Summary:

- Tesla, Inc. production in China is trending above management’s guidance on production.

- Tesla production roadmap and services implies revenue upside to consensus models which is driving the stock price.

- We quantify that China alone will contribute +113k units above delivery guidance of 1.9M total vehicles produced this year.

- We value Tesla on the basis of adjusted EBITDA and net profit growth, and anticipate higher margins versus peers given efficiency and average car price trends.

- We value Tesla stock at 25.5x FY ’25 earnings, and anticipate the stock to trade at $230 by year-end, implying +18% upside at the time of writing this report.

Xiaolu Chu

Tesla, Inc. (NASDAQ:TSLA) initial production figures for the month of January certainly sets TSLA on the right track. The production figures suggest that TSLA is trending higher than the implied guidance from the Q4 earnings deck of 750,000+ units produced in China. According to a separate report, from the Chinese Passenger Car Association, TSLA produced 66,051 units, which is trending higher than expected. Given the positive Chinese news, TSLA stock added to the momentous rally following its earnings announcement, thus driving a +72% advance in the stock over the past four weeks.

We anticipate that ramping Chinese production adds some production upside to our model of +113K units this year, we also anticipate that the Texas production line will move quicker than expected on Model Y production closer to management’s stated goals, which is why we move our production figures to conform with our heightened expectations. We think Tesla’s deliveries will be a key theme as we progress through the year.

Our thesis on selling price and margins in 2023

Our estimate on production growth, and the impact it will have on car deliveries, and total selling price will be reflected in our model. We anticipate that FY ‘25 ASPs will continue to trend lower, but likely troughs in the low-$40,000 range. We doubt TSLA goes any lower than those prices on a weighted average basis, as many conventional automakers can sustain pricing at higher levels.

Since TSLA’s volume is starting to become comparable to big automakers like General Motors (GM) at 5.9M vehicles (2022 production) versus our Tesla 2025 production estimate of 4.38M vehicles, we arrive at the unenviable conclusion that the volumes of vehicles will push ASPs lower. However, what’s catching more analysts and experts by surprise is the fact that TSLA’s competing at near-price parity with industry averages, and yet TSLA’s more profitable than the rest of the auto industry.

Keeping this in perspective however, the U.S. average non-luxury vehicle was sold at an average priced point of $49K December 2022, which compares to TSLA’s 2022 ASP of $50,736, or just a thousand dollars above the non-luxury price point in the United States. Meaning that TSLA’s positioning as a premium brand may have diminished given the absence of pricing power in some instances, but the overall gross margin and efficiency gains have translated to an argument that TSLA’s volume + margins make for a more profitable car.

Even though the short-term dynamics imply pricing pressure across the product line, we find ourselves optimistic that TSLA’s price war will have limited impact on profits, which is why our price multiple goes higher in this report as well.

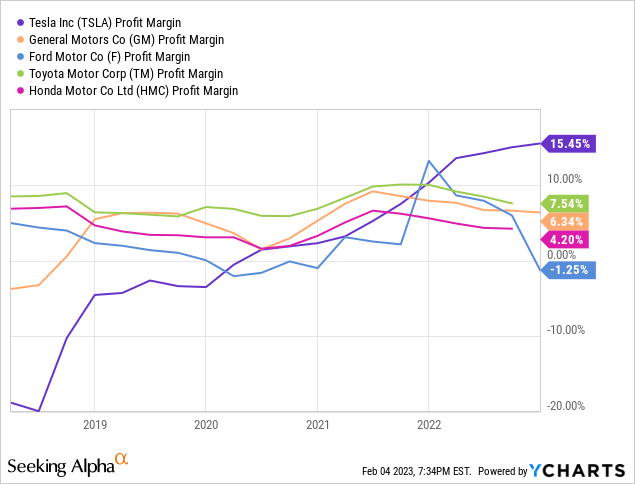

Figure 1. Tesla Profits versus conventional automakers

Ycharts (Ycharts)

TSLA is currently the most profitable mass auto manufacturer. It’s the most profitable while selling at industry price points and at industry mass vehicle production volumes. So, price competition from Detroit or Japanese automakers doesn’t yield the results investors were hoping for, as it’s difficult to hurt TSLA’s profitability with what many would consider inferior last-generation ICE cars. Big autos are making the transition from having no production lines or expertise to then suddenly producing BEV-hybrids in volume, but not at the same profit margins of TSLA.

What’s not normal is how TSLA’s profit metrics improve unlike conventional automakers over time. When compared to automakers who have historically never trended above 10% net profit margins, whereas Tesla 15% net profit margin at 1.8 million deliveries, means that BEVs (battery electric vehicles) are flat-out more profitable than conventional cars currently. And, we anticipate that these trends will become more apparent thus driving further profit contribution on the basis of production improvements.

