Summary:

- Tesla, Inc. CEO Elon Musk has confidently claimed that the company will reach 20 million annual vehicle sales by 2030.

- Analysts warn of difficulties in achieving this growth, with downside risks to earnings expectations and overestimation of Tesla’s growth potential.

- Tesla’s current valuation is significantly higher than what can be justified by its automotive business alone, and its non-automotive enterprises face challenges.

Justin Sullivan

Tesla Inc. (NASDAQ:TSLA) has grown at a rapid clip over the past several years, with deliveries rising at a blistering pace year after year. The company delivered just over 100,000 vehicles in 2017; in 2022, it delivered 1.3 million. Tesla has pledged that this scorching growth rate will continue for a long time to come. Last year, CEO Elon Musk claimed confidently that Tesla would reach 20 million in annual vehicle sales by 2030. Tesla’s pace of growth to date and investors’ confidence in its ability to achieve Musk’s ambitious targets have helped elevate the electric vehicle (“EV”) maker’s stock far beyond that of any other automaker.

Of course, promising 20 million deliveries in 2030 is much easier than actually achieving 20 million deliveries. To do so, Tesla would have to grow about 40% annually from 2024 through 2030. That seems like a tall order, even for Tesla, which is already struggling to achieve its near-term growth targets.

Wild Growth Expectations Collide with Reality

Q3 deliveries, which will be reported next week, appear set to fall short of market expectations, though Tesla is unlikely to cut its full-year delivery target of 1.8 million deliveries.

Looking beyond 2023, some analysts see further difficulties in the offing. Deutsche Bank, for example, warned that the market’s forward-looking consensus may be significantly overoptimistic:

“Looking at 2024, however, we see considerable downside risk to earnings expectations due to [a] much lower volume outlook than the market believes. On the bright side, with the company not trying to push as much volume, there could potentially be less pricing pressure next year.”

Deutsche expects Tesla to forecast approximately 2.1 million vehicle deliveries in 2024, 9.5% lower than the current Wall Street consensus estimate of 2.3 million deliveries. While this would still represent strong growth from 2023, it is indicative of the market’s tendency to overestimate Tesla’s growth potential.

Growth will only get harder over time, as the base number continues to grow. Tesla is likely to find that doubling vehicle production and sales from 100,000 to 200,000, or from 500,000 to 1 million, is much easier than going from 2 million to 4 million-let alone 2 million to 20 million. The challenge begins with the sheer cost of building out the capacity needed for such a level of production, a subject I have discussed previously on Seeking Alpha. The price tag of Musk’s ambition will be astronomical, perhaps in excess of $400 billion. With just $23 billion in the bank currently, Tesla can hardly finance such an expansion organically.

Even if Tesla does find a way to build capacity for 20 million vehicles, it will need to sell them. Given that the world’s current largest automaker, Toyota (TM), sold “just” 10.5 million vehicles in 2022, Tesla will have to seize a massive amount of market share from its competitors. That may prove easier said than done.

Valuing Tesla’s Automotive Business

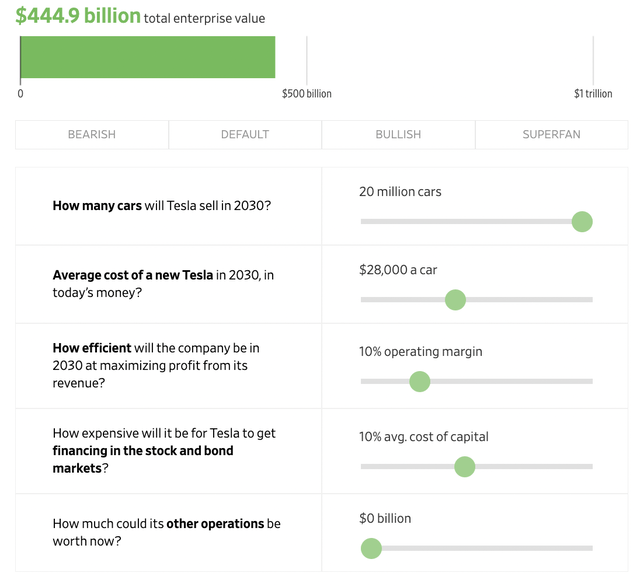

Let us assume for a moment that Tesla will successfully defy all the odds and grow its automotive business to Musk’s promised 20 million vehicles per year. Under this scenario, what valuation can we assign Tesla today? The Wall Street Journal has recently attempted to answer, publishing a DCF analysis on Sep. 28:

“If we bear with Musk, though, it follows that Tesla will become a global mass-market brand with appeal to families in richer and poorer regions alike. Our best guide to what this company might look like is still probably Toyota, whose consolidated revenue per vehicle was about $28,000 in its most recent financial year through March. If we plug that number into our Tesla model at a generous 10% operating margin-mass-market carmakers typically make single-digit margins-we still only get to an enterprise value of $445 billion for an automotive business producing 20 million vehicles a year in 2030.”

