase of 38,183 Model S and Model X deliveries year over year. This was achieved from production ramping of Model Y at Gigafactory Shanghai and the Fremont Factory as well as the start of production at Gigafactory Berlin-Brandenburg and Gigafactory Texas in 2022.

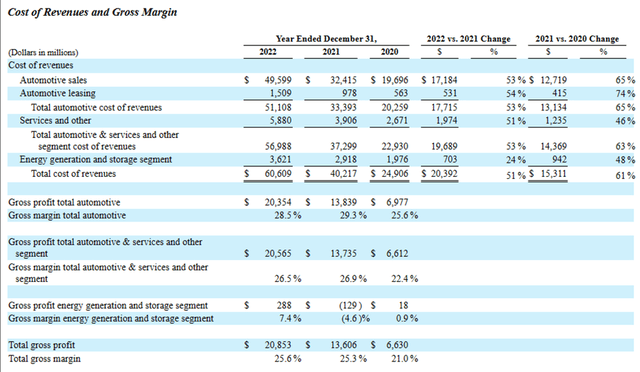

During FY22, Tesla also saw a 53% increase in the cost of revenues related to their core automotive sales business. The increase of $17.18B was primarily due to rising raw material, logistics and warranty costs.

There were also idle capacity charges of $306 million primarily related to the temporary suspension of production at Gigafactory Shanghai as well as the ramping up of production in Gigafactory Texas. Costs related to proprietary battery cell manufacturing during the year ended December 31, 2022 were also cited as contributing factors to this significant rise.

Interestingly, the huge increase in total vehicle manufacturing output led to a 0.8% decrease in the gross margins for their total automotive business. This lack of progress in reducing the COGS related to their vehicle manufacturing suggests Tesla may have missed certain key efficiency-oriented improvements in the year 2022.

However, given the hugely difficult macroeconomic environment facing all automakers in 2022, the fact that automotive sales margins remained stagnant could be considered as positive news given most automakers saw their margins contract in this same period.

The primary driver that resulted in Tesla’s total gross margin improving was the significant 12% increase in gross margins for their energy generation and storage segment. This supports the hypothesis that the primary moat driver for Tesla is their energy-provision business.

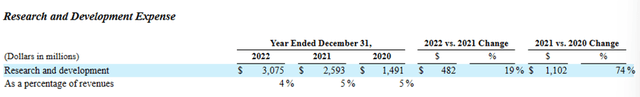

Interestingly, Tesla saw it has reduced their spending (as a % of revenue) on R&D in FY22 compared to FY21 and FY20. While the raw sum of dollars increased by around $500M, the decrease as a percentage of revenue is interesting.

This may be a result of the roughly 10% layoff in global staff seen in 2022 or due to Elon Musk freezing further hiring.

Any decrease in proportional R&D spending could expose Tesla to the threat of competing products surpassing theirs in multiple different metrics. In the short term, this reduction in R&D spending could be viewed as a necessary cost-saving initiative.

However, this would undoubtedly hurt Tesla’s image of being an innovator in the BEV market and could significantly impact long-term profitability.

From a long-term perspective, the company has operated for the last five years with a net margin of just 1.09%. While their margins for the last two years have averaged at 12.5%, it is clear that Tesla’s profitability is only in its infancy.

While gross margins have fluctuated between 15-22%, they have shown steady growth over the past three years. Positive developments in their operating margin have allowed the company to turn profitable, but significant uncertainty exists over the ability for Tesla to sustain these growth rates moving forwards.

While the significant scale improvements promised for 2023 could yield increased operational efficiencies for the company, significant uncertainty exists over the success of these projects.

Seeking Alpha | TSLA | Profitability

Seeking Alpha’s Quant assigns Tesla with an “A+” Profitability rating, which I am largely inclined to agree with when considering a short two-year timeframe.

Unfortunately, I believe the high levels of uncertainty surrounding Tesla’s future ability to generate sufficient operational margins means significant risk is present in their business.

Tesla has begun reducing the price of their vehicles due to increasing levels of competition and stagnating sales numbers, particularly in the Chinese market.

Should this be the beginning of a long-term pricing war, this will most likely lead to a reduction in the net margin per vehicle sold for the company. When combined with an increasingly homogenous product range which offer little advantages to consumers over competing vehicles, it is difficult to see how Tesla will manage to continue growing profit margins in the future.

Tesla’s balance sheets look to be in healthy shape. Their total current assets for FY22 are $41B while total current liabilities for the same period amount to just $26.7B. This leaves the firm with a good debt/equity ratio of 0.13.

Their quick ratio (current assets minus inventory divided by current liabilities) is just 0.94.