It’s sort of like the Moore’s Law of computing playing out at the battery chemistry level, where TSLA’s able to offer cost savings on battery efficiency improvements. So, as more consumers adopt BEVs the cost of battery packs go down, and the cost of production goes down, the utility of those battery packs also increases. It feels a lot like semiconductors, where the cost of a transistor dropped continuously over the past century, but the utility of computing continued to increase at an exponential pace. We think batteries can exhibit similar properties, and assuming TSLA is at the cutting edge of battery chemistries, it can maintain a cost and margin advantage over competitors, and thus maintain the semiconductor-like nature in profit expansion. This is why we think TSLA’s not at peak profitability, but rather we’re modeling a conservative scenario before valuation gets out of hand, and doesn’t offer any predictive value.

We think BEV profitability will trend higher, but for the sake of conservatism we model flat profitability in our financial model, as we expect net profit margins to trend between 15%-17% over the next couple years. However, if profitability does surprise, because of the trends we outline it could be another factor that drives material upside to the stock price, driving material upside to our bullish thesis as well.

Chinese and Texas production volumes keep us excited

We anticipate that by the end of December 2023, Tesla will eventually reach peak production capacity of about 85,000 units per week. Tesla produced 66,000 vehicles in China this past week, and we anticipate that the gradual growth in weekly unit production yields maximum production capacity by the end of 2023. Assuming those figures are met, which seem highly likely, we anticipate a substantial beat to TSLA’s guided delivery figures.

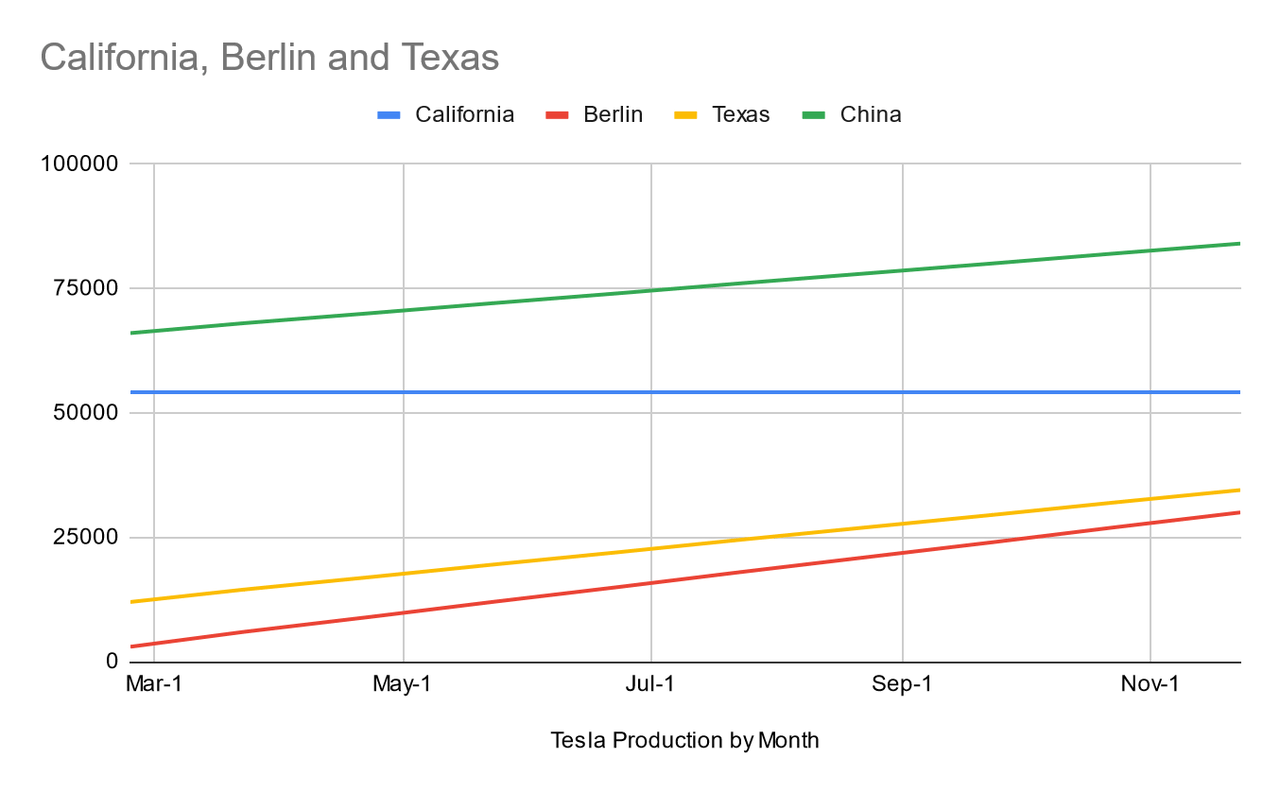

Figure 2. Production by Production Line

Estimates on Tesla Production Run Rate (Trade Theory )

