Summary:

- Tesla, Inc.’s Q1 performance is expected to be reported soon, but the company’s stock has declined by 30% since October 2023.

- Tesla’s financials show a strong balance sheet with ample cash, but sales growth has been slowing and margins have been deteriorating.

- The potential catalysts for future growth include Full Self-Driving technology and Robotaxis, but their realization may still be a few years away.

wellesenterprises

Introduction

Tesla, Inc. (NASDAQ:TSLA) is going to report its Q1 soon (post-market April 23rd), so I wanted to take a look at how the company performed throughout 2023. The company is also down around 30% since my first coverage of it back in October ’23, where I argued that 50% CAGR production is unsustainable.

Going back over it with the information that we have now, I believe I was a bit too optimistic on my assumptions, and my price target, or PT, of $180 was still too much. Given the margin deterioration and a slowdown in demand for electric vehicles, or EVs, in general, coupled with fierce competition, I believe TSLA is still too expensive.

I am sticking with my Hold rating until we get more concrete info on full self-drive (“FSD”) and Robotaxis potential. It is still not a good time to start a position here.

Briefly on Financials

As of FY23, which ended Dec 31st ’23, and whose data was filed on Jan 26th ’24, the company continues to have a stellar balance sheet, with over $29B in cash and equivalents, against around $3B in long-term debt, or negligible. The company is flush with cash, which should bode well for future growth. With all the innovations it is experimenting with, the mountain of cash is there to support these ventures, good or bad. The company does not have any liquidity issues. Now, let’s look at how other metrics progressed throughout 2023.

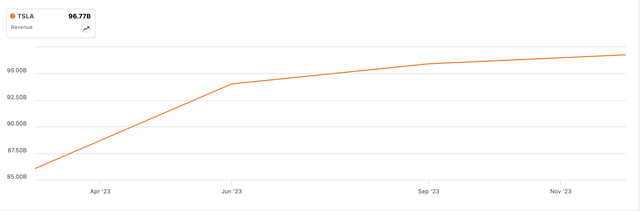

In the first quarter of the year, we can see a decent jump in sales. However, over the following quarters, the increase was diminishing. The EV transformation has hit a bit of a snag in 2023. Many analysts were very positive about the transition, but it appears that customers may not be ready to switch just yet, which is reflected in poor top-line growth for TSLA.

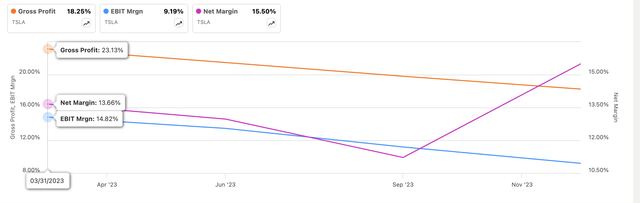

In terms of margins, we can see the cutting of prices clearly affected the company’s profitability. Tesla is into mass-producing cars rather than margins, and there is still a long way down until it matches the margins of other mass-producing car companies, so I would expect further deterioration across the board. TSLA’s net margins saw a boost due to a non-cash benefit on tax-deferred assets, so this will come back down going forward. We can see a clear downtrend.

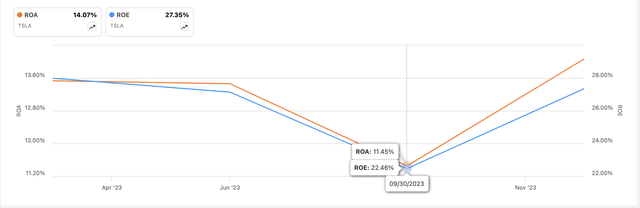

The same goes for the company’s other efficiency and profitability metrics, like ROA and ROE. These have seen a boost due to the non-cash benefit in Q4, but in the next quarter, I am expecting the downtrend to resume.

