Summary:

- Tesla, Inc.’s innovation potential is high, given its entrepreneurial culture.

- Tesla’s higher margins relative to EV peers confirm its innovation edge.

- Tesla is adept at transforming new technologies into the mass production of real products that people want and will pay up for.

jetcityimage

Note: the following True Vine Letter is an excerpt of a Letter originally published for Premium subscribers on February 20, 2023.

Entrepreneurial Approach

Over the holidays, I read The Founders: The Story Of PayPal And The Entrepreneurs Who Shaped Silicon Valley by Jimmy Soni. The subtitle reveals the plot. The main characters include Elon Musk and Peter Thiel. Musk’s x.com merged with PayPal (formerly Confinity) in March 2000 to forge what evolved into the PayPal Holdings, Inc. (PYPL) we know today. Thiel was the CEO of PayPal when the two companies merged.

The author interviewed Musk for the book, and its pages provide insight into his character, motivations, business acumen, and entrepreneurial approach. Here are my key takeaways:

-

He is not driven by money.

-

He is an extremely hard worker often found in the trenches which garners the respect of many of his employees.

-

He models himself as a “producer” who builds things and not really an executive or manager.

-

He is a visionary leader.

-

Old mindsets and regimes are often obstacles to his creative and revolutionary ways of doing things.

-

He understands the valuable learning that comes from errors and embraces this. This leads to an environment of creative freedom for employees as opposed to an environment of restrictive fear.

Although I believe Musk is misguided from a worldview perspective, I can relate to him in some ways. Reading about his entrepreneurial approach has inspired my own business career. I would readily invest in a company that he is leading at the right price because I believe the innovation potential is very high.

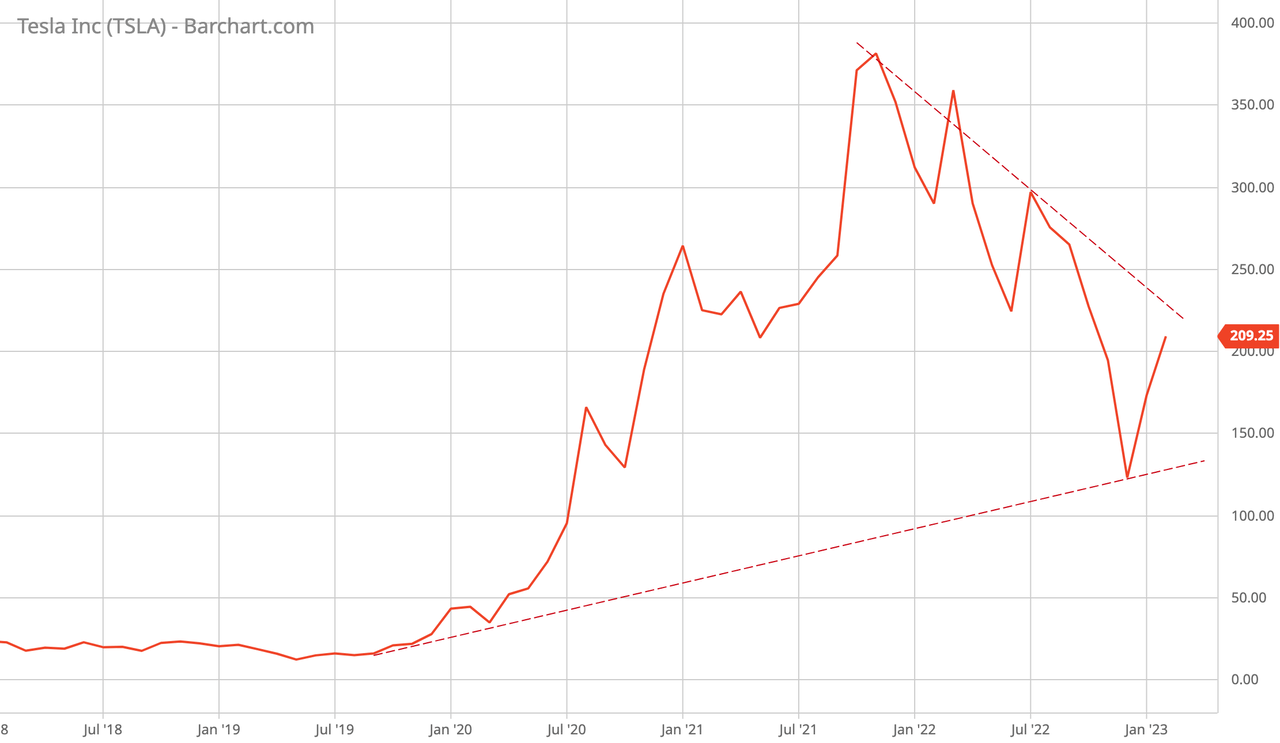

In recent days, I put together a financial model for Tesla, Inc. (NASDAQ:TSLA). If I would have built this earlier, I would have been a ready buyer during the recent selloff when the stock almost reached $100 per share. Here is the monthly chart:

Courtesy of Barchart

I suspect that we are going to get another shot to buy Tesla at a much lower price. The title of this article reveals my target price.

