Summary:

- Tesla, Inc. stock continues to decline and reach new lows, distancing itself from other tech giants like Meta Platforms, Google, Amazon, Microsoft, and Nvidia.

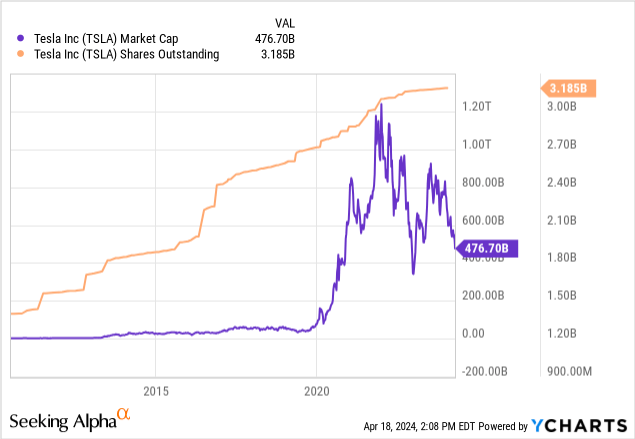

- CEO Elon Musk’s pay package, if approved, could result in significant dilution for shareholders, potentially up to 10% of the market cap.

- Tesla’s growth story is facing challenges, with competition in the EV space increasing and overall demand for EVs trending downward. Charging infrastructure remains a major issue.

- That being said, charging and energy storage opportunities remain an important growth proposition for Tesla shareholders.

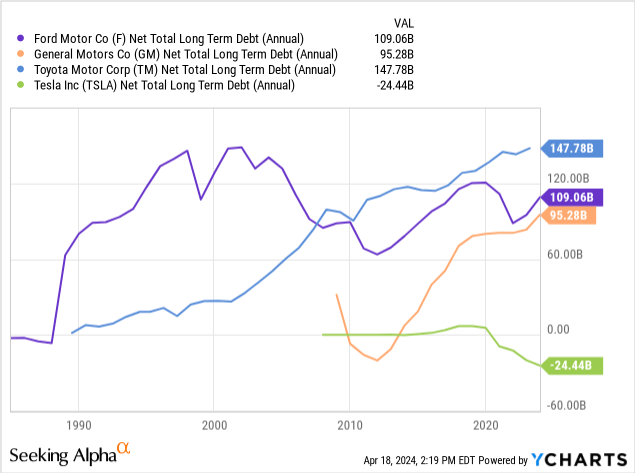

- Among the big auto companies, Tesla still holds a vastly superior balance sheet to any other automotive company, with several times more cash than long-term debt.

Monty Rakusen/DigitalVision via Getty Images

Headline

Tesla, Inc. (NASDAQ:TSLA) continues to crash and reach new 52-week lows. They have absconded as of recently from being mentioned in the light of Meta Platforms (META), Google (GOOGL), Amazon (AMZN), Microsoft (MSFT), or Nvidia (NVDA), the Mag 7 names with growth stories still intact. While Tesla remains a hold for me, it is getting closer to my personal price target. Tesla, in my eyes, is still unique in the automotive world as a company that is trying to innovate offshoot businesses that may enhance the proposition of the investment. I have no idea if they will succeed, but I acknowledge and respect their efforts.

That being said, CEO Elon Musk seems to be holding shareholders hostage and guessing if he’s staying or going, which will be highly dependent on his pay package. The $56 Billion pay package up for discussion will most likely result in large-scale dilution if approved, as much of the cash would come from floating shares. This could end up diluting shareholders up to 10% of the market cap, in my opinion.

Tesla stock has been crashing, but I’m not buying the dip yet. This is a hold.

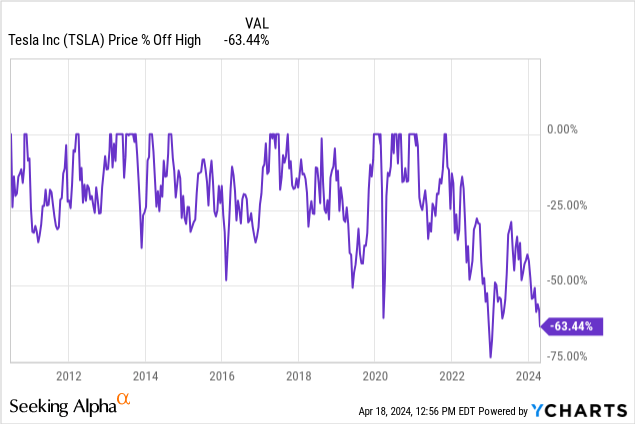

Percent off high

At -63.44% off the all-time highs, many dip buyers and Tesla bulls would consider this a buy signal. I would say, not just yet. Even if there is a warm reception to autonomous taxis come 8/8/2024, the company remains in catch-up mode behind Google’s Waymo and GM’s (GM) Cruise. The growth story in the interim remains vehicle sales for the next few years. Buyers here need to be of the patient sort if you have to convince yourself to dollar cost average, or DCA, downward.