These fiscal stability metrics illustrate that Tesla operates using healthy balance sheets. S&P upgraded Tesla in October 2022 to a BBB Credit rating from a BB+ thanks to improving production and solid cash flow prospects. The outlook is stable.

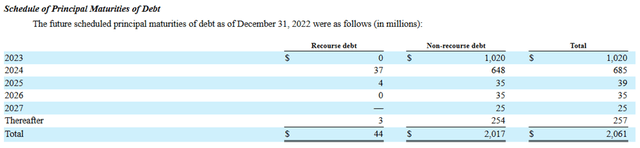

Tesla’s total long-term debt amounts to just $2.1B. This is a very small sum which is thanks to the company having aggressively paid-off these debentures over the past five years. While a significant $1.0B is due to mature in 2023, this figure is not too concerning considering their huge cash flow generation estimates.

Overall, it is clear that Tesla has been quite profitable in the last three years. While not outstanding, their healthy net margins and huge cash flow have allowed the company to become financially viable.

I believe the collapse of Silicon Valley Bank is a significant macro-indicator that future spending on tech will decrease due to the unfavorable macroeconomic conditions currently impacting markets across the globe.

This sentiment is being echoed across the market, with analyst Rob Lache adding that the expected decreased spending by consumers on automotive products during economic slowdowns could lead in increased layoffs and decreasing valuations.

Tesla’s long-term outlook remains clouded with significant uncertainty pertaining to their future ability to sell vehicles at large-enough margins. When combined with the image Elon Musk is garnering, Tesla very well may and may not be a market-leading automaker in the future.

Valuation

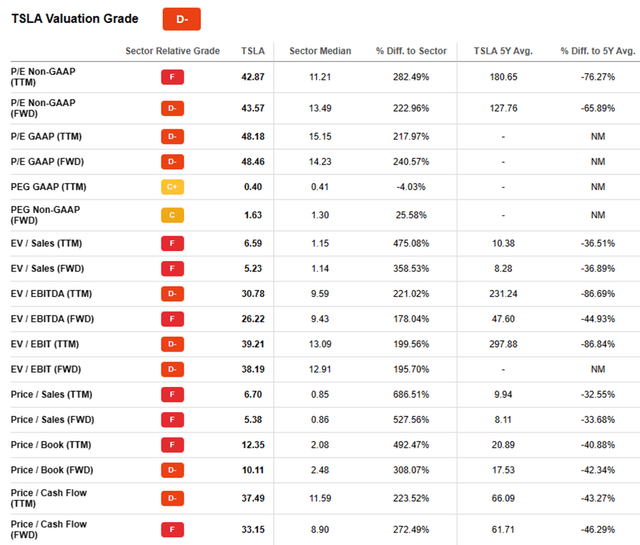

Seeking Alpha | TSLA | Valuation

Seeking Alpha’s Quant has assigned Tesla with a “D-” Valuation rating. I am largely inclined to agree with this assessment at the current time.

The firm is currently trading at an FWD P/E GAAP ratio of 48.46 and an FWD P/CF ratio of 33.15. Their FWD Price/Book ratio is 10.11 and the company’s EV/Sales FWD multiple is just 5.23. These valuation metrics suggest Tesla is currently overvalued.

Seeking Alpha | TSLA | Summary Chart

From an absolute perspective, Tesla’s shares have fallen 31.7% over the last year, resulting in shares underperforming the rest of the U.S. stock market. Considering the highs late 2021, Tesla shares have lost a huge 50% in value.

This drop in valuations was due to investors reacting to the irrational bull runs of 2021 and the post-pandemic boom which led to the astronomic valuations for Tesla’s shares.

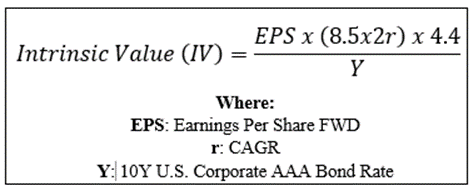

By accomplishing a simple financial valuation based on the calculation below and using the forecast average EPS for 2023 of $4.00, an conservative r value of 0.08 (8%) and the current Moody’s Seasoned AAA Corporate Bond Yield, we can derive an IV for Tesla of $94.6.

When using this conservative CAGR value for r, Tesla appears to be over-valued by a whopping 83.9%. A slightly more realistic CAGR value of 0.12 (12%) leaves Tesla being valued at around $125.

Even when using a hugely more optimistic CAGR value of 0.18 (18%), we see an undervaluation of around just 1% with an implied intrinsic value of approximately $171.

The Value Corner

Therefore, I believe Tesla, Inc. is currently sitting somewhere between overvalued and hugely overvalued. This is due to the significant uncertainty which exists with regards to the ability for Tesla to not only continue growing in profitability moving forwards but even maintaining their current margins.