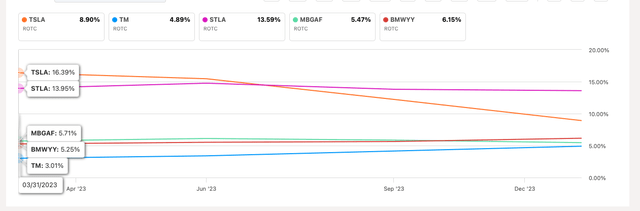

In terms of competitive advantage, it is clear that with the decrease in prices, will come a decrease in moat and competitiveness as seen from the graph below. TSLA’s ROTC in the last year has dropped significantly, indicating a loss of pricing power and appeal compared to its competition, which has seen steady numbers in the last 12 months.

Overall, it was a tough year for TSLA. Shrinking margins, plateauing sales, and higher competition in the space, that seems to be catching up. This means a loss of its competitive edge and appeal as more and more players enter the EV space and innovate.

Comments on the Outlook

I would like to discuss some of the potential catalysts that could help TSLA capture high-growth numbers once again, as many analysts right now are not projecting that break-neck speed going forward.

Full Self-Driving

FSD is one of the main focuses of the company, which does hold a lot of potential. Just a year ago or two, everyone was expecting this to take off and provide significant upside potential for TSLA. Fast-forward to today and FSD is not truly FSD but rather FSD-supervised, with the newest version 12 powered by AI and other features.

FSD is great in theory, but regulatory obstacles have been emerging. Furthermore, the company has slashed its subscription fee of FSD in half to attract more customers to try out this innovation, which right now is not going to help the company’s margins, but if it can show how advanced it is, it will manage to grab more of the market share in FSD market. Initial predictions of full self-driving have not come to fruition, and I don’t think it is getting closer to being realized in the next year or two either.

So, how much growth should I assign to this software? A report back in November said that FSD is already generating $1B to $3B in annual revenue, which was based on the company pricing the software at $12,000 or $199 a month. Now we know that this has been slashed in half, so those estimates should be more or less halved as well. Furthermore, in the same report, the analyst appears to be very excited about the opportunity in FSD, giving his projections of $10B to $75B in annual revenues by 2030. In my opinion, that is on the more positive end of the spectrum, and sounds very hopeful, just like it did back in 2020 and 2021, when everyone thought FSD would be achieved by now.

Robotaxis

Going hand in hand with FSD, robotaxis were also the talk of the town going back a few years, when many pundits believed Tesla would be able to deploy millions of self-driving taxis around the world and the new revenue catalyst would propel the company’s growth to the stratosphere. Well, that hasn’t happened.

However, the company is much closer to this dream now than it was back then, so there is still hope that it will be achieved at some point, but it is not looking likely for another couple of years in my opinion. Unless CEO Elon Musk is going to reveal something huge at the August 8th event. I don’t think he will announce an immediate release of these, since FSD is not up to snuff yet, and many are anticipating some sort of announcement next week when Elon will visit New Delhi. I expect to see some volatility after the announcement, whether it is something to do with robotaxis or the supposedly not canceled Model 2 aka “Project Redwood.”

These two ventures are very promising, but what kind of growth can I assign to these since they are nowhere near being fully realized, for at least another couple of years, if not longer? Therefore, I am going to heavily discount the potential since we don’t have any growth numbers in the past that could help us, and I don’t like investing in the hope that they will transform TSLA’s top line. Back in 2021, articles like this were going around where they said FSD alone would be worth more than its current market cap of $620B at that time. Fast-forward to today, its market cap is at around $500B and FSD with robotaxis are nowhere to be found. So, I think skepticism is warranted.

Energy Generation

Let’s move on to something that is tangible and is showing spectacular results y/y. This is the company’s energy generation and storage sales. This segment is quickly catching up to the company’s services segment in terms of total revenues. Services from FY21 to FY22 grew at around 60%, and from FY22 to FY23 at around 37%, while energy saw 48% and 63%, respectively. Services are starting to slow down while energy seems to be accelerating.

If this continues, energy will take over the services segment within two years. The non-car-related revenues accounted for around 14% of total revenues, up from around 12% y/y, so the people who are saying Tesla is more than just a car company should feel better about that statement this year than last year, but I still don’t buy that.

While the growth in the two mentioned non-car segments is growing at a decent pace, the main revenue generator has been slowing down considerably, so most of the top-line growth will depend on car sales for the foreseeable future, with a bit more upside from non-car-related segments.

