Summary:

- Tesla’s Q1 earnings report resulted in a 12% jump in stock, indicating investor optimism about the company’s transition to robotics/AI.

- However, this article highlights concern about Tesla’s struggling auto division, which could lead to financial strain in the coming year.

- I’m still optimistic about the possibilities of AI, but further cash burn could end up hurting investors.

PM Images

Thesis Summary

Tesla, Inc. (NASDAQ:TSLA) has just reported its Q1 earnings, and the stock quickly jumped over 12%.

Tesla has been selling off over the last year due to weak demand, price cuts, and an overall lack of positive sentiment. The latest quarter reflected all of these problems, showing a substantial fall in deliveries and margins.

Overall, it seems like investors believe the worst has been priced in, and are optimistic about Tesla’s “transition” to robotics/AI.

However, I see numerous problems for the company going forward, most notably potential cash burn.

While I am still optimistic about the AI vision, as I last wrote, I am now concerned that the failing auto division will prevent Tesla and Musk from reaching their lofty goals.

I am re-rating this stock at neutral following the latest earnings report.

Q1 Overview: From Bad To Worse

In my last Tesla article, “Bet On Tesla, It’s A Bet On Elon Musk’s AI Future” I discussed the idea that Tesla would need to achieve some major success with its Dojo Supercomputer, full self-driving (“FSD”), and/or Optimus robot if it were to live up to its high valuation.

Indeed, this was thoroughly emphasized in the latest earnings call, and this time around investors have taken Musk at his word.

However, after a terrible few quarters and given that the company doesn’t seem to have a clear strategy to turn around its flailing auto division, I am now highly concerned about the financial strain it will face over the next year.

Despite all the claims to the contrary, Tesla is, for now, still an auto company, which is a very competitive and capital-intensive market, and this may become an issue moving forward.

Now, let’s begin by looking at Tesla’s latest quarters and trends over the last year.

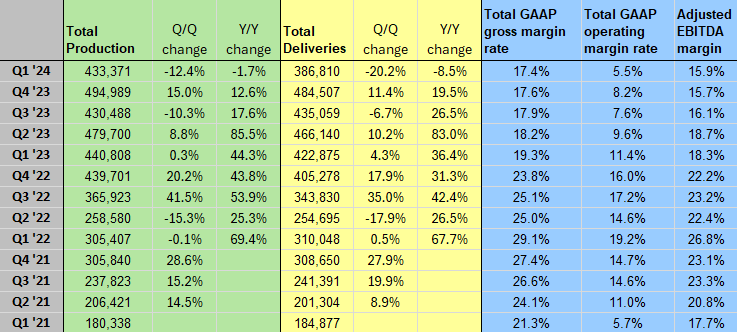

Tesla production, deliveries and margins (SA)

As we can see, deliveries have fallen by 20.2% QoQ and 8.7% YoY. Meanwhile, Tesla’s gross margin has fallen to 17.4%, down from close to 30% two years ago.

