Summary:

- I argue investors likely misinterpret Tesla management’s rationale behind cutting prices.

- Tesla’s aggressive price cuts are likely not a reflection of a short-term tactical response to increased competition . . .

- . . . but rather a signal of the EV maker’s long-term strategic to capture a 20 million EVs per year SAM by 2030, which requires price affordability.

- Tesla’s price-cuts are supported by cost-leadership — anchored industrial scale and sophistication in producing EVs.

- On the backdrop of the assumption that selling 20 million EVs by 2030 is reasonable, I value Tesla shares at a $310.61 target price.

jetcityimage

Earlier this year, Tesla’s (NASDAQ:TSLA) decision to cut prices for the Model 3 and Y caused TSLA stock to fall sharply — with Tesla shares intermittently trading down to nearly $100/share. Now, although Tesla’s stock has somewhat recovered, the EV maker’s valuation is still about 55% below ATH, as concerns about competition/ price-cuts continue to pressure investor sentiment.

That said, investors likely misinterpret Tesla management’s rationale behind cutting prices. In my opinion, Tesla’s aggressive price cuts are likely not a reflection of a short-term tactical response to increased competition, but rather a signal of the EV maker’s long-term strategic ambition to capture an enormous market share in the next-generation of mobility. In other words: on the backdrop of cost-leadership, Tesla is preparing to bring electric mobility to the mass-market. If in the process Tesla can take out some competitors, all the better.

Note: I have only recently covered Tesla stock, presenting my takeaway from the investor day. Although this coverage anchors on some key insights from the event, the argument presented in this article is an independent analysis on how I view Tesla’s pricing strategy in context of a changing EV landscape.

Price Cuts Signal Leadership

Given the (comparably) low production number of electric vehicles, as well as the high R&D costs to build and improve the relatively new technology, EVs have long been considered too expensive to produce for/ sell to the mass market. But the situation has changed: After years of expanding production, Tesla has now captured enough industrial scale and sophistication in producing EVs to profitably sell at prices that are almost competitive with gasoline-powered cars. And likely as a consequence, Tesla has decided to pass down value unlocked through cost-efficiency to customers.

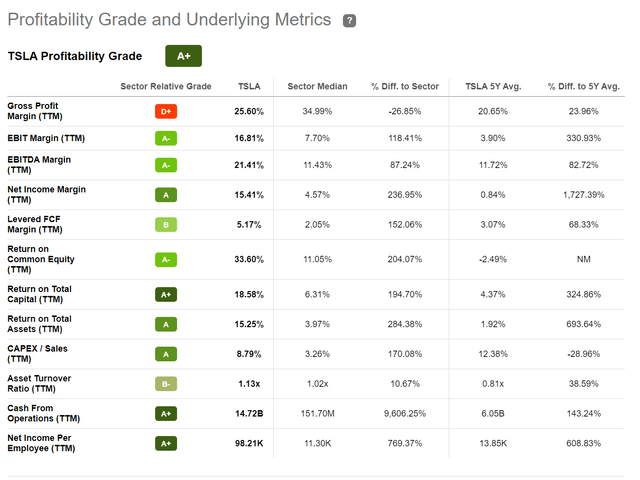

Tesla is known for having high profit margins and operating-efficiency. For the trailing twelve months, the EV maker has managed to claim an EBITDA margin of 21%, which is nearly 90% above the sector median. Similarly, Tesla’s net income margin is 15.4%, a 236% premium to the sector median respectively. With regards to capital efficiency, Tesla enjoys a return on total assets (TTM reference) of approximately 15.3%, as compared to 4% for the sector median.

Needless to say, these are some quite amazing profitability numbers (relative to the industry). But according to commentary from Tesla’s head of production, Tom Zhu, there might be still lots of untapped potential to capitalize on opportunities to further improve the cost-effectiveness of electric vehicles (EVs). In fact, anchored on the development of a new vehicle manufacturing platform, dubbed the “New Generation Vehicle”, Tesla aims to reduce the firm’s manufacturing footprint by 40% and lower the manufacturing costs per EV unit by as much as 50%.

Reflecting on Tesla’s strong profitability, and the outlook for further profitability expansion, the decision to cut prices seems like a reasonable strategic offensive to leverage the company’s cost-leadership into capturing a larger SAM.