My previous writings on Tesla

My first article on the company was in December 2022. I put a buy rating on the stock using adjusted an EBITDA PEG ratio, with growth rates still intact to justify a price target in the $130s. It subsequently dropped to $100. I bought a decent number of shares, but the price snapped back so quickly into euphoria that I dumped my position as it quickly got over $200.

Most recently, I did a PEG ratio price target comparison on the entire Mag 7 group collectively using a Nick Sleep/Bill Miller-esque analysis, adding back R&D to the operating income model. This is a model reserved for the select few hyper-growing tech companies that spend an enormous amount on research and development, which has various tax benefits in addition to helping grow the top line. The argument is that R&D outside pharma and semiconductors is a highly optional line item. While some amount is certainly necessary, adding it back helps one to visualize what a company could be dropping to the bottom line should they pull that lever back a bit.

Here’s what I came up with on Jan 23, 2024:

| STOCK | INTRINSIC VALUE | MARKET VALUE | PERCENT OF FAIR VALUE |

| GOOGL | 145.38 | 146.18 | 100.50% |

| AAPL | 115.63 | 191 | 165% |

| TSLA | 113.34 | 211.6 | 186% |

| AMZN | 177.19 | 155.58 | 87.80% |

| MSFT | 224 | 397.71 | 177% |

| NVDA | 84.98 | 592.69 | 697% |

| META | 397.24 | 383.24 | 96.40% |

While I have adjusted some of these targets since, especially in Buy articles about Google, Tesla has gotten a tad worse in the group while Nvidia has shown the growth rate to have much higher assumptions.

Specifically, at the time, I drew up Tesla’s numbers to look like this:

5-year adjusted operating income growth rate [CAGR] 58.89%- capped at 25% [Advice of Peter Lynch]*

- TTM adjusted operating income per share = $4.53

- Fair price at modified PEG 1 ratio = $4.53 X 25 = $113.34

- Current price= $211.6

Revenue sources

From Fact Set:

| Consumer Vehicle Manufacturing | 82.98% |

| Automotive Services | 8.60% |

| Power Generation and Support Products | 5.70% |

| Commercial Finance services | 2.73% |

I highlighted 3 of these items. These may not all be vehicle sales, but are all related to being a “car company,” a label that Tesla bulls despise. All told, 94.31% of revenue exposure is related to vehicle sales and the services that surround them. Be it repairs, full self-drive, or FSD, sales, or any revenue associated with financing a vehicle purchase, the company revenue sources are very similar to any company in the automotive sector.

Power Generation and Support products, namely Megapacks and the charging network, will be the next growth story if there is one in my opinion. While robotaxis and Tesla bots are great for getting investor sentiment up, they are still a long way off from generating any sort of revenue and even further from providing any profit. Investors would be wise to put pressure on management to refocus growth initiatives on this already revenue-generating segment.

Helping to build a reliable charging network and enhancing grid load management in the face of massive data center growth are two real problems that need to be addressed now. They are so important that lobbyists could start making the argument to Congress that they need to be subsidized. Any approvals of new tax credits or subsidies in a different revenue stream altogether could be just the growth catalyst that the company needs.

Story up to here, growth stalling

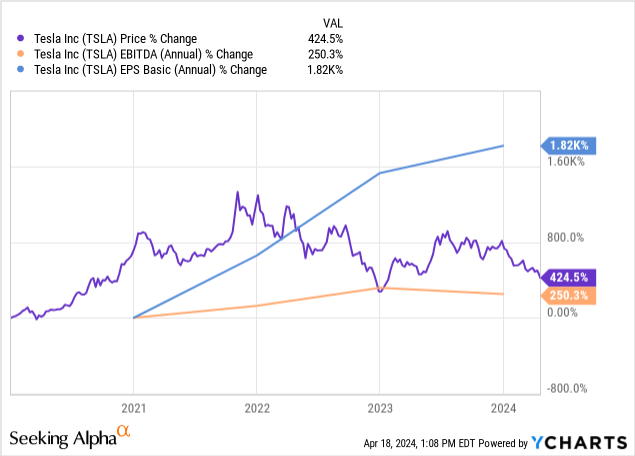

Growth has exceeded share price upside in EPS, yet EBITDA or “cash flow” has lagged share price appreciation. Tax breaks and other one-time items have enhanced the appearance of greater than normal EPS growth. If earnings growth stalls, the blue line will gap down versus the price line [purple] gapping up.

