Summary:

- Tesla, Inc. CEO Elon Musk’s recent negative surprise with Tesla’s deliveries may lead to portfolio managers selling off the stock.

- The downtrend in Tesla’s stock price and its underperformance compared to the Index indicate a search for a bottom.

- There is speculation that Musk may focus on Artificial Intelligence, which could further impact the company’s value.

NurPhoto/NurPhoto via Getty Images

Tesla, Inc. (NASDAQ:TSLA) CEO Elon Musk has made himself one of the wealthiest guys on the planet, but can he pull “X formerly Twitter” and Tesla out of the rabbit hole, or will he just leave them behind and move on to Artificial Intelligence (“AI”)? It is all playing out in real time, and TSLA just had a big negative surprise. Elon is now going to revisit the very hard lesson that you don’t hit Wall St. analysts with any negative surprises.

Of course, being the genius, he could pivot quickly, but that will not help the stock short term as it looks for a bottom. Portfolio managers are going to sell this underperformer that is hurting their 2024 performance. It will take a long time to unwind the large positions they have, and day traders likely will be front running this selling on the way down.

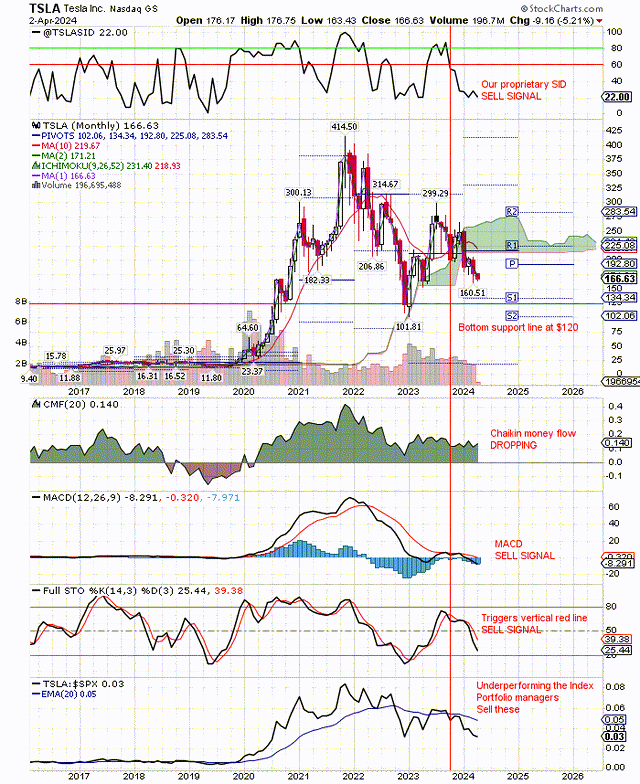

On the chart below, you can see the downtrend in TSLA price. This is not new, as we previously pointed out in our last article. If that doesn’t convince you it has a problem, just look at price strength relative to the Index. It is an underperformer. Portfolio managers, trying to beat the Index in 2024, will be selling stocks like TSLA, especially if Musk moves out of TSLA, taking AI with him for his next big victory.

I think that he is ready to leave the low P/E auto industry behind and take the AI part of TSLA with him. I guess the Elon Musk cult investors will leave TSLA if Elon leaves. Just as stocks have country risk, they also have CEO risk. What is TSLA worth without Elon? Has he already left by buying Twitter? Is he about to be distracted from TSLA even more by his entry into AI? Is the CEO risk taking TSLA down? Or is it just the negative surprise in earnings?

As a technician, I am watching TSLA price dropping, underperforming and looking for a bottom in price. This is also what bottom fishers do. But bottom fishers only buy bargains. Seeking Alpha Quant ratings and analyst articles tell me that TSLA is no bargain. That confirms our own, proprietary SID Sell signal shown on the chart below.

Let’s look at the SA Quant ratings. TSLA gets good grades for Growth and Profitability, although short term, the growth thesis was just given a negative surprise. However, it gets poor grades for Valuation, Momentum, and Revisions. This is why the price is going down. A stock cannot have an aggressive growth P/E premium without upward Momentum and good Revisions for the future. Overvalued stocks like this are hit very hard when a negative surprise occurs as the current drop in deliveries for the quarter.

Let’s look at the analyst ratings. SA analysts and the Wall St. analysts have it rated as a Hold. Many times analysts hesitate to post a Sell rating especially when their clients are trying to sell their holdings. So a Hold rating is a safe way out for the Wall St. analysts. The Wall St. analysts show only 15 buys, while there are 32 Holds and Sells. However, I am surprised at the SA analysts rating of a consensus Hold. That may change now that the bad news is out.

Let’s look for the bottom that bottom fishers might find attractive. Elon is smart enough to drop prices and increase sales volume in the USA, but I don’t think he can beat the Chinese prices around the world. Of course, discerning buyers would prefer a Tesla to a Chinese name provided the prices were close. Elon is just as smart as anyone when it comes to breakeven analysis. What is my target for TSLA bottom fishers? I think a P/E of 20 and an earnings estimate of $5 gives me a target of $100. Using technical analysis and charts, I see support for a bottom at $120 and I have drawn that line on the monthly chart below.

TSLA targeting a bottom at $120 (stockcharts.com)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: We are not investment advisers and we never recommend stocks or securities. Nothing on this website, in our reports and emails or in our meetings is a recommendation to buy or sell any security. Options are especially risky and most options expire worthless. You need to do your own due diligence and consult with a professional financial advisor before acting on any information provided on this website or at our meetings. Our meetings and website are for educational purposes only. Any content sent to you is sent out as any newspaper or newsletter, is for educational purposes and never should be taken as a recommendation to buy or sell any security. The use of terms buy, sell or hold are not recommendations to buy sell or hold any security. They are used here strictly for educational purposes. Analysts price targets are educated guesses and can be wrong. Computer systems like ours, using analyst targets therefore can be wrong. Chart buy and sell signals can be wrong and are used by our system which can then be wrong. Therefore you must always do your own due diligence before buying or selling any stock discussed here. Past results may never be repeated again and are no indication of how well our SID score Buy signal will do in the future. We assume no liability for erroneous data or opinions you hear at our meetings and see on this website or its emails and reports. You use this website and our meetings at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

To understand completely our fundamental and technical approach to making money in the stock market read my book “Successful Stock Signals” published by Wiley. This is the method that I taught to professional portfolio managers on Wall St. and now I share these secrets with you with 50 stock picking programs picking winners every day. You receive our daily email of stocks with Buy Signals before the market opens.