In terms of margins, I am anticipating further deterioration here, but maybe not as quick as before given the company is looking to lay off around 10% of its staff, which may not be the only time the company will take such drastic measures.

Valuation

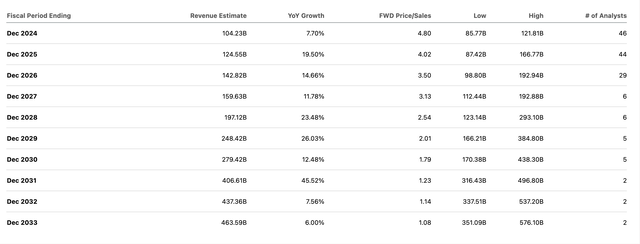

Looking back at my previous valuation attempt, I believe I was a bit too optimistic, given the massive slowdown in sales since then. However, I won’t beat the company’s estimates down too much, so I am assuming after the 8% growth we may get in 2024 according to analysts, the revenues will rebound to around 25% growth, and over the next decade, the company will see around 14% CAGR. If it was solely based on car sales, that would be much lower, but I am adding a few percentage points due to how the two aforementioned segments of energy and services have been performing.

To give myself a range of possible outcomes, I also modeled a more optimistic case and a more conservative one. Below are those estimates.

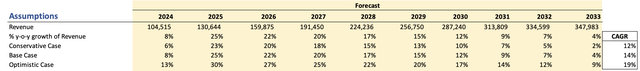

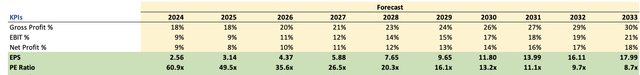

For margins, if the company’s operations were solely comprised of sales of EVs, I would have estimated a further reduction in profitability, which would match that of other car companies today. However, since TSLA does have some higher margin segments, like the software and energy, although currently, software saw only 9% margins, I would imagine this will improve over time since software usually comes with higher margins than hardware. Furthermore, the company’s laying off staff should also help somewhat; therefore, I am modeling improvements in margins as shown below.

Margins and EPS assumptions (Author)

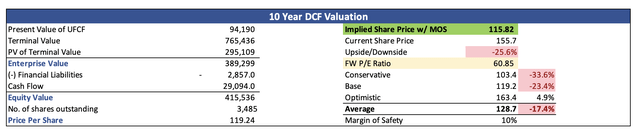

Additionally, I went with 10% as my discount for the discounted cash flow, or DCF, model and a 2.5% terminal growth rate. This is a little more lenient because the company’s current WACC is around 15%, which is very high in my opinion, and I don’t think the company’s long-term beta will be above 2 for the long term. Therefore, I believe it is fine to use 10% as that is where most of the companies end up being.

And just to be on the safer side, I am adding a 10% discount to its final intrinsic value calculation, to give a current fair value of TSLA to be around $115.82 a share. This means there is still quite a bit of downside compared to my previous estimates, and now would not be a good time to start a position.

Closing Comments

I believe the estimates I showed above are rather realistic and not too optimistic or too pessimistic. Yes, there is the potential of robotaxis and FSD being realized, but that is not that close at all, even after a few years of development. We are closer to those dreams that many pundits foresaw the company would achieve by today, but there is still a long way to go. There are most likely be more obstacles in terms of laws and regulations and other unforeseen issues that may delay the dream for longer.

The company is starting to look less like just a car manufacturer, but it is still too early to say that it is more than just that currently. Maybe when that percentage hits 30% of software sales, then I would consider it to be true, but only if that percentage increases organically and not through a massive decline in car sales.

I am going to stick with my Hold rating for Tesla, Inc. shares, meaning I don’t think it is a good time to start a position if you are not in the game already. I wouldn’t sell, especially given the underperformance we are seeing, which may be due for a nice rebound after the next earnings release if everything goes according to plan. If the company guides poorly, I expect a lot of volatility and the share price to tumble further down from these already low levels.

I have set a new price alert closer to my updated PT and will see how earnings unfold and what Elon Musk has to say about robotaxis in August. For now, though, I don’t think it’s a good idea to jump into Tesla, Inc. shares unless you are into technical analysis and like to day-trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.