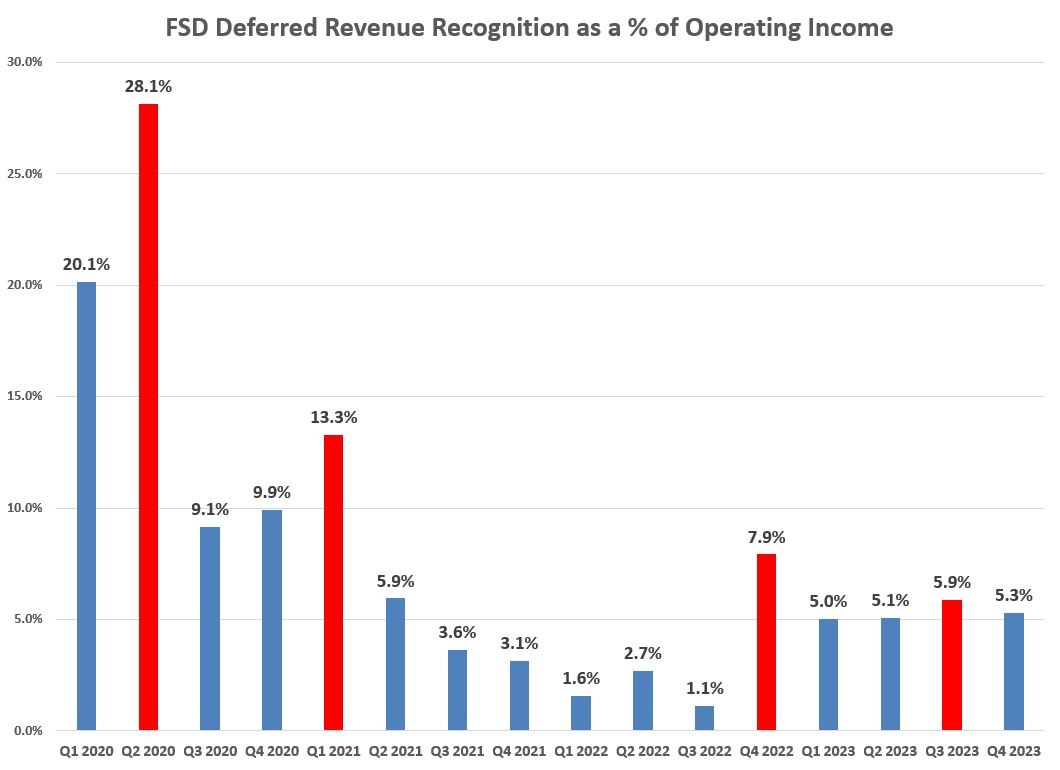

This certainly doesn’t paint a pretty picture, and it could be even worse if we factor in that a high amount of FSD deferred revenue has probably been recognized this quarter.

FSD deferred revenue recognized (Motorhead)

The key reason I believe FSD revenue has most likely compensated quite a bit towards operating income is that they have likely benefitted from a one-time increase in purchases following the price cuts carried out on April 12th.

Moreover, non-automotive gross profit also seems to be stagnating.

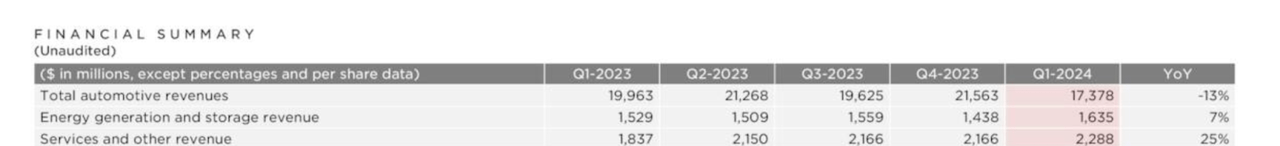

Revenue breakdown (Investor slides)

Energy generation and storage increased 7% YoY, while Services were up 25% YoY, but less than 6% QoQ.

Lastly, it is important to note that Tesla might not be releasing the Model 2 after all, favoring instead a re-launch of other models. At the very least, it seems like the Model 2 has been postponed.

In the latest call, Tesla said it would be updating its vehicle lineup

We’ve updated our future vehicle lineup to accelerate the launch of new models ahead, previously mentioned startup production is in the second half of 2025, so we expect it to be more like

atives, including AI compute. We

early 2025, if not late this year.

Source: Elon Musk on earnings call.

However, Musk gave very little explanation of what these new models will look like.

Overall, the facts show a company that is struggling to move its product, is sacrificing profitability to do so, and, as far as we can tell, is also struggling to bring new and exciting products to market. Let’s not forget that Tesla had to recall all of its Cybertrucks last week due to issues with the accelerator pedal.

Q1 Earnings Call: Very “Optimistic”

And yet, despite all this, the stock rallied following the earnings call, in which Musk and company put on a brave face and actually did a good job at defending these results. And yet, I am quite skeptical about many of the things that were said.

I think we’ll have higher sales this year than last year.

Source: Earnings Call.

Well, they are not off to a great start, and this seems very optimistic given the current trends. Tesla’s shipments from China sank to their lowest in over a year, and EV sales in Europe declined by 20% in March. Meanwhile, we know that Tesla is in the process of laying off 6000 workers.

This does not seem like the actions of a company that is expecting sales to grow.

We are able to do simple factory tasks or at least, I should say, factory tasks in the lab. In terms of – we do think we will have Optimus in limited production in the natural factory itself, doing useful tasks before the end of this year. And then I think we may be able to sell it externally by the end of next year. These are just guesses.

Source: Earnings Call.

Don’t get me wrong, I think the Optimus project could definitely be a success story, but Musk is now claiming that they will be selling their humanoid robot by 2025. Rarely does Musk meet his deadlines, and this is just going to set up investors for disappointment in the future.

We had negative free cash flow of $2.5 billion in the first quarter. The primary driver of this was an increase in inventory from a mismatch between builds and deliveries as discussed before, and our elevated spend on CapEx across various initiatives, including AI compute. We expect the inventory build to reverse in the second quarter and free cash flow to return to positive again.