Targeting A Larger SAM

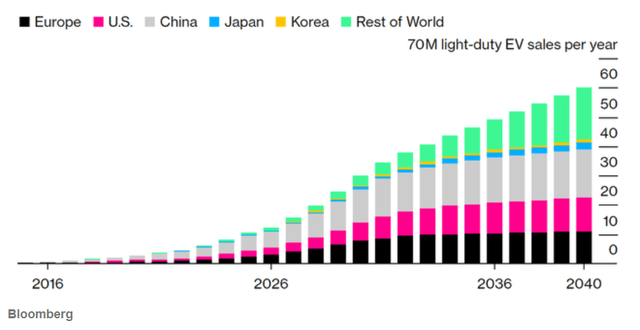

According to Bloomberg Intelligence, the market for light-duty EVs could potentially be as large as 60 million units by 2040–an enormous market potential. But, of course, it is unlikely that Tesla will be able to claim the lion share of this market without servicing the mass market. This is what the price cuts are for.

In my opinion, Tesla’s price cuts are an early signal that Elon Musk’s car company is prepared to lead the market for more ‘accessibly’ priced EVs. With that frame of reference, I would like to point out what Tesla’s head of production Tom Zhu said during Tesla’s recent investor day: (emphasis mine)

As long as you offer a product with value at affordable price you don’t have to worry about demand. We try everything to cut costs… and pass down that value to our customers.

And until Tesla launches its mass-market accessible Model 2–rumored to be priced at $25k – $30k–discounting existing models is a reasonable lever to start targeting said market opportunity.

Thus, Tesla’s lower prices are likely to be structural, rather than temporary–supporting Tesla’s ambition to sell about 20 million electric vehicles per year by 2030. While Tesla’s new pricing strategy might have some unfavorable short-term effects on margins and net-profitability, on a long-term perspective the strategy will very likely amplify scale and network effects and unlock a large commercial base for cross-selling post-purchase services–for example charging, insurance, and software.

Valuation Offers Upside

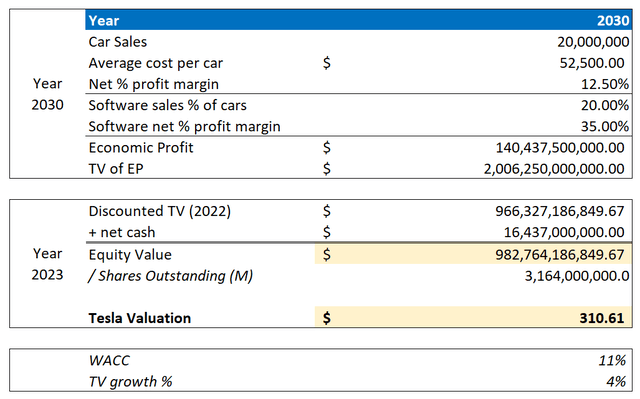

Reflecting on Tesla’s SAM expansion, I view the company’s 2030 ambition to sell 20 million cars per year as reasonable. To account for the volume expansion, however, I lower my average sales price per Tesla car to $52,000 and my net-profit margin assumption to 10.5% (pricing headwinds only partially offset by economies of scale).

I continue to assume that for every dollar of hardware sales, Tesla will be able to sell 20 cents of post-purchase revenue, including energy services, software solutions and insurance (for reference, Apple generates about 30 cents worth of services for every dollar of hardware sales). For Tesla’s software business, I continue to view a 35% net-profit margin as reasonable.

Based on this, I now calculate a $140.43 billion annual economic profit, with a present value equal to $966 billion. This number discounted back to early 2023, assuming a 11% WACC, and adding a $16.432 billion of net-cash, gives an equity value of $983 billion, or $310.61/share.

Author’s Estimates & Calculation

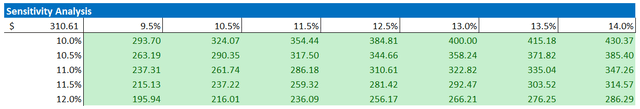

What if we vary the discount rate (row) and net % profit margin (column)? Here is the updated sensitivity analysis:

Author’s Estimates & Calculation

Conclusion

There’s a gap in the market for $25k EVs. And Tesla enjoys the cost-leadership to fill it. Conceptually speaking, the EV narrative has so far evolved in four stages: First, an early promise is enough to excite investors (ref. Nikola). Second, EV companies needed to prove that they actually have a technology/ product (ref. Lucid). Third, companies rushed to test if their technology/ product can be commercialized in a sustainable business model. Now we are in the fourth phase, which requires companies to build industrial scale and cost-efficiency. And like for phase one, two, and three, Tesla is leading the way.

Personally, I view Tesla’s 2030 ambition to sell 20 million cars per year as reasonable — the market size is the enabler, and Tesla’s cost-leadership is the lever. Anchored on that assumption, I value Tesla shares at a $310.61 target price. Reiterate ‘Buy’ rating.

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is not financial advise, but expresses the opinions of the author only.