Summary:

- The National Highway Traffic Safety Administration (“NHTSA”) has ordered the recalling of ~360K Tesla vehicles.

- The recall has pushed Tesla’s implied volatility to be near its 52-week peak.

- As such, it has created a good setup to write put options.

- If the option expires, it would provide a 7.2% return in about one month, translating into an annual return of nearly 86%.

- If the option is assigned, it would provide the shares effectively at ~$190, an attractive entry price for the long term.

remco86

Thesis

Last week, the National Highway Traffic Safety Administration (“NHTSA”) issued a recall of Tesla (NASDAQ:TSLA) vehicles. The recall would impact about ~360K of its vehicles (Model S, Model X, Model 3 vehicles, and Model Y vehicles) that are equipped with Full Self-Driving (“FSD”) Beta software.

It is not the first time that the NHTSA has ordered recalls of Tesla cars. A few other recent recalls include the 2020 recall of almost 135,000 Tesla Model S and Model X vehicles (due to a problem with the touch screen), a 2019 recall of approximately 123,000 Model S vehicles (due to an issue with the power steering system), and a 2018 recall of approximately 123,000 Model S vehicles (due to a problem with the passenger airbag).

In each of these cases, Tesla cooperated with the NHTSA and resolved the issues satisfactorily. The company has stated that it will continue to work with regulators to ensure the safety of its vehicles. Under this historical background, I am confident that this recall would be handled similarly and won’t impact Telsa’s long-term fundamentals.

In the meantime, the news of the recall has pushed Tesla’s implied volatility to be near its 52-week peak (see the next chart below). To wit, the implied volatility (“IV”) for TSLA’s near-the-money put options has surged to ~71, which is close to the highest 80% percentile of its 52-week range (i.e., only about 20% of the time its IV was higher than the current level in the last year).

And next, I will explain why such a peak IV has created a good setup to write a put option for both near-term traders and long-term investors.

Implications for investors

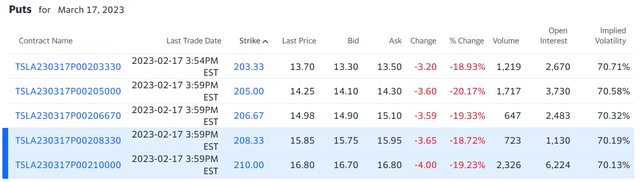

As seen in the chart below (from Yahoo!), a put option with a $206 strike price, expiring on March 17, 2023 (i.e., about 1 month from the day of this article), is currently trading around $15, which represents 7.2% of the strike price. Note that for the rest of this article, I will quote all option parameters on a per-share basis (and each option contains 100 shares). As a result, the setup is pretty attractive for both near-term and long-term investors. More specifically:

If an investor writes such a put and the stock price is above the strike price on March 17, the option will expire and provide a return of 7.2% in ~1 month. This translates to an annualized return of about 86%, which is a spectacular return for a short-term trade in my view.

Alternatively, if the stock price drops below the strike price on March 17, the option will be assigned. The investor will need to purchase the Tesla shares at the strike price. And the effective purchase price will be around $190 ($191 to be exact, which equals the strike price minus the $15 premium received upfront). And next, I will explain why $190 is an attractive entry price for long-term holding.

Implications of $190 for long-term investors

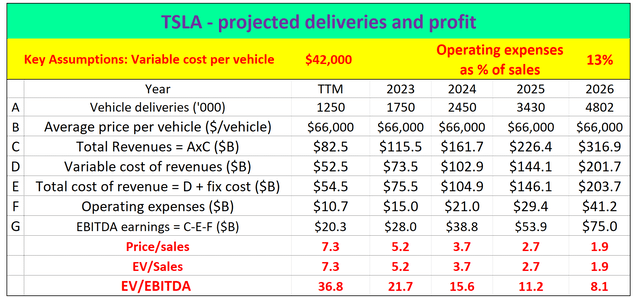

As just mentioned, if the put option is exercised, the option writer would effectively purchase TSLA shares at a share price of approximately $190. The following table displays my projections for its valuation multiples in a few years at a $190 entry price. Before I go any further, let me first articulate the assumptions that I made in these projections:

- These projections were made based on an outstanding share count of 3160 million shares, and a total debt of $5.75 billion (both taken from Seeking Alpha as of this writing).

- For its profitability, I assumed a variable cost of $42,000 per vehicle, operating expenses that equal 13% of sales, and an average vehicle sale price of $66,000. Details of these numbers are provided in my earlier article. As argued in that article, TSLA has clearly passed the break-even point of mass production, recouped the fixed cost, and will enjoy a lucrative margin going forward based on my analysis of its production and delivery data.

- Finally, this projection assumes its annual vehicle delivery expands at a 40% CAGR in the next 4~5 years. In its 2021 Q2 Earnings Call, Tesla management stated that it aims to achieve a 50% average annual growth rate in vehicle deliveries over a multi-year horizon. And TSLA advocates such as Cathie Wood believe it can even expand faster. My projections assumed a more muted 40% growth rate to be on the conservative side.

Source: Author based on Seeking Alpha data

Under these assumptions, at an entry price of $190, the P/S multiple would be approximately 7.3x and would decrease to only 1.9x in 2026. For reference, the S&P 500 traded at an average P/S ratio of 2.0x in the past decade (and currently trades at about 2.4x). Furthermore, the TTM EV/EBITDA would be around 37x under my assumptions and would decrease to only 8.1x in 2026. To provide a broader context, leading institutions like Bank of America habitually assign 10+ EV/Sales and 50+ EV/EBITDA multiples for companies with TSLA’s growth potential.

Final thoughts and risks

Lastly, let’s consider the risks associated with TSLA. Most of the risks have already been discussed thoroughly by other SA articles. And I won’t delve into them further. Instead, I want to highlight the risks associated with the thesis in this article more specifically: the recall and the writing of put options.

- For the recall, I am confident that this current recall would be handled satisfactorily like the previous ones and won’t impact Telsa’s long-term fundamentals. However, this is ultimately an assumption in itself.

- For the writing of a put option, at least in theory, there is always the possibility that TSLA’s stock price could drop to zero and the investor would have to buy the shares at the strike price.

To conclude, the recent surges in the implied volatility of TSLA’s options have created an attractive setup for both short-term and long-term investors. In particular, writing a put option with about 1-month expiry could provide a 7.2% return (or ~86% when annualized) in the case of expiration. And in the case of assignment, it would offer the shares at an effective entry price of ~$190, which translates into valuation multiples that are quite attractive both in absolute and relative terms.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.