Source: Earnings Call.

So, the company lost $2.5 billion due to “a mismatch of builds and deliveries” and high CapEx expenses.

In my opinion, the company will struggle to sell these cars unless they carry out more aggressive price cuts.

But, more importantly, won’t fulfilling Musk’s AI vision mean continued and perhaps even higher CapEx in the coming years?

Could Tesla Require More Funding??

Musk floated the idea of starting a whole new company to pursue his AI ambitions in the past and looking back; this would have probably been a sound decision.

My concern is that auto production will continue to burn Tesla’s cash and could eventually cause the company to run into financing problems.

For one thing, we already have evidence that Tesla is gearing up to prevent a liquidity crunch.

In the second half of 2023, Tesla financed $1.2 billion with asset-backed notes. Furthermore, the company expanded its revolving credit facility from $3 billion to $7 billion.

Plus, let’s not forget that Moody’s upgraded Tesla’s debt to above junk status (Baa3) only last year.

This is likely because of the company’s negative working capital. Let’s look at how Tesla compares to its peers.

|

Net Cash (mil) |

Net Cash/ Equity |

Net Working Capital (mil) |

NWC/Equity |

FCF/Equity |

S&P Debt rating |

Moody’s Debt Rating |

|

|

Daimler- Benz |

$31,659 |

48% |

$25,335 |

35% |

21% |

A |

A2 |

|

VW Group |

$38,442 |

26% |

$47,693 |

30% |

14% |

BBB+ |

A3 |

|

Honda |

$28,700 |

33% |

$15,387 |

22% |

13% |

A- |

A3 |

|

BMW |

$17,003 |

22% |

$13,829 |

16% |

11% |

A |

A2 |

|

Toyota |

$65,000 |

27% |

$22,190 |

9% |

10% |

A+ |

A1 |

|

GM |

$3,445 |

7% |

$725 |

1% |

19% |

BBB |

Baa2 |

|

Tesla |

$23,864 |

41% |

-$26 |

0% |

7% |

BBB |

Baa3 |

|

Stellantis |

$29,487 |

36% |

-$5,705 |

-6% |

16% |

BBB+ |

Baa2 |

|

Ford |

$8,780 |

21% |

-$3,670 |

-42% |

17% |

BBB- |

Ba1 |

Source: Compiled with company data.

In 2023, Tesla had negative net working capital of close to -$7.3 billion (accounts receivable + inventory – accounts payable – accrued liabilities).

The figures shown above exclude accrued liabilities to make comparisons more simple, which is why the numbers are different.

In any case, we can see that Tesla had negative working capital, and also boasts an FCF to equity of only 7%.

This explains why the company has a relatively low debt rating compared to its peers.

Is History Repeating?

There are two interesting examples from the past that we can draw on that hold some resemblance to Tesla.

Leading up to the Great Financial Crisis, General Motors Company (GM) was known for its light pickup trucks. However, as oil prices rose, these vehicles became noticeably pricier to own given their lack of fuel efficiency.

Similarly, Tesla and EVs in general today seem to be losing out to the more “efficient” hybrids. Unlike EVs, hybrid sales are actually increasing in Europe.

The other mistake Tesla has made is focusing on expanding capacity rather than creating new models. Tesla now has one of the oldest fleets out there, and no new models means fewer sales down the line.

Nissan focused too heavily on expanding production, and only limited models were available that did not appeal to the American market as much. As a result, the company made losses through the 1990s, and despite a raging bull market, the stock lost a considerable amount of value.

What’s next for Tesla?

That is, of course, the big question. The way things are going right now, Tesla will be very dependent on making things work with its AI vision.

The company is going “all in” robotaxis, and while this has the potential to be a huge market, it will still have to overcome numerous regulatory hurdles.

The question, in my opinion, is if Tesla can survive that far without running into cash problems.

To do so, it would be advisable to close down the less efficient factories altogether and possibly even raise money through equity.

For now, Tesla survives on the enthusiasm of investors for AI and the faith they place in Musk, which again, I don’t personally think is all that misplaced given his track record.

I am still long the stock. I want to give Tesla’s projects time to play out, but the company will have to improve its current trajectory if it hopes to keep investors keen.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is a high-risk/high-reward opportunity, which is exactly what I look for in my YOLO portfolio.

Joint the Pragmatic Investor today to get insight into stocks with high return potential.

You will also get:

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video