Summary:

- Tesla, Inc. reported its fourth quarter earnings results on Wednesday, January 24th.

- The company’s revenue growth was weaker than expected.

- Tesla’s earnings also were weak and margins keep declining.

Michael M. Santiago/Getty Images News

Article Thesis

Tesla, Inc. (NASDAQ:TSLA) has reported its most recent quarterly earnings results on Wednesday. The company missed estimates on both lines and saw its revenues grow by just 3.5%, which spells trouble going forward.

Past Coverage

I last covered Tesla, Inc. (TSLA) last year in an article that was focused on the Autopilot recall and its impact on Tesla. I gave Tesla a neutral rating in that article. In this article, Tesla’s earnings take center stage — what do the margin trends tell us about where Tesla is headed? What do Tesla’s profits imply for the future? Based on pretty weak growth numbers, I’m downgrading Tesla to a Sell. Let’s delve into the details.

What Happened?

As one of the first automobile companies to report, Tesla, Inc. delivered its fourth quarter earnings results on Wednesday, following the market’s close. The headline results can be seen in the following screencap from Seeking Alpha:

We see that the company generated revenue growth of just 3.5%, which was considerably weaker than expected by the analyst community and most investors, while the earnings number came in below estimates as well.

The market didn’t like these results, as Tesla’s shares were sent lower in after-hours trading. It is possible, of course, that this changes over the coming hours and on Thursday — volatility can be expected.

Growth Has Ground To A Halt

Tesla is an electric vehicle (“EV”) company, and those are seen as growth investments by most investors — which makes sense, as they oftentimes are not overly profitable (or not profitable at all), and since the EV segment of the automobile market is growing at an above-average rate.

Tesla, however, has not been delivering much on the growth front, and things got even worse during the fourth quarter. With revenue growth of just 3.5%, Tesla has barely delivered any revenue growth in nominal terms. And once we account for inflation, which stood at 3.4% in December (measured via CPI), then real growth is basically nonexistent.

It’s worth noting that some other automobile companies do not experience any meaningful business growth, either — but other non-growth or barely-growing automobile companies are not trading at the valuation (multiple) Tesla is trading at.

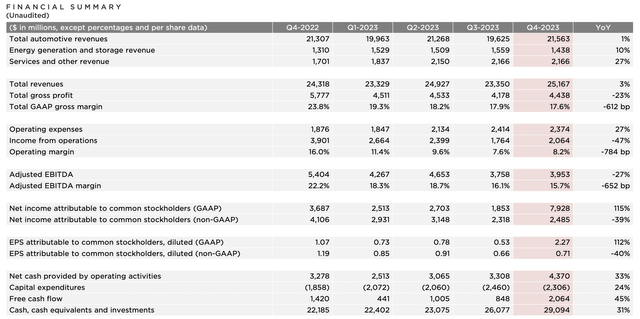

Let’s see why Tesla has not been able to grow its revenues in real terms during the most recent quarter. The following chart from Tesla’s investor presentation shows a couple of important details:

We see that automotive revenues, which make up more than 85% of company-wide revenues, were basically flat compared to the previous year’s quarter, rising by just 1% in nominal terms. This means that revenues were down in real terms, calculated with a 3%-4% rate of inflation. While some bulls argue that Tesla is more of a tech company than an automobile company, I believe that characterizing Tesla as an automobile company makes sense, as the automobile business contributes the vast majority of all revenues. Other automobile companies have non-auto revenue sources as well, such as services, subscriptions, etc. Thus, the fact that Tesla has some non-auto revenue sources does not mean that Tesla is not an automobile company — at least that’s how I see it. If we see Tesla as an automobile company, and we account for the fact that its main business is essentially not growing, the very high valuation seems highly questionable.

Looking at Tesla’s non-auto business, we see that the growth performance has been better, although not really great. The energy business (energy generation and energy storage) generated a revenue growth rate of 10% compared to one year earlier — not bad, but far from exciting. It is also worth noting that Q4 of 2023 was the worst quarter in the entire year, thus it does not look like momentum is on Tesla’s side. I expect this business to generate some growth in the coming years, but let’s be honest — a 10% growth rate is far from explosive and hardly warrants a valuation that is way higher than that of actually fast-growing companies such as Microsoft Corporation (MSFT) or Alphabet Inc. (GOOG, GOOGL).

Services revenue grew the fastest compared to the rest, with revenue growth in the high-20s, which is somewhat surprising — many bullish investors see the energy business as more important for Tesla’s growth compared to the services business. While a revenue growth rate of more than 20% for the services business is nice, it wasn’t enough to meaningfully move the needle for Tesla on a company-wide basis, hence the weak overall sales growth rate.

Profitability Issues Remain

While a lack of meaningful sales growth is an issue for Tesla, it is not the only issue. Profitability remains an issue as well, as we can see when we look at the margin performance of the company in the recent past.

Gross margins have been declining for quite some time, and that trend continued during the fourth quarter — the gross margin was just 17.6%, down more than 600 base points from the previous year’s quarter and down sequentially as well. Momentum is thus working against Tesla when it comes to its margins, too. EBITDA margins also declined further, hitting a new low for this cycle, dropping by more than 600 base points compared to the previous year’s quarter, too.

The combination of weak sales growth and declining margins caused a profit decline of around 40%, both on a company-wide basis and on a per-share basis. For a (presumed) growth company trading at a high valuation, a steep profit decline is quite an issue, I believe — and based on the share price reaction in after-hours trading, investors seem to agree.

Cash Flows Are Looking Weak

Earnings and cash flows are connected, but they don’t always move in line with each other — and they aren’t necessarily equally high. In Tesla’s case, free cash flow generation is way weaker compared to the net profits that the company generates.

Over the last year, Tesla generated free cash flows (“FCF”) of a little more than $4 billion, which is well below the more than $10 billion in net profit that the company has generated over the same time frame. That makes for a free cash flow conversion rate of way less than 50%, which isn’t a strong result at all.

The reasons for the weak free cash generation include the growing inventory numbers — inventory, in terms of days supply, has risen by 15% over the last year. While some bulls claim that rising inventory is not an issue, it is an issue when it causes weak cash generation. The rising inventory is also not really explained by vehicles being in transit — when sales aren’t growing much, the value of vehicles being in transit shouldn’t grow much, either.

The ongoing Cybertruck production ramp also is a headwind for cash flows — and based on CEO Elon Musk’s past statements, one can assume that the Cybertruck will remain a drag on cash generation for a while.

Tesla: Too Expensive

Tesla has potential in autonomous vehicle tech, but I believe that this is a risky bet and would not buy Tesla stock based solely on this reason.

Apart from that, we have a strong brand and a profitable EV business — but growth is weak (or non-existent in real terms), profits are declining, and Tesla trades at roughly 150x free cash flow. Buying an automobile company at a free cash flow yield of way below 1% seems like a bad idea to me. Based on the weak profit trend and the fact that growth has ground to a halt, I see Tesla as a “Sell” at current prices. It’s better to stay away from the stock and to lock in gains (should they remain).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!