Even with the rather generous assumptions detailed above, Tesla’s enterprise value comes out to just $445 billion. Considering Tesla’s market capitalization currently stands at $758 billion, that should be rather distressing news to anyone betting that Tesla’s stock will continue to fly high.

Simply put, Tesla cannot justify its current valuation on even the most optimistic future of its automotive business. Something else is needed to square the circle.

Is Tesla Really “More than a Car Company” After All?

Tesla has long touted itself as “more than just a car company” in order to justify its eye-watering valuation. Tesla bulls point to the company’s solar and energy storage business, as well as the immense future potential of autonomous robotaxis, as justification for Tesla’s sky-high stock price.

Let us address each of these businesses in turn.

Tesla Energy

This topic deserves an article of its own, but to address it in brief: Tesla claims to be a major player in renewable energy, but its words fall far short of its deeds. Since acquiring Solar City in 2016, solar deployments have collapsed. From a peak of 253MW deployed in Q4 2015, deployments fell to a mere 27MW in Q2 2020. While it has recovered a bit since then, it remains nowhere near the peak. In Q2 2023, Tesla deployed just 66MW-38% less than the 94MW it managed to deploy during the same period last year.

Tesla’s energy storage business, meanwhile, has been growing at a healthy rate. Energy storage deployments in Q2 2023 reached 3.7GWh, up 222% year over year. This accounted for the lion’s share of Tesla Energy’s generation and storage revenues, which increased by 74% year-over-year to $1.5 billion. However, it is still a tiny fraction of Tesla’s business.

Tesla’s energy generation and storage business accounts for just 6.1% of its total revenue. Meanwhile, the segment’s high cost of revenue, which came in at $1.2 billion in Q2, makes it a significantly lower-margin business than the automotive segment. That is hardly a ringing endorsement for awarding a premium valuation to Tesla on the basis of its energy business.

Autonomy and Robotaxis

Tesla is one of the most visible players in the autonomous vehicle development space. However, while Tesla portrays itself as a leader in AV development, the viability of its strategy is far from certain. For years, the company has been promising its customers and the market that the launch of its fully autonomous robotaxi fleet is imminent. Yet time and again, it has failed to deliver.

That has not stopped Tesla from making money on its AV efforts, however. The company has been selling full self-driving (“FSD”) to customers since 2018. More than 400,000 customers have bought FSD. That creates another wrinkle for Tesla, as failure to deliver to these customers could ultimately trigger considerable civil liability. Seeking Alpha’s Bill Maurer sought to quantify this potential liability back in February. He estimated that failure could cost Tesla $4 billion from FSD-related refunds alone. It could be much worse; if ordered to refund the full value of the vehicles in addition to the cost of the FSD package, Maurer estimated that Tesla’s bill could reach as much as $240 billion.

Betting that Tesla will crack the autonomy problem seems risky, even before factoring in the potentially catastrophic cost of failure. Assigning a dollar value to a DCF for products that do not exist, and which may never exist, makes little sense to me.

Time for a Reality Check

Buying a stock already priced for perfection is risky; buying a stock already priced for considerably better than perfection is downright dangerous. That should not be a controversial statement; indeed, it’s essentially Securities Analysis 101. Yet in the case of Tesla, that idea is fundamentally out the window. The company currently boasts a valuation far in excess of what even the most wild-eyed optimism can justify. Even if Tesla quintuples production by 2030 while maintaining industry-beating margins and cost of capital, it is still overvalued by nearly 50%.

The effort to justify Tesla’s current valuation on the basis of its non-automotive enterprises is even more fraught. Tesla’s solar business has been in decline for years, while its battery storage business remains barely a blip on its financials. Moreover, both of these segments are also hampered by competitive pressures due to their nature as essentially commodity businesses. Tesla’s autonomy program, meanwhile, remains little more than a wild promise with little material to show for it. Tesla may be able to placate investors for a while yet with further empty promises that “next year” will be the year of the robotaxi, but the clock is ticking.

Ultimately, it is my view that Tesla, Inc. stock is significantly overvalued by any reasonable metric. However, the market has been willing to keep this name riding high for a long time. While wild-eyed expectations will have to meet with clear-eyed reality someday, it is impossible at present to say when that might be. Trading against a name buoyed by animal spirits is always fraught with peril, so tread carefully!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.