California’s Fremont facility has reached mature production, so we leave the California (blue line) flat for our production ramp model. However, the remaining two production lines in Berlin (red line) and Texas (yellow line) could diverge from the production outlook. Our bias is that Berlin Germany’s production ramp won’t live up to expectations as much as Gigafactory Texas given the amount of attention and focus on the Texas production ramp versus the remaining facilities.

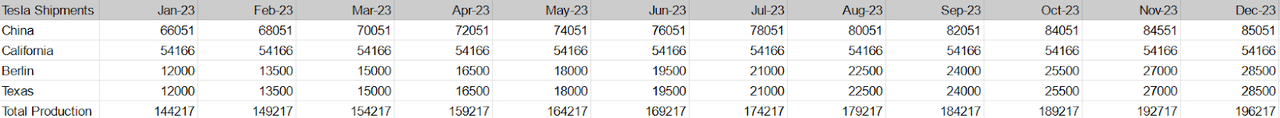

Figure 3. Production ramp table expanded

Estimate on Tesla Production Volumes 2023 (Trade Theory)

We’re anticipating monthly production volume growth of +2,000 units/per month until China maxes out production at 85,000 units per month. We think China will reach production capacity quicker, given specialization of advanced manufacturing in People’s Republic of China.

We anticipate flat production volume growth in California, as the production plant is at full capacity. Whereas the ramp-up of Berlin production is set at +1,500/month, and whereas Texas at +1,500/month given the added scale of the Texas facility but slower start time, we think production will be comparable to Berlin by the end of the year, with maximum capacity being higher at the Texas facility. Since we’re in early stage ramp-up for both production lines, the production capacity growth should be more significant at the early stages of production ramp, whereas China’s production line is more mature and is trending towards full capacity. We base our initial Texas production rate on information that was released in December.

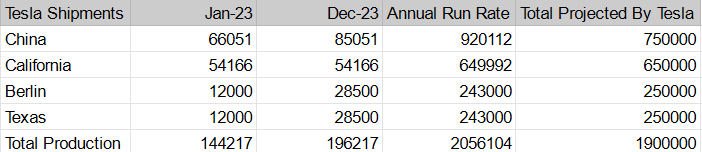

Figure 4. Production ramp summarized

Tesla Production Trend versus Management Guidance (Trade Theory)

We anticipate that Tesla will report 2.056 million total vehicle production by the end of 2023, which is meaningfully higher than the 1.9 million figure as a base from 2023 outlook. We anticipate that Tesla’s Chinese production ramp, and confirmation of continued production gains in Germany and Texas will translate to a total production figure that’s +154K units above the initial guidance.

Based on this production ramp, and assuming there’s very little or only a small contribution from the Cybertruck, our unit forecast could prove somewhat conservative. What’s driving the near-term TSLA stock price is the modest surprise on Chinese production based on how production is trending. We can always make adjustments to these figures to be more accurate as we progress through FY ‘23.

Financial model overview and financial value estimate

We embed our production ramp estimate into our total unit deliveries for our FY ‘23 estimate on revenue. Assuming pricing also declines by -6% on average based on price competition, we anticipate that Tesla will report revenue of $118.4 billion, which compares to consensus estimates of $103.18 billion. We’re above consensus estimates by +$15.22 billion on revenue, and our FY ‘23 dil. EPS figure of $4.50 compares to consensus estimates at $3.96 dil. EPS. The consensus range is wide this year, and our estimate while above the average is within the analyst consensus range of estimates on earnings and revenue for 2023.

We expect +154K additional units above delivery guidance, mostly driven by China contributing upside to production totals whereas our Berlin and Texas production estimate for 243 thousand units corresponds to TSLA’s outlook for 250 thousand units for both facilities.

We also anticipate more growth from TSLA’s remaining business units such as energy generation, storage, and services. We estimate +70% sales growth translating to a $20.35 billion business by the end of FY ‘23. We expect the remaining segments to drive +$8.4 billion in total revenue growth for FY ‘23.

We think this growth rate is achievable given the attachment of accessories, warranties, financing services, battery storage, which implies that each unit delivery will translate to some other segment contribution. Based on historical growth trends, the other business segment represents 15%-25% of TSLA’s total revenue over the next three years, which we capture in our multi-year financial model.

