Summary:

- Tesla, Inc. reported record sales in Q2, with China accounting for over half of the automaker’s global sales. However, domestic competitors in China are gaining ground on Tesla.

- Investors are looking to Tesla’s Q2 earnings report, expected on 19 July, with concerns over operating margins and the impact of price cuts on revenue. A further drop in margins could push the company into negative cash flow territory.

- Tesla’s valuation could be impacted by protectionism and nationalism, with questions over how China will tolerate overseas competitors in its electric vehicle market. There is also potential for Chinese brands to encroach on European markets.

Xiaolu Chu

Tesla, Inc. (NASDAQ:TSLA) will soon release its latest earnings after another record for deliveries. Here I discuss the outlook for the Tesla balance sheet and the valuation outlook.

Record deliveries in China, but the competition is growing

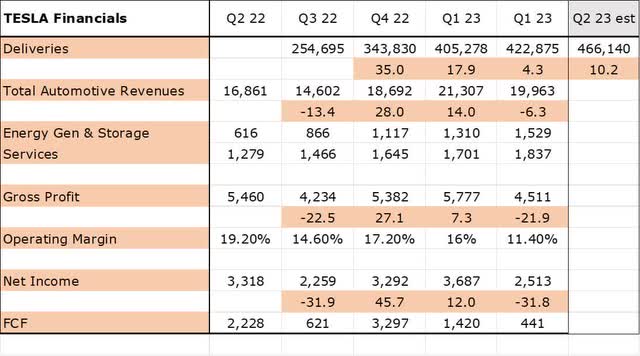

Electric vehicle pioneer Tesla reported its latest production and deliveries last week with another record for sales in the second quarter. The company reported deliveries of 466,140 units, for a 10.2% improvement over the first quarter.

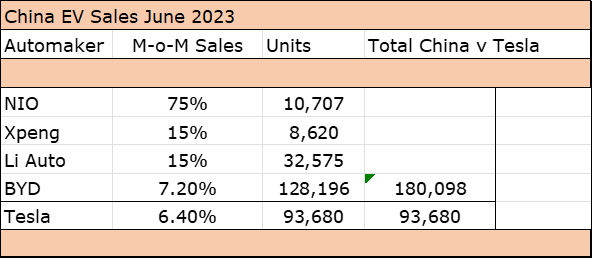

The standout from this report was wholesale deliveries of 93,680 in China, where the country now accounts for more than half of the automaker’s global sales, according to data from the China Passenger Car Association (CPCA). Yearly data adds a ribbon to the figures with a 120% jump over the same quarter a year ago, with June sales growing 19% for the same month last year.

However, the reality is that Tesla’s Chinese domestic competitors are gaining ground on the company. Four domestic competitors outsold Tesla by a factor of almost 2:1. Month-on-month gains also saw the Austin-based firm at the bottom of the pack, with a 6.4% improvement from May.

The figures also don’t include 120,000+ hybrid vehicles sold by the Warren Buffett-backed BYD Company Limited (OTCPK:BYDDF).

SCMP, Author

Tesla’s sales in China were good, but there is a growing appetite for domestic vehicles, while the effects of the Tesla price cut strategy have to be considered

What to expect from Tesla’s second-quarter earnings?

Investors will now look to Tesla’s post-market 19 July earnings report for the second quarter to consider the latest deliveries, but it is fairly easy to work out. Tesla’s financials over the last three quarters show a lower increase in revenue, compared to deliveries.

Last quarter’s 4.3% bump in deliveries saw a -6.3% decline in automotive revenues. The latest figures are likely to remain flat at best despite a 10.2% jump in deliveries.

The other problem for this coming quarter is that the company embarked on further price cuts, and this could drag revenue even lower. One benefit for Tesla is that the U.S. dollar has strengthened against the Yuan in that time, and the sales increase could negate some of the lower prices.

The big issue for the second quarter earnings will again be operating margins, which have slipped from 17.2% to 11.4% over three straight quarters. A further drop in margins would likely push the company into negative cash flow territory. The decision over the coming quarters would be whether to halt the price cuts or burn through the company’s cash pile.

The former looks like it will be the case after executives from the largest brands signed a truce over “abnormal pricing” this week. Tesla’s sales bump in the first half of 2023 may now start to slow if prices normalize.

Inventory is also an issue for this quarter with Tesla producing excess vehicles for a fifth-consecutive quarter. The cumulative total is 91,000 vehicles at a cost of around $38,000 each or a total of around $3.5 billion. The latest deliveries would add $500 million to that figure.

Increasing inventory led to a rise in working capital that hurt free cash flow in Q1.

Protectionism and nationalism is the elephant in the room

The big problem ahead with giving lofty valuations to Tesla comes in the form of protectionism and nationalism. How will China tolerate overseas competitors in its electric vehicle push? Is the latest surge in Chinese vehicle competition a sign of growing interest in domestic EVs?

A deterioration of relations between the U.S. and China has seen protectionism from both sides in the market for chips. These problems could escalate with a Chinese military move against Taiwan. China’s Premier Xi Jinping urged his military to increase war and combat planning this week, just as U.S. Treasury Secretary arrived this week to soothe tensions. If China did invade Taiwan, do U.S. companies then have to cease business in the country, like they did with Russia? Even without a war, China has always sought to protect its technology and could reduce subsidies for overseas brands as its domestic players build their own infrastructure.

As for domestic demand, Chinese consumers have relied on overseas brands for forty years, but the tide could be changing. There is also the threat of those brands encroaching on European and U.S. markets.

“It would be the best for foreign brands to learn from new Chinese EV startups if they want to survive in China or face the disruptive impact from those brands in their home markets,” Stephan Dyer, from consultancy AlixPartners said.

The company expects annual sales of Chinese cars in overseas markets to grow to 9 million vehicles by 2030. That would result in a global share of 30%, with a 15% share of Europe. Another feature will be consolidation, with analysts at AlixPartners saying only 25 to 30 of the 167 NEV brands can survive by 2030 due to a lack of sales.

A word on valuation

Tesla currently has a price/earnings ratio of 83X and a forward ratio of 58X, but those figures could rise with a further stock price surge and a deterioration in earnings per share in the second quarter release.

The stock would also see its price-to-free cash flow ratio expand beyond the current 157X. It was ok to pay those prices when Tesla was ramping up production with little competition, but it is now a mature company and could be facing headwinds with its hold on the China market, which now accounts for 50% of sales.

Tesla said that its Q1 delivery ramp was part of an effort to push further into APAC and MENA regions. Coupled with the boost from government subsidies and a price cut strategy, Tesla has reported records for deliveries and increased its share of the Chinese market. With the end in sight for Tesla’s price cut strategy, sales could start to stall for the company as Chinese buyers start to have more faith in domestic vehicles.

I believe Tesla’s earnings and financials could disappoint in the second quarter and investors would be better served considering a rotation into other electric vehicle names.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.