Via a recent report by Kelly Blue Book:

According to Kelley Blue Book estimates, Tesla sales in the U.S. were down 13.3% year over year – well below the typical double-digit growth that had become routine with the Tesla brand. Tesla’s share of the electric vehicle market in Q1 2024 was 51.3%, down from 61.7% one year earlier.

Though the overall year-over-year growth was minimal in Q1, nine manufacturers recorded more than 50% year-over-year growth in EV sales – BMW, Cadillac, Ford, Hyundai, Kia, Lexus, Mercedes, Rivian and Vinfast.

Competition is heating up in the EV space, and we are also seeing an overall demand for EVs trending downward. Having used an EV on a recent vacation, my opinion remains that charging infrastructure is the number one issue. The vehicle, a Ford Mustang Mach-E, was fun to drive, comparable to my test drives of lower-end Tesla models. Charging remains confusing; I often had to download a new app at every station I arrived at, being that they were differently branded. Arrived at a couple that were nonfunctional as well.

Growth will only go so far as battery tech and charging improvements. If Tesla wants to remain a growth story, it needs to enhance other propositions. The problem is that now they have backed themselves into a corner where the market primarily focuses on year-over-year and quarter-over-quarter vehicle sales growth. I would argue there are much more valuable areas to tackle at this point.

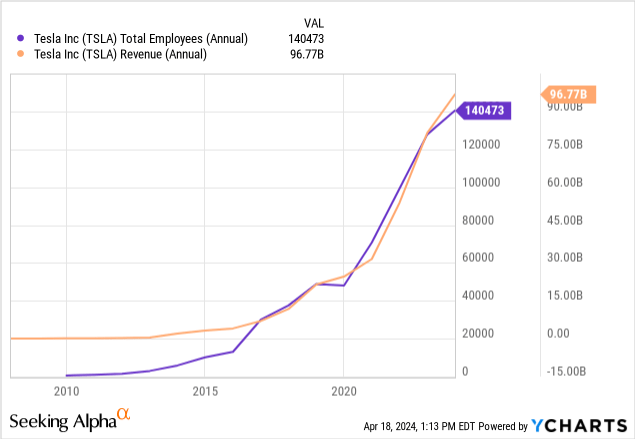

Layoffs

Since 2020, we can see that worldwide employee headcount has exploded nearly in line with the revenue growth. This also means that revenue per employee has also remained constant during this time, matching human capital with dollars of revenue. It will be interesting to see to what extent Tesla can shrink its workforce and still maintain an upward sales trajectory.

Tesla is a company that presently is very dissimilar to Google, Meta, or Microsoft. Auto sales, the ability to produce vehicles, is still a product of blunt force labor. Further factory automation will be the key to proving that Tesla has an edge in factory efficiency.

Upcoming earnings

Announce Date

4/23/2024 (Post-Market)

EPS Normalized Estimate

$0.50

EPS GAAP Estimate

$0.44

Revenue Estimate

$22.52B

EPS Revisions (Last 90 Days)*

Quarter over quarter, analysts are expecting a decline in GAAP EPS [$2.27 last quarter], Normalized EPS [.71 last quarter] and Revenue [$25.17 Billion last quarter].

Austin and Berlin seem to be two of the major staff reduction targets, indicating weakness in Europe as well as with the Model Y and Cybertruck. The Sparks, Nevada, Gigafactory, which makes and inserts battery cells with Panasonic (OTCPK:PCRFF) into the undercarriage to be shipped and finished in Fremont, is seemingly less affected along with Fremont. Giga 3 in Shanghai also appears less affected.

A reminder on the growth multiple from Peter Lynch

Before getting to my price target, I consistently like to remind my audience that long-term shareholders of any company would be wise to never assume more than 25% growth in your earnings multiplicand over long durations. Using PEG ratios to target growth companies would then lead us to believe that we should never pay more than 25 X earnings or adjusted EBITDA for growth. Peter Lynch reminds us in One Up On Wall Street and Beating The Street to never chase “hot industries” where multiples get above his sweet spot of 20-25 X, indicating 20-25% growth.