In the short term (3-10 months), it is difficult to say exactly what the stock will do. I believe the stock may begin to exhibit bearish tendencies moving towards the midpoint of FY23, simply due to the prevailing theme of a recession later in the year.

A drop in valuations in the short term could absolutely be a possibility, especially given the weak 2023 investor day held by the company a couple of weeks back.

Of course, as we have seen in the past, the popularity of Tesla among the meme-stock investors and hype-train followers means significant volatility (both up and down) is possible, particularly in the short run.

In the long term (2-5 years, Tesla faces a hugely uncertain future. Whether or not they achieve their lofty COGS targets and efficiency improvements largely hinges on the firm’s ability to maintain a real, tangible competitive advantage over the incumbent automakers.

In evaluating Tesla’s current suitability to value-oriented long-term investors, I believe it is essentially impossible to argue building a position in TSLA stock.

Even if the firm traded at a significant undervaluation, implying a share price of around $80, the volatility of TSLA stock would make it a poor long-term hold pick. Research has proven that low-risk companies with beta values of less than one (Tesla has a 5Y monthly beta of 2.07) will invariably lead to better long-term value generation than their high-risk counterparts.

Risks Facing Tesla

Tesla faces a multitude of risks which will largely impact what the future may hold for the company. Some arise from the highly competitive nature of the automotive industry while other threats are more self-inflicted.

As an automaker, Tesla faces the significant threat of increased competition in the BEV marketplace. As more manufacturers begin producing a variety of vehicles for different segments of the market, Tesla may find it more difficult to compete than before.

Increased competition would most likely result in rapidly accelerating innovation as manufacturers attempt to outdo each other to create a competitive advantage for themselves. This could force Tesla to begin spending even more on their R&D program which could eventually impact their COGS should the balance between cost effectiveness and innovation become skewed.

Tesla also faces the threat of battery electric vehicles (“BEVs”) no longer being the primary method of propulsion for personal vehicles. While many automakers such as VW Group and Toyota are exploring alternative solutions to the upcoming bans on ICE vehicle sales, Tesla has placed all their eggs in the BEV basket.

This could leave the company exposed excessively to a technology which could be superseded in the future.

Tesla also faces significant threats arising from the nature of their CEO Elon Musk. The opinions being expressed by Musk combined with perceived blunders in his other businesses such as SpaceX and Twitter could harm Tesla’s image and brand reputation in some areas.

Some of Elon Musk’s tweets have also placed Tesla in hot waters with international and national automotive regulators, who may have deemed certain statements as construing misinformation or illegal with regards to Tesla’s autonomous driving solutions.

Tesla faces a host of ESG threats. Environmentally, battery technologies are incredibly intensive on natural resources and require a large number of rare-earth metals to be manufactured. The in-house mining of lithium and other metals could expose Tesla to environmental hazards and repercussions should ecological regulations be breached.

Socially, Tesla has been accused of mistreating workers and for having a toxic work environment which fosters a culture of discrimination and harassment. Many unionization attempts have been thwarted and criticized by Elon Musk, with just recently Tesla allegedly having fired 30 employees for organizing a union drive.

Governmental risks arise from the potential for Tesla automobiles to not comply with regulations or for experiencing safety-related issues. Given the significant number of quality control issues some say are present at Tesla, the risk of a severe and consequential recall costing the company fiscally is a real threat.

All these risks and threats add-up to create a significantly uncertain future for Tesla. Unless the company can adequately mitigate the potential for undesirable future events, the company will fail to achieve their lofty profitability and efficiency targets.

I believe this leaves value-oriented long-term investors with a pretty clear situation: Tesla currently harbors excessive risk to warrant building a position. Furthermore, the significant uncertainty arising from these threats means accurately evaluating the company’s intrinsic value is almost impossible.

Summary

Tesla, Inc. had a decade over the competition to begin building a BEV empire. While the company is a market leader currently, the significant levels of competition entering the market over the coming decade leave the company facing a difficult reality.

A lack of comparative product differentiation combined with increasingly competitive alternatives for consumers means Tesla’s economic moat is left in a delicate situation. While their charging infrastructure remains unparalleled, this alone will not result in a profitable business operation.

Considering the number of risks facing the company, too much uncertainty is present in trying to calculate Tesla’s intrinsic value. While the potential exists for Tesla to continue being the market leader for decades to come, I will be watching this outcome from a non-shareholder perspective.

I, therefore, believe Tesla warrants a Hold rating. I believe building a position in the company at present exposes value-oriented investors to excessively high levels of risk.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own.

Please conduct your own research and analysis before purchasing a security or making investment decisions.