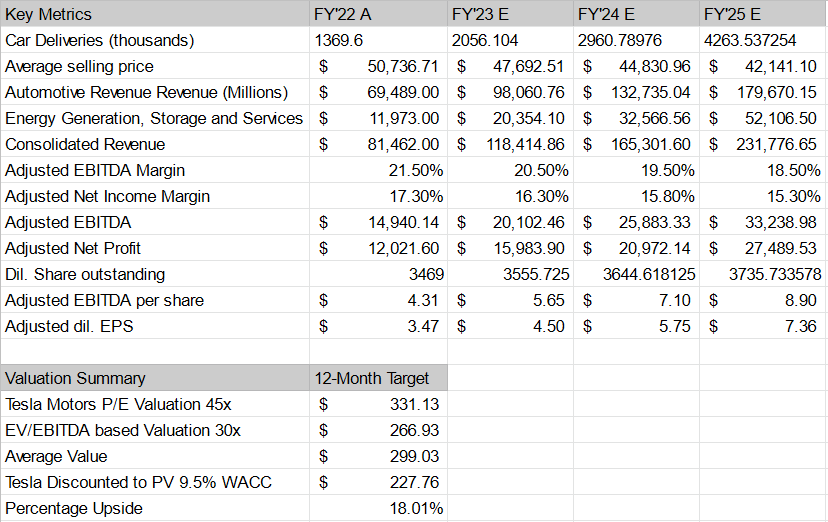

Figure 5. Tesla Financial Model 2023

Tesla Financial Model (Trade Theory)

We value Tesla on the basis of FY ‘25 results, and we apply a more aggressive growth multiple at 45x forward earnings, 30x EV/EBITDA multiple, and arrive at an average value of $300 per share before we discount the average price estimate to present value by the firm’s 9.5% WACC, which yields a price estimate of $227 currently.

We anticipate an incremental +18% upside driven by our model assumptions on pricing, units, and historical margins. We anticipate a combination of surprises in the production chain, and the ability to sustain enough pricing on ASPs to drive revenue estimates in 2023.

We anticipate a modest drop in net profitability to about 16.3% as they continue to scale-up various cost intensive OpEx items tied to future production and development of new vehicle lines before new battery technologies start to yield an even better gross margin figure that translates to even better net profit margins, perhaps by 2026 or 2027.

The production ramp for Cybertruck and Semitruck could have some negative impact on margins, so we limit our expectations on profit margin expansion in our financial model, keeping to a mid-teen profit margin. We anticipate that as those production lines start to mature, the profit contribution will trend well past what we’ve seen historically, but given the absence of actual sales data and how it affects overall profitability – we’re limiting our expectations on profitability over the next three years.

Time to load up on Tesla?

We like Tesla, Inc. stock long term, and we value the firm at 25.5x forward FY ‘25 earnings, which is quite conservative and cheap given the company’s growth rate. Strengthening production volumes in China further support our bullish thesis, as we anticipate a production beat on aggregate volumes. We think some of the negativity stems from production in Germany and Texas, but news changes quite fast, and we anticipate that production from the United States and Europe will eventually trend closer to management’s internal forecast.

What could surprise every analyst is the eventual production maximization from Shanghai, and the added contribution of services and energy revenue that continues at an insane growth CAGR of 50%-70% over the next three years. These two factors, when captured in our updated Tesla model, suggests further upside to the stock from where we’re trading, which is why we recommend TSLA as a strong buy to our readers.

Keep in mind, Tesla has rallied by +72% over the past four weeks, but it was already trading at a low base of $110 from early January, which then proceeded into what has been a parabolic rally up until this point. The stock wasn’t ever supposed to be that cheap, but markets always surprise investors with irrational pricing over shorter time frames. By the end of the year, we anticipate TSLA will achieve a much higher valuation, but we also limit our optimism with a price target of $230 implying a more modest +18% upside following what has already been a phenomenal run in the stock.

There are always risks to investing into Tesla, and we would argue that any production deficiency could have a major impact on the stock, and implied revenue estimates from analysts. We’re arguing our bull case due to promising Chinese data, but anything tied to U.S. or European production could have an adverse effect on sentiment tied to the rollout of Cybertruck or on-going Model Y production.

We don’t think consensus estimates embed any Cybertruck shipments, but those expectations will change as we go through the year, and could drive another run in the stock assuming we get details on how TSLA plans on growing production at its stated goal, and how Cybertruck plays into those numbers and average selling prices. Assuming those details start to make sense, and get priced into the stock… we could see the valuation thesis moving higher throughout the year based on anticipated news and details shared at various TSLA events.

For now, we stay the course, and recommend Tesla, Inc. to our readers, as TSLA stock could easily trade above $230+ based on our model and what we understand about the company currently.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.