My price target

Using the same extrapolation as I had previous, I will still give Tesla the long-term benefit of the doubt when it comes to long-term earnings growth. This would put them at my multiple cap of being willing to pay 25 X adjusted operating income backing out R&D. If we look at the past 5 years, for example, we will see more than a 50% CAGR in earnings. Going forward, we see analysts estimating a decline. I am being very generous here by assuming a new growth engine emerges:

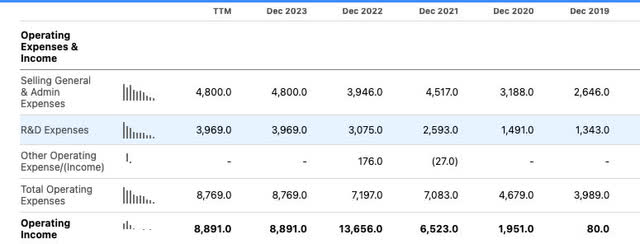

All numbers in millions courtesy of Seeking Alpha:

- $8,891 TTM Operating Income.

- Plus R&D $3,969

- Equals $12860

- Divided by shares outstanding: $12,860/3,184.8= $4.037 per share in adjusted operating income.

- $4.037 * 25 = $100.9/share.

Keep in mind, on a TTM basis, EPS for Tesla was $4.73/share. Analysts are expecting full year 2025 to actually be reduced down to $3.89 a share. We do have a high and low-end average among analysts of $4.56/share, but at best this would translate to no growth versus negative growth.

Discount for dilution

The $56 Billion pay package that Elon Musk is putting up for a vote has to come from somewhere when received. It’s probably coming at the short-term expense of shareholders for the long-term benefit of keeping Elon Musk focused on Tesla.

Tesla has not been afraid to float shares at any price, and I assume shareholders will not bat an eye to at least approving further dilution. $56 Billion currently equates to 11.76% of Tesla’s market cap. While Tesla does have ample cash on the balance sheet, I am going to assume at least a 10% dilution to pay this sum with the share price falling. More shares mean lower multiplicands, the number by which we enforce our multiplier.

If this goes through as is, I would lower my price per share assumption by at least 10% in the interim, or roughly $90/share if I was a stoic non-Tesla optimist.

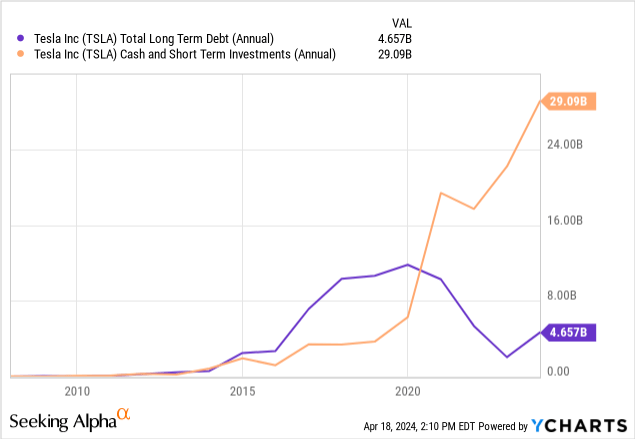

Balance sheet

To me, this remains the strength of the Tesla Thesis. There are no automotive companies that can compete with the strength of the Tesla balance sheet. This has largely been reinforced by the fan base that allows the company to finance itself with share dilution as if it were a tech startup. My guess is if the Ford CEO came out with a big dilution plan to finance the future, it wouldn’t be met with as much adoration.

Regardless, this puts Tesla in a forceful position within the expensive-to-produce EV market. Even if the company gets into a negative free cash flow situation, the cash will tide them over. Tesla is the only auto company with significant interest income over their interest expense, at nearly $1 billion in the positive.

These are the net debt numbers among the big auto companies, and Tesla is in a wonderful position at -24.48 Billion cash more than debt. This balance sheet gives Tesla an advantage and premium in my opinion to the other automakers, even if we simply consider Tesla an auto-only company going forward.

Summary

The possible dilution factor should Elon Musk’s pay package be approved is a big factor. Whether this gets paid out quickly or over the long term, it will still impact our per-share factors. Model 2 seems to be on the back burner, and who knows how much expense will go toward “robotaxis” to get it permitted and off the ground.

I will pay a 10% premium to keep Elon Musk focused on Tesla. I will also pay another 10-20% premium for the best balance sheet in the auto sector plus the promise of growth in energy storage and charging, which is a unique and separate business that would begin to differentiate the company. Even with all my premiums baked in, I would not even entertain a purchase of Tesla, Inc. shares until $120 or below.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOGL, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information provided in this article is for general informational purposes only and should not be considered as financial advice. The author is not a licensed financial advisor, Certified Public Accountant (CPA), or any other financial professional. The content presented in this article is based on the author's personal opinions, research, and experiences, and it may not be suitable for your specific financial situation or needs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.