What The Bears Have Wrong

One of the bear cases for Tesla is all the competition that is slated to come online. Although this is certainly true, Tesla has a significant lead and is producing vehicles at dramatically higher margins than its competitors. In the last quarterly earnings conference call, Elon made the following important point (emphasis added):

Yeah. And it goes back to the point, I was making. I said, it several years ago, I think Tesla’s really the competitive strength that will be, by far, the hardest for other companies to replicate is Tesla being just damn good at manufacturing and having the most advanced manufacturing technology in the world. And if you’ve got that sort of advanced manufacturing toolbox, you can apply it to many things and we’re applying it now to battery cells.

Say whatever you want about Elon, the margin profile of the business relative to its peers confirms this statement.

True Vine Letter readers are also aware that significant amounts of new battery grade lithium capacity are not going to come easily. Moreover, Tesla has developed its own lithium-ion battery cell as its latest 10-K report mentions:

We maintain extensive testing and R&D capabilities for battery cells, packs and systems, and have built an expansive body of knowledge on lithium-ion cell chemistry types and performance characteristics. In order to enable a greater supply of cells for our products with higher energy density at lower costs, we have developed a new proprietary lithium-ion battery cell and improved manufacturing processes.

If Tesla can apply its manufacturing expertise to battery cell production, then this could provide a further cost advantage.

With the advent of Tesla, we are witnessing creative destruction in the automobile industry, at least when it comes to electric vehicles.

Tesla’s entrepreneurial culture and tendency toward innovation is critical because it remains to be seen how well EVs can really compete with internal combustion engine (“ICE”) or hybrid vehicles when it comes to mass market adoption. If anyone can make this happen it will be Tesla.

Tesla also shines with its direct to consumer model and its own insurance product for Tesla owners. Buying a car in the U.S. from your typical dealership is a dreadful experience which makes the Tesla sale process attractive to consumers.

AI & More

It is important to note that Elon Musk was a co-founder of OpenAI, now well known for its ChatGPT application that Microsoft Corporation (MSFT) is making a large investment in. Musk apparently departed after the company quietly transitioned to a for-profit strategy. It seems that he thinks this for-profit, secretive approach is dangerous.

This may yet prove to be an opportunity for Tesla.

Undoubtedly inspired by Musk, Tesla has done a significant amount of its own AI research and holds an annual AI Day to showcase some of its developments. The 10-K notes the following (emphasis added):

Our mission is to accelerate the world’s transition to sustainable energy. We design, develop, manufacture, lease and sell high-performance fully electric vehicles, solar energy generation systems and energy storage products. We also offer maintenance, installation, operation, financial and other services related to our products. Additionally, we are increasingly focused on products and services based on artificial intelligence, robotics and automation.

During the 2022 AI Day Musk talked about Tesla eventually producing humanoid robots that could do all sorts of tasks at scale for less than $20,000 each. And here is where I reach my key point: Tesla (and Musk’s other companies such as Starlink) is adept at transforming new technologies into the mass production of real products that people want and will pay up for. I think this is something that many professional investors miss but enthusiastic retail investors get.

It is foolish to think that Tesla is just going to stop with the mass production of electric vehicles, which it will essentially reach this year as it closes in on 2 million vehicles globally. The company is positioned to unleash all sorts of real products and not hypotheticals that are always far off in the distance and never amount to anything (like Alphabet Inc. (GOOGL)). Recall one of my listed attributes for Elon Musk:

He models himself as a “producer” who builds things and not really an executive or manager.

I think there is a huge opportunity with Tesla, Inc. because of its product development capabilities, but it is still important to not overpay. I like it below $150, and I really like it at $125 or less. I especially see Tesla as a great long-term buy and hold opportunity below $150.

The monthly chart above points to the potential for another selloff. I hope Tesla, Inc. stock sells off aggressively because I want to be an aggressive buyer.

Lastly, Tesla, Inc. has an upcoming Investor Day on March 1st. It will be interesting to see what the company comes out with.

Thanks for reading the True Vine Letter.

Joshua

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The True Vine Letter is a publication of True Vine Investments, the investment advisory business of Joshua S. Hall, ChFC, and a Registered Investment Advisor in the U.S.A. The information presented in the True Vine Letter is general in nature and designed for do-it-yourself and professional investors. It does not have regard to the investment objectives, financial situation, and the particular needs of any person who may read this Letter. Recommendations are not personalized investment advice specific to the situation of any one individual, family, or organization. In no way should it be construed as personalized investment advice. True Vine Investments will not be held responsible for the independent financial or investment actions taken by readers. True Vine Letter content is never an offer to buy or sell any security. True Vine Letters include a disclosure of any relevant securities held by Joshua S. Hall or his immediate family. Client portfolios managed by True Vine Investments may hold positions in securities covered in the Letter. Securities in these portfolios may be bought or sold at any time in order for True Vine Investments to satisfy its fiduciary obligations to clients. All data presented by the author is regarded as factual, however, its accuracy is not guaranteed. Investors are encouraged to conduct their own comprehensive evaluation of financial strategies or specific investments and consult a professional before making any decisions. Positive comments made regarding this Letter should not be construed by readers to be an endorsement of Joshua Hall’s abilities to act as an investment advisor.